A432C12O.doc

advertisement

CHAPTER 12 B S CORPORATIONS

Based on West Federal Taxation, Corporations, Partnerships, Estates, & Trusts, 2001 ed.

1.

INTRODUCTION

1.

2.

3.

IN GENERAL p.12-2

1.

S Corporation status provides a compromise for small businesses.

1.

Avoid double taxation and loss limitations inherent in the regular corporate form

2.

Enjoy many of the nontax benefits extended to C corporations.

2.

State law:

1.

S Corporations are treated as corporations under state law. They are recognized

as separate legal entities and generally provide shareholders with the same

liability protection afforded by C corporations.

2.

Some states impose an income or franchise tax on S corporation meaning that the

corporation may not owe federal corporate tax but would owe state income tax.

3.

S corp status must be elected by a qualifying corporation and consented to by its

shareholders.

AN OVERVIEW OF S CORPORATIONS p.12-3

1.

The growth of S corporations has continued even though the individual income tax rate

has remained above the corporate rate. In 1986, only 24.1% of corporations were S

corporations, but by 1996 the percentage had grown to 49.8% or 2.3 million S

corporations.

2.

Two recent developments have affected the popularity of S corporation status.

1.

New entities called limited liability companies(LLCs) avoid restrictions that are

imposed on S corporations.

2.

Small Business Protection Act of 1996 liberalized several S corporation rules

which provide greater flexibility in forming, operating, and restructuring S

corporations.

WHEN TO ELECT S CORPORATION STATUS p.12-4

Consider these factors:

1.

Shareholders with high marginal rates relative to C corp. rates may want to avoid S

status.

2.

S corp. status allows shareholders to realize tax benefits from corporate losses

immediately such as the benefits of an NOL used to shelter other income (not available

with a C corp).

3.

If the entity electing S corporation status is currently a C corporation, any NOL

carryovers form prior years cannot be used in an S corporation year.

4.

Distributions of earnings from C corporations are usually taxed as ordinary income.

5.

S corporation rules impose significant requirements for qualifying as an S corporation.

Acct 432, Ch 12 Outline, Page 1

6.

2.

State and local tax laws should also be considered when making the S election.

QUALIFYING FOR S CORPORATION STATUS

1.

DEFINITION OF A SMALL BUSINESS p.12-5

Corporation must have these characteristics:

1.

Ineligible Corporations

1.

S corp status only granted to domestic corporations

2.

S corp status is not permitted for foreign corporations, certain banks, insurance

companies, and Puerto Rico or possessions corporations.

2.

2.

One Class of Stock B A small business corporation may have only one class of stock

issued and outstanding (does not consider different voting rights as different classes of

stock).

3.

Number of Shareholders B Maximum of 75 shareholders (35 prior to 1997). Be careful

of divorce situations.

4.

Type of Shareholder Limitation B Small business corporation shareholders may be

resident individuals, estates, certain trusts, and certain tax-exempt organizations.

5.

Nonresident Aliens B Nonresident aliens cannot own stock in a small business

corporation.

6.

Ethical consideration B p.12-8

MAKING THE ELECTION p.12-8

To be an S corporation , a small business corporation must file a valid election with the IRS.

1.

Use Form 2553

3.

2.

For existing corporations B File election either in the previous year or by the 15th day of

the third month of the tax year.

3.

For new corporations B File election at the earliest of the following dates:

1.

2 2 months from the date corporation has shareholders

2.

2 2 months from the date corporation acquires assets

3.

2 2 months from the date corporation begins doing business.

4.

Corp must qualify for S election for entire tax year for which election is made.

5.

Obtain consent for S election from all shareholders.

SHAREHOLDER CONSENT p.12-9

Acct 432, Ch 12 Outline, Page 2

4.

1.

A qualifying election requires the consent of all of the corporation=s shareholders.

Consent must be in writing, and must generally be filed by the election deadline.

2.

Both husband and wife must consent if they own their stock jointly (as joint tenants,

tenants in common, tenants by the entirety, or community property).

