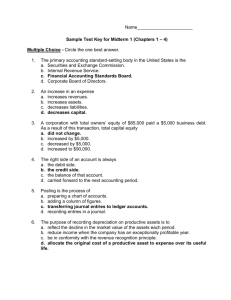

a federal government agency in charge of setting accounting

advertisement

Notes – B01.1306– 2-06-02 1 Assets = Liabilities + Shareholders’ equity – an equality that must always hold. Transactions can affect any combination of assets, liabilities and owners' equity - for example one transaction may affect an asset and a liability and the next transaction may affect two asset accounts. Accounts are ordered in their 'closeness' to cash when a balance sheet is presented to the public. 'Closeness' to cash - called liquidity - reflects the ability to convert the account in question into cash quickly. A condensed balance sheet is one where many similar or minor accounts have been combined into one for presentation to the public. Material accounts (ones that might be significant to an analysis) should not be combined with other accounts. Every balance sheet account has a beginning balance (which may be zero). Every account has the following structure: Beginning balance + inflows - outflows = ending balance If three of the above amounts are known, this algebraic relationship can be used to determine the fourth amount. Two owners' equity accounts may be used to reflect the distribution of new shares by the company directly to owners. The first is par (stated) value of common (capital) stock for the par value of the shares. Par value is usually a nominal amount used for legal reasons. The second is additional paid-in capital or excess contributed capital to reflect the rest of the amount paid to the company. Some payable accounts that you might see in a balance sheet include: Accounts payable Interest payable Wages or salaries payable Taxes payable Accrued (Wages, taxes or interest) – reflects amounts that will soon have to be paid, but which have not yet become formal obligations. Notes – B01.1306– 2-06-02 2 The income statement reflect a company's performance during a given time period - either a quarter or a year. The annual statement is audited. Most of the income statement focuses on a company's operating activities - that is, the results from the company's operating cycles. Operating cycle - usually the period or pattern that company follows as it converts cash into a saleable product and then reconverts the saleable product (through a sale and, possibly a receivable) back into cash. A company could be viewed as a package of operating cycles - some completed during the period and some partially completed at the time the income statement is created. In this view the income statement summarizes the impact of the operating cycles started this period, started and finished this period and finished this period (after starting in a previous period). Companies like Walmart and Home Depot have many, many short operating cycles per period. A company like Boeing (builder of aircraft) make take several periods to complete a cycle (commit cash to build an airplane, build it and sell the plane) Shareholders’ equity includes contributed capital (common stock or capital stock and additional paid in capital) and capital earned through business operations, but not distributed to owners (retained earnings). Income = Revenues – Expenses or Residual or leftover from operations = sales – resources used in making the sales Revenues are usually (but not always) recorded at the time of an exchange of assets (or promises of assets) between two parties. For example, the purchase of bread in a store. A sale is recorded by the cashier. (You get the bread and give up cash or promise (through a credit card) to give up cash later.) Revenues increase owners’ equity and expenses reduce owners’ equity. Income is an accrual concept because you match expenses required to sell a product to the revenues generated by the sale of the product. Cash is not necessary to record income. The accrual concept leads to a relatively smooth flow of income from the stream of operating events while requiring cash flows could lead to wildly fluctuating income. Dividends declared is that amount of owners’ equity to be distributed to owners. Retained earnings at the beginning of the period + income – dividends declared = retained earnings at the end of the period The sales event is a crucial event. There are two components. The first part is the reporting of revenue which increases owners’ equity (revenue) and increases either cash or accounts receivable . The second part is the reporting of the of the directly associated expense which decreases owners’ equity (cost of goods sold) and decreases inventory. Because revenue is greater than expense the company reports an increase in owners’ equity due to the event. (The firm is in business to generate income.) Some expenses included when measuring income include: Cost of goods sold (the cost of producing inventory for sale) Selling expenses such as the cashier and advertising Notes – B01.1306– 2-06-02 Administrative expenses such as management related expenses Insurance and rent expense Research and development expense (for new products) Revenues – cost of goods sold = Gross Margin Gross margin – other operating expenses = Operating Income Operating income – interest expense = Income Before Tax Income before tax – tax expense = Income After Tax 3