Overview of my Career

advertisement

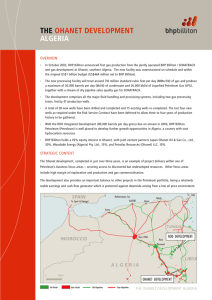

Overview of my Career My name is Chakib Khelil and I am the current President and CEO of SONATRACH, the state-owned Oil and Gas Company. I am also Algeria's minister of Energy and Mines. I became minister on December 26th, 1999, while Mr. Abdelhak Bouhafs was the president and CEO of Sonatrach. In 2000, I dismissed Mr. Bouhafs from his functions and assumed the transitional presidency of the company. I am also a former president of the Oil Producing and Exporting Countries (OPEC). Early in my career, I worked for Shell Oil Co. and Phillips Petroleum Co. in Oklahoma and for D.R. McCord & Associates in Dallas. I returned to Algeria in 1971 to join Sonatrach's petroleum engineering department and became head and president of Alcore, a joint venture of Sonatrach and Core Laboratories. In 1973-76, I served as technical adviser to the president of Algeria, Houari Boumediene, and became president of the “Valhyd Program”, which planned, developed, and financed hydrocarbon resources. In 1980, I joined the World Bank, where I conducted petroleum projects in Africa, Latin America, and Asia. I became head of the bank's energy unit for Latin America and a petroleum adviser. I took early retirement from the World Bank in October 1999 to become an adviser to the president of Algeria. I hold a PhD in petroleum engineering from Texas A&M University. I speak English, French, Spanish, Portuguese, and Arabic. Sonatrach, an International Petroleum Group The Algerian state-owned Sonatrach, founded in 1963, is the national oil company of Algeria. It is responsible for the management of the country's oil industry, which encompasses organization of Algerian exploration, production, transport, refining, processing, marketing and distribution of oil, gas and related products. Included in this portfolio is management of exploration bidding rounds for oil and gas, but this is soon to be reformed under a bill I have recently undertaken. Sonatrach also has an important role in the chemicals industry of Algeria, owning fertilizer plants and petrochemical facilities. Sonatrach is structured as a holding company with five major operating subsidiaries which encompass: exploration, production and marketing of oil, gas and chemicals, management of the Algerian oil refineries, transport, including pipeline operation and maintenance, gas liquefaction and operation of the Arzew and Skikda LNG and LPG plants; international operations, including management of foreign investments and overseas sales offices. Sonatrach is ranked as the 12th largest petroleum company in the world. It is the 1st oil company in the Mediterranean, the 4th world largest exporter of natural gas and the 2nd for LPG (liquefied petroleum gas). We also hold the fourth largest world reserves of natural gas, thus play a major role in this industry. Upon its creation, Sonatrach role was, essentially, to contribute in the national development of Algeria. It was mostly targeted to generate external payment means, but also to meet the existing and future hydrocarbons requirements of Algeria. For purposes of maximizing the long-term value of the Algerian hydrocarbons resources, Sonatrach undertook a tremendous development of activities. Production has been multiplied by four since 1970 and is expected to be twice as much by 2007. Given the privileged geo-economic situation of Algeria, Sonatrach has developed a strong commercial relationship with Western Europe and the United States and is particularly interested in the Mediterranean countries and the Maghreb. Moreover some of the largest Oil & Gas companies work in partnership with my company in Algeria: Agip, Repsol-YPF, Cepsa, BHP Billiton, BP, Anadarko, PetroCanada, TotalFinaElf, Amerada Hess, Maersk, Gaz de France, Shell, Medex, PIDC, First Calgary Petroleum, Rosneft Stroytransgaz, Petronas. Some service companies such as Schlumberger, Halliburton, Baker Hugues, Bechtel… SONATRACH VP: Vice President ED: Executive Director Chakib Kelil, President Chief Executive Officer Secretary General Upstream VP Exploration & Production Drilling Engineering ED Production Engineering ED Transport/Pipeline VP Executive Committee Downstream VP Refining & Distribution Refining ED Retail Sales ED Marketing/Trading VP Strategy & Planning VP Quality Health Safety & Environment VP Petrochemicals ED Reservoir Engineering ED Legal Affairs VP Finance VP Process Engineering ED New Ventures ED Human Resources VP Information Tech. VP History of the Hydrocarbon industry in my country, Algeria The first exploration of hydrocarbons in Algeria goes back to the ends of 1890's, in the Chlef basin but it was only in 1948 that the first discovery was made at Oued Guetirini, in the north of the country at 150 km of Algiers. In the fifties, exploration works where extended to the Sahara, where many oil and natural gas discoveries were made, drastically changing the knowledge of Algerian underground resources. Algeria has a sedimentary surface of over one and half million km2, the exploration of which is far from being completed. On the 24th of February 1971, President Houari Boumediene announced the nationalization of hydrocarbons that were previously owned by foreign companies. About 25 years ago, a decisive impetus was