here - lamplightergreen.com

advertisement

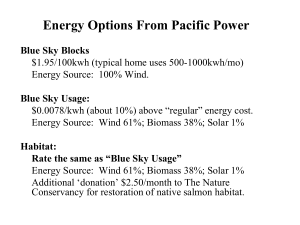

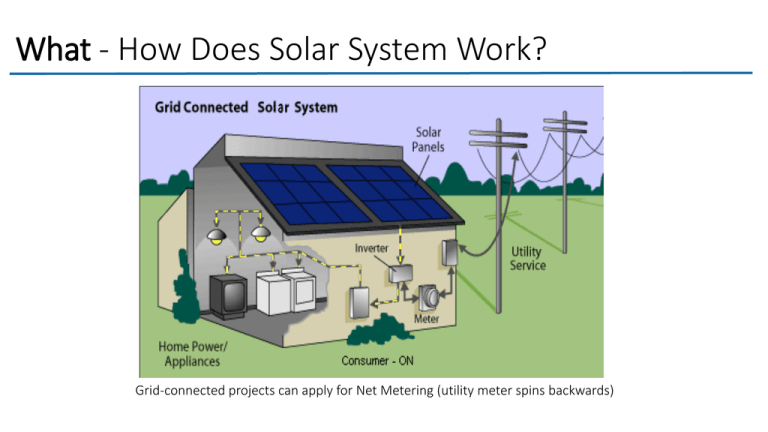

What - How Does Solar System Work? Grid-connected projects can apply for Net Metering (utility meter spins backwards) Why - Net Metering Example System Size – 5kW (5,000 watts) Annual Production ~5,600 kWh Annual Usage Onsite ~7,500 kWh December Produce 150 kWh Use 600 kWh Pay for 450 kWh on electric bill July Produce 800 kWh Net Metering!! Use 600 kWh Receive 200 kWh credit (in $) Why - Massachusetts Residential Electricity Prices 2011 Avg Residential Electricity Prices (cents per kWh) 35.00 30.00 25.00 MA 20.00 US 15.00 10.00 Sources: EIA 2011 Data WA UT AR KY SD OK MT TN MS IA KS NM GA AZ CO FL US WI MI DC RI CA NJ NH CT 0.00 HI 5.00 Why - Solar Incentives in Massachusetts High electricity prices + Reduced Solar PV Costs + Numerous Incentives = Economical solar projects Incentives Tax Incentives: Federal (30%) State (15% up to $1,000) Rebates from MassCEC: Typically $2k - $4k Net Metering SREC Sales Low/No money down options Purchase Incentive • Mass Commonwealth Solar II rebate • Residential energy tax credits Production Incentive • Net Metering • Solar Renewable Energy Certificates (SRECs) How - What makes a good site? • Southern exposure •PV panels angled 30˚ – 45˚ • At least 4-6 hours of direct sunlight • Open roof area of ~100 sq ft per 1 kW • Open space for a ground or pole mounted system http://energy.ltgovernors.com/solar-energy-pv-systems-self-generation-make-your-own-power.html How - Ownership Ownership Models Financing Options • Outright purchase • Home Equity Loan • Power Purchase Agreement • FHA Title 1 Home Improvement Loan • Lease • Local banks may offer different options How - Process for the Customer Energy Audit LGHA Design Review Contract with Installer Site Assessment Installation paperwork reviewed & approved Installation paperwork (permits, interconnection, rebates) Sign up with an SREC aggregator Installer closes out installation paperwork Installation scheduled Inspector( s) sign off on system System is turned on Apply for tax credits LGHA - Bylaw Any resident may have solar panels installed on their roof of original main structure. The following restrictions apply and an exception will not be granted under any circumstances: - Solar panels must not be installed on common land that is entitled to Corporation - Solar panels must not be installed anywhere on the yard. - Solar panels must not be installed on town's conservation land. - Solar panels must not be installed on roofs of additions, porches, sun rooms, toolsheds, garage. Resident must submit a design review before scheduling installation and that design review needs to be approved by the Corporation. In addition to the required documentation, the design review must clearly state the insurance and liability coverage pertaining to Solar panel installation. Resident is responsible for maintaining and upkeep of the panels. If maintenance issues are found, the resident will be fined and must take action to fix. The board will need 30 days notice. In case of termination of ownership of the property, unless ownership of the solar panel installation is part of the termination agreement, the installation must be removed. For solar installation, an Abutter(s) signatures is required, but ONLY for the purpose of notification. If they do not agree with the installation, Abutter(s) must mention the same on the design review form along with their signatures.