Economic Environment of Business

advertisement

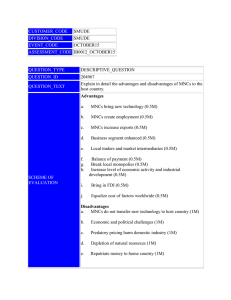

Economic Environment of Business Multinational Corporations (MNCs) and FDI (Foreign Direct Investment) What is an MNC? “…it owns and operates production or distribution facilities in two (Transnational) or more (Multinational) countries” Atkinson & Miller, 1998, p210. What are the characteristics of an MNC? It controls economic activities in more than one country It can take advantage of differences between countries (e.g. geographical and natural) It can move resources between different parts of the world to avoid the use of markets. (i.e. trade is determined by decisions taken within the firm and the management set the price charged on intra-firm activity). Why do firms become MNCs? oThe target market may be poor at distributing finished goods (e.g. marketing and after-sales service) oIt is hard to keep up with changes in market conditions overseas- therefore better to be in the target country oImport restrictions: e.g. non-tariff barriers oExchange rate changes make trading hazardous oStrategic alliances and licensing agreements with firms in target market may be unreliable What are the advantages for MNCs? Cut costs (typically via vertical integration) Cut transaction costs (imperfect information and negotiation costs etc) by internalising the market (again, typically via vertical integration) Improved marketing (hotels, car companies etc; typically via horizontal integration) Owner-specific advantages What kind of owner-specific advantages? Patent- nobody can legally copy the product Large-scale: scale economies Technological advantage Extending the product life cycle (see Fig.7.3, Griffiths and Wall,2001, p121) Foreign Direct Investment The acquisition of share or loan capital through mergers or joint ventures and also through starting new subsidiary companies The transfer of funds from parent companies to overseas subsidiaries The transfer of profits from overseas to the parent company NOT portfolio investment (investment in the shares of a company) Why carry out FDI? The MNC will typically increase the capital stock of the host nation, thereby raising the marginal productivity of capital. Value is thus added to the domestic labour force. The importance of FDI can also be seen in the sheer amount of money involved: Selected Inflows of FDI in 2004 ($m): USA 95,859 UK 78,399 China 60,630 India 5,335 (Source: The Economist, Pocket World in Figures 2007) Transfer pricing Plants can switch parts between countries, such that the low tax country plant shows the greatest profit, thus lowering the tax burden of the MNC as a whole. Maximise global profit. Balance of Payments implications: Increase trade and improve host’s BP oTake profits out of host country and worsen host’s BP, but: Import substitution improves host’s Balance of Trade oMay be facilitating exports to other countries Implication for Jobs: Local labour may be dismissed to increase productivity but.. …may be recruited for new factories Production may switch to other countries o (eg Ford switch from London to Belgium) Effects of MNCs on Competition: MNCs often play-off governments to receive inducements. E.g. Ford. They may move operations from countries with unfavourable conditions. The strength of their bargaining position will be subject to their importance as an employer, their investment and their reliance on the host country. Competition (cont.) The host can always ultimately deny access to its markets and natural resources. It can provide incentives such as tax breaks, infra-structure etc. It may still be pressured to allow such firms to bring in investment and with it jobs. Although some would claim that the MNCs are too powerful, they can and do bring benefits to many host countries. Summary We established: A definition of MNCs Motives for becoming an MNC The importance of FDI Implications of MNCs for globalisation and host countries