Executive Compensation

Insert subtitle here.

Sun Executive UL for the Small Business

Market

Disclosures

Sun Life Financial, its distributors, and its respective representatives do not provide tax, accounting, or legal

advice. Any tax statements contained here in are not intended or written to be used, and can not be used, for the

purpose of avoiding U.S. federal, state, or local tax penalties. Clients should consult their own independent

advisors about any tax, accounting, or legal statements made herein.

Universal Life products are issued by Sun Life Assurance Company of Canada (Wellesley Hills, MA) and in New

York, by Sun Life Insurance and Annuity Company of New York (New York, NY). All guarantees are based on the

claims-paying ability of the issuing company. All companies are members of the Sun Life Financial group of

companies.

©2010 Sun Life Assurance Company of Canada (U.S.). All rights reserved. Sun Life Financial and the globe symbol

are registered

3

Different goals; one flexible solution

• Business members can have different goals for an

executive benefit plan

CEO:

Needs help

recruiting, rewarding,

and replacing

executive talent

4

CFO:

Owner:

Key Person:

Wants a solution

with minimal impact

on the bottom line

Is looking to fund

own retirement and

succession plan

Expects rewards

plus an incentive to

stay and work hard

Different goals; one flexible solution

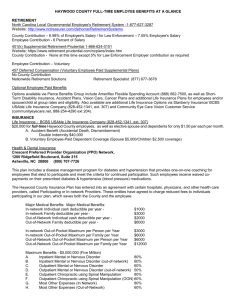

• Qualified vs. Non-Qualified plans

Qualified Plans

Non-Qualified Plans

Taxation

Contributions are deductible to the

employer and employee

Contributions are not tax

deductible

Discrimination rules

Most employees have to be

eligible

None

Administration costs

Costly to administer

Can be cost efficient

Complexity

Red tape

No red tape issues

Vesting requirements

Strict vesting rules; no golden

handcuffs

No vesting rules

Plan design

Limited flexibility

Flexible

Limits

Caps for highly compensated

employees

No caps

5

Different goals; one flexible solution

• What Non-Qualified plans offer

Increase your

company’s

market position

Greater

retirement benefits

for you and key

employees

Help you attract,

reward, and retain

key employees

Non-Qualified

Plans

Substitute or

supplement for

equity-based comp

packages

6

Allow you to

select which key

employees

benefit

Motivate key

employees,

maximizing

productivity

Different goals; one flexible solution

• Non-Qualified plan business strategies:

Deferred Compensation Plan

Supplemental Executive Retirement Plan (SERP)

Executive Bonus Plans

Split Dollar

Key Person Indemnity

Buy-Sell Agreement Funding

7

Different goals, one flexible solution

Executive Benefits

Deferred Compensation Plan

WHEN FUNDED

APPROPRIATELY,

DEFERRAL OF

CURRENT SALARY

OR BONUSES ON A

PRE-TAX BASIS

8

• An employer promise to pay an executive a

future benefit

– May be Qualified:

• Must meet provisions to “qualify” for special tax

treatment

– or Nonqualified:

• Offer greater flexibility in design

• Must meet fewer rules

• Discretionary

• BUT, contributions are not currently deductible

Different goals; one flexible solution

Executive Benefits

Supplemental Executive Retirement Plan (SERP)

EMPLOYER

AGREES TO PAY

SELECT KEY

EMPLOYEES A

• Funded by the business for the benefit of select key

employees

• Provides key employees with supplemental

retirement income

SPECIFIED INCOME

FOR A SPECIFIED

TIME, WITH NO

EMPLOYEE

DEFERRAL

9

• On top of defined contribution plans, give key

employees more robust retirement package

Different goals, one flexible solution

Executive Benefits

Deferred Compensation Plan

WHEN FUNDED

APPROPRIATELY,

DEFERRAL OF

CURRENT SALARY

OR BONUSES ON A

PRE-TAX BASIS

10

• An employer promise to pay an executive a

future benefit

– May be Qualified:

• Must meet provisions to “qualify” for special tax

treatment

– or Nonqualified:

