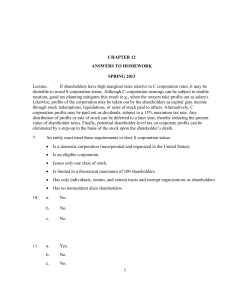

Advanced S Corporations

advertisement

Advanced S Corporations The American Jobs Creation Act of 2004 • Increase in number of shareholders – Limit increased to 100 – Family treated as 1 shareholder • Inadvertent Termination Relief • IRA as a S Corporation Bank Shareholder • ESBT Beneficiary Defined Slide 1-1 The American Jobs Creation Act of 2004- Losses • Transfer of Suspended Loss to Spouse • Passive Activity Losses and At Risk Amounts for QSSTs Slide 1-2 Eligible S Corporation Shareholders • Estates • Certain trusts – Grantor trusts – Testamentary trusts – Qualified Subchapter S Trust (QSST) – Electing Small Business Trust (ESBT) Slide 7-1 QSST Requirements • • • Owns stock in one or more S corporations; Beneficiary is a U.S. citizen or resident; and Trust terms include • • • • • Only one income beneficiary (CIB) at a time; Corpus must be distributed to the CIB; Interest of the CIB must terminate on the earlier of the income beneficiary's death or the date the trust terminates; and All corpus and income must be distributed to the CIB when the trust terminates. Beneficiary must make an election to be treated as a QSST Slide 7-2 ESBT Characteristics • Can have more than one CIB but each is treated as a separate shareholder • Trust is taxed on the S corporation income • No interest in the ESBT can be acquired through purchase • Trustee must make an election to be treated as an ESBT Slide 7-3 Rules when a Shareholder Dies • Estate can be an S corporation shareholder • In year of death will be two shareholders – the decedent and the estate • Must determine if: – Stock is subject to a buy-sell agreement – Stock is held in a trust – Stock passes to a testamentary trust Slide 7-4 Grantor Trust • Can be an S corporation shareholder • Estate will be deemed to own stock held by a grantor trust for S corporation purposes • Trust can be a shareholder until the stock is transferred or two years • A Qualified Revocable Trust (QRT) election can be made for a grantor trust Slide 7-5 Testamentary Trust • Trust that receives stock under the terms of a will • Is an eligible S corporation Shareholder for two years • At the end of the two years stock must be transferred to an eligible shareholder • A ORT election can be made for a testamentary trust as well Slide 7-6 Compensation Paid to S Corporation Shareholders • S corporation shareholders can be employees • Amount paid to shareholder / employees are treated as wages • Wages are subject to FUTA and FICA Slide 2-1 Reasonable Compensation • S corporations have a tendency to understate compensation to shareholder / employees • FICA • FUTA • Social Security Benefits Slide 2-2 Criteria for Reasonable Compensation • Size, complexity and financial condition of business • Employee’s position, time spent working and nature of services performed • Pay for comparable services and prevailing economic conditions • Company’s salary policy • Employee’s responsibilities and qualifications • Salary paid in prior years • Distributions to shareholders Slide 2-3 S Corporation Income Subject to Self Employment Tax • New proposal would increase the amount of income subject to self-employment tax • Issue that should be considered include – Entity Selection Neutrality – Choice of Entity – No Pay – No Benefit – Other Factors that Influence Compensation Slide 2-4 Fringe Benefits • Not available for “2% shareholders” including – Group Term Life Insurance – Accident and Health Plans – Meals and Lodging – Cafeteria Plans • Fringe Benefits paid for “2% shareholders” treated as wages Slide 2-5 Shareholder Expenses • Expenses paid by accrual basis corporations to cash basis shareholders – corporation not allowed deduction until shareholder reports income • Unreimbursed shareholder expenses – cannot be deducted by shareholder Slide 2-6 Computation of Basis Original basis + Additional capital contribution + Share of separately stated income items + Share of nonseparately stated income and gains + Share of tax exempt income + Excess of deduction for depletion over the basis of the property subject to depletion - Distributions - Share of nondeductible, non-capital expenses - Share of nonseparately stated ordinary loss - Share of separately stated deductions/losses - Shareholder’s deduction for depletion Shareholder’s stock basis not below zero Slide 3-1 Adjustments to Basis • Basis is adjusted in the following order: – All positive items – Distributions – Nondeductible, noncapital expenses – Other deductions • Basis is generally computed at year end • Basis is adjusted per share Slide 3-2 Basis of Indebtedness • Must be direct shareholder debt • Personal guarantees do not increase basis • Stock Basis is decreased by losses first, then basis in debt • Basis in debt is restored before basis in stock Slide 3-3 Economic Outlay • Shareholder acquires basis in debt only if they experience an actual economic outlay • Issue becomes a problem with: – Loans from Related Entities – Back to Back Loans Limitation of Deduction of Losses • Amount of losses that can be deducted limited to the sum of the shareholders basis in stock and direct loans • Losses limited by