1 st session

advertisement

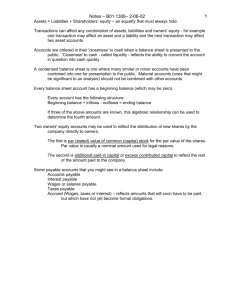

1st session: Introduction to Accounting Objectives • Develop the ability to read, analyze and interpret financial statements • Understand how financial accounting statements are constructed • Provide you with tools for economic decision making – Where to find information – How the information got there Textbook • Financial & Management Accounting, an Introduction by Pauline Weetman, 5th edition, available in two forms: – Softcover – E-book • Register on Prentice Hall website for additional materials! (Process to be announced in class, next time.) Rules of the Game • Read the assigned material, do the assigned problems before the lecture • Come to class on time • Do the assignments on a timely basis • Turn off cell phones and other communication devices • Ask questions and participate in class Course Website & e-mail I will use the schools e-learning portal to post information. Make sure you log in at: http://sca.lisboa.ucp.pt/e-sca/esca.aspx Email: rireis@ucp.pt GRADING SCHEME Final grades will be determined by the following scheme: – Assignments – Midterm – Final: 10% 40% 50% FIRM OF THE DAY Today’s Class Overview of “Accounting” in general and “Financial Accounting” in particular Discussion of Accounting terminology Mandatory Financial Reporting (including the Financial Statements) Financial Accounting • Financial accounting is the language that translates economic events into uniform and comprehensive information, understandable by OUTSIDE observers. • Unfortunately, this language has become extremely complex and heterogeneous… • This is naturally a bad thing for the outside observers. In an ideal world… “In an ideal world, the user of financial statements could focus only on the bottom lines of financial reporting. If financial statements were comparable among companies, consistent over time, and always fully reflecting the economic positions of the firms, financial statement analysis would be simple.” Adapted CFA Preparation Readings Other Types of Accounting (not covered in this course) Tax Preparation and Compliance is pretty self-explanatory Internal Information Systems and Reporting provides firm managers useful, real-time performance information to help with decision making Also referred to as Management Information Systems and/or Managerial Accounting Key element here is that information is for internal use only Therefore, there are typically few rules to govern how this “should be” done. Information systems are designed specifically to cater to a single firm’s managers’ needs, hence there is little standardization General business performance consulting has attracted many accountants since accountants are typically familiar with many facets of firm operations Who cares? “Information Useful in Investment and Credit Decisions Financial reporting should provide information that is useful to present and potential investors and creditors and other users in making rational investment, credit and similar decisions. The information should be comprehensible to those who have a reasonable understanding of business and economic activities and are willing to study the information with reasonable diligence.” SFAC 1, paragraph 34. Who cares? • Credit and equity investors Or, in other words: • Agents in Capital Markets! Types of Firm Ownership and Information Demand There are generally three types of firms in two major categories of ownership Privately Held Firms: 1. Proprietorship—typically a small firm with one specific owner 2. Partnership—typically medium-sized firms with shared ownership Publicly Held (or Traded) Firms: 3. Corporation—typically large firms with diverse ownership Ownership rights can be bought or sold on an open market We will talk primarily about corporations throughout this course since virtually all corporations must create and file financial reports Why do publicly-traded Corporations have to file financial reports? Monitoring Separation of ownership (shareholders) and control (hired managers) presents a classic principal-agent problem (agency theory) Agency theory suggests that, without proper monitoring and incentives, agents will extract perquisites (Jensen and Meckling, 1976) Financial reports are one mechanism to help monitor managers’ actions Why do publicly-traded Corporations have to file financial reports? Investing • It is true that accounting information relates to past economic events. Whereas capital market investors are worried with future value. • Financial analysis is therefore mostly a way to anticipate future economic events from information about past ones. • Statistical techniques provide the tools for this. • Financial analysis doesn’t tell what will happen, but it tells you what can happen. There is a chance of things going wrong. This chance defines risk and it can be