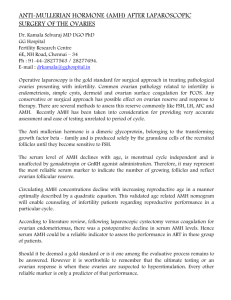

AMH

advertisement

Michael Chan John Hautzinger Constance Jiang Introduction Efficient Markets Hypothesis (EMH) Propose new framework, Adaptive Markets Hypothesis (AMH), reconciling EMH with behavioral biases Efficient Markets Hypothesis The notion that markets fully, accurately, and instantaneously incorporate all available information into market prices Participants are rational beings always making optimal choices in self-interest Psychologists and experimental economists have documented behavioral biases that do not follow market rationality EMH criticizes behavior as observations without principles to explain the origin Experiments - overconfidence Russo & Shoemaker (1989) – subjects asked to give 90% confidence answers(ranges) in response to questions w/numerical answers Subjects should be wrong only 10% of the time Results: < 1% of the subjects scored 9/10. Most missed 4- 7 questions. Most individuals are more confident of their knowledge than is warranted Experiments – reliance on representatives Tversky and Kahneman (1982) proposed a question to subjects and asked them to pick the more likely answer Linda is 31 years old, single, outspoken, and very bright. She majored in philosophy. As a student, she was deeply concerned w/ issues of discrimination & social justice, & participated in anti-nuclear demonstrations. Check the more likely alternative Linda is a bank teller Linda is a bank teller and is active in the feminist movement. Experiments – behavioral bias Kahneman & Tversky (1979) - 2 investment opportunities, A & B: A yields sure profit of $240k B yields $1mil w/25% probability & $0 w/75% probability C & D: C yields sure loss of $750k D yields $0 w/25% probability & $1mil loss w/75% probability Experiments – behavioral bias(contd) A&D equivalent to: 25% chance of $240k yield, 75% chance of $760k loss B&C equivalent to: 25% chance of $250k yield, 75% chance of $750k loss B&C has $10k higher gain, $10k lower loss Neuroscience Perspective Parts of the brain: brain stem, limbic system, cerebral cortex Physiological adaptations geared towards survival Humans adapt to fit environmental conditions [Investment] preferences may change as well Competitiveness of global financial markets suggests Darwinian selection is also applicable Unsuccessful market participants are eliminated after suffering certain losses AMH - Adaptive Markets Hypothesis Uses a Darwinian perspective financial markets = ecosystem dealers = herbivores speculators = carnivores floor traders and distressed investors = decomposers Adaptive Markets Hypothesis “Satsificing“ Due to limited computational abilities Making choices to meet satisfactory standards. How to determine what's satisfactory? Pos/Neg reinforcement leads to learning. When economic challenges stabilize, there's your optimal solution. Change of environment Become "maladaptive," fish out of water Adaptive Markets Hypothesis AMH - the new EMH (A1) Individuals act in their own self-interest. (A2) Individuals make mistakes. (A3) Individuals learn and adapt. (A4) Competition drives adaptation and innovation. (A5) Natural selection shapes market ecology. (A6) Evolution determines market dynamics. Adaptive Markets Hypothesis Everything converges to equilibrium Competition increase Resource depleted Decline in population Less competition Sometimes permanent loss of resource or extinction of species Role of the Consultant Assists managers and investors in dealing with preferences. 1. 2. 3. Educate investors and managers Assist in examine/modifying risk preferences Matching investor and manager's perferences Role of the Consultant Sensitive to changing markets. Familiar with a wide spectrum of investment products and services Must continually seek education. Financial technology Advances in neuroscience Training and certification programs Applications Problems Still in its infancy Much research must be done to establish viability However, questions arise about the relevancy of AMH compared to previously established EMH A wealth of tools exist for EMH EMHs have a long history Preferences Matter Individual preferences have long been studied in a variety of pitfalls Care must be taken to avoid pitfalls Pitfalls must first be known in order to avoid them Each industry focuses on a different aspect of decision making Psychological surveys are designed to capture broad characteristics of personality Economists perform choice experiments Market Researchers conduct field studies of consumer preferences Advances in Studying Decision Making Nueroscience Decisions are interactions between specialized parts of the brain Use of a combination of survey techniques must be used to achieve desired results Work must be done with investors on an individual basis In order to help articulate and accurately represent the final goals of the individual Revisiting Asset Allocation Another facet of the AMH framework Selection of portfolio weights for broad asset classes Relation between risk and reward Never stable over time Insights from AMH Aggregate risk preferences are constantly being shaped and reshaped over time Natural selection process Contrary to EMH arbitrage do exist from time to time As profit opportunities come to light, they are exploited and disappear New opportunities appear as older opportunities die out Insights from AMH (Cont.) Like profit opportunities, investment strategies wax and wane Unlike EMH in which opportunities are competed away, AMH allows for the assumption that opportunities may decline, but will return Example: Risk Arbitrage Became unprofitable in the decline of 2001 As pace mergers and acquisitions increase, risk arbitrage will come back to profitability Insights from AMH (Cont.) Value and growth may behave like risk factors from time to time Portfolios with such characteristics may yield higher returns than periods when those factors are favorable Bottom Line Regarding Active Asset Allocation Policies may only be right for certain people under certain market conditions AMH does not imply active asset allocation is any less difficult Provides a rationale for the apparent cyclical nature of risk factors and points the way to promising new research directions Dynamics of Competition and Market Ecology Another key application of the AMH framework to investment management is the insight that innovation is the key to survival EMH suggests that certain levels of expected returns can be achieved simply by bearing a sufficient degree of risk. AMH implies that the risk/reward relation varies through time and that a better way of achieving a consistent level of expected returns is to adapt to changing market conditions For Consideration Ask where the next financial asteroid will come from The AMH has a clear implication for all financial market participants Survival is ultimately the only objective that matters Profit maximization, utility maximization, and general equilibrium are certainly relevant aspects of market ecology The organizing principle in determining the evolution of markets and financial technology is simply survival. Innovation Key to AMH Framework Takes on an urgency generally missing from most financial decision making paradigms EMH Modern portfolio theory Capital Asset Pricing Model (CAPM) Role of Adaptive Markets in Machine Learning Adaptive markets imply an every changing, however somewhat cyclical marketplace Perfect for machine learning If truly cyclical then machine learning could use known parameters to predict outcomes in the short and long term ML allows for consideration of all aspects of the decision process