Strategic Business Management

advertisement

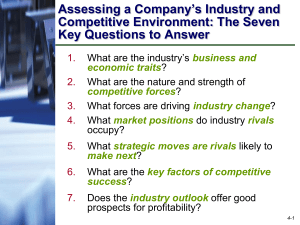

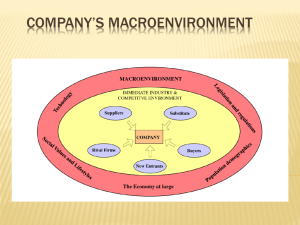

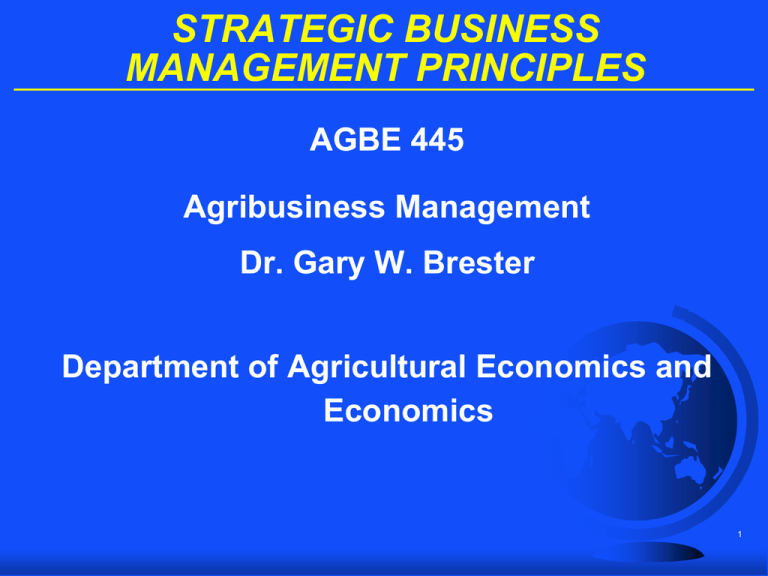

STRATEGIC BUSINESS MANAGEMENT PRINCIPLES AGBE 445 Agribusiness Management Dr. Gary W. Brester Department of Agricultural Economics and Economics 1 THREE PRIMARY ASPECTS OF STRATEGIC BUSINESS MANAGEMENT Industry and Competitive Analysis Strategy and Competitive Advantage Company Situation and Analysis 2 THREE PRIMARY ASPECTS OF STRATEGIC BUSINESS MANAGEMENT Industry and Competitive Analysis Strategy and Competitive Advantage Company Situation and Analysis 3 INDUSTRY AND COMPETITIVE ANALYSIS Situation Analysis Industry Environment Five Competitive Forces Driving Forces Key Success Factors 4 INDUSTRY AND COMPETITIVE ANALYSIS Situation Analysis Industry Environment Five Competitive Forces Driving Forces Key Success Factors 5 WHY DO A SITUATION ANALYSIS? Objective Identify features in a firm’s external & internal environment which frame its window of STRATEGIC OPTIONS OPPORTUNITIES Focuses on two considerations: EXTERNAL factors: MACRO environment (industry & competitive conditions) INTERNAL factors: MICRO environment (firm’s internal situation & competitive position) 6 Figure 1: How Strategic Thinking and Analysis Lead to Good Choices Thinking Strategically About Industry and Competitive Conditions Identifying Strategic Options Open to the Company Choice of The Best Strategy Thinking Strategically About a Company’s Own Situation 7 INDUSTRY AND COMPETITIVE ANALYSIS Situation Analysis Industry Environment Five Competitive Forces Driving Forces Key Success Factors 8 KEY QUESTIONS REGARDING EXTERNAL ENVIRONMENT 1. Industry’s dominant economic traits 2. Competitive forces at work in industry & strength 3. Drivers of change in industry 4. Firms in strongest/weakest competitive positions 5. Competitive moves of rivals 6. Key factors determining competitive success or failure in industry 7. Attractiveness of industry 9 IDENTIFYING AN INDUSTRY’S DOMINANT ECONOMIC TRAITS Market size & growth rate/stage in life cycle Scope of competitive rivalry Number of competitors & relative sizes Prevalence of backward/forward integration Entry/exit barriers Nature & pace of technological change Product & customer characteristics Scale economies & experience curve effects Capacity utilization & capital requirements Industry profitability 10 INDUSTRY AND COMPETITIVE ANALYSIS Situation Analysis Industry Environment Five Competitive Forces Driving Forces Key Success Factors 11 ANALYSIS OF COMPETITIVE FORCES Objective To identify Main SOURCES of competitive forces and STRENGTH of these pressures COMPETITIVE FORCES MATTER BECAUSE: To be successful, strategy must be designed to cope effectively with competitive pressures objective must be to build a strong, market position based on competitive advantage! 12 Figure 2: The Five Forces Model of Competition: A Key Analytical Tool Substitute Products Suppliers Rivalry Among Competing Sellers Potential New Entrants Buyers 13 THE FIVE COMPETITIVE FORCES 1. RIVALRY among competing sellers in an industry 2. SUBSTITUTE PRODUCTS offered by firms in OTHER industries 3. Potential ENTRY of new competitors 4. Bargaining power of SUPPLIERS 5. Bargaining power of BUYERS 14 PROCEDURE: ANALYZING THE FIVE COMPETITIVE FORCES Identify main sources of competitive pressures Rivalry among competitors Substitute products Potential entry Bargaining power of suppliers Bargaining power of buyers Assess strength of each competitive force Strong? Moderate? Weak? Explain how each competitive force works & its role in overall competitive picture 15 RIVALRY AMONG COMPETING SELLERS Usually the MOST POWERFUL of the five competitive forces Weapons of COMPETITIVE RIVALRY Price Quality Performance features offered