Presentation Title

advertisement

The Goldman Sachs Group, Inc.

Goldman Sachs Research

A snapshot of the life of an

‘applied’ economist

Kasper Lund-Jensen

+44 (0) 20 7552 0159

kasper.lund-jensen@gs.com

Goldman Sachs International

December 2014

Investors should consider this research as only a single factor in making investment decisions. For Reg AC certification and other important disclosures, see the Disclosure

Appendix, or go to www.gs.com/research/hedge.html.

Goldman Sachs Global Investment Research

1

The costs and motives behind FX

interventions: the case of Bank of Israel

Goldman Sachs Global Investment Research

2

Growth has slowed in Israel in recent years…

driven partly by weak exports

10%

30%

GDP growth

9%

GDP grow th

8%

20%

7%

17.4%

15.1%

6.3%

5.8%

6%

15%

5.8%

10.4%

5.1%

5%

4.3%

3.0%

5%

3.2%

3%

2.2%

1.9%

0.9% 1.5%

0%

-0.2%

1.1%

-5% -2.2%

1%

-10%

0%

-0.1%

02

Export growth

-11.9%

-15%

03

6.5%

6.4%

4.6% 4.8%

3.5%

2%

8.0%

10%

4.2%

4%

-1%

Export growth

25%

04

05

06

07

08

09

10

11

12

13

14

02

03

04

05

06

07

08

09

10

11

12

13

14

Source: CBS, Haver Analytics

Goldman Sachs Global Investment Research

3

The stagnation in Israel’s exports is driven by

weak external demand…

A weaker currency leads to higher exports after a few

quarters (as the ‘quantity effect’ kicks in)…

Impact on exports following a 1% depreciation of the real

effective exchange rate

…while stronger external demand increases exports

instantaneously

Impact on exports following a 1pp improvement (qoq ann.) in

external demand

Source: Goldman Sachs Global Investment Research, Haver Analytics

Source: Goldman Sachs Global Investment Research, Haver Analytics

Goldman Sachs Global Investment Research

4

… but is also a function of the strong Shekel

appreciation

4.1

$/ILS

4.00

4.0

Gas production from the Tamar field (March 2013)

$/ILS

30 per. Mov. Avg. ($/ILS)

3.9

3.8

3.7

3.6

3.5

3.45

Nov-14

Aug-14

May-14

Feb-14

Nov-13

Aug-13

May-13

Feb-13

Nov-12

Aug-12

3.3

May-12

3.4

Source: Goldman Sachs Global Investment Research

Goldman Sachs Global Investment Research

5

The (labor intensive) low-tech manufacturing

goods are particularly sensitive to Shekel

appreciation

The manufacturing sector is more sensitive to

the real effective exchange rate…

Impact on exports following a 1% depreciation of the real

effective exchange rate

… except high technology exports, which

have a low price elasticity

Impact on exports following a 1pp improvement in external

demand

Source: Bank of Israel

Source: Goldman Sachs Global Investment Research, Haver Analytics

Goldman Sachs Global Investment Research

6

The strong Shekel is therefore a significant

concern for the Bank of Israel

Bank of Israel’s “tool box” to fight FX pressures:

A. Monetary policy (Cut rates by 300bp since mid-2011)

B. FX interventions (Re-introduced this tool in April 2013)

Policy mix has important implications for asset prices.

Goldman Sachs Global Investment Research

7

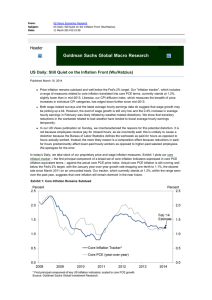

The BoI has eased monetary policy since

mid-2011…

%

BoI Policy Rate, lhs

4

3

2

1

0

08

09

10

11

12

13

14

15

Source: Haver Analytics, Goldman Sachs Global Investment Research

Goldman Sachs Global Investment Research

8

… and the BoI re-introduced FX interventions

as a policy tool back in early 2013

Bn USD

Bn USD / %

100

90

4

80

70

3

Jul 08 - Oct 09 Avg: $1.8bn

60

50

2

40

30

1

20

10

0

0

08

09

10

11

FX Interventions (bn US$), lhs

Low cost' FX gas program (scheduled)

BoI Policy Rate, lhs

12

13

14

15

'Low cost' FX gas program

QE

FX reserves (bn US$), rhs

Source: Bank of Israel, Haver Analytics

Goldman Sachs Global Investment Research

9

Lower interest rates may fuel the booming

housing market in Israel. Why has the BoI not

relied more aggressively on FX interventions?

