Sonatrach-presentation - Canada

advertisement

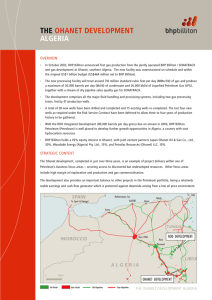

Sonatrach The Algerian National Oil & Gas Company Investment Plan 2012-2016 Dr. Djamel BEKKOUCHE Managing Director Algerian Petroleum Institute, Corporate University Sonatrach Algeria Bekkouche Djamel is currently the head of the Algerian Petroleum Institute, Corporate University of Sonatrach Algeria. Bekkouche graduated from the Algerian Petroleum Institute (IAP) in 1978 and occupied many functions and positions at Sonatrach since 1980 where he started as Geologist. Mr Bekkouche was particularly in charge of the Exploration Division at Sonatrach Upstream Activity from 2008 to 2011. He also post-graduated from Grenoble University , France and got a PhD in Sedimentology in 1992. He has many publications and communications in international conferences and forums. Contact: Email: djamel.bekkouche@iap.dz Phone +213 24 81 90 56 - Fax: +213 24 81 86 30 Adress: Avenue du 1er novembre Boumerdes 35000 Algerie Outline The Algerian Hydrocarbon Industry Sonatrach’s Profile & Vision Sonatrach Development Plan and Strategy Concluding remarks SONATRACH TODAY First Company in Africa In the World: • 1st largest condensate exporter : 15 Mt/y; • 2nd largest LNG producer : 45 Gcm/y; • 2nd largest LPG producer : 9 Mt/y; • 3rd largest gas exporter : 60 Gcm/y; The mission of Sonatrach : to meet Algeria’s present and future hydrocarbons needs to maximize the long-term value of Algeria’s hydrocarbons resources to contribute to the national development, mainly by providing the required hard currencies The Hydrocarbon Industry in the Algerian Economy The Hydrocarbon Industry plays an important role in the Algerian Economy Imports taxes and duties Government services 6% 8% The hydrocarbon industry accounts for around 44% of GDP Proceeds from hydrocarbon exports cover 98 % of hard currency resources of the country 76% of the state budget is funded by oil and gas revenues 150 000 employees work for the oil and gas industry Hydrocarbons 44% Nongovernment services 21% 9% Construction and public works 5% Industry 8% Agriculture GDP : 135 G US $ Sonatrach : A Fully Integrated Company Subsidiaries • • • • • • • • • • • Marketing Downstream Transport Upstream Core Activities International Drilling (ENTP AND ENAFOR) Well Services ( ENSP) Geophysics ( ENAGEO) Construction (ENGTP, ENGCB, …) Refining ( NAFTEC) Petrochemical ( ENIP) National distribution ( NAFTAL) Shipping ( HYPROC) Electricity and desalination of sea water (AEC) Renewable energies ( NEAL) Training ( IAP-CU) • • • Upstream Transportation Downstream • • • Marketing Shipping Others 5 An Ambitious Investment Plan for 2012-2016 Expansion of Algeria’s hydrocarbon reserves base through: Sonatrach investment plan over 2012-2016 :$68.2bn Enhancement of exploration program (including the offshore) Unconventional gas appraisal (shale and tight) Support Transportation Downstream 8% 1% Increase and insure sustainability of production levels (development of new oil and gas fields, EOR, etc…) 9% Expansion of the oil and gas export capacity (Refinery, LNG & Natural Gas) 82% Upstream Maximize the value of Sonatrach products (Petrochemical projects and International trading) Consolidate our assets internationally 6 Main Downstream Projects Strengthening the Downstream … Under-Construction Projects Revamping, Adaptation, and 10% Increase in the capacity of toppings of Skikda refinery. Commissioning : End 2012 REFINING Revamping, Adaptation, and 50% Increase in the Topping capacity of Arzew refinery. Commissioning : February 2012 Revamping, Adaptation, and 35% Increase in the Topping capacity of Algiers refinery. Commissioning : March 2014 Projects in lunching Phase New refinery of Hassi Messaoud (RHM3) and the Revamping of RHM2 (FEED) Fuel Conversion in RA1K (Skikda) Projects under Study New crude oil refinery in centre region. New refinery to process the heavy crude oil for bitumen production. 