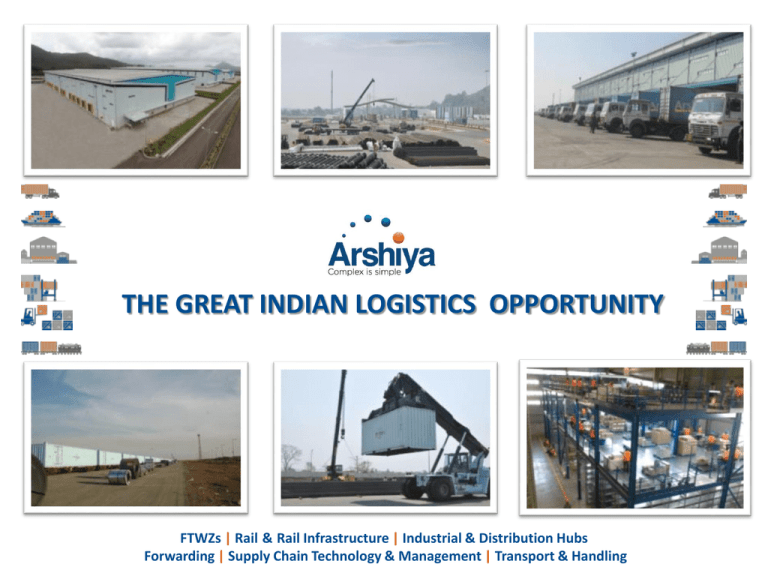

THE GREAT INDIAN LOGISTICS OPPORTUNITY

FTWZs | Rail & Rail Infrastructure | Industrial & Distribution Hubs

Forwarding | Supply Chain Technology & Management | Transport & Handling

INDIA’S GROWING MERCHANDISE IMPORTS

INDIA’S GROWING MERCHANDISE EXPORTS

1.4 %

2%

1.3 %

2.1 %

1.8 %

1.1

%

1%

2007

1.5 %

2008

2009

2007

2010

Export – India’s % contribution to world trade

India’s world ranking in terms of exporting globally consumed

merchandise moved from 26 to 20 during the period 2007 to 2010

60

40

51 %

45.9 %

40

29.6 %

30

30

20

2010

India’s world ranking in terms of importing globally produced

merchandise moved from 18 to 13 during the period 2007 to 2010

50

50

2009

Import – India’s % contribution to world trade

60

51.4 %

2008

20

9.9 %

10

10

0

0

-7.3 %

-10

% Growth of exports (2007-10)

-10

-2.5 %

-9.6 %

% Growth of imports (2007-10)

14

80

% of Penetration

60

50

China's Telecom

penetration in

'05 - 30 %

China's Telecom

penetration in

'11 – 72 %

40

30

20

12.18

India's Telecom 12

penetration in

'11 - 73.3 %

10

70

India's Telecom

penetration in

'05 - 4.8%

8

6

6.91

4

2

10

-

0.78

0.46

2005

2006

2007 2008

China

2009 2010

India

2011

2005

2006

2007

2008

China

India

2009

2010

Per capita consumption

Cement (kg)

Steel (kg)

433

176

Copper (kg)

206

55

Toothpaste (gm)

PV* (per 1000)

500

2.7

451

Aluminum (kg)

227

127

0.5

Paper (kg)

22

9

12

2

% of households across income brackets

2005

High

2

%

High

Upper Middle

7%

Upper Middle

13%

35%

Middle

28%

Middle

Low

62%

Low

Low per capita consumption

Definitions:

High: Above $10k Upper Middle: $5k-$10k

Middle: $2.5k-$5k; Low: Up to $2.5k

2020E

2010

4

%

49%

Demographic drivers

High

10%

Upper Middle

32%

Middle

33%

Low

19%

India Opportunity

*PV: Passenger Vehicles

1970

ONWARDS

1980

ONWARDS

1990

ONWARDS

2000

ONWARDS

2005

ONWARDS

2012

ONWARDS

KEEPING IT

IN THE

FAMILY

INDIA

EMBRACES

TRADE

IT ENABLES

INDIA

A VOICE TO

THE PEOPLE

THE ERA OF

INFRA

WHAT’S

NEXT?

INDIA'S GDP (IN BILLIONS OF USD)

$ 3,500

$ 3,000

$ 2,500

$ 2,000

$ 1,500

$ 1,000

$ 500

$0

1970

1975

1980

1985

1990

1995

YEAR

2000

2005

2010

2015

2020

GDP growth from 2012 assumed

at 6% p.a.