10%

Real house price growth (per year)

Since 2008Q1

8%

Since 2012Q1

6%

4%

2%

0%

-2%

-4%

-6%

-8%

IRL

GRC

ESP

NLD

DNK

ITA

USA

JPN

GBR

PRT

FRA

FIN

KOR

NZL

BEL

AUS

SWE

NOR

CAN

DEU

AUT

CHE

ISR

-10%

Source: OECD

Goldman Sachs Global Investment Research

10

A build-up in FX reserves is likely to be driven

by three motives:

Flow motives:

To boost competitiveness: FX interventions designed to weaken the currency may be

used to stimulate economic growth via higher net exports. This motive is particularly strong

in current account surplus economies, which naturally experience large capital inflows.

Reduce FX Volatility: FX interventions can also be used to reduce exchange rate volatility

that arises as a result of speculative behaviour or ‘overshooting’ effects (in both directions).

Stock motive:

Precautionary reserves: Large FX reserves reduce the likelihood of a ‘sudden-stop’ in

capital inflows. Given the substantial economic costs associated with such 'sudden-stops',

countries may seek to hold substantial foreign currency reserves and this could have been

an important driver of the acceleration in FX accumulation from the mid-1990s.

Goldman Sachs Global Investment Research

11

There are ‘fiscal’ costs associated with FX

reserves…

The costs have risen as the BoI has accumulated larger FX reserves

Costs of FX reserves, per year, for different spreads

Source: Goldman Sachs Global Investment Research

Goldman Sachs Global Investment Research

12

…and the benefits diminish arguably after a

certain point.

20

Gains, Costs

18

Costs (A: High carry)

16

Costs (B: Low carry)

14

12

Gains

10

"Marginal benefits equals

marginal costs"

8

6

4

2

FX Reserves (% of short-term external debt)

0

0

100

Optimal FX reserves (A)

('High cost', e.g Turkey)

200

300

Optimal FX reserves (B)

('Low cost', e.g. Czech Rep)

400

Source: Goldman Sachs Global Investment Research

Goldman Sachs Global Investment Research

13

Approach I: The ‘optimal’ FX reserves level (which

balances the ‘costs’ and the precautionary benefits)

depends on different factors

The optimal level of FX reserves is inversely

related to the ‘opportunity cost’ spread…

Optimal FX reserves as a function of the opportunity costs

…but depends positively on the degree of risk aversion.

Optimal FX reserves as a function of the risk aversion

Source: Goldman Sachs Global Investment Research, Jeanne and Ranciere (2006)

CORRECT SOURCE

Goldman Sachs Global Investment Research

14

The cost-benefit trade-off of FX interventions

is less appealing today than it was back in

2008

The BoI’s FX reserves are above the optimal precautionary savings level.

BoI’s FX reserves vs. optimal level

Source: Goldman Sachs Global Investment Research

Goldman Sachs Global Investment Research

15

Approach II: Quantifying the ‘precautionary’

benefits associated with FX reserves

1%

Marginal effect on 'sudden-stop' probability*

(following a 1pp increase in factor)

0%

-1%

-2%

-3%

20pp increase in FX reserves

(% of short-term external debt)

-4%

-5%

CA surplus (% of GDP)

FX reserves

(% of short-term

external debt)

Currency overvaluation

(in %)

GDP growth (in %)

Source: Goldman Sachs Global Investment Research

Goldman Sachs Global Investment Research

16

Optimal level of CB FX reserves across EMs

(note that the Czech National Bank recently

introduced a ‘peg’ against the Euro)

500

450

400

FX reserves

(% of short-term

external debt)

'Optimal' level

of precautionary

reserves

350

300

250

200

150

100

50

0

Indonesia

Malaysia

Thailand

India

China

Chile

Mexico

Colombia

Brazil

Peru

Ukraine

Turkey

Poland

Czech

Republic

Hungary

South Africa

Israel

Russia

Source: Goldman Sachs Global Investment Research, IMF

Goldman Sachs Global Investment Research

17

Central banks in emerging markets have

increased their FX reserves over the past

decades

35

FX reserves (% of GDP)

30

Median

25

CEEMEA Avg

AEJ Avg

20

LATAM Avg

15

10

5

0

1980

1984

1988

1992

1996

2000

2004

2008

2012

Source: Goldman Sachs Global Investment Research

Goldman Sachs Global Investment Research

18

Shekel Outlook

Goldman Sachs Global Investment Research

19

Shekel Outlook – where are we going from

here? GS F’cast: $/ILS at 4.00 in 12 months.