3.

Shareholders from the year before election for S status is made must also consent to

election.

LOSS OF THE ELECTION p.12-10

An S election remains in force until it is revoked or lost.

3.

1.

Voluntary Revocation

1.

Requires the consent of shareholders owning a majority of shares on the day that

revocation is to be made.

2.

Unless otherwise indicated on the revocation, C corp status will become effective

(1)

for the current tax year if filed by March 15th of that year.

(2)

for the next tax year if filed after March 15th of that year.

3.

Corp can select a future date at which point the C status will become effective.

All income for that year would then be allocated between the S corp status and

the C corp status depending on the number of days of the year for each status.

2.

Loss of Small Business Corporation Status

1.

If an S corp fails to qualify at any time after the election has become effective, its

status as an S corporation ends.

2.

Termination date of the S corp is the date corp failed to qualify as an S corp.

3.

Passive Investment Income (PII) Limitation

1.

The code provides a PII limitation for:

(1)

S corporations that were previously C corporations OR

(2)

S corporations that have merged with C corporations.

2.

If an S corp has C corp E & P and passive income in excess of 25% of its gross

receipts for three consecutive taxable years, the S election is terminated as of the

beginning of the fourth year.

3.

Passive income includes dividends, interest, rents, gains & losses from sale of

securities, etc.

4.

Reelection after Termination

After S status is terminated, a corp must wait five years before reelecting S corporation

status. The five year waiting period is waived if:

1.

there is > 50% change in ownership after the 1st year for which the termination is

applicable, or

2.

the event causing the termination was not reasonably within the control of the S

corporation or its majority shareholders.

OPERATIONAL RULES

Acct 432, Ch 12 Outline, Page 3

1.

COMPUTATION OF TAXABLE INCOME p.12-12

1.

S corporations can amortize organizational expenditures and must recognize gains, but

not losses, on distributions of appreciated property to shareholders.

2.

Dividends received deduction does not extend to S corporations.

3.

In general, S corporation items are divided into

1.

nonseparately stated income or loss and

2.

separately stated income, losses, deductions, and credits that could affect the tax

liability of any shareholder in a different manner and are reported on Schedule K

of Form 1065. (See p.12-13 for list of separately stated items.)

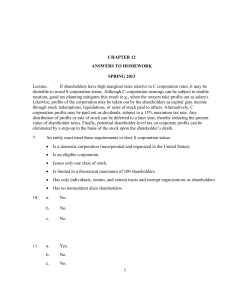

PROBLEM 12

2.

ALLOCATION OF INCOME AND LOSS p.12-14

1.

In general:

1.

Each shareholder is allocated a pro rata portion of nonseparately stated income or

loss and of all separately stated items. The pro rata allocation method assigns an

equal amount of each of the S items to each day of the year. Formula:

S corp item x % of shares owned x % of year shares owned = Amt to be

reported

2.

2.

If a shareholder=s stock holding changes during the year, this allocation assigns

the shareholder a pro rata share of each item for each day the stock is owned.

The allocation for the day of transfer is assigned to the transferor (not transferee).

3.

The per day allocation must be used, unless the shareholder disposes of his or her

entire interest in the entity.

4.

If a shareholder dies during the year, his or her share of the pro rata items up to

the date of death is reported on the final individual income tax return.

The Short-Term Election

1.

If a shareholder=s interest is completely terminated by death or disposition before

end of the S corp=s year, all shareholders and corp can elect to split the tax year

and allocate items as they accrue (per-books method) instead of prorata.

2.

Short-term election can help protect the value of the estate of a deceased

shareholder.

PROBLEM 14

Acct 432, Ch 12 Outline, Page 4

3.

TAX TREATMENT OF DISTRIBUTION TO SHAREHOLDERS p.12-16

Distributions to S corp shareholders equals the cash they receive plus the FMV of the property

distributed. Be careful!! The shareholders may be taxed on the distribution if the corporation

used to be a C corp.

