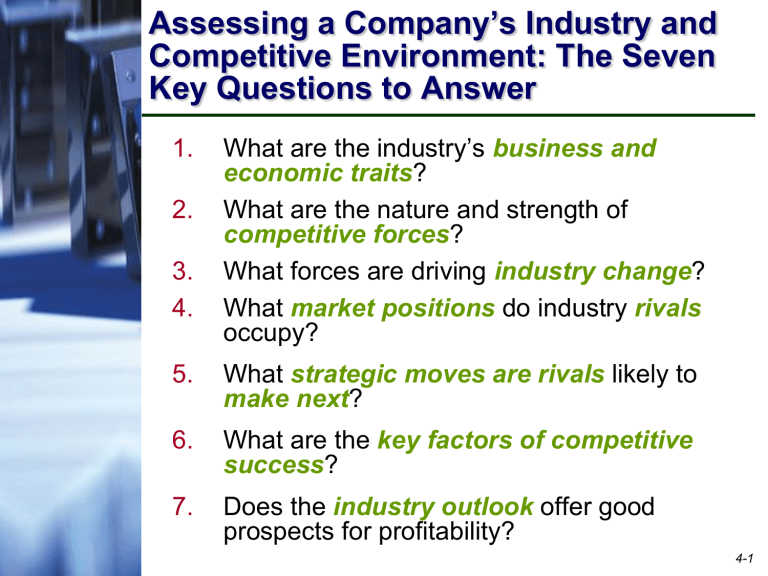

External Analysis

Assessing a Company’s Industry and

Competitive Environment: The Seven

Key Questions to Answer

1.

What are the industry’s business and economic traits ?

2.

What are the nature and strength of competitive forces ?

3.

What forces are driving industry change ?

4.

What market positions do industry rivals occupy?

5.

What strategic moves are rivals likely to make next ?

6.

What are the key factors of competitive success ?

7.

Does the industry outlook offer good prospects for profitability?

4-1

1. Identifying the Industry’s

Dominant Economic Features

Market size and growth rate

Number of rivals

Scope of competitive rivalry

Pace of technological change

Degree of vertical integration

Need for economies of scale

Learning and experience curve effects

4-2

2. Porter’s Five Forces Model of

Competition

4-3

When Is the Bargaining

Power of Buyers Stronger ?

Buyers are large and can demand concessions

Buyer switching costs for substitutes are low

The number of buyers is small

Buyer demand is weak or declining

Buyers are well-informed about sellers’ products, prices, and costs

Buyers threaten to integrate backward

4-4

When Is the Competition

From Substitutes Stronger ?

There are many good substitutes that are readily available

Substitutes are attractively priced

Substitutes have comparable or better quality and performance

End-users have low switching costs

4-5

When Is the Bargaining

Power of Suppliers Stronger ?

Industry members incur high switching costs

Needed inputs are in short supply

Supplier provides a differentiated input that enhances the quality or performance of sellers’ products

There are only a few suppliers of a specific input

Some suppliers threaten to integrate forward

4-6

When Is the Threat of Entry Stronger ?

Industry growth is rapid and profit potential is high

Incumbents are unwilling or unable to contest a newcomer’s entry efforts

The pool of entry candidates is large

Entry barriers are low

4-7

What Causes Rivalry to Be

Stronger ?

Competing sellers regularly launch fresh actions to boost market standing

Declining demand or slow market growth

The products or services offered by rivals are standardized or weakly differentiated

One or more industry rivals becomes dissatisfied with their market standing

4-8

What Causes Rivalry to Be

Stronger ?

Number of rivals increases

Buyer costs to switch brands are low

Industry conditions tempt rivals use price cuts or other competitive weapons to boost volume

Outsiders have recently acquired weak firms in the industry and are trying to turn them into major market contenders

4-9

When the Five Competitive Forces

Result in Attractive Market

Conditions

An industry’s competitive environment tends to be attractive from a profit-making standpoint when

Rivalry is moderate

Entry barriers are high and no firm is likely to enter

Good substitutes do not exist

Suppliers and customers are in a weak bargaining position thereby producing competitive pressures that are very weak!

4-10

When the Five Competitive Forces

Result in Unattractive Market

Conditions

An industry’s competitive environment tends to be unattractive from a profit-making standpoint when

Rivalry is strong

Entry barriers are low and new competitors are likely to enter

Good substitutes exist

Suppliers and customers are in a strong bargaining position thereby producing competitive pressures that are very intense or fierce!

4-11

3. Analyzing Driving Forces

1.

Identify forces likely to reshape industry competitive conditions

Changes likely to take place within next 1 – 3 years

Usually no more than 3 - 4 factors qualify as real drivers of change

4-12

Analyzing Driving Forces

2.

Assess impact of driving forces on industry attractiveness

Are the driving forces causing demand for product to increase or decrease ?

Are the driving forces acting to make competition more or less intense ?

Will the driving forces lead to higher or lower industry profitability?

3.

Determine what strategy changes are needed to prepare for impact of driving forces

4-13

External Environmental Factors

Shaping A Company’s Choice of

Strategy

4-14

Basic Driving Forces

Economic Conditions

Technological change

Demographics

Legislation and regulation

Social Values and Lifestyles

4-15

4. Identifying the Market Positions of

Rivals: Strategic Group Maps

4-16

What Can Be Learned from

Strategic Group Maps

Driving forces and competitive pressures often favor some strategic groups and hurt others

Competitive pressures may cause the profit potential of different strategic groups to vary

Identification of competitive

“white spaces” or

“blue ocean” opportunities

4-17

5. Predicting the Next Strategic

Moves Rivals Are Likely to Make

Profiling key rivals involves gathering competitive intelligence about

Thinking and leadership styles of top executives

Identifying trends in the timing of new product launches and marketing promotions

Considering which rivals have the motivation and capability to make major strategy changes

4-18

6. Pinpointing the Key Factors for Competitive Success

Key Success Factors (or KSFs ) are competitive factors most affecting every industry member’s ability to prosper.

KSFs include:

Specific product attributes

Necessary resources, competencies, and capabilities

Specific intangible assets

Competitive capabilities

4-19

Three Questions to Ask in

Identifying Industry Key Success

Factors

1.

On what basis do buyers choose between brands ?

2.

What resources are needed to compete successfully?

3.

What shortcomings are almost certain to put a company at a competitive disadvantage ?

4-20

Example: KSFs for the

Beer Industry

Full utilization of brewing capacity -to keep manufacturing costs low

Strong network of wholesale distributors -- to gain access to retail outlets

Clever advertising -- to induce beer drinkers to buy a particular brand

4-21

Example: KSFs for Apparel

Manufacturing Industry

Appealing designs and color combinations -- to create buyer appeal

Low-cost manufacturing efficiency -- to keep selling prices competitive

4-22

Example: KSFs for Tin and

Aluminum Can Industry

Locating plants close to end-use customers -- to keep costs of shipping empty cans low

Ability to market plant output within economical shipping distances

4-23

7. Deciding Whether the Industry

Presents an Attractive Opportunity

Involves assessing whether the industry and competitive environment is attractive or unattractive for earning good profits

Draws upon all the previous analysis

The industry’s growth potential

The intensity of competition

Whether the impacts of the driving forces are positive or negative

The company’s competitive position in the industry relative to rivals

How well the company performs the industry’s key success factors

4-24