4.1

$/ILS

4.00

4.0

Gas production from the Tamar field (March 2013)

$/ILS

30 per. Mov. Avg. ($/ILS)

3.9

3.8

3.7

3.6

3.5

3.45

Nov-14

Aug-14

May-14

Feb-14

Nov-13

Aug-13

May-13

Feb-13

Nov-12

Aug-12

3.3

May-12

3.4

Source: Goldman Sachs Global Investment Research

Goldman Sachs Global Investment Research

20

The Shekel continues to be overvalued

according to our preferred valuation metrics

5.0

$/ILS

$ILS > PPP: Israel price

level is below the US

USD/ILS

PPP Exchange Rate

GSDEER

4.0

$/ILS < PPP: Israel price

level is above the US

3.0

96

98

00

02

04

06

08

10

12

14

Source: Goldman Sachs Global Investment Research, World Bank

Goldman Sachs Global Investment Research

21

Institutional investors have bough large

amounts of foreign assets in recent years (but

since end-2012 they have been hedged).

25.0

% of total portf olio

20.0

21.9

22.8

12.6

12.8

21.0

20.5

17.6

15.9

15.0

13.6

11.4

10.0

9.9

10.9

11.4

8.6

7.3

7.6

10.8

12.4

12.6

12.5

8.8

8.4

5.0

D om es tic fi nancial investors foreign asset expos ure

D om es tic fi nancial investors F X exposure

0.0

2006

2007

2008

2009

2010

2011

2012

2013

14Q1

14Q2

14Q3

Source: Bank of Israel

Goldman Sachs Global Investment Research

22

Institutional investors' hedging demand

weakened in August and, especially, in

September.

2.0

1.5

Bn $

1.4

Jan-Jul: Foreign as s et purc has es are f ully 'hedged'

1.0

1.2

1.6

0.5

0.9

0.5

0.0

0.2

0.5

0.0

0.8

0.6

-0.5

- 0.9

- 1.0

0.5

0.2

0.0

-0.4

-0.5

0.7 0.3

0.6

- 0.3

-0.3

- 0.2

-0.5

-1.4

-0.5

-1.8

-1.0

C hange i n FX derivati ve exposure

-1.5

FX deriv ativ e ex pos ure ri ses

in September

T ransac tions in F X indexed ass ets

T ransac tions in F X denom inated as sets

-2.0

T otal FX transacti ons (i ncl. derivati ves)

-2.5

Jan-14

F eb-14

M ar-14

Apr-14

M ay-14

Jun-14

Jul -14

Aug-14

Sep-14

Source: Bank of Israel

Goldman Sachs Global Investment Research

23

Deflation risks have strengthened the BoI’s

motive to weaken the currency…

Goldman Sachs Global Investment Research

24

… and the BoI may hit the ‘zero lower bound’

and cut rates by 20bp (to 0.05%) in December

or 2015Q1…

Bn USD

Bn USD / %

100

90

4

80

70

3

Jul 08 - Oct 09 Avg: $1.8bn

60

50

2

40

30

1

20

10

0

0

08

09

10

11

FX Interventions (bn US$), lhs

Low cost' FX gas program (scheduled)

BoI Policy Rate, lhs

12

13

14

'Low cost' FX gas program

QE

FX reserves (bn US$), rhs

15

Source: Bank of Israel, Goldman Sachs Global Investment Research

Goldman Sachs Global Investment Research

25

… as the Shekel sell-off will not be strong enough to

prevent headline inflation from moving into negative

territory (due to fall in FX pass-through to inflation).

Goldman Sachs Global Investment Research

26

Disclaimer

I, Kasper Lund-Jensen, hereby certify that all of the views expressed in this report accurately reflect my personal views, which have not been influenced by considerations of the firm’s business or client

relationships.

Global product; distributing entities

The Global Investment Research Division of Goldman Sachs produces and distributes research products for clients of Goldman Sachs on a global basis. Analysts based in Goldman Sachs offices around the w orld produce equity

research on industries and companies, and research on macroeconomics, currencies, commodities and portfolio strategy. This research is disseminated in Australia by Goldman Sachs Australia Pty Ltd (ABN 21 006 797 897); in Brazil by

Goldman Sachs do Brasil Corretora de Títulos e Valores Mobiliários S.A.; in Canada by Goldman, Sachs & Co. regarding Canadian equities and by Goldman, Sachs & Co. (all other research); in Hong Kong by Goldman Sachs (Asia) L.L.C.;

in India by Goldman Sachs (India) Securities Private Ltd.; in Japan by Goldman Sachs Japan Co., Ltd.; in the Republic of Korea by Goldman Sachs (Asia) L.L.C., Seoul Branch; in New Zealand by Goldman Sachs New Zealand Limited; in

Russia by OOO Goldman Sachs; in Singapore by Goldman Sachs (Singapore) Pte. (Company Number: 198602165W); and in the United States of America by Goldman, Sachs & Co. Goldman Sachs International has approved this

research in connection w ith its distribution in the United Kingdom and European Union.

