Lecture 05: Effective Interest Rates

advertisement

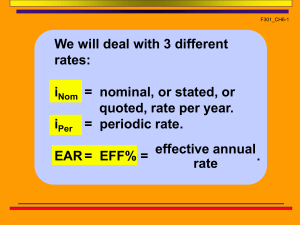

LEGOs Theory Continued… ● In learning about compound cash flows, we found ways to decompose and convert the cash flow pattern building blocks from one type to another, and how to relocate the block patterns to different points in time. ● The cash flow periods (time between arrows on cfd) are like the bumps on a LEGO brick. ● The effective interest rate per period is like the holes of the block – the bumps and holes must align for the LEGO blocks to fit together. ● There are three major cases of effective interest rate to consider – and four formulas to know. But first, there are some terms to learn… Interest Rate Terms… ● Compounding Period (cp) – the time between points when interest is computed and added to the initial amount. ● Payment Period (pp) – the shortest time between payments. Interest is earned on payment money once per period (cost of money) ● Nominal Rate ( r ) – is a simplified expression of the annual cost of money. It means nothing, unless the compounding period is stated along with it. ● Annual Percentage Rate (APR) – is the nominal interest rate on a yearly basis (credit cards, bank loans, …). It, too, should have a compounding period stated. ● Effective Rate ( i ) – is the rate that is used with the table factors or the closed form equations, and it converts the nominal rate taking into account both the compounding period and the payment period so that the blocks match. Compounding Period is Equal to the Payment Period r = nominal annual interest rate for payments that match the compounding period: (cp < year and pp = cp) Examples: 12% per year compounded monthly 10% APR, compounded quarterly i (1) (2) = interest rate per compounding period = r = m nominal interest rate ( # of compounding periods per year) Examples: 12% / 12 months = 1% compounded monthly 10% / 4 quarters = 2.5% compounded quarterly (1) (2) Which would you rather have: 12% compounded annually or 12% compounded monthly? Compounding Period is More Frequent than the Annual Payment Period EFFECTIVE INTEREST RATE ia = effective interest rate per year compounded annually = ( 1 + interest rate per cp)(# of cp per year) – 1 = 1+ r m m –1 Example: r = 12% per year compounded monthly imonth = 12% yearly = 1 % compounded monthly 12 months ia = (1 + .01)12 – 1 = 12.68% compounded annually Another example… r = 12% per year compounded semi-annually isemi-annual = 12% annually 2 times per year = 6% per 6 months ia = (1 + .06)2 – 1 = .1236 = 12.36% per year compounded annually As the compounding period gets smaller, does the effective interest rate increase or decrease? Let’s Illustrate the Answer… r = 12% per year compounded daily idaily = 12% 365 = .000329 ia = (1 + .000329)365 – 1 = .12747 = 12.747% per year compounded annually What happens if we let the compounding period get infinitely small? Continuous Compounding i = e( r )(# of years) – 1 Examples: r = 12% per year compounded continuously ia = e( .12 )(1) – 1 = 12.75% What would be an effective six month interest rate for r = 12% per year compounded continuously? i6 month = e( .12 )(.5) – 1 = 6.184% Compounding Period is More Frequent than the Payment Period EFFECTIVE INTEREST RATE ie = effective interest rate per payment period = ( 1 + interest rate per cp)(# of cp per pay period) – 1 = 1+ r m me – 1 Example: r = 12% APR, compounded monthly, payments quarterly imonth = 12% yearly = 1 % compounded monthly 12 months ie = (1 + .01)3 – 1 = .0303 – or – 3.03% per payment Summary of Effective Rates An “APR” or “% per year” statement is a Nominal interest rate – denoted r – unless there is no compounding period stated The Effective Interest rate per period is used with tables & formulas Formulas for Effective Interest Rate: If continuous compounding, use i er ( y ) 1 y is length of pp, expressed in decimal years m r If cp < year, and pp = 1 year, use ia 1 1 m m is # compounding periods per year If cp < year, and pp = cp, use m is # compounding periods per year If cp < year, and pp > cp, use me is # cp per payment period i r m m r e ie 1 1 m CRITICAL POINT When using the factors, n and i must always match! Use the effective interest rate formulas to make sure that i matches