1. Sector Overview

advertisement

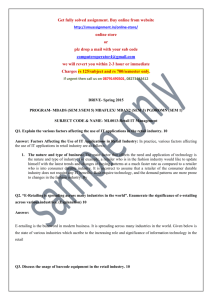

CONSUMER ELECTRONICS Retail sector overview and key trends August 2013 1 A Service LOUISE HOWARTH Senior Retail Analyst Contents 1. Sector Overview 2. Key Trends 3. Outlook and Implications 4. Further Reading 2 1. Sector Overview 1. Sector Overview Best Buy retained its position at the top of the consumer electronics (CE) specialist retailer ranking during the global economic crisis, managing to increase revenue by 2.6%. Circuit City, Office Depot and Darty all dropped out of the Top 10 between 2007-2012, with Circuit City exiting the race entirely when it filed for bankruptcy in 2008. Those players with a presence in emerging markets, less affected by the economic recession, performed best over the period. Electronics & Office: Top 10 Retailers Banner Sales, 2007-2012 (USD bn) 60 Banner Sales (USD bn) 50 2007 2012 40 30 20 N/A 10 0 Best Buy 4 Source: Planet Retail Metro Group Expert Dixons Retail Staples Euronics Yamada Denki Office Depot Darty Circuit City 1. Sector Overview The top CE retailers are focusing on improving efficiencies in order to boost profits after several years of operational margin declines. Best Buy is reducing its US total floor space by 20% but increasing touch points by 20%. Long term, Best Buy is aiming for an operating margin of 5-6% and a return on investment of 13-15% by improving efficiency. This includes cutting administrative and non-product expenses. Part of this strategy will involve store closures. The retailer intends to add 40-50 Media Markt and Saturn stores per annum. Focus is being placed on accelerated growth in large markets such as Russia and Turkey. Best Buy will work with its vendors to drive value. It also wants to collaborate with manufacturers to bring its customers the most innovative and exclusive products. A recent move has been the conversion of Saturn stores to the Media Markt banner in some countries, helping optimise the retailer’s large marketing spend volumes. Apple is building out its store network internationally, in order to give its international fans more touch points to the brand. Expert is looking to attract new organisations and independents to its network in existing markets after experiencing a tough few years when a number of its independents closed up shop. In terms of growth strategy, particular focus is being placed on China as a country with high growth potential. New stores will be rolled out at a much faster rate than seen previously. As competition increases, Apple is extending its product offering. There have been rumours in recent months regarding an Apple television, iWatch and even a games console. 5 Metro Group is expanding its online offering, in order to achieve a global online share of sales of 10% by 2014, and then double that figure again in the longer term. The retailer is committed to a restructuring programme in Portugal and Spain after being heavily impacted by the Eurozone crisis. Development of its online store in Germany.