Guidance for doing business with India

advertisement

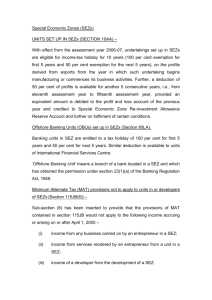

PRESENTED BY: Mr. Som Mandal Managing Partner, Fox Mandal OUR OFFICES In India: New Delhi, Noida, Bangalore, Bhubaneswar, Chandigarh, Chennai, Hyderabad, Kolkata, Mumbai and Pune with associate offices at Cochi, Trivandrum In Other Countries: United Kingdom (London), France (Paris), Guinea (Conakry) and Bangladesh (Dhaka) Liaison Office (cannot earn income) Operates as a foreign company Branch office (can earn profits/revenues) Project Office (can earn profits/revenues) Foreign Company Established as Indian Company Joint Venture Wholly Owned Subsidiary COMPANIES PRIVATE COMPANIES PUBLIC COMPANIES PRIVATE COMPANY SHARE-HOLDERS Minimum: 2 Maximum: 200 MINIMUM PAID-UP CAPITAL: INR 1 LAKHS DIRECTORS: Minimum: 2 Maximum: 12 PUBLIC COMPANY SHARE-HOLDERS Minimum: 7 Maximum: No Limit MINIMUM PAID-UP : INR 5 LAKHS DIRECTORS Minimum: 3 Maximum: 12 Benefits of Joint Ventures Shorten the Learning Curve Enhance Company Credibility Create New Profit Channels Pooling of resources Access to new markets Limited Period Concentration on core business Screening of prospective partners Ascertaining each others’ strengths and weakness and how the combination can be beneficial for all parties Joint development of a detailed business plan Undertaking detailed due diligence by each party - checking the credentials of the other party Entering into detailed Joint Venture Agreement Wholly owned subsidiary is an incorporated company formed and registered under the Companies Act, 1956 or Companies Act, 2013. Wholly owned subsidiaries can be formed as either private companies or public companies. Generally wholly owned subsidiaries are preferred to be formed as private companies because certain exemptions are granted to private companies under the Companies Act. Liaison Office can undertake only liaison activities. It is not allowed to undertake any business activity in India. A body corporate incorporated outside India, desirous of opening a Liaison Office in India is required to obtain permission from the Reserve Bank of India. Set forth below are the specific activities that can be undertaken by a Liaison Office: Representing in India the parent company / group companies. Promoting export / import from India. Promoting technical/ financial collaborations between parent/ group companies and companies in India. Acting as a communication channel between the parent company and Indian companies. Companies incorporated outside India and engaged in manufacturing or trading activities are allowed to set up Branch Offices in India with specific approval of the Reserve Bank of India. Such Branch Offices are permitted to represent the parent/ group companies and can undertake the following activities in India: Export/ Import of goods. Rendering professional or consultancy services. Carrying out research work, in areas in which the parent company is engaged. Promoting technical or financial collaborations between Indian companies and parent or overseas group company. Representing the parent company in India and acting as buying / selling agent in India. Rendering services in information technology and development of software in India. Rendering technical support to the products supplied by parent/group companies. Foreign airline / shipping company. Branch Office should be engaged in the activities in which the parent company is engaged. The profits earned by the branch office are freely remittable from India, subject to payment of applicable taxes. Branch Office is not allowed to carry out manufacturing or processing activities in India, directly or indirectly. Further, it is not permitted to undertake any retail trading activities. Typical terms of approval for establishing Branch Office Not to expand its activities or undertake any new trading, commercial or industrial activity other than that is expressly approved by the RBI. The entire expenses in India will be met either out of the funds received from head office through normal banking channels or through income generated by it in India. Reserve Bank of India has granted general permission to foreign companies to establish Project Offices in India, provided they have secured a contract from an Indian company to execute a project in India, and: The project is funded directly by inward remittance from abroad; or The project is funded by a bilateral or multilateral International Financing Agency; or The project has been cleared by an appropriate authority; or A company or entity in India awarding the contract has been granted Term Loan by a Public Financial Institution or a bank in India for the project. However, if the above criteria are not met, the foreign entity has to approach the Reserve Bank of India, Central Office, for approval. A Special Economic Zone (SEZ) is typically a designated territory within the geographical boundary of a country where exports along with certain other economic activities are promoted. In India, the Special Economic Zones Act has been enacted in 2005. This Act along with the Rules made there under forms the broad legal framework for the establishment, development and management of SEZs in India. The major incentives and facilities available to SEZ developers include: Exemption from customs/excise duties for development of SEZs for authorized operations approved by the prescribed authority. Income Tax exemption on income derived from the business of development of the SEZ in a block of 10 years in 15 years under the Income Tax Act. Exemption from minimum alternate tax under the Income Tax Act. Exemption from dividend distribution tax under the Income Tax Act. Exemption from Central Sales Tax (CST). Exemption from Service Tax under the SEZ Act. The incentives and facilities offered to the units in SEZs for attracting investments into the SEZs, including foreign investment include: Duty free import/domestic procurement of goods for development, operation and maintenance of SEZ units 100% Income Tax exemption on export income for SEZ units under the Income Tax Act for first 5 years, 50% for next 5 years thereafter and 50% of the ploughed back export profit for next 5 years. Exemption from minimum alternate tax under the Income Tax Act. External commercial borrowing by SEZ units up to US $ 500 million in a year without any maturity restriction through recognized banking channels. Exemption from Central Sales Tax. Exemption from Service Tax. Single window clearance for Central and State level approvals. Exemption from State sales tax and other levies as extended by the respective State Governments. “Arise, awake and stop not till the desired end is reached.” - Swami Vivekananda