given to the development of oil and gas deposits, the construction of production and transformation facilities as well as transport and exploration infrastructures. From 1986, adapting to the evolution trend of the world economy, Algeria provided its self with an attractive legislation, and it was made more offensive in 1991 it made possible the opening of the national mining domain to international investments, in association with the national company Sonatrach. Algeria’s Economic Profile Algeria has a state-directed economic system undergoing modest market-oriented structural adjustment and decentralization. Central government retains ownership of more than 450 state-owned enterprises. The economy is dominated by hydrocarbon sector, mainly oil, but diversifying into natural gas and refined products. There is an under-investment in agriculture and other non-oil sectors. Exports include crude oil, refined petroleum products, and gas. Non-fuel minerals include high-grade iron ore, phosphate, mercury, and zinc. Algeria's considerable natural gas reserves of about 3,200 billion cubic meters of proven recoverable gas put it as the 4th world largest reserves. Natural gas had become the country's most valuable export as a result of the decline of oil production and prices--and as an outcome of the government's diversification strategy. Despite Sonatrach's successful implementation of its diversification strategy, the government was well aware of its over-dependence on the revenue from oil and gas exports to finance its ambitious national development program and service its external debt. Foreign Relations: Policy founded on nonalignment, national self-determination, and support for Palestinian Liberation Organization in Arab-Israeli dispute. Algeria has a Membership in League of Arab States (Mr. Slimane Chikh, Ambassador of Algeria in Cairo) and Organization of African Unity. The Relations with the West improved during 1990s, primarily as result of expanding trade, increasing economic cooperation, and the opening to the globalization and market economy. Changes I am undertaking for Sontarach and Algeria’s Hydrocarbon industry I am currently managing a fundamental overhaul of Sonatrach and expecting major changes in the oil & gas industry in Algeria and abroad. I have put together a reform bill that has so far fulfilled only one goal: the reorganization of Sonatrach that began last December. The major goal of the Proposed Legislation is to separate the role of the state from the role of Sonatrach as a commercial enterprise. I acknowledge that until the law is in place, the company's role might confuse outsiders. But the law needs to be adopted by both houses of representatives: the congress and the senate; it is at that moment being debated at the parliament. Currently, Sonatrach is awarding contracts and at the same time seeks partnerships with those companies to which it awards the contracts. So there is a conflict of interest, which is going to be clarified by the new proposed law. I wish to emphasize on the fact that this is all it does. The reform does not intend to privatize or to restructure Sonatrach. It helps Sonatrach to become more efficient. Efficiency of our state oil company is crucial for a country in which exports of oil and natural gas account for 30% of gross domestic product (GDP) and more than 90% of total exports. The “reform bill on hydrocarbons” that I have undertaken envisages the creation of two autonomous national entities: - “Autorité de régulation”: authority of control and regulation of the activities in the national oil & gas industry; - “ALNAFT”: national agency for the promotion and development of the hydrocarbon resources, headed by former Sonatrach CEO, Nazim Zouioueche. The organization and the functioning of these two entities will be fixed by decree. Each one of these entities will enjoy management autonomy from a technical, economic, financial and administrative standpoint. The board of directors made up of five members manages these two entities. In addition to the Chairman and the Managing Director, the four members of the board of directors are named by decree of the Energy & Mines Minister for a three-year renewable period. The general manager, president of the board of directors, is named by presidential decree on a proposal from the Energy & Mines Minister for a six-year renewable period. What will really change for Sonatrach? First of all, the new law will relax some of the company’s current obligations. For example, the company now builds all pipelines in Algeria. Under the new law, we, Sonatrach, will be free to do these investments or not. Relieved of the burden of obligatory investment, the company will be able to concentrate on projects offering higher returns, mainly exploration and development. The new law will make Sonatrach a competitor for exploration blocks in Algeria, subject to the same conditions as foreign bidders and able, unlike at present, to retain profits from upstream operations. Sonatrach will basically have a better financial return than it has right now and we will be able to dedicate more capital to more exploration nationally and internationally. The reorganization of the past year enables Sonatrach to focus on its core business to produce and to market petroleum, petroleum