ATTRACTIVENESS OF JAFZA

JAFZA

100% Foreign Ownership

70.1%

50 year zero tax guarantee

46.7%

Proximity to Jebel Ali Port

22.2%

16.2%

Jafza 'brand name' and reputation

Proximity to customers

Proximity to suppliers

Infrastructure offered by Jafza

Easy access to labour supply

JAFZA contributes over 26% of Dubai’s GDP

and generates 160,000 direct jobs by

servicing over 6,400 companies from the

zone and contributes to 25% of Dubai Port’s

container traffic

14.0%

13.1%

10.8%

6.8%

EMPLOYMENT IN JAFZA AND TENANT COMPANIES (2006)

120000

SINGAPORE

Singapore FTZ’s has over 7,000 companies

operate through these zones. Due to FTZs

this island nation has become the gateway to

Southeast Asia & a Global Distribution Hub

for international companies

100000

80000

WAIGAOQIAO

60000

40000

20000

0

1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005

Source: PWC report for JAFZA FTZ

Waigaoqiao FTZ in Shanghai has over 9,300

companies registered in the zone, including

135 of the Fortune 500 companies. From an

economically backward country in 1970 to its

gigantic success, FTZs have been the single

most critical macroeconomic factor for

China’s rise

INDIA’S GROWING PPP

INDIA TRAILING IN THE MANUFACTURING SPACE

INDIA INCOMPETENT AS A REGIONAL HUB

1800

Container Throughput (in

millions of TEUs)

1600

1400

1200

1000

800

600

4.1X

400

200

180

160

140

120

100

80

60

40

20

0

163

9

12

28

(source: Mckinsey Report)

0

Year

2005

2010

2015

2020

2025

While Consumption in India will grow in

real terms from USD 378 billion

presently to USD 1.56 trillion by 2025 a

fourfold increase, reality is that :

India ranks 13th in terms of importing

world products, consuming just over 2%

of globally produced merchandise, but

growing @ 35%

While by 2020, India is projected to

have an additional 47 million working

population, almost equal to the total

world shortfall, with an average Indian

age of 29 fuelling our ability to become

a manufacturing mecca of the world,

reality is that:

India ranks 20th as per WTO in terms of

exporting world products contributing

just over 1.4% of globally consumed

merchandise, but growing @ 31%

India's container throughput in CY10

was around 9 million TEU's,

as

compared to Dubai (12 million),

Singapore (28 million) & China (163

million)

Indicating zero penetration to the Value

Addition, Hubbing and Re-Export market

leveraging our cost and skill arbitrage

To/From

Singapore

Consolidation / De-consolidation cargo business constitutes approximately USD

12.47 billion to the GDP and 19.2 million TEUs

30% of this potential translates to USD 3.74 billion to the GDP and 5.76 million

TEUs for INDIA

To/From

Dubai

Consolidation/ De-consolidation constitutes approximately USD 12.08 billion to

the GDP and 6 million TEUs

30% of this potential translates to USD 3.62 billion to the GDP and 1.8 million

TEUs for INDIA

Thus, if India realizes 30% of Dubai’s & Singapore’s cargo volumes it will translate to an additional USD 7.36 billion (INR

36,000 crores) as a direct contribution to India’s GDP & increase container volumes at Indian ports by 7.56 million TEUs

The extended potential will also generate three times additional indirect revenues due to increased

supporting activities and will contribute USD 22 billion (INR 110,000 crores) to India’s GDP

WHAT IS IT ?

GOI Introduces the Free Trade & Warehousing Zones Policy, as part of Foreign Trade Policy (FTP) 2004-2009

Governed by the SEZ ACT,2005 & SEZ Rules,2006 Warehousing zone designated as foreign territory within India

WHAT IS IT INTENDED FOR?

To make India into a global trading hub like China, Dubai and Singapore

ACTIVITIES ALLOWED WITHIN AN FTWZ

Storage

Bagging

Palletization

Handling

Bubble

wrapping

Tagging

Quality

Assurance

Transportation

Packing

Documentation

Labeling

Consolidation

Painting

Repairs &

Maintenance

Washing

Crating

Strapping

Cartonization

Bottling

Cutting

Refurbishment

ENTRY BARRIERS

BUSINESS SCALABILITY BARRIERS

LAND

APPROVALS

RULES

EXPERTISE

SERVICE

CAPABILITY

Min 100 Acres

contiguous

land with

100,000 SqM

built up area

at strategic

locations

Approvals

from State &

Central Govt

(Informal &

Formal

Approval,

Notification)

FTWZ in a

sector specific

SEZ cannot

cater to any

unit outside

the sector

specific SEZ

Expertise in

developing &

operating

FTWZs and in

logistics &

supply chain

activities

Integrating

hard and soft

logistics

infrastructure

to be able to

service clients

pan-India

Offering ‘one throat to catch’ end-to-end unified logistics & supply chain services

to global customers

MUMBAI

FTWZ

MASTER PLAN

165 Acre State-of-Art Facility 24km from JNPT Port featuring:

24x7 On-Site Custom Clearance House

State-of-the-Art Infrastructure with World class Safety, Equipment & Maintenance Facilities

Connectivity to our Pan-India Rail Network accelerating distribution through aggregation at strategic locations