1.

No AEP from C Corporation Years

1.

Distributions to S corp shareholders are considered tax-free if:

(1)

S corp never was a C corp OR

(2)

S corp (that used to be a C corp) has no accumulated earnings and profits

(AEP)

2.

Distributions in excess of basis are usually treated as capital gains.

2.

AEP from C Corporation Years

1.

If the S corp (that used to be a C corp) has accumulated earnings and profits, the

shareholders must be taxed on the money when it is distributed.

(1)

Distributions from AEP are taxed as dividends like they would be if it

were still a C corp.

(2)

Distributions from income earned by the S corp and taxed on the

shareholder=s return is not taxed a second time.

2.

All corps (but especially those corps that used to be C corps) must keep an

account entitled accumulated adjustments account (AAA) which accumulates the

S corp income. This income is eventually passed through tax-free to the

shareholders.

(1)

AAA is divided among the shareholders based on their proportional

interest in the stock (stock basis is irrelevant).

(2)

An S corp loss can cause a negative balance in the AAA.

(3)

A distribution by an S corp cannot cause a negative balance in the AAA.

3.

Distribution Ordering Rules

1.

A distribution from an S corp is deemed to come from the following accounts in

order:

(1)

AAA (limited to the basis in stock)

(2)

Previously taxed income (PTI) which is the same type of account as AAA

but for S corp formed before 1983.

(3)

AEP

(4)

Any additional distribution is usually treated as a capital gain.

2.

AAA bypass election B If all shareholders consent, S corp can elect to have a

distribution come first from AEP instead of AAA.

PROBLEM 22, 25

4.

Schedule M-2 B Made up of three columns (AAA, OAA, & PTI)

1.

OAA includes items that affect basis but not AAA. Examples include:

(1)

tax exempt income

(2)

related nondeductible expenses

2.

Distributions come from OAA only after AAA and AEP have $0 balances.

3.

Distributions from OAA are generally tax free.

Acct 432, Ch 12 Outline, Page 5

5.

4.

Effect of Termination the S Election B Be very careful when making distributions the

first year after the S election is terminated.

1.

Cash distribution? Treated as tax-free recovery of basis if it does not exceed

AAA.

2.

Property distributions? Do not get the same treatment.

TAX TREATMENT OF PROPERTY DISTRIBUTIONS BY THE CORPORATION p.12-20

1.

2.

5.

S corp is deemed to have sold the asset to the shareholder for the asset=s FMV

Gain?

1.

S corp passes the gain through to the shareholders who pay the tax.

2.

Gain is taxed as either capital or ordinary (depends on the asset distributed).

3.

Loss?

1.

S corp does not recognize the loss

2.

No pass through of the loss occurs.

4.

Shareholder has a basis of the FMV of the property.

SHAREHOLDER=S BASIS p.12-22

1.

Shareholder basis is increased by the following:

1.

Stock purchases

2.

Capital contributions

3.

Nonseparately computed income

4.

Separately stated income items

5.

Depletion in excess of basis in the property

2.

Shareholder basis is reduced by the following:

1.

Distributions not reported as income (e.g. AAA and PTI)

2.

Nondeductible expenses of the corporation

3.

Nonseparately computed loss

4.

Separately stated loss and deduction items

PROBLEM 20, 23

3.

To calculate basis, use the following order:

1.

Beginning basis

2.

Add: Income items

3.

Less: Distributions

4.

Less: Non-capital, nondeductible expenditures

5.

Less: Losses and Deductible expenditures

4.

Shareholder=s basis will never fall below zero. Once the zero limit is reached, any

additional losses or deductions (but not distributions) impact the shareholder=s basis in

any debt owed by the corporation to the shareholder.

1.

Any excess losses or deductions over both the stock basis and the debt basis are

suspended.

2.

Corporate loans from shareholders

PROBLEM 21

Acct 432, Ch 12 Outline, Page 6

(1)

(2)

3.

6.

