Lecture 2

advertisement

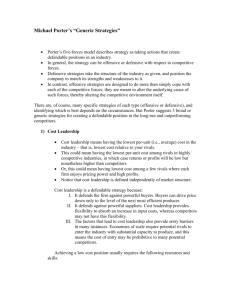

ECONOMICS 3200B Lecture 2 Ch. 1, 2, 3 September 16, 2014 1 Introduction • Decision making – – – – – Objectives Information Constraints Trade-offs Time horizons • Role of self interest, aka “greed” • Distributional issues – equity, fairness – The 1%ers 2 Introduction • From here to there – Defining here – Choosing among all possible theres – Choosing the path to get there • Options created/foregone along each path • How long to get there along each path – What if “there” chosen proves to be the wrong one? • How do you find out? – Role of milestones and contingency planning – Leadership 3 Introduction Decision making – Forward looking: Information requirements, uncertainty and risks – Time horizon: short run vs. long run – Adam Smith: individuals pursuing their own self interest will collectively produce the greatest good Greed is good, Economics 101 • Importance of incentives: individuals motivated by personal well-being 4 Introduction • Among 50 wealthiest: Bill Gates (1), Carlos Slim (2), Amancio Oretga (4), Larry Ellison (5), Koch Brothers (6), Christy Walton (8), Li Ka-shing (13), Michael Bloomberg (14), Sheldon Adelosn (15), Mark Zuckerberg (16), Bernard Arnault (17), Stefan Persson (18), Larry Page & Sergey Brin (19 and 20), Jeff Bezos (21), Michele Ferraro (22), Aliko Dangote (23), Carl Icahn (25), Mukesh Ambani (27), Jorge Lemann (30), Steve Ballmer (31), Dieter Schwarz (33), Leonardo del Vecchio (38), Phil Knight (39), Michael Dell (40) 5 Introduction • Time horizon – Longer the time horizon – fewer constraints, more uncertainty • • – Temporal interdependence among decisions made at different points in time Increasing complexity Shorter time horizon • • • Tradeoffs Rash behavior Susceptibility to herd mentality – safety in numbers 6 Introduction Decision making • Constrained optimization – Constraints • • • • • • Character, history, skills, risk tolerance Competitors’ strategies Time Resource constraints – short-run/long run (i.e. availability of resources, quality) Laws, regulations Others – directors, investors, competitors, creditors (loan covenants), contracts 7 Introduction • Economic paradigms: – – – – – – Perfect competition – many firms, homogeneous products Monopoly – one firm (seller) Contestable Monopsony – one firm (buyer) Oligopoly – small numbers Monopolistic competition – many, heterogeneous products 8 Introduction • Problem: Competition • Passive/active? • Rivalry – “the goal of competition is to kill your competitors” – Compare to concept of competition in perfect competition model • Michael Porter: Determinants of rivalry – Concentration and balance (Herfindahl-Hirschman index, concentration ratios) – facilitate collusive behavior, deter entry, dominant firm – Threat of entry, exit barriers – Product differentiation – brand identity, switching costs, reputation – Informational complexity – Intermittent overcapacity – airlines, steel – Bargaining power of buyers – Industry growth 9 Introduction Competition • Schumpeter – “This process of creative destruction is the essential fact about capitalism. Every piece of business strategy must be seen in its role in the perennial gale of creative destruction.” • Bob Crandall – “Kill your competitor” • Porter – Competitive advantage 10 Competition • • • • In 513 B.C., Heraclites of Greece observed “There is nothing permanent except change.” Andrew Grove (a co-founder of Intel): “When everybody knows that something is so, it means that nobody knows nothing.’” Organizations need to be change capable – agile, innovative, nimble, and alert. Leadership and teams 11 Introduction • Michael Porter: Competitive strategy – Establish profitable and sustainable position factoring in bargaining power of suppliers and buyers, threat of entry, threat of substitutes, intensity of rivalry • Strategies for achieving competitive advantage – Cost leadership – Differentiation – Niche • Role of management and luck – Gamblers’ ruin and industry concentration 12 Competition • Competitive strategies • • • • Be cheaper Be better – continued focus on quality Be different – continued focus on product innovation. Cost, differentiation, niche • • • Cost leadership cannot ignore differentiation Differentiation cannot ignore costs Niche cannot ignore costs and differentiation 13 Competition • • • Competitive strategies: gain competitive advantage in order to generate superior financial performance (how is this defined?) Strategies depend upon history of company, core competencies of company, possible competitor reactions (market structure within which company competes) Success depends upon skills, abilities of senior management; execution of strategies (organization structure, incentives/ motivation); luck (timing, bad decisions by competitors, right location, macroeconomic environment) 14 Competition • Continually develop new strategies and new basis for competitive advantage Don’t stand still • • • • • • • • • • Blackberry/Apple Barnes & Noble/Amazon Blockbuster/Netflix Microsoft/Google Nokia/Google, Apple Kodak and digital Cable companies/Netflix Stelco/ArcelorMittal Groupon/? 