Investment Seminar

advertisement

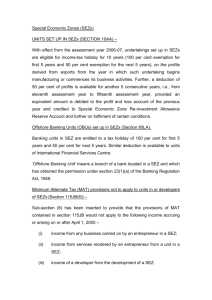

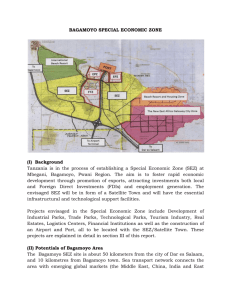

Investment Seminar South African Investment Promotion Seminar In Beijing 17 April 2014 Table of Contents 1.0 Special Economic Zone 1.1 Highlights of Government Policies 1.2 Status of the SEZ Implementation Processes 1.3 Targeted Investors for the SEZs 1.4 Key Elements of the SEZs 1.5 Planned SEZs in South Africa 2.0 Energy Policy and Opportunities In South Africa 2.1 Comprehensive Energy Policy 2.2 The South African Electricity Consumption 2.3 The South African Electricity Generation 2.4 Renewable Energy Opportunities 2.5 Objectives of Government on Energy Plan 3.0 Automotive Industry: Policy and Opportunities 3.1 The South African Automotive Manufacturing Hubs 3.2 The East London IDZ 3.3 The Rosslyn Supplier Park-Gauteng 3.4 The Rosslyn Supplier Park-Gauteng 3.5 Local Content Requirements 3.6 The South African Automotive Profile 3.7 Exports to Sub-Saharan Africa 3.Distribution Channels In Africa 1.1 Highlights of Government Policies Key Policies National Development Plan New Growth Plan Industrial Policy: IPAP Integrated Energy Plan Individual Policies: IRP, SEZs, Automotive etc. Economic Development Policies Focuses on: i.Creation of 5 million decent jobs by 2020 ii.Promoting a globally competitive economy that produces and trades with the rest of the world in innovative & value added products & services iii.SEZs were identified as one of the tools that could effectively be used to advance the government’s objective of industrialisation; iv.Regionally spread industrial development v.Beneficiation of own minerals and natural resources 1.2 Status of the SEZ Implementation Processes SEZ Bill was in parliament Aug 2013 SEZ Policy Done SEZ Strategy Done Supplier Development (In Progress) Skills Development (In Progress) Feasibility Studies for New SEZs is in Progress SEZ Incentives Done SEZ Regulations In progress SEZ Fund Done 1.3 Targeted Investors for the SEZs a) Manufacturing enterprises; b) Internationally Traded Services; c) International trade and distribution d) Primarily export oriented 1.4 Key Elements of SEZs •Transitional Arrangements of the IDZs •Minister •SEZ Board •SEZ Secretariat •M&E •SEZ Administration •New SEZs •Investments •Jobs •Exports •SEZ Incentives, •SEZ Infrastructure •Skills •R&D •Supplier Development Programmes SEZ Governance & Institutional Arrangements SEZ Support Measures SEZ Targets Value Proposition •SEZ Marketing •SEZ One Stop Shop •SEZ Incentives •Location •Resources 1.5 Planned SEZs in South Africa All Sphere of Government Government Planned SEZs •10 government SEZ Planned opportunities in all 9 provinces identified and feasibility studies are in progress; •We expecting 60% FDIs + 40% Domestic Investments •There are still opportunities for Private Public Partnership (PPP) for SEZs. 2.O Energy Policy and Opportunities In South Africa 2.1 Comprehensive Energy Policy Key Policy Objectives SECURITY OF SUPPLY WATER MININISE COST OF ENERGY CONSTRAINTS Environment Sustainability Social Development EMISSIONS ACCESS TO CAPS ENERGY Economic Development DIVERSIFY LOCALISATION & TECHNOLOGY TRANSFER SUPPLY ENERGY EFFICIENCY South Africa is currently developing comprehensive Energy Policy which will : i. Provide an energy roadmap for the country; ii. Guides the development of energy policies and regulations; iii. Guides the selection of appropriate technology to meet energy demand , iv. Guides the investment and development of energy infrastructure in South Africa, and; v. Provides alternative energy strategies for the sector. vi. Eskom is part of Southern African Power Pool, a group of utilities in the region aiming to create a common market for electricity in the region 2.2 The South African Electricity Consumption Electricity Consumption 2.70% Overview i.Eskom has a current nominal installed capacity of 44,175MW 8.10% ii.Government addressing electricity supply issues with Eskom and Independent Power Producers (“IPPs”) 11.40% 40.90% iii.Electricity generation dominated by stateowned power company Eskom, which currently produces over 96.7% of the power used in the country 36.80% Industrial Segment Residential Segment Commercial Transportation Others iv.South Africa needs over 45,600 MW new generation capacity by 2030 2.3 The South African Electricity Generation Electricity Generation 5.70% 1.20% 0.50% Transmission and distribution 0.10% I.Currently, the transmission of electricity in South Africa is undertaken by Eskom II.The company has over 28,000 km of transmission lines spanning the entire country III.Electricity distribution is the final stage in the delivery of electricity to end users, currently undertaken by Eskom, together with 187 municipalities IV.Municipalities account for 40% of the total electricity sales and 60% of