Chapter 1

advertisement

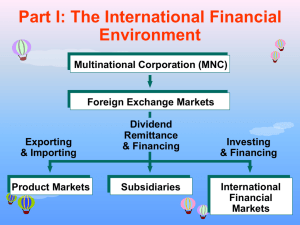

Chapter 1 Multinational Financial Management: An Overview Rashedul Hasan South-Western/Thomson Learning © 2003 Multinational or Global Corporation A corporation that operates in two or more countries. The term Multinational or Global Corporation is used to describe a firm that operates in an integrated fashion in a number of countries. Decision making within the corporation may be centralized in the home country, or may be decentralized across the countries the corporation does business in. C1 - 2 Why do firms expand into other countries? 1. To seek new markets. 2. To seek raw materials. 3. To seek new technology. 4. To seek production efficiency. 5. To avoid political and regulatory hurdles. 6. To diversify. C1 - 3 Reasons for going global • To broaden their market: After a company has saturated its home market, growth opportunities are often better in foreign markets. Thus some U.S. firms like Coca-Cola, Pepsi are expanding into overseas markets on the other hand, Sony and Toshiba now dominate the U.S. consumer electronic market. C1 - 4 Reasons for going global • To seek raw materials: Many U.S. oil companies, such as Exxon Mobil, have major subsidiaries around the world to ensure access to the basic resources needed to sustain the company’s primary business line. C1 - 5 Reasons for going global • To seek new technology: No single nation holds a commanding advantage in all technologies, so companies are scouring the globe for leading scientific and design ideas. For example, Xerox has introduced more than 80 different office copies in U.S. that were engineered and built by its Japanese joint venture, Fuji Xerox. C1 - 6 Reasons for going global • To seek production efficiencies: Companies in high-cost countries are shifting production to low-cost region. For example, GE has production and assembly plants in Mexico, South Koria and Singapore. C1 - 7 Reasons for going global • To avoid political & regulatory hurdles: The primary reason Japanese auto companies moved production to the U.S. was to get around U.S. import quotas. Now Honda, Nissan, Toyota, Mazda and Mitsubishi all have assembling plant in U.S.A. C1 - 8 Reasons for going global • To diversify: • By establishing worldwide production facilities and markets, firms can minimize the impact of adverse economic trends in any single country. For example, GM minimize the blow of poor sales in U.S. market during 1990-1991 recession with strong sales by its European subsidiaries. C1 - 9 What factors distinguish multinational financial management from domestic financial management? 1. Different currency denominations. 2. Economic and legal ramifications. 3. Language differences. 4. Cultural differences. 5. Role of governments. 6. Political risk. C1 - 10 Theories of International Business The commonly held theories why firms become motivated to expand their business internationally are, Theory of comparative advantage The imperfect market theory The product cycle theory C1 - 11 Theory of comparative advantage Multinational business has generally increased over time. Part of this growth is due to the realization that specialization by countries can increase production efficiencies. Some countries, such as, U.S. Japan etc have technological advancement, while other counties, such as Bangladesh, Jamaica, Mexico etc have advantage in the cost of basic labor. Since this advantage cannot be easily transferred or transported, countries tend to use their advantages to specialized in production of goods that can be produced with relative efficiencies. C1 - 12 The imperfect market theory Countries differ with respect to resources available for the production of goods. Moreover the real world suffers from imperfect market conditions where Factors of Production (land, labor, capital & entrepreneurship) are somewhat immobile. There are costs and other restriction related to the transfer of labor and other resources used for production. These imperfect market conditions are one of the important reasons for going global. C1 - 13 The product cycle theory • According to this theory, firms become established in-home market first. • As a firm matures, it may recognize additional opportunities outside its home country. Foreign demand for firm’s product will initially be fulfilled by export. As time passes, the firm may feel the only way to retain its advantage over competitors in foreign countries is to produce the product in foreign market, thereby reducing its transportation cost. The different phases of the product cycle theory are as follows, C1 - 14 The International Product Life Cycle Firm creates product to accommodate local demand. a. Firm differentiates product from competitors and/or expands product line in foreign country. Firm exports product to accommodate foreign demand. or b. Firm’s foreign business declines as its competitive advantages are eliminated. Firm establishes foreign subsidiary to establish presence in foreign country and possibly to reduce costs. C1 - 15 International Business Methods There are several methods by which firms can conduct international business. • • • • • • International trade Licensing Franchising Joint venture Acquisitions of existing operations Establishing new foreign subsidiaries. C1 - 16 International trade Is a relatively conservative approach involving exporting and/or importing. This approach entails minimum risk because the firm does not place any of its capital at risk. The Internet facilitates international trade by enabling firms to advertise and manage orders through their websites. C1 - 17 Licensing Allows a firm to provide its technology (copyright, patents, trademarks or trade name) in exchange for fees or some other benefits. For example, IGA, Inc. that operates more than 3000 supermarkets in U.S. has a licensing agreement to operate supermarket in China and Singapore. AT&T and Verizon communications have licensing agreement to build and operate part of India’s