Other expenses - University of Guelph

advertisement

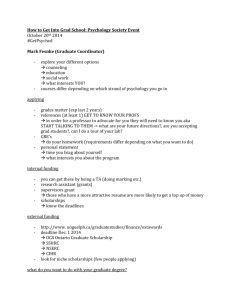

The Business of Budgets SSHRC - Insight Grant Preparation Workshop Diane Dobbins, MA Manager, Research and Partnerships (ddobbins@uoguelph.ca or ext 52152) July 6, 2011 Quick Tips • Review SSHRC guidelines on eligible (and ineligible) expenses – if you are not sure, ask! • Estimate costs of research realistically • Check past competition results, by committee, to gage possible funding patterns • Link proposed activities or anticipated milestones to budget where possible • When you need a break from grant writing, work on your budget. Don’t leave until the end. The budget is now part of the adjudication process! SSHRC 2010 Budget Template • Personnel costs – Student salaries and benefits/Stipends *(mandatory stipend amounts no longer exist) • • • • Undergraduate Masters Doctorate Non-student salaries and benefits/Stipends – Postdoctoral – Other • Travel and subsistence costs – Applicant/Team member(s) • • • Canadian travel Foreign travel Students – Canadian travel – Foreign travel • Other expenses – Professional/Technical services – Supplies – Non-disposable equipment • • • Computer hardware Other Other expenses (specify) – Ex. Communication/Dissemination SSHRC 2010 Budget Justification Budget Justification: – 2 page maximum – Use the same headings within the SSHRC budget template and include a short statement/justification for each component – Example #1. “One undergraduate research assistant per year at $6,000 is included in the budget”. – Example #2. “One Ph.D. student is supported for 3 years at $12,000 per year. Four Masters students are engaged in the program. Three are supported by this program, each for two years (1 starts in Year 1; 2 start in Year 2) at $8000 per annum”. – Be realistic and specific when possible. Items to Consider Personnel Costs (including salaries and wages, vacation pay and benefits) - Faculty Members *NOTE POLICY ON FACULTY PAY* - Support Staff - Students - Technicians - Post Doctoral Fellows - Project Managers (if applicable, if appropriate) - Benefits *NOTE RATES PUBLISHED BY FINANCIAL SERVICES annually* Items to Consider Travel, Accommodation & Living Expenses * NOTE POLICY ON TRAVEL * - Accommodation - Meals - Airfare - Transportation (Non-Airfare) - Incidental Travel Expenses Items to Consider Operating Expenses - Office Supplies - Laboratory Supplies - Field Supplies - Publication Charges - Audit Costs (if applicable) Items to Consider Equipment Expenses * NOTE PROCUREMENT/PURCHASING POLICY* Consultant's Fees (outside University of Guelph) *NOTE PROCUREMENT/PURCHASING POLICY* Items to Consider Costs of research subcontracts with collaborators (sending funds outside University of Guelph) - Office of Research rule of thumb: if the collaborator is identified as a scientific/technical contributor, we can issue a research subcontract - For all other personnel involved in the projects who are external to the University, usual procurement processes would apply Items to Consider Other Costs - Computer Charges (specify rate & computer type) - Rental - Audio Visual Costs Items to Consider Indirect Costs – not applicable on SSHRC grants SSHRC Budget Template • SSHRC budget template and the online application should be available by mid-July. Resources Procurement Policy March 2011 - http://www.fin.uoguelph.ca/sites/default/files/FI1802011Mar29_0.pdf Travel Policy May 15, 2011 - www.fin.uoguelph.ca/sites/default/files/Travel%20Policy%20&%20Procedure%20V%201.06%20%20Apr%2028,%202011.pdf Benefit Allocation Rates 2011-2012 - www.fin.uoguelph.ca/sites/default/files/20112012%20Benefit%20Allocation%20Rates.pdf Faculty Collective Agreement - www.uoguelph.ca/vpacademic/documents/CAupdateApr11.pdf Undergraduate Student Wages - www.uoguelph.ca/hr/admins/student-wages GSA Wages - $37.56hr www.uoguelph.ca/registrar/graduatestudies/index.cfm?regguide/working GSA Definition Graduate Service Assistant (GSA) Typically, the services provided by GSAs fall into two categories: • Work that is directly related to the academic enterprise but not properly a GTA or GRA. • Examples of these services include the preparation of academic or administrative reports and the compilation of statistics for departmental use. This work may not contribute to the student's thesis research. • The GSA(i) rate of pay is established annually. • Work that is not directly related to the academic enterprise. Examples of these services include locking/unlocking doors, cooking, cashiering, snow removal, and lifeguarding. Students are paid at the appropriate hourly rate set by Human Resources for the appropriate kind of work. • The university provides a T4 tax information slip each year to students with GSAs. GRA Definition Graduate Research Assistant (GRA) • Graduate students may be supported through research grants received by faculty members from external agencies or governments. • The student's research must contribute to the research of the faculty member under whose direction it is conducted. It must be used in the preparation of the student's thesis. • The dollar value of GRA stipends are no longer determined by the external granting agencies' guidelines on support of graduate students through research operating grants. • GRAs must be approved by the department chair or school director on the recommendation of the adviser. • The university provides a T4A tax information slip each year to students with GRAs. Questions? Diane Dobbins, MA Manager, Research and Partnerships College of Management and Economics ddobbins@uoguelph.ca or ext. 52152