FREE Sample Here - Find the cheapest test bank for your

advertisement

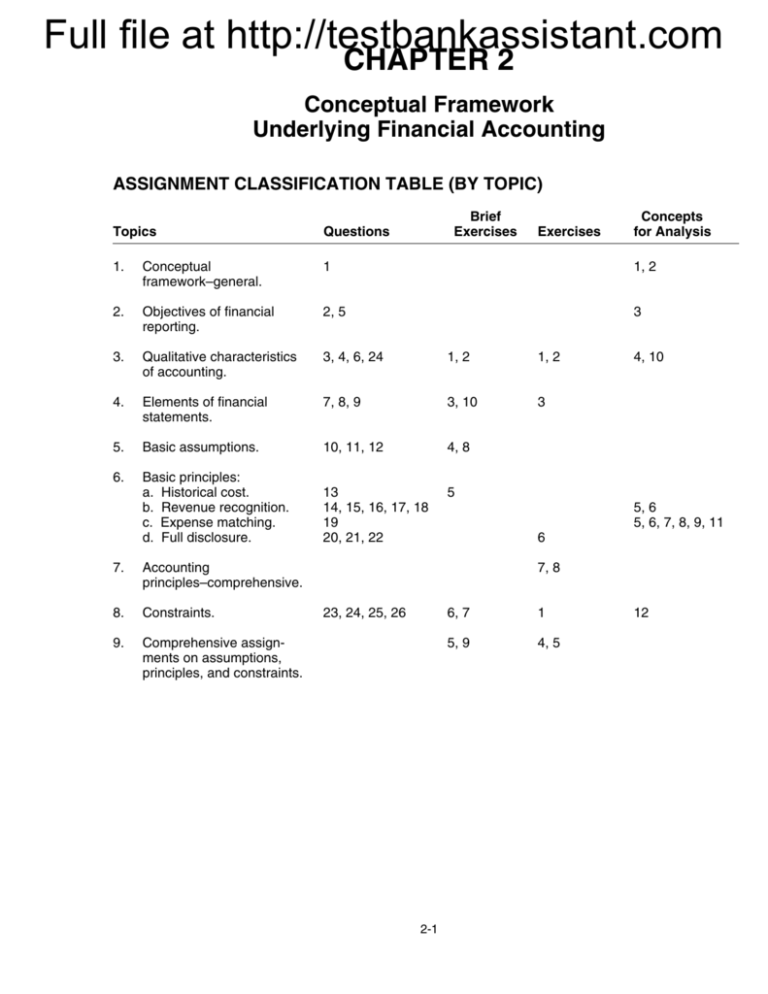

Full file at http://testbankassistant.com CHAPTER 2 Conceptual Framework Underlying Financial Accounting ASSIGNMENT CLASSIFICATION TABLE (BY TOPIC) Brief Exercises Questions 1. Conceptual framework–general. 1 1, 2 2. Objectives of financial reporting. 2, 5 3 3. Qualitative characteristics of accounting. 3, 4, 6, 24 1, 2 1, 2 4. Elements of financial statements. 7, 8, 9 3, 10 3 5. Basic assumptions. 10, 11, 12 4, 8 6. Basic principles: a. Historical cost. b. Revenue recognition. c. Expense matching. d. Full disclosure. 13 14, 15, 16, 17, 18 19 20, 21, 22 5 7. Accounting principles–comprehensive. 8. Constraints. 9. Comprehensive assignments on assumptions, principles, and constraints. Exercises Concepts for Analysis Topics 4, 10 5, 6 5, 6, 7, 8, 9, 11 6 7, 8 23, 24, 25, 26 2-1 6, 7 1 5, 9 4, 5 12 Full file at http://testbankassistant.com ASSIGNMENT CLASSIFICATION TABLE (BY LEARNING OBJECTIVE) Learning Objectives Brief Exercises Exercises 1. Describe the usefulness of a conceptual frame work. 2. Describe the FASB’s efforts to construct a conceptual framework. 3. Understand the objectives of financial reporting. 4. Identify the qualitative characteristics of accounting information. 1, 2 1, 2 5. Describe the basic elements of financial statements. 3, 10 3 6. Describe the basic assumptions of accounting. 4, 8, 9 4, 5 7. Explain the application of the basic principles of accounting. 5, 9 4, 5, 6, 7, 8 8. Describe the impact that constraints have on reporting accounting information. 6, 7, 9 1, 4, 5 2-2 Full ASSIGNMENT file at http://testbankassistant.com CHARACTERISTICS TABLE Item Description Level of Difficulty E2-1 E2-2 E2-3 E2-4 E2-5 E2-6 E2-7 E2-8 Qualitative characteristics. Qualitative characteristics. Elements of financial statements. Assumptions, principles, and constraints. Assumptions, principles, and constraints. Full disclosure principle. Accounting principles–comprehensive. Accounting principles–comprehensive. Moderate Simple Simple Simple Moderate Complex Moderate Moderate 25–30 15–20 15–20 15–20 20–25 20–25 20–25 20–25 CA2-1 CA2-2 CA2-3 CA2-4 CA2-5 CA2-6 CA2-7 CA2-8 CA2-9 CA2-10 CA2-11 CA2-12 Conceptual framework–general. Conceptual framework–general. Objectives of financial reporting. Qualitative characteristics. Revenue recognition and matching principle. Revenue recognition and matching principle. Matching principle. Matching principle. Matching principle. Qualitative characteristics. Matching–ethics. Cost/Benefit. Simple Simple Moderate Moderate Complex Moderate Complex Moderate Moderate Moderate Moderate Moderate 20–25 25–35 25–35 30–35 25–30 30–35 20–25 20–25 20–30 20–30 20–25 30–35 2-3 Time (minutes) Full file at http://testbankassistant.com LEARNING OBJECTIVES 1. 2. 3. 4. 5. 6. 7. 8. Describe the usefulness of a conceptual framework. Describe the FASB’s efforts to construct a conceptual framework. Understand the objectives of financial reporting. Identify the qualitative characteristics of accounting information. Define the basic elements of financial statements. Describe the basic assumptions of accounting. Explain the application of the basic principles of accounting. Describe the impact that constraints have on reporting accounting information. 2-4 Full CHAPTER file atREVIEW http://testbankassistant.com 1. Chapter 2 outlines the development of a conceptual framework for financial accounting and reporting by the FASB. The entire conceptual framework is affected by the environmental aspects discussed in Chapter 1. It is composed of basic objectives, fundamental concepts, and operational guidelines. These notions are discussed in Chapter 2 and should enhance your understanding of the topics covered in intermediate accounting. Conceptual Framework 2. (S.O. 1) A conceptual framework in accounting is important because it can lead to consistent standards and it prescribes the nature, function, and limits of financial accounting and financial statements. The benefits its development will generate can be characterized as follows: (a) it should be easier to promulgate a coherent set of standards and rules; and (b) practical problems should be more quickly solved. 