State-of-the-art ICD/CFS facility with superior Safety and Hazardous cargo handling capacity of 10,000+

containers including reefers

FOR EXPORTS

FOR IMPORTS

Flexibility towards end-

Products from India entering the FTWZ

distribution in India

Duty deferment benefits (freeing

up working capital)

duty- payment

Exemption on SAD, VAT & CST on

Hassle-free re-export regulatory /

transportation inside India

Lowered product costs

Foreign exchange transaction

capability

labour

products imported into FTWZ; meant for re-

inside the FTWZ

export out of India

reverse logistics through quality control

before dispatch from India

Exemption from custom and stamp duty on

Excise & VAT) on all activities conducted

Increased efficiency through lowered

Reduced buffer stocks

services availed; including

immediate benefits to suppliers

companies exporting into FTWZ

duty implications

Service Tax exemption on

conducted inside the FTWZ including rental &

Export quotas able to be met for

imports through FTWZ

Service tax exemption on all activities

are treated as deemed export providing

Local Tax Exemption (eg. CST, Sales Tax,

Quality control capability prior to

FOR RE-EXPORTS

Foreign exchange transaction capability

Increasing supply chain efficiencies

Income tax exemption on profit where

applicable

Hassle-free re-export process

Permission of 100% FDI for the set-up of

units by the unit holder of the FTWZ

Ability to leverage India’s cost, skill &

geographic positioning advantage as a hub

(forward & reverse) while enhancing

for regional/global distribution post value

capital cash flow

optimizing activities

Flexibility towards end distribution in India

Duty deferment benefits (freeing up working capital & increasing sales )

Quality control capability prior to duty- payment

Exemption on SAD, VAT & CST on imports through FTWZ

Hassle-free re-export regulatory /duty implications

Reduced buffer stocks

Service Tax exemption on services availed; including transportation inside India

Lowered product costs

Foreign exchange transaction capability

CASE STUDY

BENEFITS OF IMPORTING PRODUCTS

INTO INDIA THROUGH THE FTWZ

(DEEMED FOREIGN TERRITORY)

Rejection after

duty payment

International

Suppliers

Supply of spares

and parts to Dealers

in India for after

sales and service

International

Suppliers

International

Suppliers

Dealers in India

Indian

Ports

India

Manufacturing

Plant

International

Suppliers

International

Suppliers

Dealers in India

Dealers in India

Dealers in India

Rejection after

duty payment

Storage of Spares,

Parts and Components

for after sales & service

post duty payment

Dealers in India

Duty paid storage of spares implicating higher working capital of the supply chain implicating higher cost of

product

Limitations in volume of storage increasing lead time for customer delivery

Higher lead time for client delivery creating customers dissatisfaction (unauthorised spares in the market)

Quality control post duty payment increasing hassle for re-export and therefore cost

International

Suppliers

Rejection without

duty payment

Storage of Spares, Parts

and Components for

after sales & service

without duty payment

International

Suppliers

Dealers in India

International

Suppliers

International

Dealers

FTWZ

International

Suppliers

International

Suppliers

Dealers in India

Rejection without

duty payment

Regional distribution of

spares and parts enabling the

income tax exemption on the

re-export of imported spares

and parts

International

Dealers

International

Dealers

Duty deferred storage reducing working capital and therefore cost of product

Reduction in lead time in supplying the spares for after sales and limitless capability of spares storage

Quality control before duty payment enabling hassle free re-export process and therefore lowering

of associated supply chain costs

Regional Distribution capability leveraging cost/skill arbitrage of India in addition to Income tax exemption

of profits from this activity

Products from India entering the FTWZ are treated as deemed export providing immediate

benefits to suppliers

Local Tax Exemption (e.g. CST, Sales Tax, Excise & VAT) on all activities conducted inside the FTWZ

Export quotas able to be met for companies exporting into FTWZ

Increased efficiency through lowered reverse logistics through quality control before dispatch from

India

Foreign exchange transactions capability

Increasing supply chain efficiencies (forward & reverse) while enhancing capital cash flow

CASE STUDY

BENEFITS OF EXPORTING PRODUCTS

INTO INDIA THROUGH THE FTWZ

(DEEMED FOREIGN TERRITORY)

Reverse logistics of

rejected materials

Breaking and re-invoicing of

units as per different store

demands is conducted before

dispatches to the stores.

Store

1

Supplier 1

Supplier 2

Various

Ports across

India

DC in

Europe

For value

addition

Store

2

Supplier 93

93 suppliers from India ,

Karachi(18) Bangladesh(15),

& Sri Lanka (4)

All the SKUs are sent by

the suppliers directly to DC

in Europe by suppliers

Distribution Center (DC) in Europe maintained only due to invoicing regulatory limitations where

consolidations of products sourced from India is done

Increased supply chain cycle lead time and associated costs

Company’s India trading arm responsible for any under/over invoicing or customs issues with respect to

shipments of suppliers without having any control over process

Quality control currently in European DC causing higher product returns

European DC doing labeling for products made in India/Asian sub-continent

Store

173

Supplier 1

Store

1

Supplier 2

Store

2

Supplier 93

FTWZ

Supplier

in Pakistan

Supplier in

Bangladesh &

Sri Lanka

DC in FTWZ for

Value addition

Store

173

FTWZ removes regulatory limitations of consolidating product from suppliers in India, Sri Lanka, Bangladesh &

Pakistan in Asia

Significant reduction in DC operations costs of India Vs. Europe

Value addition for end-distribution to world-wide stores done in FTWZ in India lowering costs.