Customer service Warranties and guarantees Advertising & special promotions Dealer networks Product innovation 16 COMPETITIVE FORCE OF POTENTIAL ENTRY New entrants boost competitive pressures By bringing new production capacity into play Through actions to build market share Seriousness of threat of entry depends on BARRIERS to entry Expected REACTION of existing firms to entry Barriers to entry exist WHEN It is difficult for newcomers to enter market A new entrant’s small sales volume puts it a price/cost disadvantage 17 COMPETITIVE FORCE OF SUBSTITUTE PRODUCTS Concept SUBSTITUTES matter when products of firms in another industry enter the market picture Examples Transgenic Seeds vs. Chemicals Transgenic Seeds vs. Traditional Seeds 18 COMPETITIVE FORCE OF SUPPLIERS Suppliers are a strong competitive force when Item makes up large portion of costs of product, is crucial to production process, and/or significantly affects product quality It is costly for buyers to switch suppliers They have good reputations & growing demand for their product They can supply a component cheaper than industry members can make it themselves They do not have to contend with substitutes Buying firms are not important customers 19 COMPETITIVE FORCE OF BUYERS Buyers are a strong competitive force when They are large & purchase a sizable percentage of industry’s product They buy in volume quantities They incur low costs in switching to substitutes They have flexibility to purchase from several sellers Selling industry’s product is standardized They can integrate backward Product being purchased does NOT save buyer money or has low value to buyer 20 STRATEGIC IMPLICATIONS OF THE FIVE COMPETITIVE FORCES Competitive environment is unattractive when: Rivalry is very strong Entry barriers are low Competition from substitutes is strong Suppliers & customers have considerable bargaining power 21 INDUSTRY AND COMPETITIVE ANALYSIS Situation Analysis Industry Environment Five Competitive Forces Driving Forces Key Success Factors 22 IDENTIFYING & ASSESSING DRIVING FORCES Concept Industry conditions change because EXTERNAL FORCES are DRIVING industry participants to alter their actions DRIVING FORCES are the MAJOR UNDERLYING CAUSES of changing industry & competitive conditions 23 TYPES OF DRIVING FORCES Changes in long-term industry growth rate Changes in who buys the product & how they use it Product innovation Technological change/process innovation Marketing innovation Entry or exit of major firms Diffusion of technical knowledge 24 TYPES OF DRIVING FORCES Increasing globalization of industry Changes in cost and efficiency Shifting from standardized to differentiated products (or vice versa) Regulatory influences & government policy changes Changing societal concerns, attitudes, & lifestyles Changes in degree of uncertainty & risk 25 INDUSTRY AND COMPETITIVE ANALYSIS Situation Analysis Industry Environment Five Competitive Forces Driving Forces Key Success Factors 26 PINPOINTING INDUSTRY KEY SUCCESS FACTORS Basic Concept KEY SUCCESS FACTORS (KSFs) spell difference between Profit & loss Competitive success or failure A KEY SUCCESS FACTOR can be Specific skill or talent Competitive capability Something a firm must do to satisfy customers 27 PINPOINTING INDUSTRY KEY SUCCESS FACTORS Identifying KSFs is top priority as they are good cornerstones of a firm’s strategy Winning COMPETITIVE ADVANTAGE often hinges on being distinctively better than rivals at one or more of the KSFs KSFs consist of the 3 - 5 really major determinants of financial & competitive success in industry 28 INDUSTRY AND COMPETITIVE ANALYSIS Situation Analysis Industry Environment Five Competitive Forces Driving Forces Key Success Factors 29 THREE PRIMARY ASPECTS OF STRATEGIC BUSINESS MANAGEMENT Industry and Competitive Analysis