• Offer greater flexibility in design

• Must meet fewer rules

• Discretionary

• BUT, contributions are not currently deductible

Different goals; one flexible solution

Executive Benefits

Executive Bonus

BONUS MADE

TO SELECT

EXECUTIVES TO

BUY LIFE

INSURANCE

• Potential for immediate income tax deduction

• May provide golden handcuffs

• Discriminatory so key execs can be rewarded

• Inexpensive to administer

• Can be life insurance protection and supplemental

retirement income for key employee

11

Different goals; one flexible solution

Executive Benefits

Split Dollar

ALLOWS A

BUSINESS TO

RECOVER

PREMIUMS PAID,

• Provides option of low-cost life insurance to the

employees

• Business and employee split the cost of policy

premium

AND CAN BE

STRUCTURED SO

THE EMPLOYEE’S

BENEFICIARY CAN

RECEIVE THE FULL

POLICY FACE

AMOUNT IF

DESIRED

12

• In event of insured’s death, company recovers paid

premiums; employee’s beneficiary receives policy

face amount

Different goals; one flexible solution

Business Planning

Key Person Indemnity

LIFE INSURANCE

OWNED BY AND

PAYABLE TO THE

BUSINESS TO

INDEMNIFY IT

UPON THE DEATH

OF A KEY

PERSON

• Protects your business in the event of the death

of a key employee

• Provides liquidity needed to:

– Maintain operations

– Replace loss of employee by recruiting/training

new employee

– Contract with necessary resources to keep

business running

– Overcome potential drop in business

13

Different goals; one flexible solution

Business Planning

Buy-Sell Agreement Funding

LIFE INSURANCE

USED TO FUND

A BUY-SELL

AGREEMENT

14

• Good succession planning depends on a

well-drafted, well-funded buy-sell agreement

• Provides clear and defined succession/exit strategy to:

– transform control of the business into retirement

wealth

– insure that the future of the business is being

managed by desired parties

– Insure business is owned as intended in the event of

retirement, disability or death

Sun Executive UL Highlights

• High Target Premiums with Heaped

Commissions

• High Potential First Year Cash Values

• Underwriting Flexibility

• GI (10+ lives)

• XGI (5-9 lives)

• Full Medical Underwriting (1-4 lives)

Our fastest growing product

in

sales volume…

Average Case

Target Premium

is $808K*

• Innovative Features

• Emergency Travel Assistance Rider Assist America Benefit

• Charitable Giving Benefit Rider

*As of 7/09

15

What Should You Be Looking For?

• Business owners who may be personally underinsured

• Business owners who may not have reviewed their personal insurance for a

number of years

• Owners of small to medium size businesses with business continuation needs

• Business owners who want to recruit, retain, and reward key employees

• Businesses that may lose key employees if supplemental executive benefits

are not offered

• Business owners who want to supplement their (or their employee’s)

retirement plan in a tax advantaged manner

16

Questions to Ask

The plan you have in place…is it the right plan for you,

your business, your key employees?

Do you have the right type of executive benefit plan(s) in place now for

the current state of your business?

Are your plan funding vehicles sufficient to meet future personal and

business objectives for you and your key employees?

17

Disclosures

Sun Life Financial, its distributors, and its respective representatives do not provide tax, accounting, or legal

advice. Any tax statements contained here in are not intended or written to be used, and can not be used, for the

purpose of avoiding U.S. federal, state, or local tax penalties. Clients should consult their own independent

advisors about any tax, accounting, or legal statements made herein.

Universal Life products are issued by Sun Life Assurance Company of Canada (Wellesley Hills, MA) and in New

York, by Sun Life Insurance and Annuity Company of New York (New York, NY). All guarantees are based on the

claims-paying ability of the issuing company. All companies are members of the Sun Life Financial group of

companies.

©2010 Sun Life Assurance Company of Canada (U.S.). All rights reserved. Sun Life Financial and the globe symbol

are registered

18

www.Partners advantage.com/advanced

Contact Information

888-251-5525

Director of Advanced Markets

Richard Finkelstein ext 139

Senior Marketing Consultant

David Clifford ext 134