Debt basis must be restored to its original amount before the

shareholder=s stock basis can be increased.

Get a note or evidence of the debt so that deductions can be substantiated.

Corporate loans from third parties

(1)

do not affect shareholder=s basis.

(2)

do not affect shareholder=s basis even if shareholder personally

guarantees the debt.

TREATMENT OF LOSSES p.12-24

1.

Net Operating Loss

1.

NOLs can be passed through to shareholders and used as a deduction on their

personal returns in the year in which the S corp. tax year ends.

2.

Shareholder=s basis in the stock is reduced to the extent of the NOL. NOL

deduction is not allowed on the shareholder=s tax return for an amount exceeding

shareholder=s basis in his stock and any debt due to him by the corp.

3.

Shareholder=s AAA is reduced by the same deductible amount

4.

If S corp incurs more than one type of loss (e.g., NOL, passive loss, capital loss),

the loss must be allocated appropriately.

PROBLEM 27

5.

6.

Distributions adjustments are made to the shareholder=s stock basis prior to

applying any of the loss limitations for the year.

Any unused losses (i.e., losses that exceed shareholder=s stock basis and debt

basis) can be carried forward and used by that same shareholder when he has

restored his debt basis or his stock basis.

PROBLEM 28

7.

7.

If the AS@ status is lost or revoked, any unused carried over loss is lost forever

after one-year.

2.

Passive Losses and Credits B OMIT

3.

At-Risk Rules B OMIT

TAX ON PRE-ELECTION BUILT-IN GAINS p.12-27

1.

S-corporations converting from C-corporation status may be subject to three taxes:

1.

Built-in gains tax (' 1374)

2.

LIFO recapture tax

3.

Passive investment income tax

2.

General Rules (for Built-in Gains Tax)

1.

Applies to C-corporations converting to S-corp status after 1986.

2.

S corp is taxed at corp level on any built-in gain recognized when it disposes of

an asset within 10 calendar years after date of S-corp status election.

3.

Designed to catch those corporations seeking to avoid double tax on disposition

of appreciated property by electing S-corp status.

Acct 432, Ch 12 Outline, Page 7

4.

5.

6.

7.

Base for tax includes any unrealized gain on appreciated assets (real estate, cash

basis receivables, goodwill).

Highest corporate tax rate (now 35%) to unrealized gain when assets are sold.

Gain on sale (less the ' 1374 tax) passes through as a taxable gain to

shareholders.

Maximum amount of recognized gain

(1)

C corp=s unrealized gain less unrealized losses at time of S election.

(2)

Appreciation on assets after S-corp election is subject to S corp pass-thru

rules.

8.

Loss assets:

(1)

Built-in losses/gains are netted each year to determine annual '1374 tax

base.

(2)

Any loss asset contributed to a C corp within 2 years of the S election will

not reduce corp net unrealized built-in gain.

9.

AAs-if@ taxable income:

(1)

Built-in gain recognized in any year is limited to Aas-if@ taxable income

(as if corporation were a C-corporation).

(2)

Any excess is carried forward for recognition in future when income is

sufficient.

10.

Sales or distributions

(1)

Gains on sales or distributions of assets of S-corporations are presumed

built-in gains unless taxpayer can prove appreciation occurred after

conversion to S-corp status.

(2)

Get an appraisal on date of S election.

11.

Carryovers B Normally tax attributes of C corp do not carry over to converted Scorporation, however, S-corporation can utilize the following C corp leftover

items.

(1)

unexpired NOLs OR

(2)

capital losses OR

(3)

business credits

12.

Calculation of Built-In Tax Liability

(1)

Use smaller of built-in gain or taxable income (Any excess built-in gain

over taxable income is carried forward if within 10-year recognition

period)

(2)

Less:

(1)

unexpired NOLs

(2)

capital loses

(You are now at your tax base.)

(3)

Multiply tax base in step 2 by top corporate income tax rate (35%)

(4)

Deduct any business credit carryforwards and AMT credit carry-overs

arising in C-corp year from amount obtained in step 3.