measured. Risk vs Return Equity vs Credit Investors • If you want to share more risk and become a partner of the firm, then you want to know the potential growth of the firm and basically you want to know all the info you can get: you want to be an equity investor! • If you want to limit your risk and you are a creditor, then your concern will be the potential ability of the borrower to pay. • In between there is a rich palette of different flavors of investors, concerned with accurate information for their investments. Financial Reporting (Key Players) Managers Ultimately responsible for the information disclosed Financial information reflects the economic outcome of their decisions May have their compensation linked to some financial numbers Do possess some discretion power as to some of the decisions conditioning the financial information Shareholders Can hire or fire managers Use financial information to evaluate the performance of the managers Use financial information to make investment decisions Financial Reporting (Key Players) Financial Accountant Hired by a firm to help prepare the firm’s financial reports Usually works beneath the senior supervision of the Chief Financial Officer Head Financial Accountant is usually called the Controller Auditor Independent Agent hired by the firm to regularly assess and attest to the financial reporting quality of the firm Maintains an on-going relationship with the firm (the audit client) to allow for regular inspection of financial processes and internal controls over financial processes Typically works for a “CPA Firm” Financial Reporting (Key Players) Auditor (continued) Few major national “CPA Firms” exist, due to mergers and Enron Many of these firms also offer internal control compliance consulting services • Other potential users of the informations Authorities: government, regulatory bodies, and tax authorities – They want the information to monitor whether their policies are been executed. • General public and special interest groups: labor unions, environmentalist, consumer groups. – They want specific information that help them protect their interests. • Competitors: – They want information to gain competitive edge. Other professions using the information • ANALYSTS: – They want the information to be vast! • CONSULTANTS: – They want the information to be exclusive. • AUDITORS: – They want clear information that easily signals wrongdoings. • CORPORATE LAWYERS: – They want normative (ambiguous) information… • ACADEMICS: – They want the information to be consistent with some rationality. Rules for everyone? • Can the financial reporting system keep everyone happy? – Obviously not! There are contradicting incentives surrounding accounting information. • How does the system deal with this? – By hearing as many people as possible. – By aiming at simpler rules, that shift most of the responsibility to the preparers of information. • What’s the implication for financial analysis? – There is a lot of room for ambiguity and a lot of need for interpretation. Financial Reporting System Who decides what constitutes Generally Accepted Accounting Principles (GAAP)? • SEC Securities and Exchange Commission – http://www.sec.gov/ “The mission of the U.S. Securities and Exchange Commission is to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation.” – They do not set the accounting rules. They simply tell publicly traded firms what rules to follow and what information to disclose. (Regulation S-X) Financial Reporting System • AICPA American Institute of Certified Public Accountants – http://www.aicpa.org/ “Its mission is to provide members with the resources, information, and leadership that enable them to provide valuable services in the highest professional manner to benefit the public as well as employers and clients. ” – It is a professional organization for American accountants. Financial Reporting System • FASB Financial Accounting Standards Board – http://www.fasb.org/ “The mission of the Financial Accounting Standards Board is to establish and improve standards of financial accounting and reporting for the guidance and education of the public, including issuers, auditors, and users of financial information.” – They are the ones setting the accounting rules! Financial Reporting System – FASB has 4 major types of publications: • Statements of Financial Accounting Standards • Statements of Financial Accounting Concepts • Interpretations • Technical Bulletins Financial Reporting System • Governmental Accounting Standards Board (GASB) • Other influential organizations (e.g. American Accounting Association, Institute of Management Accountants, Financial Executives Institute) International Financial Reporting Standards • IASB International Accounting Standards Board – http://www.iasb.org/ “Its principal objectives are: • to develop a single set