Economic Capital

advertisement

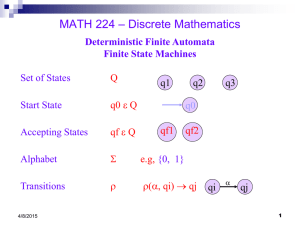

INTEGRATED MANAGEMENT OF RISK AND CAPITAL Internal Capital Modeling as a Decision-Making Platform FROM REGULATORY TO RATING -AGENCY TO ECONOMIC CAPITAL Regulators and Rating Agencies Agree on Importance of ERM • ORSA as an internal tool: • Requires (re)insurance enterprises to adequately assess their own short- and long-term risks • “Own funds” necessary to cover the identified risks and uncertainties •Methodology used to determine solvency needs • ORSA as a tool for the supervisory authorities: • Enables the regulators to evaluate the insurer’s risk profile, risk management practices, and approach to capital management • Internal capital models to complement standard SCR Risk Mgmt / ERM Review (Rating Agencies) • Higher-rated insurers are expected to have better risk mgmt and stronger capital • ERM is the link between risk-taking and capital • (S&P) Internal capital modeling to supplement RBC 3 INTEGRATED MANAGEMENT OF RISKS AND CAPITAL ORSA (Solvency II, NAIC SMI) and SCR: S&P has been reasonably successful in “rating” insurers’ ERM: • Risk governance and culture, including the Board’s oversight, ERM organization and committees, risk tolerances/appetite/limits, risk coordination and communication (reporting and dashboards), and risk objectives in incentive compensation. • Risk controls: insurance risks (underwriting, pricing, reserving, risk transfer), investment risks, asset-liability management, liquidity management, counterparty/credit and operational risks. • Risk aggregation, concentrations and contagions. • Risk analytics/modeling. • Emerging-risk management. • Strategic risk management (SRM): The insurer‘s framework for value creation through controlled risk-taking; balancing short- and longterm objectives; integrated management of risk and capital; capital allocation under the economic, rating-agency and regulatory constraints. S&P EXPERIENCE: CONDUCTING ERM REVIEWS SINCE 2006 Can an External Observer Evaluate the Strength of ERM? 4 Analytics in (Re)Insurance Decision-Making Quantification and Aggregation Desired Risk Profile Risk-Vs.-Reward INTEGRATED MANAGEMENT OF RISKS AND CAPITAL Risk Limits (& other controls) Risk Tolerance(s) Beginning Balance Sheet Economic Scenario Generator GDP, Inflation, Yield Curve, Equity Prices… Assets Coupons, Dividends, Sales, Reinvestments & Valuation Insurance Risk Scenario Generator Exposures, Premiums, Expenses, Losses (incl. Cat), Adverse Reserve Development Operational and Strategic Risks Cash Flows Income Statement Ending Balance Sheet TVaR1% VaR0.5% Liabilities Payments, Outstanding, & Valuation ECM: INTEGRATED STOCHASTIC RISK-VS.-CAPITAL MODELING DFA as a Platform for Economic Capital Analyses Insurance risks (underwriting/pricing and reserving risks) are typically modelled within homogeneous groupings (e.g. new Homeowner’s business written in Florida, or Excess Workers’ Compensation loss reserves, etc.), usually as aggregate-loss or severity/frequency loss probability distributions. •Important issues to consider: • Parameter uncertainty (model risk), especially for low frequency / high severity risks (such as catastrophes, liability/“tort” shocks, etc.) • Complex dependency structure for insurance risks •The projected valuations of the reserves are affected by economic scenarios: •Claim-cost inflation is correlated with general inflation •Discounting under the path-specific (future) yield curve •Reserving risk reflects regulatory regime; e.g. Solvency II’s market-value (risk) margins •Underwriting cycle and systemic events (e.g. tort reform) may result in (positive) correlation across insurance risks UNDERWRITING/PRICING AND RESERVING RISKS ECONOMIC CAPITAL MODELING (DFA) Simulating Insurance-Specific Scenarios •A simplified approach: rank-order correlation or copulas •Difficult to parameterize •May miss the interdependencies with asset risks 7 In evaluating the health of the future balance sheet, DFA “marks to model” all assets and liabilities relative to the future macro-economic environment simulated by an ESG (particularly, under the yield curve in each simulated scenario). This common environment naturally “correlates” the projected economic valuations of the assets and liabilities. This is particularly important for longer-tailed (e.g. Liability) businesses, as both their assets and liabilities tend to be especially sensitive to these macro-economic variables. • P&C (non-Life) actuaries tend to pay less attention to market and asset risks • Important issues to consider: • Parameterization, testing and validation; ESG IN ECM’S DEPENDENCY STRUCTURE ECONOMIC CAPITAL MODELING (DFA) Economic Scenario Generator (ESG) • Alignment of projected macroeconomic scenarios with the management’s own views (the “use test”); • ESG-based portfolio analytics and investment decision-making; • “Holy Grail”: Stochastic multi-line, multi-year underwriting-cycle and claimcost inflation model. 