3. (S.O. 2) The FASB recognized the need for a conceptual framework upon which a consistent set of financial accounting standards could be based. The FASB has issued six Statements of Financial Accounting Concepts (SFAC) that relate to financial reporting. They are listed and described briefly below: SFAC No. 1. “Objectives of Financial Reporting by Business Enterprises” presents the goals and purposes of accounting. SFAC No. 2. “Qualitative Characteristics of Accounting Information” examines the characteristics that make accounting information useful. SFAC No. 3. “Elements of Financial Statements of Business Enterprises” defines the broad classifications of items found in financial statements. SFAC No. 5. “Recognition and Measurement in Financial Statements of Business Enterprises” gives guidance on what information should be formally incorporated into financial statements and when. SFAC No. 6. “Elements of Financial Statements” replaces SFAC No. 3 and expands its scope to include not-for-profit organizations. SFAC No. 7. “Using Cash Flow Information and Present Value in Accounting Measurements,” provides a framework for using expected future cash flows and present values as a basis for measurement. Basic Objectives 4. (S.O. 3) SFAC No. 1 describes the objectives of financial reporting as the presentation of information that is useful (a) in making investment and credit decisions, (b) in assessing cash flow prospects, and (c) in learning about economic resources, claims to those resources, and changes in them. SFAC No. 2 identifies the primary and secondary qualitative characteristics of accounting information that distinguish better (more useful) information from inferior (less useful) information for decision-making purposes. 2-5 Full file at http://testbankassistant.com Primary Qualities 5. (S.O. 4) The primary qualities that make accounting information useful for decision making are relevance and reliability. Relevance. Accounting information is relevant if it is capable of making a difference in a decision. For information to be relevant, it should have predictive or feedback value, and it must be presented on a timely basis. Reliability. Accounting information is reliable to the extent that it is verifiable, is a faithful representation, and is reasonably free of error and bias. To be reliable, accounting information must possess three key characteristics: (a) verifiability, (b) representational faithfulness, and (c) neutrality. Secondary Qualities 6. The secondary qualities identified are comparability and consistency. Comparability. Accounting information that has been measured and reported in a similar manner for different enterprises is considered comparable. Consistency. Accounting information is consistent when an entity applies the same accounting treatment to similar events from period to period. Basic Elements 7. (S.O. 5) An important aspect of developing an accounting theoretical structure is the body of basic elements or definitions. Ten basic elements that are most directly related to measuring the performance and financial status of an enterprise are formally defined in SFAC No. 6. These elements, as defined below, are further discussed and interpreted throughout the text. Assets. Probable future economic benefits obtained or controlled by a particular entity as a result of past transactions or events. Liabilities. Probable future sacrifices of economic benefits that arise from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events. Equity. Residual interest in the assets of an entity that remains after deducting its liabilities. In a business enterprise, the equity is the ownership interest. Investments by Owners. Increases in net assets of a particular enterprise resulting from transfers to it from other entities of something of value to obtain or increase ownership interests (or equity) in it. Assets are most commonly received as investments by owners, but that which is received may include services or satisfaction or conversion of liabilities of the enterprise. 