Botswana Investment & Trade Centre

advertisement

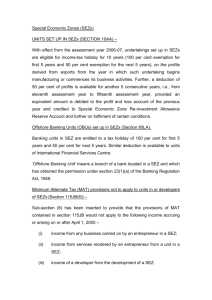

Role of SEZs in Regional Economic Development Francistown Investment Forum 2014 Letsebe Sejoe Chief Executive 19 August 2014 Agenda 1. Global Expo 2014 2. Conceptualization & Relevance of SEZ to Economic Dev. 3. SEZ Selected Sites in Botswana 4. Target Sectors or Economic Activity 5. Leveraging on Incentives SEZs Global Expo 2014 – 17th – 19th November, 2014 – Conference & Exhibition Centre, Fairgrounds, Gaborone – Theme: ‘Enhancing the business landscape through foreign direct investment & exports’ – 2nd Investment & Trade Conference on 17th & 18th Nov, 2014 (Offering free delegate passes) – 8 Plenary sessions will focus is on promotion of investment opportunities within the identified opportunity areas in Business Services (multimedia, data centers, BPO), Public-Private Partnerships (PPP), Special Economic Zones & clusters – Other topics :-competitiveness of business environments, employment creation, AGOA & SADC-EU EPA • • Expected exhibitors - Jordan, Turkey, Azerbaijan, Poland, China and Brazil, South Africa, Zimbabwe, Swaziland, Namibia, Ghana and locally from Botswana. Benefits of Participating at GEB Establish business networks – global buyers/sellers of your product or JV partners Network with private & public procurement practitioners Engage agents/distributors of your product Explore new export markets Access to Business match-making services Learn from experts about topical investment & trade topics (conference) Relevance of SEZ to Regional Economic Development Relevance of SEZs to Reg. Economic Development • Special Economic Zones (SEZs) are designated areas within a geographical area of a country that function with administrative, regulatory and fiscal regimes that are different from the domestic economy. • Primary Aim of SEZs is to overcome barriers to trade, investment & the attraction of FDI – (ie)restrictive Policies, excessive red tape and access to land – Creating a more competitive or conducive business environment for the attraction investors – Increase and diversify our export, increase our foreign earnings – Create substantial employment • SEZ Bill is at Draft Stage • Bill will Permit SEZ to promptly;-Register businesses, issue business licenses & grant work & residence permits. Selected SEZ Sites in Botswana Selected SEZ Sites in Botswana • Selection/Confirmation of SEZ Sites -informed by the SEZ mapping study • Research by Kaizer Associates identified eight sites in Botswana. • Francistown SEZ would be positioned as a Mining and logistics hub. • Competitive advantage of Greater Francistown is its central locality in relation to potential markets and also the proliferation of mines in the City’s locality. • From Francistown investors can reach the SADC region Africa efficiently • SSK International Airport in Gaborone: Multi-use SEZ; CAAB, BIH, BITC, International Diamond Activities. • Selibe Phikwe: Selibe Phikwe Economic Diversification Unit (SPEDU) ,BCL Polaris II, Iron steel, Copper and Metal (mineral beneficiation), Horticulture(Tuli), Logistics hub etc.. • Fairgrounds area in Gaborone: Financial services and domicile for intermediary hold co./corporate HQ • Lobatse: Beef, leather and biogas park. • Greater Palapye: Energy Decicit, low levels of innovation; Integrated coal value addition: coal power generation, export of excess power and, export of coal; Dry-port, logistics hub • Pandamatenga : Agro Business. Inadequate food supply, Integrated farming. Food Processing Phased Implementation of Selected Sites 1. SEZ roll out in Botswana F/Town Palapye Tuli Block Lobatse Fair grounds Phase I SSKIA Panda Phase III SPEDU Phase II Complexity of setting up the SEZ Leveraging SEZs on Incentives Completed Draft SEZ Incentives Leverages pre-existing tax incentives a) b) c) d) 15 % tax for companies that do not meet (j) below 200 % tax deductible training costs Duty free importation of Machinery and equipment All clearances will be done internally e.g. import, export etc. e) No income tax for the first 5 executive positions for the first five years f) Quota/Automatic issuance of work and resident permits- 5 executive positions (subsequent permits to be issued by SEZA) g) Lease price for land discounted at 35% below market price h) Industry specific preferential rates at 50% on primary inputs: e.g. (a) data, (b) voice, (c) water, (d) fertilizer, (e) power. i) All business registration and licensing (e.g. Trading, Manufacturing and, distribution) will be granted promptly by SEZA. Other Proposed SEZ Incentives in Botswana (j) Tax holiday under Development Approval Order for companies that meet the criteria below: No. of YEARS 10 8 6 4 2 1 INVESTMENT (Billion Pula) 5 2.5 1.25 0.625 0.3125 0.15625 No. of JOB: (at least) 2500 1250 625 312 156 80 % of TURNOVER SPENT ON R&D 15.00 12.50 10.00 7.50 5.00 2.50 PULA VALUE OFSPIN OFFS(of at least) 30% of the investment 25% of the investment 20% of the investment 15% of the investment 10% of the investment 5% of the investment THANK YOU www.bitc.co.bw