Satyam Saga_FC

advertisement

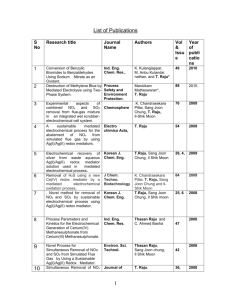

Satyam Saga Confession – January 7th , 2009 Background It was set up as Private Limited Company by Ramalingam Raju in 1987 which was later in 1991 recognized as public limited company. One of the major providers of IT service in India which provides Software development service , embedded service , engineering service , system integration , ERP solution , Enterprise Application Integration , Customer relationship , ecommerce and consulting. First company listed on NYSE, EURONEXT and NSE First Indian company to list its American Depositories Shares Achievement & Awards Year • Description 2000 •World Economic Forum identifies Satyam as one of the hundred leading pioneering technology company •HRD awards Ramalinga Raju as “ The IT Man of the Year “ 2002 •Top choice by SAP Support by GIGA research group 2003 •Facilitated with Lotus Award •Outsourcing contract awarded by World Bank 2004 •Ranked amongst top 10 best employers by CNBC Contd.. 2005 2007 2008 • Ranked amongst top 13 best managed company by Forbes • Largest global development centre outside India being operations • Ranked number one in ITO global processing consulting vendor • Raju wins the Ernst & Young Entrepreneur of the year • First company listed on NYSE and NSE • First Indian company to list its American Depositories Shares Fall of Satyam Three Phases of the Scam First Phase :1999-2001 Ascent of Indian IT sector on Y2K phenomenon Second Phase :2001-2005 Maintaining Growth Third Phase :2007 The Debacle Why Confession ? Recession drained the liquidity to run the show Out standings were piling up Unmanageable gap between actual and book profit “Every attempt made to eliminate the gap failed. As the promoters held a small percentage of equity, the concern was that poor performance would result in a take-over, thereby exposing the gap. It was like riding a tiger, not knowing how to get off without being eaten”. Who are the responsible parties? Indian Bankers Ramalingam Raju Board of Directors Auditors Fabricated Income Statements ‘Creative Account Practice’ • Details of cash balances with Scheduled banks are not there in the Annual report • Question raised by Equity analyst Kawaljeet Saluja -$500 mn cash parked in current account Fake FD receipts The money has already vanished Take fake FD receipts Repeat the procedure At the end show the original FD receipts Park the Money in other Bank Tell to Banks FD receipt is Lost Ask for Duplicate Receipts Use the Duplicate to Withdraw money Chairman Raju’s role Inflated billing to customers Non-existent cash & bank balances $ 1 bn Overstated Debtors $ 100 million Operating margin shown high at 24% in Q2 (Sept 2008) as against 3% real profit margin Such manipulation done in earlier years( 6 yrs-$ 1.2 Bn) Increased costs to justify higher level of operations. Actual employee strength was 40000 but shown at 53000. Attempt to merge Son’s Company ‘Maytas’ with huge land Bank to bridge the gap failed Role of Director Satyam's Board of Directors consisted of nine members including Krishna Palepu Harvard Professor and corporate governance expert, Rammohan Rao, the Dean of the Indian School of Business, and Vinod Dham, co-inventor of the Pentium Processor. Satyam revealed that it did not have a financial expert on the board during 2008. The Board of Directors were not independent. The Board first came under fire on December 16, 2008 when it approved Satyam's purchase of real estate companies in which Mr. Raju owned a large stake. Furthermore, the Board should have caught some of the same red flags. Role of Auditors Global auditing firm Price Waterhouse Coopers ("PWC") audited Satyam's books from June 2000 for nearly 9 years and did not uncover the fraud, whereas Merrill Lynch discovered the fraud as part of its due diligence in merely 10 days PWC signed Satyam's financial statements and was responsible for the numbers under Indian law. One particularly troubling item concerned the $1.04 billion that Satyam claimed to have on its balance sheet non interest bearing securities. It appears that the auditors did not independently verify with the banks in which Satyam claimed to have deposits. The fraud went on for a number of years and involved both the manipulation of balance sheets and income statements. Whenever Satyam needed more income to meet analyst estimates, it simply created fictitious sources and it did so numerous times without the auditors ever discovering the fraud. Role of Bankers The company's bankers -- and it has a whole bunch of them, considering it is a huge company -- too have been shown in poor light. Satyam's books showed cash to the tune of over Rs 5,300 crore (Rs 53 billion) in its banks. Satyam's banks -- ICICI Bank, HDFC Bank, Bank of Baroda, etc -- were supposed to provide bank statements on a quarterly basis and bank certificates on basis of which auditors go ahead and signed the balance sheet. Maytas Infra Ltd Maytas Properties Ltd An infrastructural development, construction and project management company A property development company Founded on May 6 , 1988 by Ramalinga Raju ‘s kins Run by Teja Raju ,son of Ramalinga Raju Raju’s hold 36.64 per cent while institutional holding is 10.92 per cent Satyam planned to acquire 51 per cent stake for $0.3 billion Founded in 2005 by Ramalinga Raju ‘s kins Raju’s family owns 35% of Maytas properties Satyam planned to acquire 100 per cent stake for $1.3 billion In 2008 , Satyam proposed to acquire Maytas Infrastructure Ltd and Maytas Properties founded by family relations of company founder Raju for $1.6 billion Intention was to bail out Satyam by covering up the irregularities in the books of accounts such as inflated cash balance etc This was met with strong opposition from independent directors and shareholders and ultimately proposal was withdrawn It was a major blow to Satyam ’s credibility as it was unethical and violated corporate governance laws Consequences of confession Investors- Panicked as Stock plummeted & Class action suits filed in US Employees- stranded in many ways- morally, financially, legally and socially Customers- shocked and worried about the project continuity, confidentiality and cost over run Bankers - concerned about recovery of financial and non-financial exposure and recalled facilities Government- worried about image of the Nation & IT Sector affecting faith to invest or to do business Anchoring the downfall Government ICAI Tech Mahindra • Board Restructuring • SFIO investigation • Delliote & KPMG • Action against PWC • S Gopalakrishnan and V S Prabhakar Gupta ban for life • Rs1757 crore -> 31% stake • Turnaround of the company Recommendations : Auditor Appointment and remuneration of auditors should be done by stock exchanges. Involvement of Forensic auditors Implementation of Investigative audit techniques Audit must be conducted in accordance with AAS(Auditing and Assurance Standard) Rotation of auditors with limited tenure Recommendations: Management Independent director must be chosen from a pool of qualified professionals The tenure of Independent director must be finite 360 degree feedback system should be used Market driven compensation guidelines should be disclosed Recommendations: Regulators ▶ Clear guidelines should be given for admission of watchdogs ▶ Special investigation should be undertaken of top 100 hundred companies and some other select companies to examine their balance sheets. ▶ Amending laws and regulations for improved corporate governance. T E A M M E M B E R S Avinash Kumar Kanchan Nishit Kumar Wg. Cdr. R. K. Vashisht Siddhant Goyal Shalabh Gupta Shivans Gupta Surabhi Sehgal Vijendra Pandey