Presentation - Magyar Nemzeti Bank

advertisement

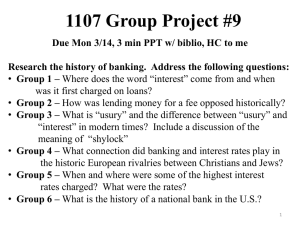

Report on Financial Stability Vonnák Balázs director 12th November 2014 1 Content I. Settlement of FX loans II. The asset management agency III. Vulnerability – results of the stresstest IV. Lending developments Magyar Nemzeti Bank 2 Dia címe I. Settlement of FX loans 3 Settlement of the FX loan problem has a significant impact on every aspect of financial intermediation Profitability, capital position Settlement Loan conversion to HUF Fair banking system Significant one-off losses, decreasing interest bearing assets Moderating credit and financing risks Decreasing interest margins Lending Short term Competition Medium term Downward risks due to loan losses Moderating risks has a positive effect Reliance on external debt Liquidity Healthy assets may contribute to a banking system which supports growth better More intense competition for FX Worsening loan conversion to liquidity position HUF Decreasing reliance Fair refinancing conditions intensify competition in household lending Downward risks due to loan losses Source: MNB 4 Fx loan measures What is the main point? Who is affected? Every credit to consumers which was disbursed after 1 May 2004 and was not terminated before 26 July 2009 (excluding state-subsidised loans, credit card and current account ) Settlement Decrease of outstanding debt, or reimbursement, and resetting the interest rate to its fair level Fair banking system - Maturity shorter than 3 years: fixed interest rate and spread - Maturity longer than 3 years: interest and spread changes along consecutive changes in the specific rates of modifications All new and currently outstanding loans FX loan conversion to HUF Conversion to HUF and defining the new pricing conditions Currently outstanding FX mortgage loans Source: MNB 5 What will change in case of a typical foreign exchange debtor? At the time of contracting Currently Settlement and interest rates reset to the fair level Outstanding debt 5,6 HUF million (37 CHF thousand) 7,5 HUF million (29,1 CHF thousand) 6 HUF million (23,4 CHF thousand) Interest rate 5,7 percent (FX) 7,8 percent (FX) 5,7 percent (FX) Spread (above the reference rate) 3,4 percentage point (CHF LIBOR) 7,8 percentage point ( CHF LIBOR) 5,7 percentage point ( CHF LIBOR) Instalment 40 HUF thousand 78 HUF thousand 56 HUF thousand In the future Level of initial interest rates after loan conversion to HUF is not defined yet Change in interest rates and interest spreads will be possible in predefined periods (at least every 3 years) along consecutive changes in the specific rates of modifications accepted by the MNB. Source: MNB 6 The impact of the settlement arising from nullification of the exchange rate spread and unilateral contract modifications on the profitability of the financial institutions HUF billion Estimated gross effect Terminated FX mortgage contracts and Total loans other loans Forcast for Estimated annual loss net effect in interest on income income Forcast for the reduction in net interest margin (percentage point) Forcast for the reduction in ROE (percentage point) Banking sector and branches 695 89 784 608 92.1 0.27 3.24 Total financial intermediary system 786 156 942 731 0 0 0 Magyar Nemzeti Bank 7 Source: MNB,CCIS Substantial heterogeneity is expected in the reduction of borrowers’ debt 35 per cent per cent 30 25 30 25,2 27,9 26,9 24,8 22,7 25 19,4 20 20 15 10 35 