acts affecting bankers

advertisement

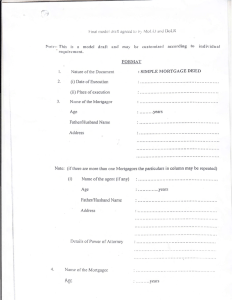

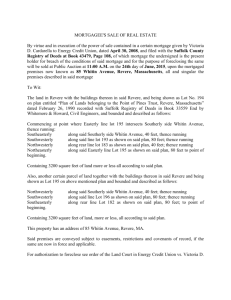

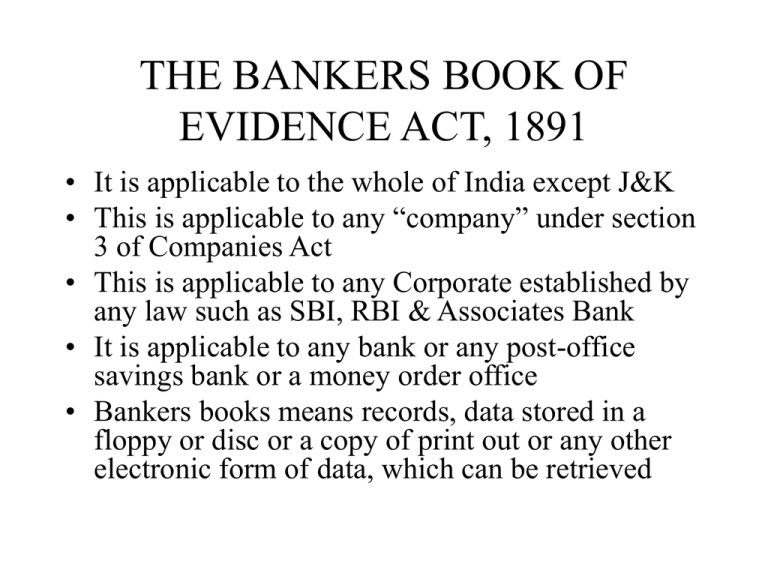

THE BANKERS BOOK OF EVIDENCE ACT, 1891 • It is applicable to the whole of India except J&K • This is applicable to any “company” under section 3 of Companies Act • This is applicable to any Corporate established by any law such as SBI, RBI & Associates Bank • It is applicable to any bank or any post-office savings bank or a money order office • Bankers books means records, data stored in a floppy or disc or a copy of print out or any other electronic form of data, which can be retrieved continued • A certified copy of any entry in bankers book will be the evidence of prima facie evidence of existence of such entry • No officer can be compelled to produce any documents of the bank in any legal dispute to which the bank is not a party unless ordered by the court. • The judge of a court can or may order any party to inspect and take any copies of any entry in the banker’s book for any purpose of any proceedings within a specified time. It would be served to the bank 03 clear days (excluding bank holidays).The bank may offer to produce the book at the trial or give notice of their intentions to show cause aagainst such order within the specified time. Continued • The costs of anything done or to be done under the order of a court will be the discretion of such court, who may further order that such costs or any part thereof to be paid to any party by the bank, if there is delay on the part of the bank. Any such order to pay the cost by the bank may be enforced as if the bank were a party to the proceeding. • Under section 6 of the Act bank has a statutory right to object to any order directing inspection of their books though the order is made under section 91 of Code of Criminal Procedure. THE LIMITATION ACT,1963 • Applicable in whole of the country except J&K • It is a law of repose, peace and justice which bars the remedy after a lapse of a particular period by way of public policy and expediency without extinguishing the right in certain cases. • If such period expires on a day when the court is closed , the suit or appeal may be preferred on the day when the court reopens. • Any appeal may be admitted after the prescribed period, if the applicant satisfies the court that he had sufficient reason for not preferring the application within such period. CONTINUED • If a person entitled to institute a suit or application for the execution of a decree is at the time from which such period is to be reckoned, a minor or insane or an idiot may institute the suit within the same period after the disabilities has ceased. If the disability continues up to the death of that person his legal representative may institute the suit within the same period after death. (Section 6) • In computing the period of limitation for any suit, appeal or application, the day from which such period is to be reckoned shall be excluded continued • The period of limitation shall not begin to run until the plaintiff or applicant has discovered the fraud or the mistake or could with reasonable diligence, have discovered it. Where a judgmentdebtor has by fraud or by force prevented the execution of of a decree or order within the period of limitation, the court may on application by judgment creditor made after the said expiry period extend the period for execution of the decree order. Continued • An acknowledgement of liability in respect of any property or right has been made in writing signed by the party against whom such property or right is claimed, a fresh period of limitation shall be computed from the time when the acknowledgement was so signed. Signed means signed either personally or by an agent duly authorised in this behalf. • Where payment on account of a debt or of interest on a legacy is made before the expiration of the prescribed by the person liable to pay the debt or legacy or by his agent duly authorised in this behalf, a fresh period of limitation shall be computed from the time when the payment was made. LIMITATION PERIODS • For money payable for money lent- 03 years from the date when the loan is made • For money payable on demand- 03 years from the date demand is made • By a surety against the principal debtor or a cosurety- when the surety pays the creditor, when the surety pays anything in excess of his own shares. • To recover possession of immovable property mortgaged and afterwards transferred by the mortgagee for a valuable consideration- 12 years THE TRANSFER OF PROPERTY ACT, 1882 • Mortgage is the transfer of an interest in specific immoveable property for the purpose of securing the payment of money advanced or to be advanced by way of loan existing or future debt or the performance of an engagement which may give rise to a pecuniary liability. TYPES OF MORTGAGES • Simple Mortgage-Mortgagor bound personally to pay mortgage money and the mortgagee will have right to cause the mortgaged property to be sold • Mortgage by Conditional Sale- Ostensible sale which on default on a certain date becomes absolute sale. On payment being made , the buyer shall transfer the property to the seller • Usufructuary Mortgage- Possession with the mortgagee, who can receive the rents or profits accruing from property DIFFERENT TYPES OF MORTGAGES • English Mortgage- Mortgagor binds himself to repay the mortgage money on a certain date and absolute transfer is done but with a provision of re-transfer to the mortgagor upon payment of mortgage money. • Equitable Mortgage • Anomalous mortage INDIAN REGISTRATION ACT,1908 • Section 24- Documents executed by several persons at different times may be presented for registration or re-registration within 04 months from the date of each execution. In case of delay in presentation, a fine up to 10 times the amount of proper registration fee, such documents shall be accepted for registration. • Documents executed outside India should be presented within 04 months from the date of its arrival in India • Wills may be presented for registration at any time