Reduction in suppliers working capital due to faster payment cycle

Lowered reverse logistics cost

Enhanced control and efficiency in inventory management - closer to the suppliers

Service tax exemption on all activities conducted inside the FTWZ including rental & labour

Exemption from custom and stamp duty on products imported into FTWZ; meant for re-export out

of India

Income tax exemption on profit where applicable

Hassle-free re-export process

Permission of 100% FDI for the set-up of units by the unit holder of the FTWZ

Ability to leverage India’s cost, skill & geographic positioning advantage as a hub for regional/global

distribution post Value Addition activities

CASE STUDY

BENEFITS OF HUBBING & VALUE

ADDITION OF PRODUCTS IN INDIA

THROUGH THE FTWZ

(DEEMED FOREIGN TERRITORY)

Supply of Charger, Earphone

and packaging material

CHINA

Supply of completely

packaged mobile phones

Indian

Subcontinent

Middle East

Supply of battery

Far East Asia

USA

Supply of handset

GERMANY

Regional Value Addition,

Hubbing & Distribution

Centre in

Singapore/Dubai

VOS like Labelling, packaging, assembly

and consolidation based on the country

of export

South East Asia

Africa/Eastern

Europe

Higher cost of operations in Singapore i.e. Labour, Water, Electricity, Materials etc.

Higher charges for Value Optimising Services (VOS) like labeling, packaging, assembly etc. Increasing cost of

product

Technically skilled manpower expensive and not abundant

Cost of economies of scale

Supply of Charger, Earphone

and packaging material

CHINA

Supply of completely

packaged mobile phones

Indian

Subcontinent

Middle East

Supply of battery

Far East Asia

USA

FTWZ

Supply of handset

GERMANY

VOS like Labelling, packaging, assembly

and consolidation based on the country of

export

South East Asia

Africa/Eastern

Europe

Lower cost of operations in India i.e. Labour, Water, Electricity, Material etc.

Minimum charges for Value Optimising Services (VOS) like kitting, labeling, packaging, assembly etc.

decreasing cost of product

Local tax exemptions (Excise, VAT etc.) on all the value added service inside FTWZ

Abundance of technically skilled manpower

ARSHIYA’S MUMBAI FTWZ

Main Gate

Custom office Entry

Customs Office

Warehouse External View

Container Yard

Stuffing at Container Yard

Docking Area

Docking Area

Cargo storage inside

Warehouse

ARSHIYA’S MUMBAI FTWZ - Over Dimensional Cargo (ODC) Yard

ARSHIYA MUMBAI FTWZ : SNAPSHOTS

Warehouse Internal View

Temp. Controlled Area

VOS Area

Marshalling Area

Server Room

Electrical Sub-Station

Generators for Power Backup

Security System at Warehouse

CCTV Cameras

World-class Warehouses of 13 M height with G+6 palletized racking system, super-flat flooring & state-of-theart Material Handling Equipments (MHEs)

Dedicated & customized Office space & area for Value Optimizing Services (VOS) within the Warehouse

Mezzanine storage area with temperature controlled HVAC system & optional humidity control

Container Yard (CY) with Pavement Quality Concrete (PQC) flooring for stacking containers in a G+5 stacking

system using state-of-the-art Rubber Tyre Gantry Cranes (RTGCs) & Reach Stackers

Maintenance & Repair (M&R) Yard, Scrap Yard & an Empty Container Yard, Food court, Medical dispensary

with Ambulance at site

Open & covered Over Dimensional Cargo (ODC) Yard with Paver-Block flooring for storage of cargo that cannot

be stored in the Warehouse

Business Ancillary Services: On-site Office spaces, Banks, Insurance, Currency Exchanges & CHAs that reduce

operating costs for companies operating in the Foreign Territory

Fire & Safety Amenities: Primary & Secondary fire fighting systems along with Tertiary Fire Engine at FTWZ site

with trained Fire Fighting Professionals. Personnel having expertise & certification in handling DG Cargo

Secure IT Connectivity: Comprehensive IT system with network infrastructure such as server room within each

warehouse & a centralized data center with uninterrupted data, voice & video connectivity & 100% back up

Supporting Infrastructure: Weigh bridge, road network with up to 6 lanes to avoid congestion, Fuel Station in

the processing zone, uninterrupted water & power supply systems & 100% power back-up using DG Sets

Earthquake Resistant & Storm Water Drainage System: Warehouses designed as per Seismic Zone 4

requirements. In addition the FTWZ has a capacity to handle rainfall with peak intensity of 156 mm/ hour or 10

cubic m per sec, i.e. 3 times the highest recorded level of rainfall in Mumbai.

Corporate Social Responsibility: Ambulance and Fire Tender to service not only Arshiya’s FTWZ but also the

residents of the neighboring area

At Arshiya, we believe there is a way to

contribute to the environment, play a

pertinent sustainable role through varied eco

friendly and environment effective measures.