13,1 15 12,1 12,9 10 7,8 5 3,5 2,3 5 0,8 0,6 0-5 per cent 5-10 per cent 10-15 per cent 15-20 per cent 20-25 per cent 25-30 per cent 0 >30 per cent 0 Decrease in outstanding principle Based on outstanding debt Based on number of contracts Estimated distribution of debt reduction of performing CHF-denominated mortgage loans following the settlement Magyar Nemzeti Bank 8 Source: MNB Expected details and effects of FX loan conversion to HUF • Only mortgage loans will be affected • Official MNB exchange rate on 7th November (EUR: 309, CHF: 256,5) OR average exchange rates since the decision of the Curia on June 16th – whichever is lower; • Banking clients have the right to terminate within 60 days if conditions change according to the framework of the ”fair banking system” • Household's open foreign currency position disappears • External debt and currency swaps decrease as open foreign currency position closes • MNB provides the necessary foreign exchange liquidity • Systemic HUF liquidity decreases • Due to the FX loan conversion competition may arise in • Pricing of HUF loans according to the framework of the ”fair banking system” • HUF funding, i.e. for HUF deposits Magyar Nemzeti Bank 9 Households’ FX debt significantly decreases due to the conversion into HUF 9 000 per cent HUF Bn 55 50 7 000 45 6 000 40 5 000 35 4 000 30 3 000 25 2 000 20 1 000 15 0 10 Jan-05 Apr-05 Jul-05 Oct-05 Jan-06 Apr-06 Jul-06 Oct-06 Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 Jul-15 Oct-15 8 000 Household HUF loans Household FX loans Household loans/GDP (RHS) Households’ debt structure by currency and in percent of GDP Magyar Nemzeti Bank 10 Source: MNB Household's open foreign currency position decreases per cent per cent 65 60 55 50 45 40 35 30 25 20 15 10 5 0 -5 -10 2000Q1 Q3 2001Q1 Q3 2002Q1 Q3 2003Q1 Q3 2004Q1 Q3 2005Q1 Q3 2006Q1 Q3 2007Q1 Q3 2008Q1 Q3 2009Q1 Q3 2010Q1 Q3 2011Q1 Q3 2012Q1 Q3 2013Q1 Q3 2014Q1 Q3 2015Q1 65 60 55 50 45 40 35 30 25 20 15 10 5 0 -5 -10 Household sector Non-financial corporate sector General government consolidated with MNB Open FX position of the main sectors in the balance sheet as percentage of GDP Magyar Nemzeti Bank 11 Source: MNB The ”fair banking system” creates transparent pricing for long term loans… Possibility of unilateral interest-rate hikes Earlier Disbursement Reference rate based product with flexible interest rate spread (at the end of the periods: can be amended along consecutive changes in the specific rates of modifications accepted by the MNB) Disbursement Fair banking system Right to terminate (free of charge) Fix interest rate through the Interest period (at least 3 years) (at the end of the periods: can be amended along consecutive changes in the specific rates of modifications accepted by the MNB) Disbursement Right to terminate (free of charge) Effects of the ”fair banking system” on the pricing of long term loans Magyar Nemzeti Bank 12 Source: MNB ...and also for short term loans Possibility of unilateral interest-rate hikes Earlier Disbursement Reference-rate based product with fix interest rate spread Disbursement Fair banking system Fixed interest rate Disbursement Effects of the ”fair banking system” on the pricing of short term loans Magyar Nemzeti Bank 13 Source: MNB Banks with outstanding levels of liquidity and capital buffer are expected to benefit the most from the conversion Deposit coverage ratio after the settlement (per cent) 120 100 80 60 40 20 0 8 10 