of high quality, understandable, enforceable and globally accepted international financial reporting standards (IFRSs); • to promote the use and rigorous application of those standards; • to take account of the financial reporting needs of emerging economies and small and medium-sized entities (SMEs); and • to bring about convergence of national accounting standards and IFRSs to high quality solutions.” International Financial Reporting Standards • IFRS in a broad sense comprise: – Framework for the Preparation and Presentation of Financial Statements—stating basic principles and grounds of IFRS – IAS—standards issued before 2001 – IFRS—standards issued after 2001 – SIC—interpretations of accounting standards, giving specific guidance on unclear issues – IFRIC—newer interpretations, issued after 2001 Balance Sheet • Assets – Probable future economic benefits obtained or controlled by a particular entity as a result of past transaction or events • Liabilities – Probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events • Equity – Residual interest in the net assets of an entity that remains after deducting its liabilities. FUNDAMENTAL EQUATION OF THE BALANCE SHEET Assets = Liabilities + Equity Income Statement • Revenues – Inflows from delivering or producing goods, rendering services, or other activities that constitute the entity’s ongoing major or central operations • Expenses – Outflows from delivering or producing goods, rendering services, or carrying out other activities that constitute the entity’s ongoing major or central operations • Gains (and losses) – Increased (decreases) in equity (net assets) from peripheral or incidental transactions Statement of Cash Flows (SFAS 95) • • • Operating Cash Flows – Breadwinner of the firm. Cash flow consequences of the revenue-producing activities of the firm – Reported directly, using major categories of gross cash receipts and payments – Reported indirectly as reconciliation of net income to net cash from operating activities Investing Cash Flows – Relates to decisions to maintain the firm operating in longer terms. (Acquisitions or divestitures in PP&E or subsidiaries) – Should be reported directed, as all investment/divestment related cash payments and receipts should be identifiable. (gross, rather than net) Financing Cash Flows – In theory, this should be a residual category. What ever cash is left should either go to retire debt or to return to the stockholders, which ever money is lacking, should be raised from debt issuance or requested from stockholders. Statement of Stockholders’ Equity • Categories inside the SE: – – – – – – – Preferred shares Common shares Additional paid-in capital Retained earnings Treasury shares Employee stock ownership plan adjustments Accumulated Other comprehensive income Footnotes • Mostly they serve the purpose of providing additional information to better interpret the numbers disclosed in the financial statements. They refer to: – Accounting methods, assumptions, or estimates used by the prepares to determine the data in the fin. stat. Contingencies • Firms are required to disclose information related to added risk. Some losses may happen with an increased probability and such losses are called contingent losses. – When it is probable that the assets have been impaired or a liability has been incurred (SFAS 5 suggests a probability of 50% or more) – The expected value of the amount of the loss can be reasonably estimated. • Things such as: – Environmental remediation liabilities, litigation, expropriation, self/insurance, debt guarantees, repurchase agreements, takeor-pay contracts, and throughput arrangements. Risks and Uncertainties • Disclosure of Certain Significant Risks and Uncertainties require the following: – Nature of operations – Use of estimates – Certain significant estimates – Current vulnerability due to certain concentrations Supplementary Schedules • Special Cases for certain industries require these additional supplements – Oil and gas companies are required to provide additional data on their exploration activities, including the NPV of some of their projects – Impact of changing prices – Segment disclosure of sales revenue, operating income, according to geographical or business segments – Financial instruments and hedging activities. Management Discussion and Analysis • Mandated by the SEC, the MD&A is required to discuss: – D&A of the management’s opinion on the current and prospective situation of the operations of the firm (trends in sales and expenses) – Same for the cash flow situation. Where will the funding come from? Role of the Auditor • Independent CPA, their role is to certify the financial statements in conformity with GAAP. • Must agree (or explain disagreement) with the management’s choices of accounting policies and estimates. • Hired by the management, they are