Potential

advertisement

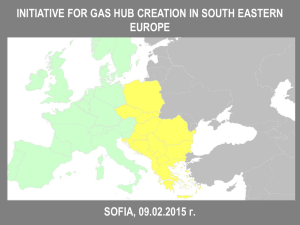

RATIO OIL EXPLORATION (1992) Limited Partnership Partnership Presentation August 2013 [1] Disclaimer This presentation was prepared by Ratio Oil Exploration (1992) – Limited Partnership (the “Partnership” or “Ratio”) . It is not an offer to buy or sell securities of the Partnership, nor an invitation to receive such offers, and is designed, as aforesaid, for the provision of information only. The information used to make the presentation (the “Information”) is given for convenience purposes only and is neither a basis for the making of any investment decision, nor a recommendation nor an opinion, and is no substitute for the investor’s discretion.\ Everything stated in this presentation with respect to an analysis of the Partnership’s business is merely a summary. To obtain a full picture of the Partnership’s business and the risks facing the Partnership, review the Partnership’s Periodical Reports and Immediate Reports ,as filed with the Israeli Securities Authority through the Magna website. The Partnership does not warrant that the Information is either complete or accurate, nor will bear any liability for any damage and/or losses which may result from the use of the Information. Various issues addressed in this presentation, which include forecasts, goals, estimates, assessments and other information pertaining to future events and/or matters, whose materialization is neither certain nor within the Partnership’s control, including in connection with data, income forecasts, the value of the Partnership, costs of projects, development plans and concepts and construction thereof etc. are forward-looking information, as defined in the Securities Law. Such Information is based solely on the Partnership’s subjective assessment, based on facts and figures concerning the current state of the Partnership’s business, and macro-economic facts and figures, all as are known to the Partnership on the date of preparation of this presentation. The Partnership does not undertake to update and/or change any such forecast and/or estimate to reflect events and/ or circumstances occurring after the date of preparation of this presentation. The materialization or non-materialization of the forward-looking information will be affected, inter alia, by risk factors characterizing the Partnership’s business, as well as by developments in the general environment and outside factors affecting the Partnership’s business, third-party representations not materializing, delays in the receipt of permits, etc., which cannot be estimated in advance and are beyond the Partnership’s control. The Partnership’s results of operations may differ materially from the results estimated or implied from the aforesaid, inter alia due to a change in any one of the foregoing factors. [2] THE LEVANT BASIN Ratio is focused on hydrocarbon exploration and production in the Eastern Mediterranean Sea [3] THE LEVANT BASIN Potential ~ 122 Tcf* Discovered ~ 38 Tcf** * Source: US Geological Survey (USGS) Fact sheet 2010-3014 , March 2010 ** Reserves and Contingent Resources (Best Estimate Category) [4] RATIO ASSETS Ratio Yam Licenses 15% interest (Operator: Noble Energy) Rachel Amit Hanna Eran Gal Licenses 70% interest (Operator: Edison SpA) Neta Royee [5] RATIO YAM LICENSES Eitan Aizenberg, one of Ratio's founders, is the prospect generator of the Leviathan and Dolphin discoveries Ratio held 100% interest in the Ratio Yam exploration areas and in 2007 invited its current partners to farm-in Leviathan Discovery World-class asset in terms of quantity and quality The Leviathan field was discovered in late 2010 Located in the Rachel & Amit Licenses, approx. 135km west of Haifa, Israel in water depths of approx. 1,630 meter, and covers approx. 325 km2 Drill stem test confirms high quality reservoir with a single well capable of producing 250 mmcf/d Completed two appraisal wells which validated the quality, quantity, continuity and extent of the field The most significant gas field in the Basin Contingent Resources, NSAI estimation (as of March 31, 2013) [6] Low (1C) Best (2C) High (3C) Natural Gas (Tcf) 14.89 18.91 24.14 Condensate (MMBBL) 26.9 34.1 43.4 LEVIATHAN DISCOVERY Scale and location allow for multiple possibilities Potential supply to Jordan and Palestinian Authority via onshore pipeline [7] LEVIATHAN DISCOVERY First phase: Sanction expected in 2013 capacity 1,600 mmcf/d (*) (**) Anticipated development phases Domestic Market (750 mmcf/d) Pre-investment in upstream for export project (850 mmcf/d) Second phase: capacity 1,600 mmcf/d (*) (**) Operator targets initial sales to domestic market by end 2016 Export Market Domestic Market [8] * Source : Noble Energy Analyst Conference – December 2012 ** Source: Noble Energy UBS Global Oil & Gas Conference – May 2013 DOMESTIC MARKET Power generation New Capacity - 4,000 - 5,000 MW gas fired plants are expected to commence operations by 2017- 2018 Conversion of IEC’s coal fired plants to utilize gas 1,400 MW by 2017 Strong and growing demand Industrial uses Conversion of heavy industries’ production facilities burners to utilize gas Development of new industries which heavily utilize gas Forecasted supply in 2013 is 5.6 BCM (**) Long term natural gas demand for power generation and industrial uses (*) Forecasted demand in 2015 is 10 BCM (***) Approx. 