2-6 Full file at http://testbankassistant.com Distributions to Owners. Decreases in net assets of a particular enterprise that result from transferring assets, rendering services, or incurring liabilities by the enterprise to owners. Distributions to owners decrease ownership interests (or equity) in an enterprise. Comprehensive Income. Change in equity (net assets) of an entity during a period from transactions and other events and circumstances from nonowner sources. It includes all changes in equity during a period, except those resulting from investments by owners and distributions to owners. Revenues. Inflows or other enhancements of assets of an entity or settlement of its liabilities (or a combination of both) during a period from delivering or producing goods, rendering services, or other activities that constitute the entity’s ongoing major or central operations. Expenses. Outflows or other using up of assets or incurrences of liabilities (or a combination of both) during a period from delivering or producing goods, rendering services, or carrying out other activities that constitute the entity’s ongoing major or central operations. Gains. Increases in equity (net assets) from peripheral or incidental transactions of an entity and from all other transactions and other events and circumstances affecting the entity during a period except those that result from revenues or investments by owners. Losses. Decrease in equity (net assets) from peripheral or incidental transactions of an entity from all other transactions and other events and circumstances affecting the entity during a period except those that result from expenses or distributions to owners. Basic Assumptions 8. (S.O. 6) In the practice of financial accounting, certain basic assumptions are important to an understanding of the manner in which data are presented. The following four basic assumptions underlie the financial accounting structure: Economic Entity Assumption. The economic activities of an entity can be accumulated and reported in a manner that assumes the entity is separate and distinct from its owners or other business units. Going Concern Assumption. In the absence of contrary information, a business entity is assumed to have a long life. The current relevance of the historical cost principle is dependent on the going-concern assumption. Monetary Unit Assumption. Money is the common denominator of economic activity and provides an appropriate basis for accounting measurement and analysis. The monetary unit is assumed to remain relatively stable over the years in terms of purchasing power. In essence, this assumption disregards any inflation or deflation in the economy in which the entity operates. 2-7 Full file at http://testbankassistant.com Periodicity Assumption. The life of an economic entity can be divided into artificial time periods for the purpose of providing periodic reports on the economic activities of the entity. As you progress through the remaining chapters in the text, the reasoning behind these assumptions should become more apparent. Basic Principles 9. (S.O. 7) Certain basic principles are followed by accountants in recording the transactions of a business entity. These principles relate basically to how assets, liabilities, revenues, and expenses are to be identified, measured, and reported. The following is a brief review of the basic principles considered in Chapter 2 of the text: Historical Cost Principle. Acquisition cost is considered a reliable basis upon which to account for assets and liabilities of a business enterprise. Cost has been found to be a more stable and consistent benchmark than other suggested valuation methods. Recently, the FASB appears to support greater use of fair value measurements in the financial statements. Revenue Recognition Principle. Revenue is recognized (1) when realized or relizable and (2) when earned. Recognition at the time of sale provides a uniform and reasonable test. Certain variations in the revenue recognition principle include: certain long-term construction contracts, end-of-production recognition, and recognition upon receipt of cash. Matching Principle. Accountants attempt to match expenses incurred while earning revenues with the related revenues. Use of accrual accounting procedures assists the accountant in allocating revenues and expenses properly among the fiscal