15 Strategic Behavior • Competitive strategy to be successful – Act before rivals or learn from mistakes of rivals – Deter entry – Difficult to imitate – time lags – Commitment to strategy, as long as it appears to be correct • Contingency plans – Blackberry and Playbook; Tokyo Electric, AIG, GM 16 Competition – – Compete on strength Shift rivalry to difficult to detect, timeconsuming to respond strategies • • • • • Product innovations/introductions Marketing Lobbying Production technology innovations Exclusive contracts – suppliers, distributors 17 Introduction • Sustainability of competitive advantage – Barriers to imitation not insurmountable, thus firm must create moving target by investing to continually improve position – Well executed offensive strategy best defense against attack by challenger – Role remains for defensive strategy – increase structural barriers to entry, increase probability of retaliation; retaliate when entry attempted – Deeper pockets – Risk-taking vs. risk aversion – role of regulations, fear of liabilities 18 Competitive Success • Financial performance: management talent, incentives, strategy, luck – Interaction will lead to small number of dominant firms in each industry • – Successful firms able to attract “best and brightest” – Goldman Sachs, Google Leaders will change over time 19 Competitive Success Execution: Moving the company from here to there • Leadership that can communicate clearly the essence of the strategy and its goals, inspire employees and gain their confidence and their cooperation (buy-ins to what the leaders are trying to accomplish); • Accountability so that everyone knows what is expected of her/him, and clear-cut rewards and penalties; • Breaking down the “grand” strategy into a number of clear and manageable projects, each with specific milestones, and each assigned to a team with a designated leader; • Consistency among the projects and in the timing of the projects. 20 Introduction • Problem: Market definition • Identification of buyers, sellers – potential entrants, potential sources of supply • Geographic scope – Local, regional, national, international – Trade barriers, information • What constitutes a substitute product? – Cross-price elasticities – measurement, critical values – MR>0: elastic range of demand curve, thus high degree of substitutability with products that are not included in market – Substitutability over time – alternative energy sources 21 Introduction • Entry barriers – ease, speed of entry – Entry by outsiders (who are they?); entry by insiders – Height, perception of entry barriers – reputation, economies of scale/scope, learning curves, access to distribution networks, switching costs, firm specific capital (patents, trade secrets, management skills, location) – Strategic behavior of incumbents – entry accommodation or deterrence • Time period for defining markets – time required for adjustments in buyer/seller behavior in response to certain size price change 22 Introduction • Problem: Information • What do buyers know about availabilities, prices, quality? – Search costs – Uncertainties re. quality – signals by firms for quality (advertising, warranties, investments in creating brand names) – Limited search enhances market power of each firm – Impact of Internet – search sites • What do suppliers know about technologies (product, production), consumer tastes, price elasticity, number and location of buyers, number and competencies of rivals, cost structures of rivals, strategies of rivals – Role of B2B – impact on relative bargaining advantages • What do potential entrants know? – Impact of Internet 23 Introduction • Theory: If, then – If perfect competition, then P=MC – If monopoly, then, P>AC – If no entry barriers and zero exit costs, then markets contestable and P=AC – If economies of scale to Q0 and diseconomies of scale beyond Q0 , then AC curve is U-shaped – If oligopoly, then ??? – If heterogeneous product, then monopolistic competition – If economic profits, then entry occurs 24 Introduction • Common shortcomings – Time: short run vs. long run – Market/industry boundaries – Competitive behavior – competitive strategies, competitive advantage – First entrant • • • • Learning curves Economies of scale Tipping point Networks – Evolution of technology • Disruptive technologies 25 Introduction • Problem: Many paths to the “if”, thus many paths for “then” • Example: Monopoly – How was monopoly created? • Government, natural monopoly, successful strategies, superior management, luck – Entry barriers created as part of process? • Depends on how monopoly created – Strategies to sustain monopoly? • Rent seeking – public vs. private sector • Sustainability 26