John Berg-Manager MidAtlantic Sales

advertisement

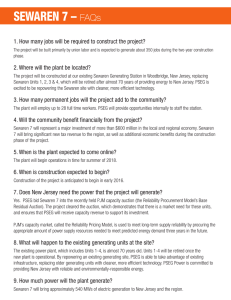

AEA Utility Management Conference Smart Sourcing of Electricity Supply March 13, 2013 John Berg-Manager MidAtlantic Sales Mobile: 732.259.9072 Office: 732-494-0089 x226 John.berg@directenergy.com Who is Direct Energy Business? Direct Energy Business is one of North America’s leading competitive energy suppliers offering: – – – – Highly competitive supply rates Flexible product options Expert advice Unparalleled customer service KEY FACTS • 25 years of industry experience • 180,000+ customers of all sizes • $4 billion company providing electricity and natural gas supply • Headquartered in Pittsburgh, PA FOR THE COMMUNITY Each year, Direct Energy donates over $1.8 million to charitable organizations across North America through corporate donations in the areas of finding solutions to homelessness, energy poverty, climate change, and supporting employee charitable endeavors. 2 Developing a Procurement Strategy Consideration of Your Needs and Current Supply Arrangements Risk Tolerance Operational Concerns Business and Financial Needs/Requirements Development of Procurement Strategy Evaluation of Competitive and Default Supply Options Development of Budgetary Expectations and Internal Procurement Requirements Analysis of External Market and Regulatory Conditions 3 PSEG Power Cost Components 4 Energy 5 Capacity – RPM – UCAP – Locational Reliability $/MW-D COMED AEP DAY DUQ PSEG JCPL AECO RECO DPL PECO BGE APS PPL METED PENELEC FE_PP FE_OH DEOK PY12-13 16.74 16.74 16.74 16.74 157.73 143.06 143.06 143.06 171.27 143.06 133.42 133.42 133.42 16.74 133.42 133.42 133.42 20.46 20.46 16.52 PY13-14 28.37 28.37 28.37 28.37 250.12 250.12 250.12 250.12 250.12 250.12 231.08 244.74 244.74 28.37 232.07 232.07 232.07 28.37 28.37 28.37 PY14-15 128.17 128.17 128.17 128.17 170.24 137.61 137.61 137.61 145.32 137.61 137.60 137.60 137.60 128.17 137.60 137.60 137.60 128.17 128.17 128.17 PY15-16 134.62 134.62 134.62 134.62 165.78 165.78 165.78 165.78 165.78 165.78 165.78 165.78 165.78 134.62 165.78 165.78 165.78 294.03 294.03 134.62 $/MWh (50% LF) COMED PEPCO_DC PEPCO_MD AEP DAY DUQ PSEG JCPL AECO RECO DPL PECO BGE APS PPL METED PENELEC FE_PP FE_OH DEOK PY12-13 1.40 1.40 1.40 1.40 13.14 11.92 11.92 11.92 14.27 11.92 11.12 PEPCO_DC PEPCO_MD 11.12 11.12 1.40 11.12 11.12 11.12 1.71 1.71 1.38 PY13-14 2.36 2.36 2.36 2.36 20.84 20.84 20.84 20.84 20.84 20.84 19.26 20.40 20.40 2.36 19.34 19.34 19.34 2.36 2.36 2.36 PY14-15 10.68 10.68 10.68 10.68 14.19 11.47 11.47 11.47 12.11 11.47 11.47 11.47 11.47 10.68 11.47 11.47 11.47 10.68 10.68 10.68 PY15-16 11.22 11.22 11.22 11.22 13.82 13.82 13.82 13.82 13.82 13.82 13.82 13.82 13.82 11.22 13.82 13.82 13.82 24.50 24.50 11.22 30.00 Capacity Price Curve $/MWh - 50% Load Factor COMED AEP 25.00 DAY DUQ 20.00 PSEG JCPL AECO 15.00 RECO DPL 10.00 PECO BGE 5.00 PEPCO_DC PEPCO_MD APS 0.00 PY12-13 6 PY13-14 PY14-15 PY15-16 Market/Regulatory Changes Scarcity Pricing Took effect on 10/01/201 Minimal impact to pricing (~3¢/MWh) Not explicitly modeled into Cogs Generation Deactivation a.k.a. RMR 22 GWs of coal capacity retirements expected for all US through 2015; of which 11 GWs in PJM Stringent EPA regulations on existing and future new coal gen; namely MATS Low commodity price environment NITS-related cost re-allocation Ferc filing, pending Commision approval in Spring 2013 Proposal to change the allocation of costs for RTEP projects Costs expected to remain the same for PJM as a whole; impact will be significant shuffling of costs among load zones 7 Supply Side Flexibility to Demand Initiatives Demand Side Initiatives • Renewables • Co-Generation • Demand Response • Energy Efficiency Product Flexibility • Fixed price provisions • Time-of-use vehicles to navigate price signals associated with demand-side activity • Encourages demand–side activity without penalty 8 Implementation Implementing Strategy and Supplier Selection Final Selection of Product and Hedging Strategy Timing of Purchase and Term Ensure Transparency Implement a Competitive Procurement Process Benchmark and Improve 9 Questions and Answers