the period of interest (sum any payments in-between compounding periods so that n matches i before using formulas or tables) Note: Interest doesn’t start accumulating until the money has been invested for the full period! Shows up here on CFD… Deposit made here … (End of Period Convention) Returns interest here! i X 0 1 2 periods Problem 1 The local bank branch pays interest on savings accounts at the rate of 6% per year, compounded monthly. What is the effective annual rate of interest paid on accounts? GIVEN: r = 6%/yr m = 12mo/yr DIAGRAM: NONE NEEDED! FIND ia: m r ia 1 1 m 12 0.06 1 1 6.17% 12 Problem 2 What amount must be deposited today in an account paying 6% per year, compounded monthly in order to have $2,000 in the account at the end of 5 years? GIVEN: F5 = $2 000 r = 6%/yr m = 12 mo/yr FIND P: n 5 yrs DIAGRAM: m $2 000 0 1 2 5 yrs P? 12 r 0.06 ia 1 1 1 1 6.17% / yr m 12 P $2000( P | F , 6.17%, 5) $2000(1 0.0617 )5 $2000(.74129) $1482.59 Problem 2 – Alternate Soln What amount must be deposited today in an account paying 6% per year, compounded monthly in order to have $2,000 in the account at the end of 5 years? GIVEN: F5 = $2 000 r = 6%/yr m = 12 mo/yr FIND P: DIAGRAM: $2 000 0 1 2 60mos P? 12 mos ( 5 yrs ) 60 mos n ( m )(# yrs ) yr r 0.06 1yr i 0.5% / mo m yr 12 mo P $2000( P | F ,0.5%,60 ) $2000( 0.7414 ) $1482.80 Problem 3 A loan of $5,000 is to be repaid in equal monthly payments over the next 2 years. The first payment is to be made 1 month from now. Determine the payment amount if interest is charged at a nominal interest rate of 12% per year, compounded monthly. GIVEN: P = $5 000 r = 12%/yr m = 12 mo/yr FIND A: DIAGRAM: $5 000 1 2 yrs 0 A? Problem 4 You have decided to begin a savings plan in order to make a down payment on a new house. You will deposit $1000 every 3 months for 4 years into an account that pays interest at the rate of 8% per year, compounded monthly. The first deposit will be made in 3 months. How much will be in the account in 4 years? DIAGRAM: 0 1 F? 2 3 4 yrs $1 000 Problem 5 Determine the total amount accumulated in an account paying interest at the rate of 10% per year, compounded continuously if deposits of $1,000 are made at the end of each of the next 5 years. DIAGRAM: 0 1 2 F? 3 5 yrs $1 000 Problem 6 A firm pays back a $10 000 loan with quarterly payments over the next 5 years. The $10 000 returns 4% APR compounded monthly. What is the quarterly payment amount? DIAGRAM: $10 000 1 2 3 5 yrs = 20 qtrs 0 $A Problem 7 Anita Plass-Tuwurk, who owns an engineering consulting firm, bought an old house to use as her business office. She found that the ceiling was poorly insulated and that the heat loss could be cut significantly if 6 inches of foam insulation were installed. She estimated that with the insulation she could cut the heating bill by $40 per month and the air conditioning cost by $25 per month. Assuming that the summer season is 3 months (June, July, August) of the year and the winter season is another 3 months (December, January, and February) of the year, how much can she spend on insulation if she expects to keep the property for 5 years? Assume that neither heating nor air conditioning would be required during the fall and spring seasons. She is making this decision in April, about whether to install the insulation in May. If the insulation is installed, it will be paid for at the end of May. Anita’s interest rate is 9%, compounded monthly. Problem 7 GIVEN: SAVINGS = $40/MO (DEC,JAN, FEB); $25/MO (JUN, JUL, AUG) r = 9%/YR, CPD MONTHLY FIND P(SAVINGS OVER 5 YEARS): 1ST YR DIAGRAM: PA ? $25 5 YR DIAGRAM: PA $40 0 0 1 2 3 4 5 6 7 8 9 10 11 12 MO 1 2 3 4 5 YRS P? i = r = 0.09 = 0.75% / MO m 12 PA = Pα + Pβ(PPβ) = Aα(P|A,i,nα) + Aβ(P|A,i,nβ)(P|F,i,6) = $25(P|A,0.75%,3) + $40(P|A,0.75%,3)(P|F,0.75%,6) = $25(2.9556) + $40(2.9556)(0.9562) = $186.94 at the start of each year… Problem 7 cont. GIVEN: SAVINGS = $40/MO (DEC,JAN, FEB); $25/MO (JUN, JUL, AUG) r = 9%/YR, CPD MONTHLY FIND P(SAVINGS OVER 5 YEARS): 5 YR DIAGRAM: $186.94 0 1 2 3 4 5 YRS P? m r ia 1 1 m 12 0.09 1 1 12 9.38% P P0 PA A A(P | A, i,N) (1 i)N 1 A A N i ( 1 i ) $186.94 $186.94(P | A,9.38%,4) (1 0.0938)4 1 $186.94 $186.94 4 0 . 0938 ( 1 0 . 0938 ) $186.94 $186.943.21288 $787.56