telecommunication services. C1 - 18 Franchising Obligates a firm to provide specialized sales or service strategy, support assistance, and possibly an initial investment in the franchise in exchange for periodic fees. For example, McDonald’s, Pizza Hut, KFC etc have franchises that are owned and managed by the local residents in many foreign countries. Like licensing, franchising also allows firm to penetrate foreign market without a major investment in foreign countries. C1 - 19 Joint venture • Joint Venture is a venture that is jointly owned and operated by two or more firms. Firms may also penetrate foreign markets by engaging in a joint venture (joint ownership and operation) with firms that reside in those markets. Most joint venture allows two firms to apply their respective comparative advantages in given project. For example, General Mills have a joint venture with Nestle so that the cereals produced by General Mill could be marketed through the overseas sales distribution network established by Nestle. Xerox Corp. and Fuji Co. engage in a joint venture that allowed Xerox to penetrate the Japanese market and allowed Fuji to enter into Photocopy machine business. C1 - 20 Acquisitions Acquisitions of existing operations in foreign countries allow firms to quickly gain control over foreign operations as well as a share of the foreign market. For example, Proctor & Gamble recently purchased a bleach company in panama. By doing so P&G has received a well established production facilities as well as marketing network. C1 - 21 Foreign subsidiaries Firms can also penetrate foreign markets by establishing new foreign subsidiaries. Like acquisition it requires a large investments. But it is more preferred to acquisition because the operation can be tailored exactly to the firm’s need. C1 - 22 Degree of International Business by MNCs Foreign Sales as a % of Total Sales Foreign Assets as a % of Total Assets 70% 62% 60% 46% 50% 66% 58% 50% 40% 33% 40% 30% 20% 47% 26% 12% 10% 0% Campbell's Dow Soup Chemical IBM Motorola Nike C1 - 23 http://www.tradenet.gov C1 - 24 http://www.business.gov/busadv/ index.cfm C1 - 25 http://www.trade.gov http://www.export.gov C1 - 26 How firm’s growth can be affected by foreign Investment and Financing opportunities? • International Opportunities • Financing opportunities C1 - 27 International Opportunities The marginal return on projects for an MNC is above that of a purely domestic firm because of the expanded opportunity set of possible projects from which to select. C1 - 28 Financing opportunities An MNC is also able to obtain capital funding at a lower cost due to its larger opportunity set of funding sources around the world. C1 - 29 International Opportunities Cost-benefit Evaluation for Purely Domestic Firms versus MNCs Purely Domestic Firm Investment Opportunities Marginal Return on Projects Marginal Cost of Capital MNC MNC Purely Domestic Firm Financing Opportunities Appropriate Size for Purely Domestic Firm X Appropriate Size for MNC Y Asset Level of Firm C1 - 30 International Opportunities • Opportunities in Europe ¤ ¤ ¤ The Single European Act of 1987. The removal of the Berlin Wall in 1989. The inception of the euro in 1999. • Opportunities in Latin America ¤ ¤ The North American Free Trade Agreement (NAFTA) of 1993. The General Agreement on Tariffs and Trade (GATT) accord. C1 - 31 International Opportunities • Opportunities in Asia ¤ ¤ ¤ The reduction of investment restrictions by many Asian countries during the 1990s. China’s potential for growth. The Asian economic crisis in 1997-1998. C1 - 32 Factors affecting the MNC’s Exposure to Risk What are the factors increases the MNC’s exposure to International Risk? -Exchange rate movements -Foreign economies -Political risk C1 - 33 Exchange rate movements Exchange rate fluctuations affect cash flows and foreign demand. Most International Business results in the exchange of one currency for another to make payment. Since Exchange rate fluctuates over time, the cash outflows required making payment change accordingly. C1 - 34 Foreign economies Economic conditions affect demand. When MNCs enter foreign market to sell products, the demand for these products is depended on the economic conditions in those markets. Therefore the cash flow of the MNCs can be affected adversely. For example, during the Asian Crisis in 1998, NIKE, experienced lower than expected cash flows because of week Asian Market. C1 - 35 Political risk Political risk arises because the host Govt. or the Public may take actions that can affect MNC’s cash flow. The host Govt. may impose higher Taxes on U.S. MNCs due to the bad bilateral relations. People’s sentiment can also negatively affect the MNC’s cash flow. For example, during the war in Iraq in 2003, antiAmerican protest against war in Middle-East countries forced some U.S. based MNCs to shut down their operations temporarily. Moreover the protest led to decline in the demand for products produced by U.S. based MNCs like Coca-Cola. C1 - 36 Overview of an MNC’s Cash Flows Profile A: MNCs focused on International Trade U.S.based MNC Payments for products U.S. Customers Payments for supplies U.S. Businesses Payments for exports Foreign Importers Payments for imports Foreign Exporters C1 - 37 Overview of an MNC’s Cash Flows Profile B: MNCs focused on International Trade and International Arrangements U.S.based MNC Payments for products U.S. Customers Payments for supplies U.S. Businesses Payments for exports Foreign Importers Payments for imports Foreign Exporters Fees for services Costs of services Foreign Firms C1 - 38 Overview of an MNC’s Cash Flows Profile C: MNCs focused on International Trade, International Arrangements, and Direct Foreign Investment Payments for products Payments for supplies U.S.based MNC Payments for exports Payments for imports U.S. Customers U.S. Businesses Foreign Importers Foreign Exporters Fees for services Costs of services Foreign Firms Funds remitted Funds invested Foreign Subsidiaries C1 - 39