Here’s a look at few :

STP: By way of a sewage treatment plant, recycled

water is used for irrigation purposes

Reutilization of excavated rocks: Excavated rocks

are used for project construction thereby

conserving resources

Green Zone: At Arshiya we ensure that more than

10% of the project area is covered under green

zone along with specific selection of plant species

Natural Lighting & Insulation: Optimum, natural

sunlight presence along with provision for

ambient temperature at the FTWZ Site via

articulate architecture planning/construction

ensures optimal electricity consumption and

ensures harmony at workplace

Rain Water Harvesting: Bore wells, recharge pits

and natural ponds provide for maintenance of

ground water level

Environmental Consciousness: At Arshiya it is

our constant effort to emit no Industrial effluents

and contribute towards maintaining sanctity of

the environment through Waste Disposal Units

FACILITIES & VALUE OPTIMISING SERVICES (VOS) IN FTWZ

STANDARD WAREHOUSE

ODC YARD (OPEN & COVERED)

CONTAINER YARD (CFS)

CHILLER/FREEZER

HAZARDOUS STORAGE

TEMPERATURE CONTROLLED STORAGE

STRONG ROOM

OFFICE INFRASTRUCTURE

VOS ON CONTAINER

VOS ON PALLETS /

BREAK-BULK OF PALLETS

HIGH END VOS

Customs Documentation

Carting & Shifting of the Pallets

Quality Control (QC)

Incoming & Outgoing Transportation

Palletization

Sorting / Assorting

Carbonization

Kitting / De-kitting

Strapping

Bottling/ Blending

Shrink Wrapping

Assembling

Packaging / Re-packaging

Cutting & Threading

(Port to FTWZ & return)

Gate Coordination (incoming &

outgoing)

Survey of Cargo/Containers

(incoming & outgoing)

(into smaller parcels/cases /cartons)

Consolidation

Labeling / Re-Labeling

Agglomeration

Bar-Coding

Repairs & Maintenance

Weighment of Containers

Strapping, refurbishment

CKD/ SKD assembly

Fumigation of Containers

Tagging, shrink / stretch / bubble

Cutting/ Polishing

Handling / Loading & Unloading

(inbound & outbound)

Scanning of Containers

Lashing / Unlashing Services etc.

wrapping etc.

Painting/ Coating

Filming/ Re-sizing

Splitting

Threading

Coupling, etc.

Understanding of client’s business model and Pain areas

Creating consolidated business proposal specific to client’s business model with one price inclusive of all elements

like Transportation to and from FTWZ, Storage, VOS etc..

Pricing strategy based on client’s VOS scope and throughput

Also based on client’s industry standard pricing practices e.g.,

For Steel Industry: Per ton basis

For Wine Industry: Per case/piece basis

For Large Importers and Exporters: Per Container Basis (Movement from Port to FTWZ and back including

storage and all other services)

All above logos are property of respective owners

Sector

Trading (Import & Re-Export)

Product Type

FMCG Products such as Perfumes, Sports Items, Deodrant, Shoes etc.

REVENUE MODEL

Rental

Racked Warehouse Rent

INR 800/pallet

Per Pallet

Per TEU

800

16,000

Value Optimizing Services (VOS)

Comments

Activity

Rate

Per Pallet

Per TEU

Gate Charge (Inbound)

INR 150/TEU

7.5

150

Survey Charges (Inbound)

INR 150/TEU

7.5

150

Handling (Inbound)

INR 100/Pallet

100

2,000

Handling (Outbound)

INR 100/Pallet

100

2,000

Gate Charge (Outbound)

INR 150/TEU

7.5

150

Survey Charges (Outbound)

INR 150/TEU

7.5

150

230

4,600

Total Compulsory VOS

Avg. 20 Pallets/Container

Packaging

INR 20/Carton

200

4,000

Labeling

INR 2/Piece

1,000

20,000

Bar coding

INR 0.50/Piece

250

5,000

Transportation (Inbound)

Rs. 4400/TEU

220

4,400

Transportation (Outbond)

Rs. 4400/TEU

220

4,400

Palletization

INR 500/Pallet

500

10,000

Total Discretionary VOS

2,390

47,800

Total VOS

2,620

52,400

Ratio (VOS Revenue / Rental Revenue)

3.28

No. of Cycle in a month

3

Actual VOS/Rental ratio

9.83

A. 1 Pallet = 10 Cartons

B. 50 pieces per carton

C. Total Cartons/Container = 200

D. Total Pieces/Container = 10,000

In this case all the incoming cargo will be

palletized again for re-export

Per Piece Rate – INR 6.99

34% reduction on current cost for

customer

THE FTWZ REVOLUTIONIZING THE INDIAN LOGISTICS LANDSCAPE

THROUGHPUT

FORWARDING

VOS ON

CONTAINER

RENTAL

RAIL & RAIL

INFRASTRUCTURE

VOS ON

PALLETS

HIGHER END

VOS

INDUSTRIAL &

DISTRIBUTION

HUBS

SUPPLY CHAIN

TECHNOLOGY &

MANAGEMENT

TRANSPORT &

HANDLING

REVENUE FROM UNIFIED SUPPLY

CHAIN INFRASTRUCTURE

SOLUTIONS

REVENUE FROM VALUE

OPTIMISING SERVICES (VOS) ON

CONTAINERS AND PALLETS

REVENUE FROM RENTALS OF

WAREHOUSE, CHILLER/FREEZER,

CONTAINER &ODC YARD, OFFICE

SPACE

LOGISTICS SPEND AS A % OF GDP

Developed Countries

India

14%

9 – 10%

INEFFICIENCIES IN LOGISTICS IN INDIA

Absolute Value inefficiency & market potential of

USD 80 Billion on USD 1.6 Trillion GDP owing to

excess spending on Logistics

India burns nearly USD 2.5 Billion of fuel due to

trucks idling on interstate check-posts

Avg time to clear cargo at ports in Singapore is 3-4

days vs 19 days at ports in India

% of Containerization of

Trade

% OF CONTAINERIZATION OF TRADE

SHARE OF ROAD VS RAIL TRANSPORT

100

90

Road: 65%

80

Rail: 30%

60 - 70%

70

60

50

40

30

25 %

20

Others: 5%

10

0

India

World

An Economies of Scale problem requires an Economies of Scale solution

Free Trade & Warehousing Zones (FTWZs) :