products, and other hydrocarbons, including gas, for the highest return possible for Sonatrach and, of course, for its main shareholder, which is the Algerian state. After the reorganization, the company has four vice-presidents in charge of exploration and production, transportation, marketing and refining and liquefaction. Before the reorganization there were 13 vice-presidents! Activities such as finance, human resources, environmental protection, planning, legal services, and business development now support the operating units. Among other changes due for Sonatrach is expansion of international operations. At present, about 10% of the company's assets are outside of Algeria. I expect the non-Algerian share to increase to 30-40%. The company has offices in London and The Hague for trading and marketing. Its main international exploration and production venture is a joint venture in Yemen with Agip Yemen BV involving offshore Block 3, where an exploration program is under way. Sonatrach has other E&P interests in Mali, Niger, and Sudan. Downstream, Sonatrach is a minority partner in a joint venture with Germany's BASF AG, building a propylene plant in Taragon, Spain. And it is part of a consortium laying pipelines to carry production from the Camisea natural gas fields under development in Peru. Our expansion capacity Algeria's crude oil production capacity recently reached 1.1 million b/d and will climb to 1.5 million b/d soon. Recent production levels were unofficially reported as 845,000 b/d of crude, 430,000 b/d of lease condensate, and 190,000 b/d of natural gas liquids. The country's quota as a member of the Organization of Petroleum Exporting Countries is 693,000 b/d of crude, and I have requested an increase of that quota. Most of the recent and imminent capacity increases come from two oil fields: Hassi Berkine South (HBNS), in which Anadarko Petroleum Corp. is Sonatrach's main partner, and Ourhoud, in which Spain's Cepsa is the chief international partner. Our capacity target of 1.5 million b/d is not a hope or something we are dreaming of, it is a reality. It is just a question of completing the surface facilities, so it is not reserves that need to be found. Sonatrach continues to form production-sharing agreements (PSA) with international operators. We signed 10 contracts last year, a record I hope to duplicate this year and next. Natural Gas is our main resource for the future and these last years, companies are bidding not just to develop gas reserves but also to lay a pipelines and gazoducs and expand liquefaction facilities. Sonatrach exports about 6.2 billions cubic feet per day of natural gas through its four LNG plants and two pipelines across the Mediterranean Sea to Europe (to Spain and Italy). With expansion planned for both means of export, I think gas exports can reach 8.5 bcf/d by 2005. LNG accounts for about 3.3 bcf/d of Algerian gas exports and most of the gas goes to Europe. The rest of the exported gas flows through the 667-mile Enrico Mattei pipeline (formerly TransMediterranean) to Italy via Tunisia and the 1,013-mile Pedro Duran Farell pipeline to Spain via Morocco. Two other major gas pipelines crossing the Mediterranean to Europe are in prospect. One of them would transit Sardinia en route to Italy. We entered an agreement last year with Enel SPA of Italy and Wintershall AG of Germany to consider the project. Feasibility studies have begun on a second gas line to Spain. In that project, Sonatrach is working with a consortium of European companies. We are also working in a joint venture with Nigerian National Petroleum Co. to study a land pipeline to carry gas now flared in Nigeria to Algeria for export to Europe. But it's a long-term project. We are not seeing the Nigeria project for tomorrow, we are seeing it in 10 or 15 years. My view on World Energy Market The main change I expect is increased cooperation between OPEC and non-OPEC countries and companies. I believe there will be situations where OPEC is not going to be able to stabilize the market alone; it needs the help of all the producers to do this. I also think that better information would help market stability: information on the world supply and demand situation should be transparent on both the producing side and the consuming side, including information from oil companies, to allow different parties in the oil market to play their role in the stabilization of the market. Right now, the volatility in the oil market is due to the lack of information. With natural gas, I see opportunity for all suppliers: the European market is a huge market. We see the demand doubling within the next 20-25 years. So there is room for all producers, not only for Russia and Algeria but also for newcomers like Qatar, Egypt, and others. I expect gas to remain linked to oil for pricing, and suppliers can't produce gas at a loss, he notes, which is why projects such as the Nigeria-Algeria pipeline and long-distance systems such as pipelines from Russia won't materialize quickly. I wish there is a “harmonization" of European energy taxation and environmental goals. We see, for example, taxation of gas but no taxation of coal. If coal is dirtier it should be taxed more, but that is not the case." Group Members: Mazine Kessaissia Christopher O’Connor Maya Anu Jadhav