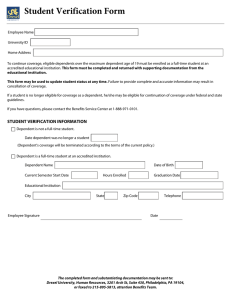

Business Development Grant

advertisement

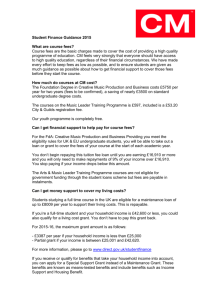

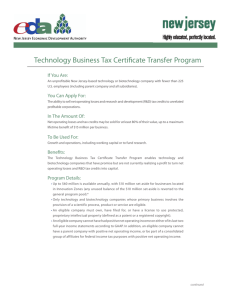

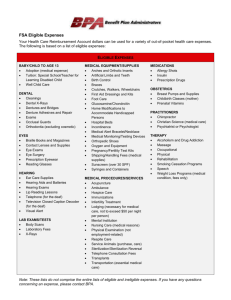

Micro Enterprise Financial Supports Eibhlin Curley Oifig Fiontair Áitiúil Chathair Bhaile Átha Cliath Local Enterprise Office Dublin City __________ Eligibility for Funding Micro-enterprises with 1 – 10 employees, hiring new full-time paid employee(s) Business operating full-time within the Dublin City Council area Not getting other state financial support eg Enterprise Ireland at the same time Sectors: Financial support is focused on innovative niché market businesses that are: • Manufacturing eg Food producers • Internationally traded services eg software • Services with overseas customers Not retail, trades, professionals, imports or local services Feasibility Study Grants Maximum €20,000 For Product development & Market research Use an Enterprise Ireland Innovation Voucher if possible Application Form & LEO Feasibility Proposal Framework Must have the money to spend it and get 50% refund based on receipts (excluding VAT) • 50% consultancy - 3rd party costs • 50% patent costs • 50% prototype development - 3rd party costs Business Development Grant Commercially viable businesses trading over 18 months Must to hiring at least 1 new full-time permanent paid employee Eligible Costs: • Job Creation Salary costs average €10,000 per person • Capital items (50% costs towards manufacturing/ industrial equipment). Mobile assets not eligible (van, laptop etc) • 3rd party Consultancy/ Marketing Business Development Grant/Loan up to €80,000 depending on # jobs created Terms & Conditions: Must be at least 1 new full-time job created A portion could be refundable (no interest charged) after 1 year moratorium Grants up to €20,000 0% refundable Grants over €20,000 50% or 66% or100% Refundability decided on a case by case basis depending on amount of grant, number of jobs created, assets etc A current valid Business Tax Clearance Certificate required Application Process Identify what type of grant & eligible business expenses you are applying for and get 3 quotes for each item, identify possible candidates for the new job(s) You will need to have the finance to pay for the items above since the grant covers 50% excluding VAT based on the proof of the 100% payment. Submit; Application Form, C.V., Business Plans (LEO Framework) For Priming & Business Development Grant 12 month projected cashflow, 3 year projected Profit & Loss A/c, plus most recent Management Accounts (Audited A/cs for larger loans) Deadline: 1st October and 5th November 2014 at 12 noon Meet a LEO Executive Evaluation & Approvals Committee decision up to €40,000 Enterprise Ireland approval needed for funding over €40,000 - €80,000 Letter of offer issued Grant/ Loan accepted Grant claim must be within 4 months Payment made when the necessary paperwork is submitted and signed Repayments begin 12 months after the final drawdown Reasons why projects are rejected; • Sector • Deadweight • Displacement • Commercial viability Re Grant Claim if approved funding Payments made based on receipted expenditure of approved expenses, bank statements Salary contribution is made in 2 instalments 6 months apart Business Tax Clearance Certificate (not personal) Accountants letter confirming employees full-time paid Annual employment survey and follow up every year – report to Dept of Jobs, Enterprise & Innovation Audited by C&A.G. and EU, Internal Audit & external auditors – correct procedure and paperwork a must Other Types of Funding from LEO Export Grant To exhibit at overseas trade shows 50% of expenses up to a maximum of €3,500 Eligible expenses: Marketing material (Quotes from 3 suppliers) Exhibitor fees, Travel & Accommodation Online Trading Voucher Purpose to promote online sales for bricks & mortar business Compulsory a half day workshop 50% of expenses up to a maximum of €2,500 Must get quotes from 3 suppliers Thanks for listening Q&A