European Union: Goldman Sachs International authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, has approved this research in connection w ith its

distribution in the European Union and United Kingdom; Goldman Sachs AG and Goldman Sachs International Zw eigniederlassung Frankfurt, regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht, may also distribute research

in Germany.

General disclosures

This research is for our clients only. Other than disclosures relating to Goldman Sachs, this research is based on current public information that w e consider reliable, but w e do not represent it is accurate or complete, and it should not

be relied on as such. We seek to update our research as appropriate, but various regulations may prevent us from doing so. Other than certain industry reports published on a periodic basis, the large majority of reports are published at

irregular intervals as appropriate in the analyst's judgment.

Goldman Sachs conducts a global full-service, integrated investment banking, investment management, and brokerage business. We have investment banking and other business relationships w ith a substantial percentage of the

companies covered by our Global Investment Research Division. Goldman, Sachs & Co., the United States broker dealer, is a member of SIPC (http://w w w .sipc.org).

Our salespeople, traders, and other professionals may provide oral or w ritten market commentary or trading strategies to our clients and our proprietary trading desks that reflect opinions that are contrary to the opinions expressed in

this research. Our asset management area, our proprietary trading desks and investing businesses may make investment decisions that are inconsistent w ith the recommendations or view s expressed in this research.

The analysts named in this report may have from time to time discussed w ith our clients, including Goldman Sachs salespersons and traders, or may discuss in this report, trading strategies that reference catalysts or events that may

have a near-term impact on the market price of the equity securities discussed in this report, w hich impact may be directionally counter to the analysts' published price target expectations for such stocks. Any such trading strategies are

distinct from and do not affect the analysts' fundamental equity rating for such stocks, w hich rating reflects a stock's return potential relative to its coverage group as described herein.

We and our affiliates, officers, directors, and employees, excluding equity and credit analysts, w ill from time to time have long or short positions in, act as principal in, and buy or sell, the securities or derivatives, if any, referred to in this

research.

The view s attributed to third party presenters at Goldman Sachs arranged conferences, including individuals from other parts of Goldman Sachs, do not necessarily reflect those of Global Investment Research and are not an official

view of Goldman Sachs.

Any third party referenced herein, including any salespeople, traders and other professionals or members of their household, may have positions in the products mentioned that are inconsistent w ith the view s expressed by analysts

named in this report.

This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction w here such an offer or solicitation w ould be illegal. It does not constitute a personal recommendation or take into account the

particular investment objectives, financial situations, or needs of individual clients. Clients should consider w hether any advice or recommendation in this research is suitable for their particular circumstances and, if appropriate, seek

professional advice, including tax advice. The price and value of investments referred to in this research and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed,

and a loss of original capital may occur. Fluctuations in exchange rates could have adverse effects on the value or price of, or income derived from, certain investments.

Certain transactions, including those involving futures, options, and other derivatives, give rise to substantial risk and are not suitable for all investors. Investors should review current options disclosure documents w hich are available

from Goldman Sachs sales representatives or at http://w w w .theocc.com/about/publications/character-risks.jsp. Transaction costs may be significant in option strategies calling for multiple purchase and sales of options such as

spreads. Supporting documentation w ill be supplied upon request.

In producing research reports, members of the Global Investment Research Division of Goldman Sachs Australia may attend site visits and other meetings hosted by the issuers the subject of its research reports. In some instances the

costs of such site visits or meetings may be met in part or in w hole by the issuers concerned if Goldman Sachs Australia considers it is appropriate and reasonable in the specific circumstances relating to the site visit or meeting.

All research reports are disseminated and available to all clients simultaneously through electronic publication to our internal client w ebsites. Not all research content is redistributed to our clients or available to third-party aggregators, nor

is Goldman Sachs responsible for the redistribution of our research by third party aggregators. For all research, models or other data available on a particular security, please contact your sales representative or go to http://360.gs.com.

Disclosure information is also available at http://w w w .gs.com/research/hedge.html or from Research Compliance, 200 West Street, New York, NY 10282.

© 2014 Goldm an Sachs.

No part of this m aterial m ay be (i) copied, photocopied or duplicated in any form by any m eans or (ii) redistributed w ithout the prior w ritten consent of The Goldm an Sachs Group, Inc.

Goldman Sachs Global Investment Research

27