12 14 16 18 20 CAR after the settlement (per cent) Estimated level of capital adequacy and deposit coverage ratio after the settlement, by banks – the bigger the bubble, the bigger the loss born Magyar Nemzeti Bank 14 Source: MNB Hungary is expected to be among the less efficient countries in international comparison 80 per cent per cent 80 Hungary HU after settlement Cost to income ratio (2013) Malta 0 Czech Republic 0 Estonia 10 Latvia 10 Spain 20 Croatia 20 Poland 30 Bulgaria 30 Slovakia 40 Cyprus 40 Romania 50 Lithuania 50 Italy 60 Portugal 60 Slovenia 70 Greece 70 Cost to income ratio in international comparison Magyar Nemzeti Bank 15 Source: MNB II. The asset management agency 16 Following a continuous decrease for almost two years, the NPL-ratio increased in 2014 22 per cent HUF Bn 1 300 1 200 20 1 100 18 1 000 16 900 14 800 12 700 10 600 8 500 400 6 300 4 200 100 0 0 2007Q1 Q2 Q3 Q4 2008Q1 Q4 Q3 Q2 2009Q1 Q2 Q3 Q4 2010Q1 Q2 Q3 Q4 2011Q1 Q2 Q3 Q4 2012Q1 Q2 Q3 Q4 2013Q1 Q2 Q3 Q4 2014Q1 Q2 2 31-90 days delinquency ratio 90+ days delinquency ratio Loans with 90+ days delinquency (RHS) Share of non-performing corporate loans of the banking sector Source: MNB. 17 The deterioration of the corporate loan portfolio can be clearly linked to real estate project loans 900 per cent HUF Bn 33 Q2 6 2014Q1 0 Q4 9 Q3 100 Q2 12 2013Q1 200 Q4 15 Q3 300 Q2 18 2012Q1 400 Q4 21 Q3 500 Q2 24 2011Q1 600 Q4 27 Q3 700 Q2 30 2010Q1 800 NPL - project financing NPL - other corporate loans NPL ratio - project financing (right-hand scale) NPL ratio - other corporate loans (right-hand scale) Non-performing project and other corporate loans within the banking sector Source: MNB. 18 The high NPL portfolio lowers the efficiency of the lending channel Exchange rate adjusted change in corporate loans outstanding between December 2008 and June 2014 (per cent) 10 Bank7 0 -10 Bank1 Bank6 -20 Bank8 Bank9 -30 Bank4 Bank5 -40 Bank2 -50 Bank3 -60 0 5 10 15 20 25 30 35 NPL ratio of corporate loans, June 2014 (per cent) Change in loans outstanding and NPL ratio in the corporate segment Source: Jones Lang LaSalle. 19 The asset manager proposed by the central bank could efficiently remedy the distressed corporate portfolio Eligible counterparty Eligible assets Minimum value threshold for assets Time of origination Transfer price Any solvent and liquid credit institution (both corporations and co-operatives) active in the EU, which has commercial real estate exposure in Hungary or holds Hungarian commercial real estate on its balance sheet. Commercial real estate loan or foreclosed commercial property, where the bank provided financing for property development for future sales or rentals, partly or totally, or where the source of repayment is the cash-flow generated by the real estate property. For commercial real estate loans min HUF 500 million. For foreclosed real estate properties min HUF 200 million. Will be determined later on. The pricing technique remains to be determined, no conciliations have taken place with the banks. The transfer price may be below book value. MNB credit line up to HUF 300 billion, with a term of maximum 10 years. Financing Planned operating period of the Asset 10 years maximum Management Agency The main characteristics of the asset management agency initiated by the Central Bank Source: MNB. 20 III. Vulnerability – result of the stress test 21 Ratio of non-performing FX mortgage loans are still increasing 26 per cent per