Goldman Sachs Global Macro Research

advertisement

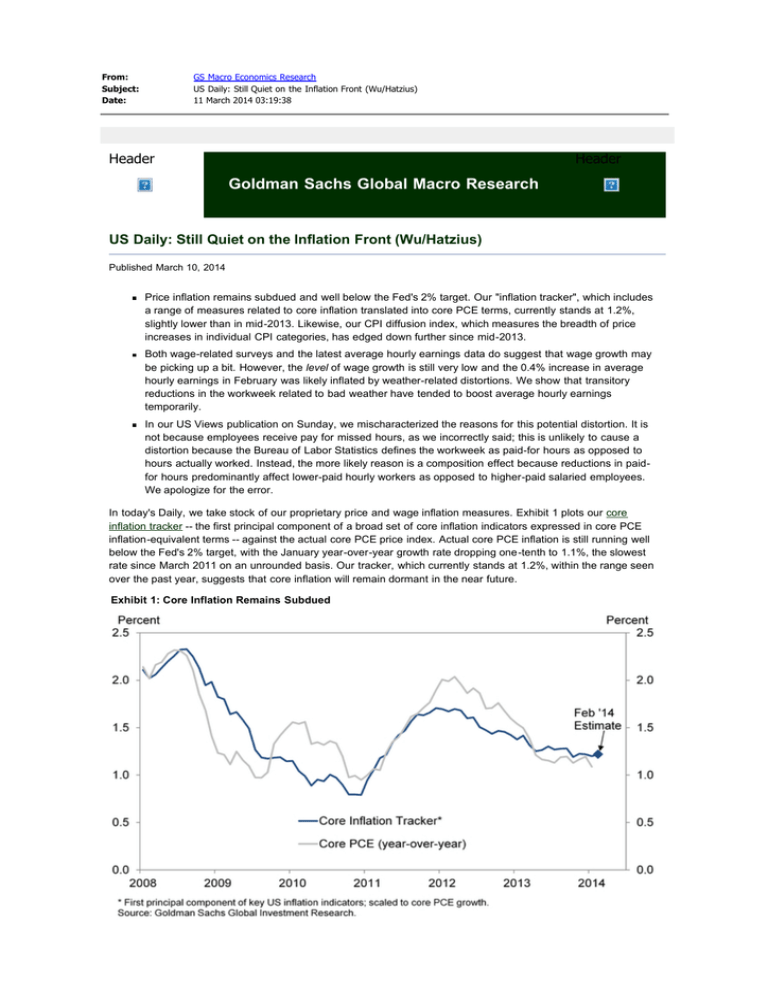

From: Subject: Date: GS Macro Economics Research US Daily: Still Quiet on the Inflation Front (Wu/Hatzius) 11 March 2014 03:19:38 Header Header Goldman Sachs Global Macro Research US Daily: Still Quiet on the Inflation Front (Wu/Hatzius) Published March 10, 2014 Price inflation remains subdued and well below the Fed's 2% target. Our "inflation tracker", which includes a range of measures related to core inflation translated into core PCE terms, currently stands at 1.2%, slightly lower than in mid-2013. Likewise, our CPI diffusion index, which measures the breadth of price increases in individual CPI categories, has edged down further since mid-2013. Both wage-related surveys and the latest average hourly earnings data do suggest that wage growth may be picking up a bit. However, the level of wage growth is still very low and the 0.4% increase in average hourly earnings in February was likely inflated by weather-related distortions. We show that transitory reductions in the workweek related to bad weather have tended to boost average hourly earnings temporarily. In our US Views publication on Sunday, we mischaracterized the reasons for this potential distortion. It is not because employees receive pay for missed hours, as we incorrectly said; this is unlikely to cause a distortion because the Bureau of Labor Statistics defines the workweek as paid-for hours as opposed to hours actually worked. Instead, the more likely reason is a composition effect because reductions in paidfor hours predominantly affect lower-paid hourly workers as opposed to higher-paid salaried employees. We apologize for the error. In today's Daily, we take stock of our proprietary price and wage inflation measures. Exhibit 1 plots our core inflation tracker -- the first principal component of a broad set of core inflation indicators expressed in core PCE inflation-equivalent terms -- against the actual core PCE price index. Actual core PCE inflation is still running well below the Fed's 2% target, with the January year-over-year growth rate dropping one-tenth to 1.1%, the slowest rate since March 2011 on an unrounded basis. Our tracker, which currently stands at 1.2%, within the range seen over the past year, suggests that core inflation will remain dormant in the near future. Exhibit 1: Core Inflation Remains Subdued Our inflation "heat map" provides a more detailed temperature check on the full range of indicators that go into our inflation tracker. Specifically, the heat map shows the level of core (and headline) PCE inflation consistent with the latest readings of each indicator. Exhibit 2 shows that, while actual core PCE inflation stands near the bottom of the range, the implied levels of most other indicators are also subdued, averaging roughly 1.5% on a year-over-year basis. Exhibit 2: Inflation Tracker Heat Map The consumer price index remains benign as well, as both the January headline and core CPI rose only 1.6% on a year-over-year basis. Our unweighted CPI diffusion index has also fallen steadily over the past year (Exhibit 3). It is constructed by seasonally adjusting all 178 individual CPI categories for which we have sufficient data, calculating the month-to-month change, and then reporting the percentage of categories showing price increases plus half the percentage showing no change. That is, values above 50 indicate that more categories are seeing price increases than decreases; the higher above 50, the greater the breadth of price increases relative to price decreases. (We perform our own seasonal adjustment because the Labor Department only provides seasonally adjusted CPI data for a subset of product categories.) The latest readings on both a monthly and a 12-month average basis stand at the lower end of the range seen over the past three years, suggesting that price increases are not particularly widespread across categories. Exhibit 3: Less Breadth of Price Increases Across CPI Categories On the wage front, there is tentative evidence that wage growth may be picking up a bit. Our wage survey leading indicator, which summarizes wage and income-related questions from three consumer surveys and seven