(5)

Corporation pays any tax resulting from step 4

Acct 432, Ch 12 Outline, Page 8

(6)

Unrealized gains of corporation are offset against unrealized losses; net

gain/loss sets upper limit on tax base for built-in gains tax.

PROBLEM 29

Acct 432, Ch 12 Outline, Page 9

3.

LIFO Recapture Tax

1.

If FIFO used in C corp=s last year before S election, built-in gain is recognized

and taxed as inventory is sold.

2.

If LIFO used, corp does not recognize gain unless it invades LIFO layer during

10-year recognition period

3.

To preclude deferral of gain recognition under LIFO, LIFO recapture amount at

time of S-corp election is subject to corporate level tax

4.

Taxable LIFO recapture = FIFO value - LIFO value

5.

If LIFO is more than FIFO, no tax benefit is derived.

6.

Tax payable in four equal installments:

(1)

Payment #1 due on due date of return for last C-corp year (disregard

extensions)

(2)

Payments # 2, 3, & 4 due on due dates of subsequent tax returns

(3)

No interest due if payments made by due dates

(4)

No estimated taxes due on four tax installments

7.

Basis of LIFO inventory adjusted to account for LIFO recapture but accumulated

adjustment amount is not decreased by tax payment

PROBLEM 30

8.

PASSIVE INVESTMENT INCOME PENALTY TAX p.12-31

1.

Tax imposed on excessive passive income of S-corp possessing accumulated earnings

and profits (AEP) from C-corp years.

1.

Tax rate is highest corp rate for the year

2.

Formula

Passive investment income in excess

Excessive Net Passive Income =

of 25% of gross receipts for year

X Net

Passive Investment

Passive investment income

Income for the Year

for the year

3.

4.

5.

6.

7.

9.

Passive investment income includes gross receipts derived from royalties, passive

rents, dividends, interest, annuities, and sales and exchanges of stocks and

securities.

Only net gain from disposition of capital assets (other than stocks and securities)

taken into account in computing gross receipts

Net passive income is passive income reduced by any deductions directly

connected with production of that revenue

Any passive income tax reduces amount shareholders must take into income

Excess net passive income cannot exceed C-corp taxable income for the year

before considering NOL deduction or special deductions allowed under ''241250 (except organizational expense deduction of '248)

OTHER OPERATIONAL RULES

Acct 432, Ch 12 Outline, Page 10

1.

2.

3.

4.

5.

6.

7.

8.

9.

4.

S-corp is required to make estimated tax payments due to exposure of recognized built-in

gain and excess passive investment income

S-corp is not subject to 10% of taxable income limit on charitable contribution as is a Ccorp.

Family members who provide services for S-corp must be paid reasonable compensation;

IRS can adjust compensation to reflect value of services rendered

Shareholder compensation is not considered self-employment income, but compensation

for services is subject to FICA taxes

S corp is placed on cash basis for purposes of deducting business expenses and interest

owed to cash basis related party; as such, timing of shareholder income and corporate

deduction must match

S-corp election not recognized in Dist. of Col., Connecticut, Michigan, New Hampshire,

& Tennessee?

Some or all of entity income may be subject to state-level income tax

If '1244 stock is issued to S-corp, it and its shareholders may not treat losses on stock as

ordinary losses; S-corp may issue '1244 stock to its shareholders to obtain ordinary loss

treatment

Losses may be disallowed due to lack of profit motive under the hobby rule of '183

TAX PLANNING CONSIDERATIONS

1.

WHEN THE ELECTION IS ADVISABLE

1.

2.

3.

4.

5.

2.

MAKING A PROPER ELECTION

1.

2.

3.

4.

3.

When losses are anticipated since losses pass directly to shareholders

If individual shareholders are in lower tax bracket.