cent 26 Q2 0 2014Q1 0 Q4 2 Q3 2 Q2 4 2013Q1 4 Q4 6 Q3 6 Q2 8 2012Q1 8 Q4 10 Q3 10 Q2 12 2011Q1 12 Q4 14 Q3 14 Q2 16 2010Q1 16 Q4 18 Q3 18 Q2 20 2009Q1 20 Q2 22 Q3 22 Q4 24 2008Q1 24 Household NPL ratio by products Source: MNB. 22 The banking system’s resilience to shocks will decline considerably after the settlement 1 200 per cent HUF Bn 40 900 30 600 20 300 10 0 0 -10 2005 Q1 Q2 Q3 Q4 2006 Q1 Q2 Q3 Q4 2007 Q1 Q2 Q3 Q4 2008 Q1 Q2 Q3 Q4 2009 Q1 Q2 Q3 Q4 2010 Q1 Q2 Q3 Q4 2011 Q1 Q2 Q3 Q4 2012 Q1 Q2 Q3 Q4 2013 Q1 Q2 Q3 Q4 2014 Q1 Q2 -300 Capital need to meet regulatory requirement Capital buffer above the regulatory requirement Solvency Stress Index (RHS) Solvency Stress Index with FX mortgage loan conversion (RHS) Capitalisation of the banking sector in stress Source: MNB. 23 FX risk disappears from households’ loan portfolio after FX conversion to HUF 1 100 HUF Bn HUF Bn 1 000 1 100 1 000 +52 HUF Bn 900 900 800 800 700 700 600 600 500 500 400 400 300 300 200 200 100 100 0 0 +11 Huf Bn -100 Now -100 After the conversion Capital need to meet regulatory requirement Capital buffer above the regulatory requirement Consolidated capital buffer and capital need along the stress scenario Magyar Nemzeti Bank 24 Source: MNB. IV. Lending developments 25 The FGS generated new demand for loans Would has the client borrowed for the same purpose if there was no FGS? Magyar Nemzeti Bank 26 Source: MNB, Survey It was primary spent on capacity extension Investment loans by their purpose according to a corporate survey Magyar Nemzeti Bank 27 Source: MNB, Survey Corporate lending has improved significantly as a result of the FGS 0 -100 -200 -300 -400 -500 -600 -700 -800 -900 -1 000 -1 100 -1 200 -1 300 per cent per cent 0 -100 -200 -300 -400 -500 -600 -700 -800 -900 -1 000 -1 100 -1 200 -1 300 2012 Q1Q2 Q3 Q42013 Q1Q2 Q3 Q42014 Q1Q2 Q3 Q42015 Q1Q2 Q3 Q42016 Q1Q2 Q3 Fact Forcast - 2012 Q4 (FGS is not given) Forcast - 2013 Q3 Forcast - 2014 Q2 Forcast - 2014 Q3 (with new framework) Forecast for corporate lending in different periods (cumulative transactions) Source: MNB. 28 Market-based lending still has not recovered yet 1 400 HUF Bn HUF Bn 1 400 1 200 1 200 1 000 1 000 800 800 600 600 400 400 200 200 0 0 -200 -400 -400 -600 -600 -800 -800 Jan-08 Apr Jul Oct Jan-09 Apr Jul Oct Jan-10 Apr Jul Oct Jan-11 Apr Jul Oct Jan-12 Apr Jul Oct Jan-13 Apr Jul Oct Jan-14 Apr Jul -200 Privately owned credit institutions without FGS new loans Overall transactions State owned banks and FGS new loans 12-month cumulative corporate loan transactions vis-à-vis the government and privatlyowned institutions Source: MNB. 29 Corporate lending is expected to accelerate further on the forecast horizon 2 per cent per cent 2 Actual Forecast - March 2014 Q3 Q2 2016 Q1 Q4 Q3 Q2 2015 Q1 Q4 -6 Q3 -6 Q2 -5 2014 Q1 -5 Q4 -4 Q3 -4 Q2 -3 2013 Q1 -3 Q4 -2 Q3 -2 Q2 -1 2012 Q1 -1 Q4 0 Q3 0 Q2 1 2011 Q1 1 Forecast - September 2014 Forecast for lending to non-financial corporations (transaction-based, year-on-year data) Source: MNB. 30 After a drop due to settlements, yoy growth rate predicts slowing deleveraging of households 0 per cent per cent 0 Actual Forecast - March 2014 Q3 Q2 2016 Q1 Q4 Q3 Q2 2015 Q1 Q4 -16 Q3 -16 Q2 -14 2014 Q1 -14 Q4 -12 Q3 -12 Q2 -10 2013 Q1 -10 Q4 -8 Q3 -8 Q2 -6 2012 Q1 -6 Q4 -4 Q3 -4 Q2 -2 2011 Q1 -2 Forecast - September 2014 Forecast for lending to households (transaction-based, year-on-year data) Source: MNB. 31 Thank you for your attention! 32