To enable EXIM cargo Consolidation, Value Addition and allow India to become a Regional Trading Hub

Industrial and Distribution Hubs:

For Domestic distribution, cargo value addition and consolidation for Rail transportation to remove dependency

on road

Rail and Rail Infrastructure :

Comprises innovative Customized Containers for specific product types, Service Level agreements on timeline

and deliver with Key Performance Indicators

State-Of-The-Art Rail Terminals, at strategic locations across India with modern equipment to increase speed

of loading/unloading and churn

Unified Logistics & Supply Chain Infrastructure with Supply Chain Technology & Management,

Transport & Handling and Forwarding :

Global ocean & air logistics, domestic forward and reverse supply chain management with ownership on

reduction of working capital and product visibility & control, through technology

ARSHIYA INTERNATIONAL LTD.

Capitalizing on India’s mammoth logistics

opportunity through Unified Supply Chain

Infrastructure & Solutions

Partnering towards

FTWZs with integrated ICD/CFS

Rail and Rail Infrastructure

Industrial & Distribution Hubs

Supply Chain Technology & Management

Forwarding

Transport & Handling

DUBAI

DUBAI

Established in 1985, Jebel Ali Free Trade Zone (JAFZA) is spread across an area of 48 sq kms, with

over 6,400 companies operating in the zone, including 120 of the Fortune Global 500

enterprises

Accounts for 25% of all container throughput at Jebel Ali port & 12% of all air freight at Dubai

International Airport.

Over the years it has created over 1,60,000 direct jobs in the UAE through its companies

Increased its revenue at an average of 34% year-on-year

Contributed to Dubai’s GDP at 25% on a year-to-year basis

Accounted for more than 50% of Dubai’s total exports

Accounted for 20% of all FDI inflow into the UAE

Grown its customer base by over 60% in the last four years

Even with an economy which is purely a transhipment hub, with comparatively low level of

domestic consumption, FTWZ has been a game changer for Dubai

CHINA

CHINA

FTZs are operational since 1980

Waigaoqiao FTZ in Shanghai is spread across an area of 10 sq kms & over 9,300 companies

registered in the zone, including 135 of the Fortune 500 companies

Other zones being - Zhuhai (3 sq kms), Ningbo (2.3 sq kms), Xiamen (5 sq kms),

Futian (1.35 sq kms), Shatoujiao (0.27 sq kms) & Yantian Port (0.85 sq kms)

From an economically backward country in 1970 to its gigantic success, FTZs have been

the single most critical macroeconomic factor for China’s rise

SINGAPORE

SINGAPORE

FTZs were first established in the island nation in 1969, today the entire country is a Free Trade

Zone

Notable FTZs being – Keppel (2.59 sq kms), Pasir Panjang (0.65 sq kms), Jurong (0.61 sq kms),

Sembawang (0.19 sq kms) & Air Logistics Park of Singapore at Changi Airport

Over 7,000 multinational companies operate through these zones

Due to FTZs this island nation has become the gateway to Southeast Asia & a Global

Distribution Hub for international companies

Dubai

Mumbai

Singapore

At present, majority of product hubbing & value addition is done in Dubai & Singapore

70% to 80% of these value additions, is done for products meant for Indian market

Compared to Dubai or Singapore, India is much larger market for product consumption and is an emerging

manufacturing hub

India has tremendous advantages in terms of cost & skill arbitrage vis-à-vis Dubai & Singapore

Due to its strategic positioning, India is much better suited for being a Transhipment , Value Addition & Global

Distribution hub than other economies

India is world’s 2nd largest developing & fastest growing

economy just behind China

With a population of approx 1.1 billion, our domestic

consumption comprises 58% of our GDP

Strategically located between South East Asia & Middle East,

we have 7,000 kms of coastline & unlike China our population

is evenly spread across hinterland

Unlike Dubai, India has a strong manufacturing base where

global companies are producing products for domestic as well

as export opportunities

Logistics infrastructure is the single largest challenge as well

as the biggest opportunity for sustaining India’s fast paced

GDP growth

In-efficiencies due to lack of logistics infrastructure & organized logistics, costs India an additional USD 65

billion per year

In a growing economy if logistics infrastructure doesn’t grow at faster pace than the GDP, it would cost India

very dearly

Indian economy is losing around 1.5% in GDP growth, due to lack of logistics infrastructure

India loses approximately INR 55,000 crores per year of food produce due to lack of logistics infrastructure