periods that compose the life of a business enterprise. Full Disclosure Principle. In the preparation of financial statements, the accountant should include sufficient information to permit the knowledgeable reader to make an informed judgment about the financial condition of the enterprise in question. Constraints 10. (S.O. 8) Although accounting theory is based upon certain assumptions and the application of basic principles, there are some exceptions to these assumptions. These exceptions, often called constraints, sometimes justify departures from basic accounting theory. The constraints presented in Chapter 2 are the following: Cost-Benefit Relationship. This constraint relates to the notion that the benefits to be derived from providing certain accounting information should exceed the costs of providing that information. The difficulty in cost-benefit analysis is that the costs and especially the benefits are not always evident or measurable. 2-8 Full file at http://testbankassistant.com Materiality. In the application of basic accounting theory, an amount may be considered less important because of its size in comparison with revenues and expenses, assets and liabilities, or net income. Deciding when an amount is material in relation to other amounts is a matter of judgment and professional expertise. The accounting for immaterial items need not follow GAAP. Industry Practices. Basic accounting theory may not apply with equal relevance to every industry that accounting must serve. The fair presentation of financial position and results of operations for a particular industry may require a departure from basic accounting theory because of the peculiar nature of an event or practice common only to that industry. Conservatism. When in doubt, an accountant should choose a solution that will be least likely to overstate assets and income. The conservatism constraint should be applied only when doubt exists. An intentional understatement of assets or income is not acceptable accounting. 2-9 Full file at http://testbankassistant.com LECTURE OUTLINE The material in this chapter can usually be covered in two class sessions. The first class session can be used for lecture and discussion of the concepts presented in the chapter. The second class session can be used to develop student’s understanding of these concepts by applying them to specific accounting situations. Students frequently believe that they understand the concepts but have difficulty correctly identifying improper accounting procedures in practical situations. Apparently, students are not alone in this difficulty. The conceptual framework structure described in the chapter includes SFAC No. 5, “Recognition and Measurement in Financial Statements.” SFAC No. 5 indicates that an information item should meet four fundamental recognition criteria to be recognized in the financial statements: (1) Definitions. The item meets the definition of an element of financial statements. (2) Measurability. It has a relevant attribute (e.g., historical cost, current cost, etc.) which is measurable with sufficient reliability. (3) Relevance. The information is capable of making a difference in user decisions. (4) Reliability. The information is representationally faithful, verifiable, and neutral. Because current practice is generally consistent with these criteria, the overall approach of Chapter 2 remains unchanged. We have incorporated SFAC No. 5 into the third level of Illustrations 2-1 and 2-2. This was done by grouping the assumptions, principles, and constraints of the third level under the heading “Recognition and Measurement Concepts.” TEACHING TIP The issues discussed in the chapter can be integrated by using the following illustrations. Illustration 2-1 might be put up first to show the relationship between objectives, characteristics, elements, assumptions, principles, and constraints. The relationship between the three levels could be emphasized. The Illustration 2-2 could be used to fill in the details of the six categories of items by listing the objectives, characteristics, elements, etc., and describing each one in some detail. Illustration 2-3 could then be used for a more detailed discussion of the qualitative characteristics, pointing out their hierarchical nature, the tradeoffs that are implied, and the components of the primary qualities. Illustration 2-4 can be used in defining the elements of financial statements. A. (L.O. 1) Need for a Conceptual Framework. 