7 Main Downstream Projects … & Developing the Petrochemical sectors Under-Construction Projects PETROCHEMICALS Pier of the Ammonia/Urea Plant - Mers El Hadjadj Building of a pier intended for the Ammonia/Urea Plant of Mers El Hadjadj. Commissioning : End 2011 Revamping of the CP1K Plant Upgrading of the production units and implementation of a DCS. Commissioning : End 2014 Extension of the CP1Z Plant Methanol Unit Revamping and increase in capacity of the Methanol unit. Commissioning : Jan. 2015 New Urea-Formol UFC 85 Pre-condensates Unit for the CP1Z Plant Installation of a new mixed production Unit of Urea Formol 85 pre-condensates. Commissioning : Jan. 2014 Projects under Study Project dehydrogenation of propane and polypropylene production in Arzew 8 LNG PROJECTS Insure a sustainable position in the Natural Gas Market New LNG train – Skikda Annual Production capacity : 4.5 MT Commissioning : August 2012 New LNG train– Arzew Annual production capacity : 4.7 MT of LNG Commissioning : June 2013 Tankers capacity of 1 million m3 LNG JHK GL3Z LNG unit of 4,7 MT/y GPDF 11,5 BCM GL2K LNG Unit of 4.5 MT/y MEDGAZ 08 BCM Skikda GALSI 08 BCM Arzew PIPELINE PROJECTS GEM 33,7 BCM GALSI Transportation Capacity : 8 BCM Hassi R’Mel TSGP 20-30 bcm TSGP Transportation Capacity : 20 to 30 BCM 9 Sonatrach : from Regional to Global player USA : Regasification Spain: Reganosa (10%): Regasification GEPSA(30%) : cogeneration CGC (30%) : Trading SGC (100%) : Trading Propanchem (49%): Petrochemical UK & Netherlands: Oil, LPG & LNG regasification & Trading France Trading of LNG Portugal: 2% of EDP 25% in Power stations of EDP (one in Spain) Peru : Pipeline Project Transport of Oil & Gas from Camisea Field to Lima & Callao Development of the blocks 88 and 56 in Camisea Mauritania: 6 exploration blocks Italy Trading of Gas Tunisia : 01 Exploration block Libya : 2 Exploration blocks in Ghadames basin Mali : 2 exploration blocks Nigeria : Gas pipeline TSGP Korea : Crude oil storage capacities Singapore : Trading Niger : 01Exploration block 10 Concluding remarks (1) Main Factors of Success for our company and the investors in Algeria, 1. Important base of reserves 2. Sedimentary basins of high potential and under explored 3. More than 40 years of experience in integrated oil and gas activities, from upstream to downstream 4. Leading experience in the gas chain, mainly in gas liquefaction 5. Proximity to important markets 6. Successful record of partnership Concluding remarks (2) Sonatrach considers partnering as a key liver for implementing his strategy, Partnership with foreign companies has given substantial results in the upstream and our ambition is to reach similar results in downstream activities, Many projects in the downstream sectors are planned for the next five years in refining and petrochemicals (more than 10 billions $US will be invested) The Algerian mining domain is still under explored and the potential of the unconventional resources, Tight ands shale gas is very high: so welcome to the Canadian company to explore and develop shale gas in Algeria. More than fifty Billions US$ will be instead in the the investment in the upsteram Several opportunities available in the hole hydrocarbon value chain (E&P, energy services, Construction, Refinery, Petrochemicals…) and in the renewable and new energy. The Canadian Oil and Gas company are welcome to invest in Algeria were all the conditions and rules for transparency are set up to allow to the foreign company to be present in force. Many Canadian companies are present in Algeria, as SNC Lavalin in the construction and Talisman in the Upstream (field developpement) with a successful business and we hope that others company will visit our country to see the reality and to meet business private and state companies. THANK YOU Contact Ministère de l’Energie et des Mines Tour A, Val d’Hydra Alger, Algérie Tel + 213 21 48 85 26 FAX + 213 21 48 85 57 Email: infomem-algeria.org Web Site: www.mem-algeria;org Contact Direction Générale Sonatrach Chemin Djenane El Malik Hydra Alger Algérie Tel + 213 21 54 70 00 FAX + 213 21 54 77 00 Email: Sonatrach@sonatrach.dz Web Site: www.sonatrach-dz.com