the customer base 92.60% Coal Nuclear Power Pumped Hydroelectric Gas Turbine 2.4 Renewables Energy Opportunities (IRP Determinant) MW allocation in accordance with the Determination MW capacity allocated in the First Bid Submission Phase Onshore wind 1 850.0 MW 634.0 MW 562.5 MW 653.5 MW Solar photovoltaic 1 450.0 MW 631.5 MW 417.1 MW 401.4 MW 200.0 MW 150.0 MW 50.0 MW 0.0 MW Small hydro (≤ 10MW) 75.0 MW 0.0 MW 14.3 MW 60.7 MW Landfill gas 25.0 MW 0.0 MW 0.0 MW 25.0 MW Biomass 12.5 MW 0.0 MW 0.0 MW 12.5 MW Biogas 12.5 MW 0.0 MW 0.0 MW 12.5 MW 3 625.0 MW 1 415.5 MW 1 043.9 MW 1 165.6 MW Technology Concentrated solar power Total MW capacity allocated in the Second Bid Submission Phase MW capacity for allocation in future Bid Submission Phases 2.5 Objectives of Government on the Energy Plan The South Africa Government remains committed to: i.Ensure security of energy supply; ii.Diversification of the energy mix that includes clean and renewable resources to meet the needs of our fast growing economy, without compromising our commitment to access clean, sustainable and affordable energy; iii.Promotion of energy efficiency across the energy value chain; iv.Regional integration and support for regional projects, and v.Commitment to the UN secretary General call for sustainable energy for all, doubling energy efficiency and doubling the deployment of renewable energy. 3.0 Automotive Industry: Policy and Opportunities 3.1 The SA Automotive Manufacturing Hubs Automotive hubs in South Africa Automotive Production in SA Ford (Pretoria) Ranger Bantam Nissan/Renault (Pretoria) NP200/300 Sandero BMW (Pretoria) BMW 3 series Toyota (Durban) Hilux Corolla Fortuner Mercedes Benz (East London) C class GM (Port Elizabeth) Chevrolet Utility Isuzu VW(Uitenhage) Polo Polo Vivo FAW (Coega) 3.2 East London IDZ An established automotive investment solution 1. World Class Automotive Supplier Park (ASP) i. 16ha of Industrial facilities, 20ha expansion in progress ii. Home to global Suppliers (Johnson Controls, Otto Fuchs etc) iii. East London IDZ ASP – world-class infrastructure for OEMs and Multi-Level Car Terminal component manufacturers iv. Numerous second-tier component manufacturers supplying MercedesBenz are located in the EL IDZ 2. ASP Tugger Route i. Comprises a vein through the centre of the ASP linking all suppliers to the “milk-run” ii. speedy and accurate just-in-time and just-in-sequence supply to Mercedes-Benz SA iii. Shared logistics service reduces operation costs Facilitated by renowned Logistics Service Provider (LSP) UTI iv. Mercedes-Benz are located in the EL IDZ 3. Secured, State of the Art Vehicle Storage Centre (VSC) Streamlines the processing of incoming and outgoing vehicles 2,500 covered and 1,154 open bays 4. Competent Skills Pool 5. Science & Technology Park 6. Complete Investor Pre and Post Settlement Support Containerisation 3.3 Rosslyn Supplier Park - Gauteng Business Support Services SHARED FACILITIES i. The Central Hub incorporates offices for service providers ii. 4-star graded conference centre with full conferencing facilities iii. Central Canteen coffee shop fast food outlet and ATM iv. Medical Centre to service the tenants of the ASP on a shared service basis. ICT i. Centre of Excellence ii. Shared funding and resourcing iii. Economies of scale iv. Customer service orientation v. Governance & risk management vi. Business Continuity & Disaster recovery vii. Enabling ASP to be a “technology-aware” park viii. Modular design to allow customers to “slot in” 3.4 Rosslyn Supplier Park -Gauteng Logistics Optimisation i.Common logistic centre operated by an independent service provider - Comprises warehouse of over 34,000m2 and serves ASP tenants and other automotive customers. ii.Three logistic service providers based at ASP provide a wide range of local and international logistic services; iii.Centrally located container depot - Able to handle all the inbound and outbound container traffic of the park. 3.5 Local Content Requirements 65%: % of total material cost Electrical / Electronic •Harnesses •Starter motors •Alternators •Wiper systems •HVAC Body 15% 6% 19% 35%: true local material plus value add as % of total material cost Exterior •Glass •Paint •Bumpers •Mirrors 5% •Bonnets •Bootlids •Sideframes •Doors 10% 3% Interior 23% •Cockpit •Seats •Door panels •Carpets 7% Chassis and Drive-train 33% •Engines •Auto catalysts •Drive shafts •Brakes 14% 3.6 The South African Automotive Profile The South African Automotive Profile 800000 720000 700000 650000 600000 500000 400000 300000 200000 100000 0 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Production Sales Imports Exports 3.7 Exports to Sub-Saharan Africa Supported by trade Agreements Trade Agreements in Africa Source: Ernst & Young’s 2011 Africa attractiveness survey 3.8 Distribution Channels In Africa Thank You