North

Central

FTWZ

East

West

Rail Connected, Planned Pan-India

INDUSTRIAL & DISTRIBUTION HUBS

Planned Pan-India, Complimenting

the FTWZ Network

RAIL & SUB HUBS

Planned 150 Train Pan-India Rail Operations

with Rail Terminals at strategic locations

South

18 km from the new Yamuna

Expressway connecting Noida to

Agra

12 km from proposed

international airport at Jewar in

UP

Sikandarabad – the neighbouring

Developed Industrial City is < 30

km from the FTWZ

Tughlakabad – 80 km

Dadri – 60 km

Bulandshahr – 20 km

About 70 km away from the

National Capital Region (NCR)

Khurja Integrated

Infrastructure

Masterplan

315 Acre Comprehensive Facility 90 km from Delhi

Side-by-Side FTWZ (135 Acres - launched in Jan 2012) and Industrial & Distribution Hub (130 Acres)

Arshiya Rail Infrastructure (50 Acres), including on-site Rail Siding

Operations live as of H2FY’12 to be joined by similar models in Central, South & East

State-of-the-art ICD/CFS facility with superior Safety and Hazardous cargo handling capacity of 10,000+ containers

including reefers

ARSHIYA’S KHURJA FTWZ

RAIL INFRASTRUCTURE: SETTING THE PACE OF GROWTH

Mode Share (percent of Ton-Km)

Share estimated for 2007 excluding pipelines

100% =

5,275

billion ton-km

5,930

billion ton-km

1,325

billion ton-km

1%

1%

1%

100

90

%

%

14 %

30 %

%

48 %

60

50

%

36 % %

80

70

6 %

Air

Waterways

47%%

40

57 % %

30

20

10

Freight Transport in

India is dominated

by road

Rail

Road

37 %

22%

%

0

China

US

India

…. shows India’s high dependency on roads as compared to US/China who have

developed rail infrastructure ….

Network

length

Freight

Tonne

carried

Tonne Kms

(Km)

(Millions)

(Millions)

USA

226,706

1,775

2,820,061

23,990

India

63,327

728

480,993

China

China

63,637

63,637

2,624

2,624

Russia

84,158

1,344

Country

Freight

Lead

NTKM/

Employee

NTKM/

Route

Length

NTKM/ Wagon/

Day

(Km)

(Millions)

(Millions)

(Millions)

475,416

1,589

15.08

12.44

16,251

8,110

207,719

661

0.34

7.60

6,344

2,211,246

17,222

571,078

843

1.07

34.75

10,608

2,090,337

12,063

566,802

1,555

1.85

24.84

10,104

No. of

Locos

No. of

Wagons

With almost same network length as India, China was carrying more than 4 times India’s Tonnage.

The real parameter is NTKM or Tonne –Km (Tonnes multiplied by Km travelled). In utilizing the network, China was 5 times more efficient

and Russia was 4 times more efficient. (Ton-Km divided by Network Length)

As far as wagon efficiency is concerned (Tonnage carried X Distance carried), China is 67 % more efficient than India and USA is 150 % more

efficient than India.

China’s ratio of Wagons to Locomotives is worse than India (33 against 25), still it had better wagon utilization efficiency.

…. showed India’s railway network was not as efficiently utilised as China and therefore prompted policy changes.

BACKGROUND AND OPERATIONS

Acquired Category I pan-India rail license in

2008, permitting it to transport containerized

cargo throughout India

Provides pan-India customized container rail

freight movement, and rail terminal services and

facilities for transporting domestic and EXIM

cargo

Currently has 20 rakes, 4,500 containers and a

rail terminal siding at Khurja (New Delhi)

#1 Company in the domestic container segment;

#2 PCTO in terms of number of operational

rakes

SCOPE OF OPERATIONS

EXISTING ROUTES

PROPOSED ROUTES

Batala Sahnewal

Ahmedgarh

Loni

Patli

Nawa City ACTL-Faridabad

Ahmedgarh

Bilaspur Road

Faridabad

Khurja

Durai

Jogbani

Guwahati

Morbi

Morbi

Sanand

Rourkela

Kolkata

Jharsuguda Haldia

Chalthan

Mumbai

Lonand

Mundra

Sanand

Pipavav

Mumbai

Malanpur Jamshedpur

Lapanga

Haldia

Nagpur

Vizag

Vizag

Chennai

Bangalore

Bangalore

Milavittan

Guwahati

Kolkata

Cochin

SELECTED CLIENTS AND AWARDS

2012: Private Train Operator of the Year - 2nd Indian

Supply Chain & Logistics Excellence Awards 2012

2011: Private Rail Operator of the Year – Gateway

Excellence Awards: Supply Chain Management &

Logistics

Private Rail Operator of the Year, Domestic

Cargo – Maritime and Logistics Awards

PCTO of the Year – 5th Express Supply Chain and

Logistics Award

Rail Operator of the Year – Gateway Media

Open top containers increasing speed of

loading heavy cargo

Customized Containers for Steel Cargo

Enhanced Security Arrangement

Multi-purpose containers for

increasing return utilization

dry-cargo

Enhanced cargo locking facility inside the

containers

Customized containers for carrying various

types of cargo

Customized Solutions (Auto Shipments)