Section 1336(d) are carried over indefinitely • Losses carried over only with respect to that shareholder • Losses are then limited by at-risk basis and passive activity rules Slide 3-5 Distributions • Distributions are payments to shareholders are based on stock ownership • No effect on corporate income • Whether or not taxable to the shareholder depends on if the S corporation has AE&P Slide 4-1 Cash Distributions made by S Corporation without E&P • Tax Free Return of Stock Basis • Distribution reported when received • Gain only if amount received exceeds basis • Distribution reduces basis in stock Slide 4-2 Cash Distributions by S Corporation with AE&P • Distributions come out of the following accounts in the order shown – Accumulated Adjustments Account (AAA) – Previously Taxed Income (PTI) – Accumulated Earnings & Profit (AE&P) – Other Adjustments Account (OAA) • Election allowed under Section 1368(d) to take distribution out of AE&P first Slide 4-3 Tax Effect of Distributions • AAA, PTI and OAA – – Nontaxable to the extent of basis; – Gain in excess of basis • AE&P – – Taxable Dividend; – No effect on basis Slide 4-4 AAA • • Balance starts at zero the 1st day of the 1st taxable year after 1982 Increased by: – – – • Nonseparately stated income; Separately stated items of income and gain; Excess depletion (other than oil and gas); and Decreased by: – – – – Nonseparately stated loss; Separately stated items of loss or deduction; Nondeductible or noncapital expenses; Cost Depletion Slide 4-5 Differences Between AAA and Basis • The AAA increases and decreases by the same items as basis does each year, except: – Tax-exempt income increases basis, but does not increase the AAA. – Expenses relating to tax-exempt income reduce basis, but do not decrease the AAA. – Federal taxes relating to a C corporation year reduce basis, but do not decrease the AAA. – The order that increases and decreases are applied to basis and AAA differ. – Losses and deductions (but not distributions) can reduce the AAA below zero. Basis can never have a negative balance. Slide 4-6 Property Distributions • Amount Distributed = FMV of property • S corporation must recognize income (but not loss) as if the property had been sold • Sale could be subject to BIG tax Slide 4-7 Post Termination Transition Period (PTTP) • Cash distributions during PTTP applied against basis to the extent of AAA • PTTP begins on the day after the last day as S corporation and ends the later of (1) one year after termination, (2) the due date (including extended date) of final S return or (3)120 days after a final determination (e.g., court decision) that S election was terminated. Slide 4-8 Built-in Gains Tax • BIG is gain that had accrued when a C corporation converted to S status • BIG recognition period is ten years after the conversion • BIG tax could be triggered when an S corporation liquidates • BIG tax determined by multiplying the highest corporate rate by the BIG recognized during the year. Slide 6-4 History of QSubs • Effective for years after 1996 S corporations can own 100% subsidiary • Congressional intent – …understands that there are situations where taxpayers may wish to separate different trades or businesses in different corporate entities… in such situations, shareholders should be allowed to arrange these separate corporate entities under parentsubsidiary arrangements as well as brother-sister arrangements. Slide 5-1 Definition of QSub • Section 1361(b)(3)(B) defines a QSub as any domestic corporation that is not an ineligible corporation if: – An S corporation holds 100 percent of the stock of the corporation, and – The S corporation parent elects to treat the subsidiary as a QSub. Slide 5-2 Eligibility • A parent S corporation may elect to treat a subsidiary as a QSub if the subsidiary is: 1. wholly owned by the S corporation; 2. a domestic corporation; and 3. not an ineligible corporation (as that term is defined in section 1361(b)(2)). Slide 5-4 QSub must be Wholly-Owned • Determination made based on general tax principles • Issues could arise if – Subsidiary stock held by a disregarded entity owned by the S corporation; or – Another entity holds nominal title to the shares Slide 5-5 QSub Election • Election must be made by filing Form 8869 • A QSub election can be made at any time during the year and will be effective on the date on the form. The effective date specified cannot be more than: – two months and fifteen days before the date the election is filed, or – twelve months after the date the election is filed. • There is late election relief under Rev. Proc. 2003-43 Slide 5-6 Termination of QSub Election • QSub election may terminate in one of four ways: – By termination of the S election of the parent; – By the subsidiary ceasing to qualify; – By revocation; or – By transfer of 100% of the sock by sale of reorganization Slide 5-8 Tax effect of Termination • Subsidiary will be treated as a new corporation that acquires all of its assets and liabilities from the S parent immediately before the termination • New corporation must make any necessary elections • Formation of new corporation may or may not be tax-free Slide 5-9