business surveys -- points to a pickup in wage growth to around 2.3% at an annualized rate (Exhibit 4). Furthermore, the latest February average hourly earnings for production and nonsupervisory workers jumped 0.4%, the highest since January 2011, while the year-over-year growth rate rose to 2.5%, the highest since October 2010. Exhibit 4: Wage Inflation May Pick Up, But From a Low Level Despite these signs suggesting a pickup in wage growth, we do not expect upward pressure on inflation from the wage side at the moment for two reasons. First, the level of wage growth is still very low. As shown in Exhibit 4, our wage tracker -- the first principal component of average hourly earnings for production and nonsupervisory workers, the employment cost index, and hourly compensation in the nonfarm business sector -- shows nominal wage growth of only 1.5% at an annual rate in 13Q4 and has remained around 2% since the recovery, well below the 3%-4% pace that is probably consistent with the Fed’s 2% inflation target. Second, as discussed in the latest US Views, we would discount February's 0.4% increase in average hourly earnings because weather-related, transitory reductions in the workweek have historically often led to a transitory increase in average hourly earnings. Exhibit 5 shows all nine instances going back to 1964 in which the workweek for production and nonsupervisory workers dropped by at least 0.2 hours in a winter month and rebounded by at least 0.2 hours the following month. On average, these nine episodes show earnings growth of 0.17pp above the centered 7-month average. The three episodes with the largest workweek declines—January 1978, January 1982, and January 1996—show earnings growth of 0.36pp above the centered 7-month average. These deviations are typically reversed the next month, which strongly hints at a weather-related distortion. Exhibit 5: Historical Episodes Suggest Weather-Related Distortion to Average Hourly Earnings Growth What is the reason for this distortion? It is not because employees receive pay for missed hours, as we incorrectly said in our US Views publication; such a distortion is unlikely because the Bureau of Labor Statistics defines the workweek as paid-for hours as opposed to hours actually worked. Instead, the more likely reason is a composition effect that arises because reductions in paid-for hours predominantly affect lower-paid hourly workers as opposed to higher-paid salaried employees. To take a highly stylized example, if there are as many salaried workers as hourly workers, if salaried workers are on average paid twice as much as hourly employees, and if a 0.2-hour (0.6%) drop in the workweek is all due to hourly employees, then this drop will boost measured average hourly earnings by about 0.2% purely through composition effects. If this example is close to reality, the underlying growth of average hourly earnings in February may well have been only half the 0.4% reported rate. Shuyan Wu Jan Hatzius Jan Hatzius - Goldman, Sachs & Co. (212) 902-0394 jan.hatzius@gs.com Alec Phillips - Goldman, Sachs & Co. (202) 637-3746 alec.phillips@gs.com Jari Stehn - Goldman, Sachs & Co. (212) 357-6224 jari.stehn@gs.com Kris Dawsey - Goldman, Sachs & Co. (212) 902-3393 kris.dawsey@gs.com David Mericle - Goldman, Sachs & Co. (212) 357-2619 david.mericle@gs.com Shuyan Wu - Goldman, Sachs & Co. (212) 902-3053 shuyan.wu@gs.com Michael Cahill - Goldman, Sachs & Co. (801) 884-4621 michael.e.cahill@gs.com Click here to view the printer-friendly version of this document. To provide feedback, please click here To change your interests or unsubscribe (if you no longer wish to receive these messages), please click the following: https://360.gs.com/gir/portal/research/alertsetup Legal Disclaimers & Disclosures: https://360.gs.com/gs/portal?action=redirect&redirect.alias=disclaimers Important Information About Goldman Sachs Global Investment Research: https://360.gs.com/gir/portal?action=redirect&redirect.node=navigation.portal.disclaimer.ir Contact Us: gs360help@gs.com US & Canada 1-866-727-7000 The Americas 1-212-357-9994 Europe & Africa 44-20-7552-2555 Asia 81-3-6437-4844 If you have any difficulties accessing the above links contact eco-ldn-production@gs.com