1. Coherence in rules and standards. 2. Quick solutions to new and emerging practical problems by reference to an existing framework of basic theory. 3. Increased user understanding of and confidence in financial reporting. 4. Enhanced comparability among companies’ financial statements. 2-10 Full file at http://testbankassistant.com B. (L.O. 2) Development of a Conceptual Framework. TEACHING TIP Describe the components of the conceptual framework as shown in Illustration 2-1. You may wish to point out the expanding nature of this cone shaped diagram. That is, the objectives of the first level are the beginning point of the conceptual framework. The objectives describe the goals and purposes of financial accounting. The next level up includes the qualitative characteristics and the elements of financial statements. This second level serves as a bridge between the objectives and the recognition and measurement concepts of the third level. The third level consists of the recognition and measurement concepts which implement the basic objectives of this first level. C. (L.O. 3) First Level: Objectives. (Recall that these were discussed in Chapter 1). TEACHING TIP Describe the details of the conceptual framework as shown in Illustration 2-2. 1. Information that is useful to present and potential investors and creditors in making rational investment, credit, and similar decisions. 2. Information to help present and potential investors and creditors and other users in assessing the amount, timing, and uncertainty of future cash flows. 3. Information about the economic resources of an enterprise, the claims on those resources, and the effects of transactions, events, and circumstances that change its resources and claims to those resources. D. (L.O. 4) Second Level: Qualitative Characteristics and Elements. TEACHING TIP Describe qualitative characteristics of accounting information using Illustration 2-3. 1. Qualitative characteristics. The overriding criterion for evaluating accounting information is that it must be useful for decision making. To be useful, it must be understandable. a. Primary qualities of useful accounting information. (1) Relevance. Accounting information is relevant if it is capable of making a difference in a decision. Relevant information has (a) Predictive value. (b) Feedback value. (c) Timeliness. 2-11 Full file at http://testbankassistant.com (2) Reliability. Accounting information is reliable to the extent that users can depend on it to represent the economic conditions or events that it purports to represent. Reliable information has (a) Verifiability. (b) Representational faithfulness. (c) Neutrality. b. Secondary qualities of useful accounting information. (1) Comparability. Accounting information that has been measured and reported in a similar manner for different enterprises is considered comparable. (2) Consistency. Accounting information is consistent when an entity applies the same accounting treatment from period to period to similar accountable events. 2. (L.O. 5) Elements. (See text page 35 for definitions.) Items a-c are elements at a moment in time. Items d-j are elements during a period of time. TEACHING TIP Discuss the elements of financial statements using Illustration 2-4. Stress the time frame of each element and the articulation of amounts. a. Assets. b. Liabilities. c. Equity. d. Investments by owners. e. Distributions to owners. f. Comprehensive income. g. Revenues. h. Expenses. i. Gains. j. Losses. E. (L.O. 6) Third Level: Recognition and Measurement Concepts. 1. Assumptions. a. Economic entity assumption—economic activity can be identified with a particular unit of accountability. 