13 BCM in the year 2020 and 15 BCM in the year 2025 Approx. 430 BCM during years 2016-2040 [9] (*) Ministry of Energy & Water forecast, April 2012. (**) Delek Group, 2012 Annual Report (***) Tzemach Governmental Committee, Final Report, September 2012 EXPORT PROJECTS Growing Demand 2012 demand ~ 46 BCM ; 2020 forecast ~ 60 BCM Gas supply diversification In 2012, 75% of Turkey's gas was imported from Russia and Iran Turkey is a significant potential market for piped gas Potential Transit Hub from East to West Several regional transmission lines are planned (TAP, TANAP) Pipeline length ~ 400-450 kilometer from Israeli EEZ to south-east Turkey Existing import gas pipelines and LNG Terminals [10] EXPORT PROJECTS Egypt Natural gas is required to feed-in two existing LNG facilities: Damietta plant (5 mtpa) is idled due to lack of gas supply Idku plant (7.2 mtpa) is operated in limited capacity due to reservoir performance Egypt, Jordan and the Palestinian Authority are also potential markets for piped gas Jordan Natural gas is required to mainly generate electricity Gas supply from Egypt for power generation has been decreased from 3.1 BCM in 2009 to 0.8 BCM in 2011 Jordan has issued RFP for purchase of LNG in mid 2014 at Aqaba Palestinian Authority Palestinians seek electrical independence; Currently, private company develops a 200 MW gas fired power plant to be located in West Bank [11] EXPORT PROJECTS Global LNG Forecasted Demand & Supply Remaining market opportunity ~ 58 MMt/y by 2022 Worldwide LNG projects compete to secure market and reach FID by 2018 [12] Poten & Partners 2013 * Oceania = Ausralia and PNG Woodside Transaction Australia based Woodside has been selected as a strategic partner bringing-in LNG expertise Ratio will sell 5% of the interest in the Rachel and Amit Licenses Woodside brings Leviathan added values: Woodside proposed to pay approx. $2.5 billion in return for acquiring 30% of the interests in the Rachel and Amit licenses Experience in design, construction and operation of onshore LNG plants Skills in shipment, trading, marketing and financing of LNG plants Expected Ratio's revenues from the sale ~$420M (Less overriding royalties) Strong relations with Asian markets for the past 28 year Extensive FPSO and LNG experience with capabilities in project integration [13] Woodside's Pluto LNG Plant Australia EXPORT POLICY Governmental Export Decision (June 2013) Initial allocation of reserves for domestic use – 540 BCM from all reservoirs Export of up to 50% from each reservoir exceeding 200 BCM plus up to an additional 25% is permitted following swap transactions Onshore LNG facility / FLNG will be built in territories controlled by the State of Israel, unless agreed in a bilateral agreement between countries Regulation sets the foundations for export Leviathan has a potential to export up to 400 BCM (~14 Tcf) [14] Ratio Yam Licenses Operator expects drilling rig to arrive late 2013 and forecasts 25% geologic chance of success Mesozoic rocks produce hydrocarbons throughout the Middle East and northern Africa Enormous regional implications, especially on neighboring structures, if hydrocarbons are found Leviathan Deep Mesozoic Prospect Prospective Resources, NSAI pre-drill estimation Geologic Success: Middle Cretaceous A play with step-change potential Attwood Advantage drilling Rig [15] 15% Lower Cretaceous 21% Gal Licenses In 2010 Ratio obtained the Gal preliminary permit and in 2012 completed the acquisition and processing of 3D seismic survey in the Neta and Royee licenses In November 2012 Edison International joined Ratio to operate and further explore the assets. Edison holds 20% of the interest in the licenses Ratio initiated the exploration activities in 2010 In April 2013 the Oil Commissioner granted the licenses within the preliminary permit area Located south-west of the Leviathan Discovery According to the Licenses terms: • Drilling prospect with resource estimate to be submitted to the Ministry by June 2014 • First exploration well to be spud by April 2015 [16] Financial & Stock Exchange Data Fund raising Since its inception in 1992, Ratio has raised $170M, including approx. $38M in 2013 Potential fund raising through warrants exercise up to $108M Tradability on the TASE One of the most ten traded in 2011-2012 Immediate access to capital markets Market Capitalization $720M, Unit Price 33.4 As of June 30, 2013 Unit Target Price UBS - 49, Barclays - 44 Listed in Tel Aviv 75 Index [17] Contact Details Ratio Oil Exploration 85 Yehuda Halevy St. Tel Aviv 6579614 Israel Tel: +972-3-5661338 Fax: +972-3-5661280 office@ratioil.com [18]