Short-Version_-Rationale-for-a-VFIT_Reg-Flex

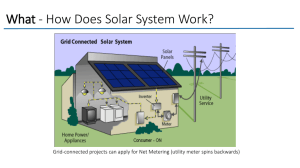

advertisement

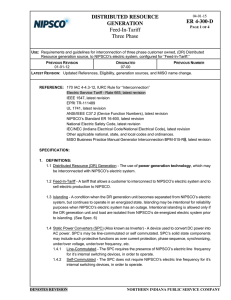

Presentation on 9/18/13 to the Regulatory Flexibility Committee by Laura Ann Arnold, President Indiana Distributed Energy Alliance (Presentation available at IndianaDG.net) To be the voice of the renewable energy (RE) and distributed generation (DG) business, educational and public sectors in Indiana to advocate public policies and to foster economic growth which fosters this business sector, creates jobs, promotes national security, provides stabilized energy resources and improves the quality of the environment. Renewable energy and distributed generation (RE&DG) developers both located in Indiana doing projects here and elsewhere across the country, as well as developers located outside the state either doing business or wanting to do business in Indiana Manufacturers of RE systems Supporting non-profits and individuals wanting to develop a project The key element of a feed-in tariff is to set a price that reflects the cost of generating the energy, including a reasonable rate of return that is fair and equitable to both investors and ratepayers. A Properly Designed Feed-in Tariff Can Lower the Cost of Capital and Keep Electric Rates Down Properly designed FIT pricing is generally designed the same way that regulators set electricity rates, by looking at a utility’s costs – including investments in new generation – and setting rates at a level to recover those costs plus a reasonable rate of return to their investors. The rate of return is critical, because there is evidence that the necessary rate of return under a feed-in tariff program can be lower than the typical rate of return that utilities require. This means that renewable energy is cheaper with a feed-in tariff than without a feed-in tariff. Golden Rule: Do onto others as you would have them do unto you. VFIT Golden Rule: Treat VFITs like electric utilities treat themselves, i.e. VFIT contracts should reflect the cost of generation including a reasonable rate of return that is fair and equitable to both investors and ratepayers. Collaborative process to establish terms and conditions as well as rates Broad range of renewable energy and distributed generation technologies Contract length of 25-30 years for solar PV Allows third party financing Does not limit project to customer usage Transparent selection process Reasonable milestones Tariffs based on cost of generation Differentiation by technology, project size, application and density For example, solar PV tariff could depend on: Solar PV integrated into building design; Solar PV panels installed on the roof; or Solar PV ground mounted. FIT programs of US municipalities include: Gainsville Regional Utilities (FL) Sacramento Municipal Utility District (SMUD) Long Island Power Authority (LIPA) Los Angeles Department of Water and Power (LADWP) Palo Alto (CA) Municipal Utility Utility 2013 Rates 2013 Capacity 2012 Rates 2012 Capacity IPL peak $0.0299 $7.42 $0.0282 $7.30 IPL off-peak $0.0257 Duke $0.02851 $7.05 $0.033687 $9.85 I&M TOD peak $0.0234 $8.56 $0.0274 $8.70 I&M off-peak $0.0223 NIPSCO peak .03221-.0399 NIPSCO offpeak .02377-.02847 Vectren peak $0.03882 Vectren offpeak $0.03428 $0.0246 $0.0241 $5.45 .03533-.03990 $5.49 .02196-.02631 $4.81 $0.04077 $0.03603 $5.03 170 IAC 4-4.1-4 Filing of rate data—annually 170 IAC 4-4.1-5 Obligation to purchase and sell 170 IAC 4-4.1-8 Rates for energy purchase 170 IAC 4-4.1-9 Rates for capacity purchase Indianapolis Power and Light (IPL) Rate REP & Northern Indiana Public Service Company (NIPSCO) Experimental Rate 665 Renewable FIT Cause No. 43623 Petition filed 12/29/08 Order issued 2/10/10 Cause No. 43960 Petition filed 10/13/10 Motion to temporarily suspend Rate REP 2/7/11 Order issued 11/22/11 Cause No. 44018 Petition filed 4/11/11 Order issued 03/07/2012 Tariff expired 3/30/2013 All projects with IURC approved contracts must be commissioned by ??? Cause No. 43922 filed 7/16/10 Technical conference held 10/04/10 Settlement Agreement filed 4/18/11 IURC order issued: 7/11/2011 Two stakeholder annual meetings held in Goshen on 7/18/ 12; and Munster on 8/1/13 NIPSCO VFIT 1.0 expires 12/31/13 NIPSCO filed petition with IURC 9/11/13 in Cause No. 44393 to explore another VFIT Prehearing conference TBA Technical conference TBA IndianaDG filed petition to intervene 9/15/13 Duke Energy Indiana (DEI) enters into Settlement Agreement on Edwardsport air permit on 8/28/13 requiring DEI to either: Implement a feed-in tariff for Solar PV modeled on the current NIPSCO FIT; or Construct/install, and/or execute a long term contract with one or more independent producers for energy and capacity from wind and/or solar with a combined nameplate capacity of no less than 15 MWs (minimum shall be 5 MW solar). Duke Energy Indiana (DEI) VFIT: Implemented in DEI service territory; Total program cap no fewer than 30 MW; No fewer than 5 MW to be reserved for small systems (no larger than 10 kW in size); and Be requested in a filing not later than 6/1/14. Settlement not to preclude DEI and Petitioners from collaborating on other or additional VFITs. IPL RATE REP NIPSCO RATE 665 Wind 50-100 KW: $0.14/kWh Wind ≤ 100kW: $0.17/kWh Wind 100 kW-1 MW: $0.105 Wind 101kW-2MW: Wind > I MW:$0.075/kWh Solar 20-100 kW: $0.24/kWh Solar >100 kW: $0.20/kWh Biomass 50 kW- 1 MW: $.085 $0.10/kWh Solar ≤ 10kW: $0.30/kWh Solar 11kW-2MW: $0.26/kWh Biomass ≤ 5MW: $0.106/kWh New Hydro ≤ 1MW: $0.12/kWh What steps or actions can be taken to encourage more electric utilities to offer VFITs in Indiana? What happens at the end of current 15 year VFIT contracts? To give VFIT customers option to net meter, net metering rule needs to be revised to: Allow net metering > 1 MW; and Allow third party net metering. Provided upon request Laura Ann Arnold, President Indiana Distributed Energy Alliance 545 E. Eleventh Street Indianapolis, IN 46202 (317) 635-1701 (317) 502-5123 cell Laura.Arnold@IndianaDG.net or Laura.Arnold@thearnoldgroup.biz Subscribe to website Follow IndianaDG on Twitter Like our Facebook Page Join IndianaDG LinkedIn Group