8 Internal Capital Models (DFA) Integrated, fully stochastic model. All plausible risks can be explicitly incorporated to determine the targeted amount of capital that would assure ongoing solvency. Explicit modeling of key risk interdependencies; coupled with correlations or copulas. Extreme events and systemic dislocations reduce the benefit of diversification. Capital Adequacy: The amount of current assets sufficient (relative to the desired rating) to assure ongoing solvency over a one-year period under the aggregate impact of all stochastically generated scenarios. vs. S&P Capital Model Factor-based approach; factors are stochastically calibrated. Target capital – as affected by market, credit, operational, underwriting and catastrophic risk. Credit for diversification recognized for correlations in the tail, but at a lower value than observed in the industry (e.g. 50% haircut). Capital Adequacy: Present value of the expected economic losses in surplus measured over the expected duration of the assets and liabilities and observed over a one-year period for the stress scenario corresponding to the desired rating. INTERNAL CAPITAL MODELS ARE BETTER SUITED TO SUPPORT SRM Internal Models Vs. Regulatory and Rating-Agency Models ECM AND STRATEGIC DECISION-MAKING EC = (minimum) capital sufficient – to a pre-defined security standard – to meet the insurer’s obligations even under extremely adverse outcomes associated with various risks of an enterprise. (a.k.a. “Risk Capital”) • EC is a capital-at-risk indicator and a capital-adequacy constraint DEMYSTIFYING THE EC ECONOMIC CAPITAL MODELING (DFA) How Is EC Calculated? • Means different things to different people (e.g. in-force only, or with one year of new business) • Highly sensitive to the selected metric (e.g. one-year VaR99.5%; other metrics are also popular, e.g. TVaR98%) • Highly prone to model risk (since it is based on modeling rare/extreme events) • It is usually based on a one-year solvency target, and thus only partially reflects long-term creation of value (e.g. from strategic decisions) • Tends to disregard mgmt actions, such as capital mgmt, changing reinsurance strategy, changing investment allocations, etc. 11 • Highly sensitive to the selected metric (e.g. one-year VaR99.5%; other metrics are also popular, e.g. TVaR98%) • Highly prone to model risk (since it is based on modeling rare/extreme events) • Means different things to different people DEMYSTIFYING THE EC EC = (minimum) capital sufficient to offset future businessenvironment adversities, and assure the payment of . • EC is a capital-at-risk indicator and a capital-adequacy constraint ECONOMIC CAPITAL MODELING (DFA) Economic Capital (EC) • It is usually based on a one-year solvency target, and thus only partially reflects long-term creation of value (e.g. from strategic decisions) • Tends to disregard mgmt actions, such as capital mgmt, changing reinsurance strategy, changing investment allocations, etc. 12 • Even as a constraint, VaR-based EC is insufficient. Additional constraints may be needed to help contain the loss given insolvency (the risk to policyholders) DEMYSTIFYING THE EC Frequently, practitioners refer to “optimizing economic capital”. • EC is not an objective function (target to achieve, or to optimize). It’s just a capital-at-risk indicator and a capitaladequacy constraint! ECONOMIC CAPITAL MODELING (DFA) EC in Decision-Making (cont.) • E.g. in addition to imposing a constraint on the probability of insolvency, a model may also seek to constrain the average loss given insolvency • Other metrics are needed to reflect the creation of value within an insurance enterprise • RoE • Multi-year book-value growth 13 (here FX is the cumulative probability distribution) • Co-x-TVaR is indicative of the product’s contribution to the tail