S-corporation, while immune from Federal income tax laws, may be subject to state and

local corporate taxes or from several Federal penalty taxes

C-corp NOL carryover from prior year cannot be used in an S-status year (except for

built-in gains tax)

Choice of form of doing business may be dictated by other factors such as a need for

substantial capital or possibility of a public offering. Sometimes, a partnership or limited

liability company may better.

All shareholders must consent

Election must be timely and properly filed; a copy of the filing should be part of the

corporation files

Be certain when the timely election period begins to run for a newly formed corporation;

corporation must be in existence before filing is made

Original shareholders have nothing to lose by complying with '1244; in event of

business failure, original shareholder can obtain an ordinary deduction for a loss on sale

or worthlessness of stock, asopposed to long-term capital loss treatment

PRESERVING THE ELECTION

Acct 432, Ch 12 Outline, Page 11

1.

2.

3.

4.

5.

6.

7.

8.

9.

4.

Election may be lost intentionally or unintentionally and requires waiting 5 years before

available again.

Make all shareholders aware of conditions under which election may be lost

Watch for disqualifying events

Divorce of a shareholder, accompanied by property settlement, could result in maximum

number of shareholders being exceeded (pre-1997, 35 limit; after 1997, 75 limit)

Death of shareholder resulting in non-qualifying trust becoming shareholder; can be

avoided with buy-sell agreement

Make sure a new majority shareholder does not file a refusal to continue the election

Watch for passive investment income limitation; avoid third year with excess passive

income if corporation has C-corp AEP, in which case, assets producing passive

investment income might be held by individual shareholders outside the corporation

Do not transfer stock to nonresident alien

Do not issue a second class of stock

PLANNING FOR THE OPERATION OF THE CORPORATION

1.

Accumulated Adjustments Account (AAA)

1.

2.

3.

4.

5.

2.

Most AAA used by S-corp with AEP from C-corp years

(1)

S-corp should maintain accurate record of AAA due to grace period for

distributions after termination of S-status

(2)

When AEP exists, a negative AAA may cause double taxation of S-corp

income.

(3)

With a negative AAA, a distribution of current income restores negative

AAA balance to zero. Distribution is considered to be in excess of AAA

and is taxable as a dividend to the extent of the AEP.

Distributions during year reduce stock basis for determining allowable loss for

year, but loss does not reduce the stock basis for determining tax status of

distributions made during year.

In determining tax treatment of distributions by S-corp have AEP, any net

adjustments (excess of losses and deductions over income) for the tax year are

ignored.

AAA bypass election may be used to reduce exposure to accumulated earnings

tax or PHC tax in Post S-status years. Bypass election allows AEP to be

distributed instead.

A net loss allocated to a shareholder reduces the AAA. This required adjustment

should encourage S-corp to make annual distributions of net income to avoid

reduction of AAA by future net loss.

Salary Structure

1.

Salary structure requires careful consideration

2.

Larger salary advantageous if maximum contribution for retirement plan has not

been met.

3.

Smaller salary beneficial if trying to shift taxable income to lower-bracket

shareholders, reduce payroll taxes, curtail reduction of Social Security benefits,

or restrict losses that do not pass through due to basis limitations

Acct 432, Ch 12 Outline, Page 12

4.

5.

6.

7.

8.

Reducing shareholder compensation reduces employment taxes; however, IRS

looks at services performed and may recharacterize distributions as wages subject

to FUTA and FICA

For planning purposes, some level of compensation should be paid to all

shareholder-employees.

Compensation paid to family members may be adjusted by IRS for

reasonableness.

Deductible compensation under '162 reduces S-corp taxable income relevant to

built-in gains.

Compensation may be one of larger items S-corp uses to reduce taxable income

to minimize built-in gains penalty tax and is subject to scrutiny by IRS

3.

Loss Considerations

1.

Net loss in excess of tax basis may be carried forward and deducted only by same

shareholder in succeeding years

2.

In sale of stock, seller should increase basis in stock/loan to flow through the

loss. Purchaser does not obtain the loss carryover.

3.

Unused loss carryover in existence at termination of S-status election may be

deducted only in the next year and is limited to the shareholders stock (not loan)

basis in post-termination year

4.