Strategy and Competitive Advantage Company Situation and Analysis 30 STRATEGY AND COMPARATIVE ADVANTAGE Three Generic Competitive Strategies Low-Cost Leadership Strategy Differentiation Strategies Focus Strategies 31 STRATEGY & COMPETITIVE ADVANTAGE COMPETITIVE ADVANTAGE exists when firm has an edge in Defending against competitive forces & Securing customers KEY TO SUCCESS Convince customers firm’s product/service offers SUPERIOR VALUE Offer buyers a good product at a lower price Use differentiation to provide a better product buyers think is worth a premium price 32 WAYS TO WIN A COMPETITIVE ADVANTAGE Become the low-cost producer Make the best-made product Provide customer more value for the money Save customer money Provide superior customer service Enhance performance buyer gets Provide more convenient locations Make a more reliable & durable product 33 Figure 3: The Three Generic Competitive Strategies TYPE OF ADVANTAGE SOUGHT MARKET TARGET Lower Cost Broad Range of Buyers Buyer Segment or Niche Low-Cost Leadership Strategy Differentiation Differentiation Strategy Focused Strategy 34 THE THREE GENERIC COMPETITIVE STRATEGIES LOW-COST LEADERSHIP Striving to be the overall low-cost provider in industry 35 THE THREE GENERIC COMPETITIVE STRATEGIES DIFFERENTIATION Striving to build customer loyalty by differentiating one’s product offerings from rivals’ products 36 THE THREE GENERIC COMPETITIVE STRATEGIES FOCUS STRATEGY Concentrating on a narrow buyer segment, outcompeting rivals on either a lower cost basis or offering niche members a product or service customized to their needs 37 THREE PRIMARY ASPECTS OF STRATEGIC BUSINESS MANAGEMENT Industry and Competitive Analysis Strategy and Competitive Advantage Company Situation and Analysis 38 COMPANY SITUATION ANALYSIS Determining How Well Present Strategy is Working SWOT Analysis Strengths & Weaknesses of Firm Opportunities & Threats Facing Firm Strategic Cost Analysis & Value Chains Assessing Firm’s Competitive Position Identifying Strategic Issues 39 KEY QUESTIONS IN COMPANY SITUATION ANALYSIS 1. How well is firm’s present strategy working? 2. What are firm’s strengths, weaknesses, opportunities, & threats? 3. Are firm’s prices & costs competitive? 4. How strong is firm’s competitive position? 5. What strategic issues does firm face? 40 S W O T ANALYSIS S W O T represents the first letter in S trengths W eaknesses O pportunities T hreats SWOT analysis involves sizing-up firm’s INTERNAL strengths & weaknesses and EXTERNAL opportunities & threats 41 IDENTIFYING INTERNAL STRENGTHS & WEAKNESSES A STRENGTH is something firm is good at or characteristic giving it an important capability Useful skill Important know-how Valuable organizational resource or competitive capability Achievement giving firm a market advantage A WEAKNESS is something firm lacks, does poorly, or condition placing it at a disadvantage 42 IDENTIFYING EXTERNAL OPPORTUNITIES OPPORTUNITIES most relevant to a firm are factors in EXTERNAL environment offering Some kind of competitive advantage Important avenues for growth 43 IDENTIFYING EXTERNAL THREATS EXTERNAL FACTORS posing a danger to firm Emergence of cheaper technologies Introduction of new/better products by rivals Entry of low-cost foreign competitors New regulations Vulnerability to rise in interest rates Potential of hostile takeover Unfavorable demographic shifts Adverse shifts in foreign exchange rates Political upheaval in a country 44 SUMMARY Industry and Competitive Analysis Current Industry Situation Competitive Forces in the Industry Driving Forces Causing Change Key Success Factors Strategy and Competitive Advantage Low-Cost Strategy Differentiation Strategy Focus Strategy Offensive Strategy -- Implement Defensive Strategy -- Protect Company Situation and Analysis SWOT Analysis 45