- Tiffany & Bosco PA

advertisement

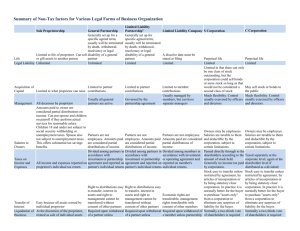

STARTING OFF ON THE RIGHT FOOT: BUSINESS FORMATION AND OWNER AGREEMENTS James P. O’Sullivan & May Lu Tiffany & Bosco, P.A.* Camelback Esplanade II, Third Floor 2525 E. Camelback Road Phoenix, AZ 85016 (602) 255-6017; (602) 255-6032 jpo@tblaw.com; mlu@tblaw.com * Offices in Phoenix, AZ and Las Vegas, NV Disclaimer Information presented here is general information. Choice of the right legal strategies for your business depends on your fact situation and how the law and market conditions apply to that situation. Consult professional advisors such as your accountant, insurance professional and business attorney. INTRODUCTION Why Bother? CHOOSING A BUSINESS ENTITY FORM Comparison of Business Structures Chart Available Legal Forms Sole Proprietorship Partnerships Corporations Limited Liability Company Sole Proprietorship Limited value, considering allowance of onemember LLC in Arizona and many other states Partnerships General Partnership Limited Liability Partnership Limited Partnership General Partnership In a general partnership, all partners subject to personal liability! Innocent Partner Still Liable “Thelma and Louise” Rule Limited Liability Partnership If general partnership or limited partnership, easy and wise to switch to LLP Limited Partnership Still need at least one general partner Usually ‘money’ person and ‘manager’ Unlimited liability for general partner Corporations ‘S’ Corporation ‘C’ Corporation C Corporation Default whenever a corporation is created Limited liability for shareholders Corporate Formalities S Corporation Tax Election of a C Corporation or Limited Liability Company Protection still the same S Corporation Relatively confining requirements Corporation of state or U.S. territory; Limits on who can be shareholders; No more than 100 shareholders; Only citizens or residents of U.S. may be shareholders; Only one class of stock (can have voting/non-voting). Limited Liability Company Limited Liability – Even for one member Ability to Elect Federal Taxation as Corporation or Partnership History of LLC Statutes Limited Liability Company Management Member-managed Manager-managed Very Flexible Organization No Annual Reports in AZ Typically, Less Formalities to Operation than Corporations. Arizona Corporation Commission www.cc.state.az.us Search Corporations, LLCs, Trade Names, & Trademarks Check Name Availability Forms, Instructions, and Fees Arizona Secretary of State http://www.azsos.gov/business_services/filings.htm Search Partnerships, Trade Names & Trademarks Checklist for Limited Partnership Filings Applications for Trade Names & Trademarks Forms, Instructions, and Fees OWNER AGREEMENTS Different Types, But Similar Issues: Partnership Agreement (Partnership) Articles of Incorporation, Bylaws, Shareholder Agreement (Corporation) Articles of Organization, Operating Agreement (Limited Liability Company) Money Concerns How does money come in? Debt (Personal Guaranties) Equity “Sweat” Equity Money Concerns How does money come out? Return on Investment Profits and Losses Compensation to Owners/Employees Governance and Management Differences Among Business Entity Forms Board of Directors, Officers and Shareholders Partners Managers and Members Governance and Management You’re not the boss of me! (Are you?) What duties and rights do the parties have? A.R.S. Section 10-732 Governance and Management When, Where and How Do They Meet? What Must They Do to Act? Records and Oversight Access to Internal Information Audits Financial Reporting Tax Protection From the Outside Insurance Indemnification Restrictions on Transferability Spousal Provisions/Consents Grounds for Business Divorce Breaches Dissolution Release from Guarantor Indemnification Security for Payment Exit and Termination Triggering Events Death, Disability Divorce Termination Tag Along/Bring Along Non-Compete/Trade Secrets Exit and Termination Call Right? Right of First Offer/Refusal? Buy-Sell Rights? Shotgun? Valuation of Business Book Value Fair Market Value Determined by Appraisal Fixed Initial Price + Annual Increase Based on Earnings/Other Factor Amount Offered by Bona Fide 3rd Party Purchaser Value on Company’s Earnings * Some Multiplier Payment Terms Cash Promissory Note Cash and Promissory Note Life Insurance/Disability Insurance Proceeds Security for Payment Pledge of Stock UCC Lien Against assets of the company and/or owner Personal Guaranty Saving the Marriage (or at least the business) Alternative Dispute Resolution Informal Negotiations Formal Negotiations Mediation Arbitration Saving the Marriage (or at least the business) Litigation Restraining Order/Injunction More Legal Considerations Notices Choice of Law Attorneys’ Fees Attorney Representation Provision QUESTIONS?