Document

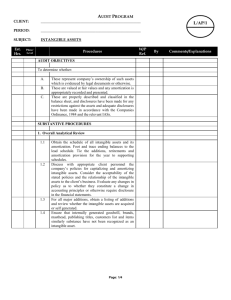

advertisement

Contents • Introduction • Leadership • What did we do? – Action Plan – Strengthen Oversight • Conclusion Introduction • A Clean Audit has major advantages for any municipality because: – It instills confidence to the Ratepayers which results in improved revenue collection – Instills confidence in would be investors – Promotes the culture of good governance – Ensures sound financial management Western Cape Lead Financial Years National Clean Audits W/C Clean Audits 2009/2010 7 1 2010/2011 13 2 2011/2012 9 5 Leadership • To obtain a Clean Audit requires good leadership • Leadership means: – – – – – The Mayor Municipal Manager Chief Financial Officer All Councillors Senior Managers • It is everybody’s business What did we do- The Action Plan • We have taken the Management Letter and created an Action Plan – All comafs were listed in the action plan – All the issues raised by the IA were also listed in the Action Plan • Regular meetings were held with all affected officials to report on what they doing to rectify or avoid recurrence • Quarterly feedback is submitted to AG and Province No Audit Finding 3. EX.22 (COMAF 18) No agreements in place Detailed Finding AG recommendation Management response Progress to date Contractual agreements for land sales in respect of long term debtors between the municipality and home owners of scheme 135, Bonnievale, could not be provided. During the process of amalgamation the documentation was to be transferred from Bonnievale to Ashton but had been misplaced and cannot be found. It is recommended that management regularly review and confirm the review all control reconciliations in order to ensure that information available for reporting is complete and accurate. This agreements as kept by the former Bonnievale Municipality, was transferred to Ashton with the amalgamation process nearly 10 years ago as indicated. Steps will be taken to try to find the agreements. Copies of the contracts were found. Responsible person Mr J de K Jooste Ms J Louw No Audit Finding 4. EX.15 (COMAF 13) Useful lives incorrect Detailed Finding AG recommendation Management response In terms of paragraph 92 of Generally Recognized Accounting Practice (GRAP) 102 – Intangible assets, the useful life of an intangible asset that arises from binding arrangements (including rights from contracts) shall not exceed the period of the binding arrangement, but may be shorter depending on the period over which the entity expects to use the asset. If the binding arrangements (including rights from contracts) are conveyed for a limited term that can be renewed, the useful life of the intangible asset shall include the renewal period(s) only if there is evidence to support renewal by the entity without significant cost. Management should assess the useful lives of intangibles assets based on the period the intangible asset will be in use. Management agrees with the audit finding as it relates to the internal control deficiency. Management will implement the recommendation and assess the useful lives of intangible assets from 01 July 2012 based on the period the intangible asset will be in use. Progress to date As from 1 July 2013 all intangible assets useful lives are changed to be the same as the licence agreements. Responsible person Mr. CF Hoffmann Mr. B Brown What did we do?- Bid Evaluation Committee • Regulation 44 of SCM is the key issue for most municipalities • Proper evaluation of tenders • Established a permanent Bid Evaluation Committee (BEC) – Ensure consistent application of requirements – Proper training of BEC Members What did we do? Strengthen Oversight • Competent Audit Committee • IA Unit must be functionally competent – Implement a proper Audit Plan • Compliance Officer – Follow a compliance programme – Advise MM on compliance matters – Compile and Administer a Risk Management Programme What did we do? Preparation plan for the AG • Every year in May the BTO prepares a Plan for the end of the year and compilation of AFS – Timelines for requisitions and receipt of invoices – Information required for the Audit File – Responsible persons are identified to provide the required information • Audit Committee must review the AFS • Draft AFS are given to AG to comment of the record Conclusion • The myth that clean audit does not contribute to service delivery is incorrect because: – Compliance with Laws and Regulations – Sound Financial Management – Predetermined Objectives which is service delivery DIE EINDE Dankie Enkosi Thank You