Shareholder may wish to purchase more stock to increase tax basis in order to

absorb the loss.

5.

In last election year or post-termination year, if possible NOL is apparent or

possible to use up any loss carryover, each shareholder should examine his basis

to see if it can absorb its share of the loss. If not, additional investment may be

considered by additional stock purchase either from the corporation or its

shareholders.

4.

Avoiding the Passive Investment Income Tax

1.

Excess passive investment income may result in '1375 penalty tax and/or

termination of S-status election

2.

Avoid tax, or reduce tax by:

(1)

If small AEP exists, a AAA bypass to purge AEP

(2)

Corporation might reduce taxable income below excess net passive

income.

(3)

Passive investment income might be accelerated into years in which there

is offsetting NOL

(4)

Increase gross receipts without increasing passive investment income. PII

in excess of

(1)

25% of gross receipts is reduced

(2)

Perform significant services with respect to real estate to elevate

rent income to non-passive

5.

Managing the Built-In Gains Tax

1.

Taxable income limitations encourage S-corps to create deduction and accelerate

deductions into years when built-in gains are recognized

Acct 432, Ch 12 Outline, Page 13

2.

3.

4.

5.

6.

Time value of money makes postponement of built-in gain beneficial

Payment of compensation, rather than distribution, creates a deduction that

reduces taxable income and postpones the built-in gains tax

Contributing built-in gain prop. to charitable organization does not trigger builtin gains tax.

Built-in gain may be a preference item at the shareholder level for purposes of

AMT

To reduce/eliminate built-in gains tax, built-in loss property may be sold in the

same year as the built-in gain property is sold.

6.

Controlling Adjustments and Preferences Items

1.

Individual AMT more prevalent since tax base has expanded and difference

between regular tax rates and individual AMT has narrowed.

2.

AAlmost-AMT Taxpayer@ at risk

(1)

Tax preferences of S-corp may push taxpayer into AMT

(2)

All shareholders in S-corp might not be in same situation and avoidance

procedures could have beneficial effect on some and negative effect on

others; some may need deductions, others may not.

7.

Allocation of Tax Items

1.

At death of shareholder or stock transfer during taxable year, tax items may be

allocated on two bases:

(1)

Pro rata approach- equal portion of each item to each day of tax year and

dividing portion pro rata among shares outstanding on transfer day

(2)

Per books approach- divide taxable year into two taxable years; first

portion ends on date of termination; shareholder owns shares on date of

termination Per books method prevents income/loss allocation to

deceased shareholder from being affected by postdeath events

8.

Termination Aspects

1.

Always advisable to avoid AEP in S-corporation

2.

Always danger of terminating election due to excess passive investment income

in three consecutive years

3.

Try to eliminate AEP through dividend distribution or liquidation of S-corp with

subsequent reincorporation.

4.

If AEP account is small, all shareholders may consent to have distributions

treated as first from AEP rather than from AAA (AAA bypass election)

5.

If shareholders decide to terminate the election other than voluntary revocation,

do so in manner that possesses substance. If intent of parties is obvious and

represents technical non-compliance rather than real change, IRS may disregard

and force parties in S-status.

9.

Liquidation of an S Corporation.

1.

Many liquidation rules same as C-corporation

2.

Distribution of appreciated property to shareholders in complete liquidation

treated as if property sold to shareholder in taxable transaction

3.

S-corporation incurs no incremental tax on liquidation gain, since gains flow to

shareholders subject only to built-in gains tax.

Acct 432, Ch 12 Outline, Page 14

4.

5.

Corporation gain increase shareholder stock basis by a like amount and reduces

any gain realized by the shareholder when he or she receives the liquidation

proceeds

S-corporation avoids double tax imposed on C-corporation, however, when Scorp liquidates, all special tax attributes disappear (AAA, AEP, PTI, Corporaiton

NOLs, suspended losses)

Acct 432, Ch 12 Outline, Page 15