risk to capital •(It is unclear how to chose a ) •Many insurers continue to use VaR-based EC as the basis for capital allocation, which raises many concerns: • VaR is not a coherent risk measure • VaR tends to focus too far in the tail DECISION-MAKING APPLICATIONS OF DFA Capital allocation is a widely used and powerful application of DFA. •TVaR is a popular tail-risk measure used to allocate capital to individual business segments (i), since: ECONOMIC CAPITAL MODELING (DFA) Capital Allocation •Very sensitive to model risk (especially parameter-estimation risk) •Smaller contributors to overall risk would tend to not register on the VaR “radar” •VaR cannot adequately address the value created by risk transfer (reinsurance) 14 • Value protection: allocation of risk capital to the product (or individual insurance contract) reflects the product’s (contract’s) potential claim on risk capital • Value creation: the minimum (“permissible”) price should be such that the expected cash flows (incl. the cash “trapped” by allocated risk capital) generate an IRR consistent with the return-on-capital target. • E.g. if RoE is the target, then the cash flows should factor in the attributed interest expense, taxes, etc • On the other hand, interest expenses and taxes should be ignored if the pre-tax return-on-available-capital is the target DECISION-MAKING APPLICATIONS OF DFA ECONOMIC CAPITAL MODELING (DFA) Capital Allocation as a Pricing Tool • While all capital-allocation methodologies try to reflect a product’s contribution to the potential depletion of capital, they may produce dramatically different results, and thus cause divergent views on the product’s profitability 15 Integrated Mgmt of Risk & Capital Regulatory, RatingAgency and Economic Capital Capital Mgmt - Amount - Structure - Share Buybacks - Excess Capital Position Capital Attribution and Risk-Adjusted Profitability Risk vs. Reward in Decision-Making Strategic Opportunities RAC, RoRAC, RARoC Risk-based (adjusted) profitability targets Enter/Exit LOB Improved Risk Selection M&A - Predictive Modeling Risk-Adjusted Price - Data Mining Portfolio Optimization - Right-sizing LOBs/segments - Cat. portfolio optimization - Risk-transfer optimization - Asset portfolio optimization Balancing Objectives - Short-Term vs. Long-Term - Growth vs. Stability - Shareholders vs. Policyholders INTERNAL MODELS: TACTICAL OR STRATEGIC? Other Tactical and Strategic Applications Strategic Risk Management “STAIRWAY TO HEAVEN” Risk Measurement and Analytics Play Pivotal Role in ERM Evolution Risk Models: Value Creation Through ERM Economic Capital, DFA, ESG, Stochastic Reserving, etc. High Integration into DecisionMaking Medium Integrated Management of Risk & Capital Quantification KRI Loss Control & Mitigation Low Compliance Risk control; protection of balance sheet and earnings Industry standard in the last 5-10 years Risk/reward optimization Today Industry standard in the next 5-10 years EVOLUTION OF ENTERPRISE RISK MANAGEMENT Strategic Role • U.S. RE Analytics is a consulting arm of U.S. RE. Using the most sophisticated, ever evolving risk analysis tools, we identify, quantify and combine all factors consequential to the financial strength of our insurance clients. SPEAKER About U.S. RE Analytics • ERM Consulting • Regulatory requirements and rating-agency expectations • Integrated management of risk and capital / Economic Capital Modeling • www.usre-analytics.com • Our staff of analysts, actuaries and senior executives with real world experience in management can help you chart a course to protect and grow your business. • About the speaker: Vlad Uhmylenko is an expert in risk management, financial and actuarial modeling, mathematics, and Decision Theory. He is Managing Director at U.S.RE Analytics where he leads Enterprise Risk Management, Economic Capital Modeling, and broker-support consulting. Before joining U.S. RE Analytics, he was Director-Enterprise Risk Management at Standard & Poor’s where he led ERM analytics on Property-Liability (P&C) insurance and reinsurance companies. Earlier, he spent 12 years at Aon in various risk management consulting roles. He holds advanced degrees in Mathematics and Finance, and his main area of analytical expertise is Decision-Making under Uncertainty, which includes Capital Modeling, Dynamic Financial Analysis, and Program Optimization. •vuhmylenko@usre-analytics.com 19