expected to be completely independent of it and do a thorough analysis of the firm’s accounts, by verifying the internal control system through their own separate control systems. Role of the Auditor • Audit Opinion: Summary of the audit results regarding the financial reports and an assessment of internal controls – Unqualified: Financial statements appear to be presented fairly and in accordance with Generally Accepted Accounting Principles (GAAP); internal controls appear to be adequate – Qualified: Generally, financial statements appear to be presented fairly and in accordance with Generally Accepted Accounting Principles (GAAP), but there is some material issue that needs to be addressed; there is an issue that needs to be addressed regarding internal controls – Adverse: There is a high probability of material errors within the financial statements; there are material weaknesses in internal controls Role of the Auditor • Auditors should be the main Agency Problem mitigators as they operate on behalf of the stockholders. • Commonly ignored, their reports should always be checked by an analyst, specially if it raises doubts about the firm’s financials. • Auditors are mandated to express not only their disagreements but also their doubts, mostly about: – The going concern assumption; – Uncertainties related to the value of some assets or liabilities; – Some contingencies. Critical definitions of terms used throughout this course Assets: items owned by the firm Liabilities: items the firm owes to creditors (One source of funds available to purchase or create assets) Net Assets: Assets – Liabilities (the assets left over after paying off debt) Owners’ Equity: the owners’ claims to the assets Owners’ Equity = Net Assets. Why? These are the fundamental concepts for the Balance Sheet Assets (what is owned) = Provide funds for Liabilities (what is owed) Owners’ Equity (owners’ claims) Critical definitions of terms used throughout this course (contd.) Accounting Equation: Assets = Liabilities + Owners’ Equity Cash + Other Assets (what is owned) = Liabilities (what is owed) Owners’ Equity (owners’ claims) Retained Earnings (cumulative profits kept within the firm) Revenues (inflows of resources) Contributed Capital (Stock Issues) (note this is a second source of funds for purchasing or creating assets) Expenses (outflows of resources) Critical definitions of terms used throughout this course (contd.) Revenues: inflows to the firm (from providing services or sales) Expenses: outflows by the firm that are generated to help create revenues Gains: increases in value of firm assets Losses: decreases in value of firm assets Net Income: “profit” earned during the period Revenues - Expenses + Gains - Losses Note: the difference between these classifications is often subtle and confusing Generally, “revenues” and “expenses” are associated with fundamental operational transactions = Net Income “Gains” and “losses” are associated with tangential transactions These are the fundamental concepts for the Income Statement In N’ Out Burger’s sales of hamburgers would generate “revenues” In N’ Out Burger’s sales of a delivery truck might generate a “gain” or a “loss” Critical definitions of terms used throughout this course (contd.) Income Statement: summary of revenues and expenses for the period Revenues - Cost of Sales (Cost of Goods Sold) = Gross Margin Operations Section - Selling and Administration Expenses = Income from Operations - Interest Expense - Other Expenses or Losses + Other Revenues or Gains Non operations Section = Income before Taxes - Income Tax Expense = Income before Irregular Items -/+ Loss or Gain from Discontinued Operations (net of tax) -/+ Loss or Gain from Extraordinary Items (net of tax) -/+ Loss or Gain from Change in Accounting Principle (net of tax) = Net Income Irregular Items Section We’ll cover this in more detail later… Revenues $152,866 Expenses $132,386 Net Income $16,819 Critical definitions of terms used throughout this course (contd.) Dividend: periodic payment back to the owners; a distribution of profits Now, let’s put this all together… The Big Picture Review The firm also borrows funds to purchase or create assets Assets (what is owned) Owners’ funds are used to purchase or create firm assets Liabilities (what is owed) Owners’ Equity (owners’ claims) Investors (owners) contribute funds to create a firm The Big Picture Review Assets (what is owned) Liabilities (what is owed) Assets are used up (expenses) to generate revenues which nets to Net Income Owners’ Equity (owners’ claims) Net Income (Revenues – Expenses) is collected within the firm (as Retained Earnings) Retained Earnings Back to Owners Some proportion of Retained Earnings is distributed to owners as a Dividend Next Class… Overview of the Financial Statements. More detailed discussion of the Balance Sheet.