FREE TRADE & WAREHOUSING ZONES

TRANSPORT & HANDLING

Implementation and

operations of Free

Trade &

Warehousing Zones

(FTWZs)

First and last mile

domestic

transportation

services

RAIL AND RAIL INFRASTRUCTURE

Customized and

Chartered Pan India

Rail Freight services

and state-of-the-art

Rail terminal

facilities

SUPPLY CHAIN TECHNOLOGY &

MANAGEMENT

INDUSTRIAL AND DISTRIBUTION HUBS

Strategically located

warehousing hubs

and rail consolidation

across India

Provides end-to-end

supply & demand

chain solutions

FORWARDING

Logistics solutions

including end-to-end

freight management

& transportation

services in over 150

countries worldwide

GROUP FINANCIAL HIGHLIGHTS

Revenue

164%

EBITDA

PAT

EBITDA Margins

166%

428%

19.4

16.4 %

14.6 %

12.8 %

%

FY08 FY09 FY10 FY11 FY12

FY08 FY09 FY10 FY11 FY12

Consolidated Highlights

FY 2008

FY 2009

Operating Income— ₹ Cr.

401.2

503.0

EBITDA — ₹ Cr.

51.4

73.5

12.8%

14.6%

45.4

EBITDA MARGIN %

PAT — ₹ Cr.

PAT MARGIN %

EPS — ₹ per share

FY08 FY09 FY10 FY11 FY12

FY 08FY 09FY 10FY11 FY12

FY 2011

FY 2012

H1FY13

525.9*

821.5

1057.3

714.4

86.1*

159.2

271.6

201.6

16.4%

19.4%

25.7%

28.2%

65.6

98.3

82.0

120.8

70.1

11.3%

13.0%

18.7%

10.0%

11.4%

9.8%

9.7

11.3

16.7

13.9

20.5

11.9

Financial Year ending 31 Mar

* Excluding income from sale of software marketing rights at ₹ 38.89 cr

FY 2010

25.7

%

Q2 FY 2011

Q2 FY 2012

` 195.05 Cr.

Q2 FY 2013

` 247.96 Cr.

` 372.57 Cr.

FTWZ

FTWZ

Rail

Others

24

%

16%

21

%

51

%

Rail

24%

78

%

Forwarding

60%

Others

H1 2011

Rail

Forwarding

Forwarding

H1 2012

`372.00 Cr.

H1 2013

` 470. 56 Cr.

` 714.41 Cr.

FTWZ

FTWZ

23

%

15%

Rail

19

%

Others

Rail

52

%

23%

80

%

62%

Rail

25

%

Forwarding

Others

Forwarding

25

%

Forwarding

66

Project (` in crore)

Debt

Equity

Total

O/s debt

Panvel FTWZ – Phase I & II

850

329

1179

850

Khurja FTWZ – Phase I

259

270

529

259

Rail Infrastructure

400

341

741

360

Khurja Industrial & Distribution Hub

399

249

648

399

1908

1189

3097

1868

Total

Notes (Not included in table above):

1. Total Debt including non-project loans and working capital loans is Rs. 2430 crore.

2. Company has invested ₹ 93 crore as equity in Arshiya Central FTWZ (Nagpur) for land acquisition

purpose.

3. Company has also invested equity of ₹ 112 crore in Khurja FTWZ Phase II

2012

Supply Chain Visionary of the Year

2012

CFO 100 Roll of Honour 2012

Best ELSC Logistics Infrastructure

Company of the Year 2012

2nd Shine Awards 2012

Best Managed Company

in India 2012

Institute of Public Enterprise (IPE)

HR Leadership Awards 2012

Private Train Operator of the

Year 2012

2011

Leading Business Woman

of the Year 2011

Best Rail Operator

of the Year 2011

SAP ACE 2011 –

SAP Implementation Award

Private Rail Operator

of the Year 2011

Private Container Rail Operator of

the Year-Domestic Cargo 2011

Achievement Award for Best ProjectUrban Infrastructure (2011)

THE ARSHIYA TEAM

Ajay S Mittal

Archana Mittal

Group Chairman and

Managing Director

Joint Managing

Director

Sandesh Chonkar

Executive Director

11th JANUARY, 2O12

6TH JANUARY, 2O12

Delivered with ready state-of-the-art

hubbing and rail infrastructure

The FTWZ claiming business from

other regional hubs like Dubai and

Singapore

Ten year services legacy leveraged

with infrastructure offering a ‘one

stop shop’ logistics solution for

customers

Fully unified logistics and supply

chain delivery capability

Rightly positioned to enable and

capitalize on India’s growth

Corporate HQ: 301 Ceejay House, Level 3, Shiv Sagar Estate, F-Block, Dr. Annie Besant Road, Worli, Mumbai - 400 018. Maharashtra, India.

Ph: +91 22 4230 5500 /1 /2 Fax: +91 22 4230 5555

Registered Office: Arshiya House, 3rd Floor, Plot No.61, Road No.13, M.I.D.C., Andheri (East), Mumbai - 400093,Maharashtra, India.

Ph: +91 22 4048 5300

For more info please write to us at:

info@arshiyainternational.com

Copyrights © , All Rights Reserved. Arshiya International Ltd

www.arshiyainternational.com