HAYWOOD COUNTY FULL-TIME EMPLOYEE BENEFITS AT A

advertisement

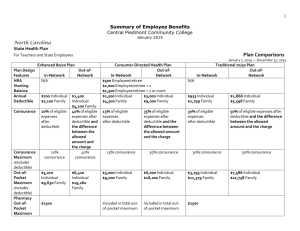

HAYWOOD COUNTY FULL-TIME EMPLOYEE BENEFITS AT A GLANCE RETIREMENT North Carolina Local Governmental Employee's Retirement System -1-877-627-3287 Website: http://www.nctreasurer.com/dsthome/RetirementSystems County Contribution – 6.98% of Employee's Salary / for Law Enforcement – 7.05% Employee's Salary Employee Contribution - 6 Percent of Salary 401(k) Supplemental Retirement-Prudential 1-866-624-0151 Website: https://www.retirement.prudential.com/ncplans/index.htm County Contribution - None at this time except 5% for Law Enforcement Employer contribution as required Employee Contribution – Voluntary 457 Deferred Compensation (Voluntary Employee Paid Supplemental Plans) No County Contribution Nationwide Retirement Solutions Retirement Specialist (877) 677-3678 Optional Employee Paid Benefits Options available via Pierce Benefits Group include Ameriflex Flexible Spending Account (888) 662-7500, as well as ShortTerm Disability Insurance, Accident Plans, Vision Care, Cancer Plans and additional Life Insurance Plans for employees and/or spouse/child at group rates and eligibility. Also available are additional Life Insurance Options via Stanberry Insurance/ BCBS USAble Life Insurance Company (828-452-1341, ext. 307) and Community Eye Care Vision Customer Service (communityeyecare.net, 888-254-4290 ext 204). INSURANCE Life Insurance - BCBS USAble Life Insurance Company (828-452-1341, ext. 307) $20,000 for full-time Haywood County employees, as well as elective spouse and dependents for only $1.50 per each per month. A. Accident Benefit (Accidental Death, Dismemberment) Double Indemnity $40,000 B. Voluntary Employee-Paid Dependent Coverage (Spouse $5,000/Children $2,500 coverage) Health & Dental Insurance Crescent Preferred Provider Organization (PPO) Network, 1200 Ridgefield Boulevard, Suite 215 Asheville, NC 28806 (800) 707-7726 This plan includes a disease management program for diabetes and hypertension that provides one-on-one coaching for employees that elect to participate and meet the criteria for continued participation. Such employees receive waived copayments on their prescribed diabetes & hypertensive (blood pressure) medications. The Haywood County Insurance Plan has entered into an agreement with certain hospitals, physicians, and other health care providers, called Participating or In-network Providers. These entities have agreed to charge reduced fees to individuals participating in our plan, which saves both the County and the employee. Major Medical Benefits: Major Medical Benefits: In-network Individual cash deductible per year In-network Family deductible per year Out-of-Network Individual cash deductible per year Out-of-Network Family deductible per year - $1000 $3000 $2000 $6000 In-network Out-of-Pocket Maximum per Person per Year In-network Out-of-Pocket Maximum per Family per Year Out-of-Network Out-of-Pocket Maximum per Person per Year Out-of-Network Out-of-Pocket Maximum per Family per Year $3000 $6000 $6000 $12000 Maximum Benefits - $5,000,000 (Five Million) A. Inpatient Mental or Nervous Disorder 80% B. Inpatient Mental or Nervous Disorder (out-of-network) 60% C. Outpatient Mental or Nervous Disorder 60% D. Outpatient Mental or Nervous Disorder (out-of-network) 50% E. Outpatient Chiropractic using Spinal Manipulation 80% F. Outpatient Chiropractic using Spinal Manipulation (OON) 60% G. Most Other Expenses (In Network) 80% H. Most Other Expenses (Out-of-Network) 60% Pharmacy Coverage Tiered Plan $10 Generic – $35 Preferred– $50 Non-formulary Brand Name (Note: Several generic drugs are available for a $0 co-pay, as well as a mail-order pharmacy allowing 90 day supply for a 2 month co-pay Cost per month to Employee for Health Insurance Total Cost Health Insurance per Month Includes Medical, Dental & Rx Card Employee only $770 Employee/Spouse $974.40 Employee/One Child $763.88 Employee/Family 1136.84 Employee Pays per Month $0 $349.40 $138.88 $511.84 Employer Pays per Month $770 $770 $770 $770 OR Effective Jan. 1, 2011 an additional Health Care Savings Account Plan option is available. Benefits for the HSA are as follows: In Network Providers Out of Network Providers Deductible $1,500.00 $3,000.00 Family Deductible $3,000.00 $6,000.00 Out of Pocket $2,000.00 $2,000.00 Family Out of Pocket $6,000.00 $2,000.00 Benefit Percentage 80% 60% (until out of pocket met) Preventive Care 100% no limit 100% no limit All Other Covered Services Deductible – 80% Deductible – 60% Pharmacy Benefit Deductible – 80% Deductible – 60% Dental Insurance (Either Plan) A. Preventive and Diagnostic Services and Supplies B. Basic Therapeutic Services C. Major Restoration and Prosthetic Supplies and Services Maximum of $1000 per person per calendar year D. Orthodontia (child dependents under age 19 only) Lifetime Maximum of $1000 Paid at 100% Paid at 80% Paid at 50% Paid at 50% The Wellness Center is available to all County employees and their dependents that are covered under our Health insurance program. While the program is voluntary, utilization will be the key to being able to continue to provide and even expand these services. As an incentive to utilize the program, eligible employees and dependents may complete their medical history and utilize the free clinic and without being required to take time off of work to go between the following hours: 8:00 am – 12 Noon Mondays -Wednesday and Friday & 2:00 pm – 6 pm only on Thursdays *(Acute Care, Not to replace primary care or for extreme emergencies) VACATION ACCRUAL Less than 2 years Service 2 Less than 5 years Service 5 Less than 10 years Service 10 Less than 15 years Service 15 Less than 20 years Service 20 or more years Service SICK LEAVE - 12 days per year 10 days earned per year 12 days earned per year 15 days earned per year 18 days earned per year 21 days earned per year 24 days earned per year HOLIDAYS - 11 or 12 per year as follows: New Years Day, Martin Luther King, Jr. Day, Good Friday, Memorial Day, Independence Day, Labor Day, Veterans Day, Thanksgiving (2 days), Christmas (2 or 3 days). If the days both preceding and following Christmas Day are workdays, 3 holidays will be observed. LONGEVITY (Made in lump sum in the employees anniversary month) 5 years but less than 10 years of continuous service 2 % of basic annual salary 10 years but less than 15 years of continuous service 2.5% of basic annual salary 15 years but less than 20 years of continuous service 3% of basic annual salary 20 years but less than 30 years of continuous service 3.5% of basic annual salary 30 years or more 4% of basic annual salary Haywood County provides an Employee Assistance Program 1-800-454-1477 (EAP) to all employees and immediate family members through Employee Assistance Network to help in resolving family problems, alcoholism, marriage difficulties, financial trouble, stress, drugs, depression and others. An initial evaluation and brief counseling session(s) are free and completely confidential. COUNTY EMPLOYEE HOSPITALIZATION INSURANCE AFTER RETIREMENT Retire with 30 years service in the North Carolina State or Local Government Retirement System with a minimum of seven ( 7) years continuous Haywood County service immediatley preceeding retirement. At the time of retirement, the employee must be enrolled in the County’s insurance plan. 100% of Medical Coverage up until age 65 (at that time, the employee will need to submit a Medicare Supplement Application) RETIRE WITH FEWER THAN 30 YEAR’S SERVICE (INCLUDING ACCRUED SICK LEAVE) MIN AGE 50 to 59 Years of Service 20 21 22 23 24 25 26 27 28 29 30 Percentage of Year’s/ Employer Rate 67% 70% 73% 77% 80% 83% 87% 90% 93% 97% 100% EE Rate 33% 30% 27% 23% 20% 17% 13% 10% 7% 3% 0% RETIRE FEWER THAN 30 YEAR’S SERVICE (INCLUDING ACCRUED SICK LEAVE) MIN AGE 60 to 64 Minimum of 5 year’s of service up to 14 years Minimum of 15 year’s service up to 19 years Minimum of 20 year’s service & up to 30 years. EE Pays 100% EE Pays 33% See age 50 schedule Supplement to Medicare: MIN AGE 65(unless waived by Social Security/Medicare due to disability) within 60 days of eligibility As of 5/14/08 Minimum of 5 years of service and up to 19 years. EE Pays 50% Minimum of 20 years of service and up to 29 years. EE Pays 33% Minimum of 30 years service. EE Pays 0% NOTE: Employee pays full premium for allowable dependents coverage until age 65. New dependents cannot be added at time of or after retirement. Departments must notify County Manager's office prior to hiring an employee with prior local or State government experience.