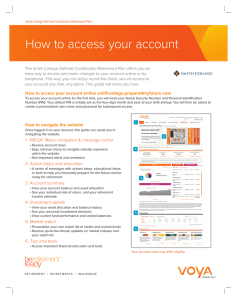

Voya Retirement Challenges Select Advantage

advertisement

Voya Select Advantage IRA A Mutual Fund Custodial Account Anthony Nizzi, AAMS Divisional Sales Manager CN0903-22048-0916 For registered representative use only. Not for public distribution. Disclosures Your clients should consider the investment objectives, risks, and charges and expenses of the mutual funds offered through an individual retirement account carefully before investing. The prospectuses contain this and other information and can be obtained by contacting your local representative. Please read the information carefully before investing. Mutual Funds offered through an individual retirement account are considered long-term investments designed for retirement purposes. Withdrawals from a Traditional Individual Retirement Account (IRA) are generally subject to Federal income tax, except for withdrawals of any after-tax or nondeductible contributions. An IRS 10% premature distribution penalty tax will apply to all taxable distributions you receive before you reach age 59 ½, unless another statutory exemption applies. Taxable distributions may also be subject to State income tax. Contributions to a Roth Individual Retirement Account (Roth IRA) are made on an after-tax basis. Distributions of earnings from a Roth IRA are not subject to Federal income tax, provided that certain Internal Revenue Code requirements are met. Distributions that do not meet these requirements may be subject Federal income tax, including an additional 10% Federal penalty tax. Refer to your Voya Select Advantage Disclosure Statement for further information. Taxable distributions may also be subject to State income tax. Tax laws change frequently. Please consult your personal tax advisor regarding taxation. Account values fluctuate with the market conditions, and when redeemed the principal may be worth more or less than the original amount invested. Voya Institutional Trust Company is the custodian for mutual fund custodial accounts distributed by Voya Financial Partners, LLC (member SIPC) or other broker-dealers with which it has a wholesaling or selling agreement. Recordkeeping services provided by Voya Retirement Insurance and Annuity Company (Windsor, CT). All named companies are members of the Voya™ family of companies." May Lose Value | Not A Deposit Of A Bank | Not Bank Guaranteed | Not FDIC/NCUA Insured | Not Insured By Any Federal Government Agency For registered representative use only. Not for public distribution. The Opportunity 10,000 baby boomers turning 65 daily Trend began in 2011 Projected to continue for 19 years 26% of the total population are Baby Boomers Baby Boomers Face Unique Challenges Source – Pew Research Center For registered representative use only. Not for public distribution. 3 Retirement Challenges Pension Plans Social Security Personal Retirement Savings For registered representative use only. Not for public distribution. 4 Retirement Challenges Source: National Center for Health Statistics, National Vital Statistics Reports, Volume 58, Number 21. United States Life Tables, 2006. For registered representative use only. Not for public distribution. 5 Retirement Challenges Defined Benefit Plan Trends For registered representative use only. Not for public distribution. 6 Voya Select Advantage IRA What is it? What it is not: Personal retirement program allowing clients to invest in a multimanager suite of mutual funds from well-known fund managers Not an advisory account IRA account with one simple record-keeping fee plus individual fund expenses Easy to present and easy to service For registered representative use only. Not for public distribution. Not an insurance product Not your typical retail IRA program Not guaranteed Voya Select Advantage IRA Simple to Explain: No front-end loads No back-end fees No transaction fees No deferred sales charges No transfer-out fees Only cost from Voya is a Record Keeping Fee* * Fund operating expenses also apply. Accounts with values less than $15,000 will incur a $50 annual maintenance fee. An annual recordkeeping fee of 0.50%-0.60% applies to all accounts. For registered representative use only. Not for public distribution. Voya Select Advantage IRA Typical Clients: Job changers and retirees Clients desiring to consolidate retirement assets Clients that need to diversify current mutual fund assets Clients that don’t fit your advisory platform SEP and SIMPLE IRA Plans Start-up IRA and Roth IRA accounts For registered representative use only. Not for public distribution. Freedom to Choose Over 120 funds from over 30 industry leading fund managers covering all major sectors Mutual funds offered through a retirement plan are long-term investments designed for retirement purposes. If withdrawals are taken prior to age 59 ½ an IRs 10% premature distribution penalty tax may apply. Money distributed from the program will be taxed as ordinary income in the year the money is received. The mutual fund values fluctuate with market conditions, and when surrendered, the principal may be worth more or less than it original amount invested. You should consider the investment objectives, risks, and charges and expenses of the mutual funds offered through an individual retirement account carefully before investing. The prospectuses contain this and other information and can be obtained by contacting your local representative. Please read the information carefully before investing. For registered representative use only. Not for public distribution. Facts At-a-Glance Minimums: $5,000 initial investment $1,000 additional contributions $100 minimum automatic monthly investments Record Keeping Fee: Total Assets Annual Record Keeping Fee $0 to $49,999 0.60% $50,000 to $99,999 0.55% $100,000 and above 0.50% *accounts under $15,000 are assessed a $50 annual account fee For registered representative use only. Not for public distribution. Facts At-a-Glance Additional Features: Automatic Asset Reallocation Dollar Cost Averaging Block Reallocations Agent Initiated Withdrawals Access balances over the phone or online Dividend Sweeps Prospectuses on CD or Website For registered representative use only. Not for public distribution. Voya Select Advantage IRA Registered Representative’s need to know: Only need a Series 6/63 registration Upfront plus trail based compensation 1% upfront compensation with .50% annual trail starting in year 2 1-Stop website for product information and paperwork www.voyaselectadvantage.com For registered representative use only. Not for public distribution. Password: Advantage Voya Select Advantage IRA Marketing Support Client Material – Prospecting and Customizable www.voyaselectadvantage.com Password: advantage Sales Ideas Diversifying non-diversified IRA mutual fund assets Talk about 401(k) rollovers with your clients Assist clients outside your threshold for advisory accounts For registered representative use only. Not for public distribution. THANK YOU Help your clients grow, protect and enjoy their Orange MoneyTM For more details, please contact the Sales Desk: 800-344-6860 For registered representative use only. Not for public distribution.