2-12 Full file at http://testbankassistant.com 2. b. Going concern assumption—business enterprises will have a long enough life to justify the use of accruals and deferrals. c. Monetary unit assumption—the monetary unit (i.e., the dollar) is the most effective means of expressing to interested parties changes in capital and exchanges of goods and services. A second assumption is that the monetary unit remains reasonably stable. Note that during the inflationary period of the 1970s this assumption was criticized by many accountants. d. Periodicity assumption—activities of an enterprise can be divided into artificial time periods. (L.O. 7) Principles. a. Historical cost principle—definite and objective, not subject to interpretation. b. Revenue recognition principle—revenue is recognized when the earning process is virtually complete and an exchange transaction has occurred. Exceptions to the revenue recognition principle include: (1) During production—e.g., long-term construction contracts. (2) End of production—e.g., agricultural products, gold. (3) Receipt of cash—e.g., installment sales accounting. c. Matching principle—efforts (expenses) should be matched with accomplishments (revenues) if feasible. (1) Practical rules for expense matching: Analyze costs to determine whether a relationship exists with revenue. (a) When direct association exists, expense costs against revenues in the period when the revenue is recognized. (b) When association exists but is difficult to identify, allocate costs rationally and systematically to expense in the periods benefited. (c) When little if any association exists, expense immediately. d. Full disclosure principle—revealing in financial statements any facts of sufficient importance to influence the judgment and decisions of an informed reader. (Develop concept of reasonably prudent investor.) Discuss use of notes and supplementary information in financial reporting. 2-13 Full file at http://testbankassistant.com 3. (L.O. 8) Constraints modifying basic theory: a. Cost-benefit—the benefit to be derived from having accounting information should exceed the cost of providing it. Frequently it is easier to assess the costs than it is to determine the benefits of providing a particular item of information. b. Materiality—if the amount is significant when compared with other items, sound and acceptable standards should be followed. (1) The determination of materiality requires considerable judgment; a potential for abuse exists. (2) Occasionally students erroneously believe that immaterial items need not be recorded. Remind them that immaterial items are recorded but need not be separately disclosed. c. Industry practice—peculiar nature of industry or business may result in variation. d. Conservatism—when in doubt choose the solution that will be least likely to overstate assets and income. 2-14 2-15 First Level Source: Kieso, Weygandt and Warfield, Intermediate Accounting, 12th Edition OBJECTIVES of financial reporting Third Level Second Level CONSTRAINTS ELEMENTS of financial statements PRINCIPLES QUALITATIVE CHARACTERISTICS of accounting information ASSUMPTIONS Recognition and Measurement Concepts Full ILLUSTRATION file at http://testbankassistant.com 2-1 A CONCEPTUAL FRAMEWORK FOR FINANCIAL REPORTING 2-16 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. First Level Source: Kieso, Weygandt and Warfield, Intermediate Accounting, 12th Edition Provide information: 1. Useful in investment and credit decisions. 2. Useful in assessing future cash flows. 3, About enterprise resources, claims to resources, and changes in them. Assets Liabilities Equity Investment by owners Distribution to owners Comprehensive income Revenues Expenses Gains Losses ELEMENTS OBJECTIVES 1. Primary qualities A. Relevance (1) Predictive value (2) Feedback value (3) Timeliness B. Reliability (1) Verifiability (2) Representational faithfulness (3) Neutrality 2. Secondary qualities A. Comparability B. Consistency QUALITATIVE CHARACTERISTICS Third Level Second Level Cost-benefit Materiality Industry practice Conservatism CONSTRAINTS 1. 2. 3. 4. Historical cost Revenue recognition Matching Full disclosure PRINCIPLES 1. 2. 3. 4. 1. 2. 3. 4. Economic entity Going concern Monetary unit Periodicity ASSUMPTIONS Recognition and Measurement Concepts ILLUSTRATION 2-2 A CONCEPTUAL FRAMEWORK FOR FINANCIAL REPORTING (with details) Full file at http://testbankassistant.com 2-17 Secondary Qualities Ingredients of Primary Qualities Primary Qualities Pervasive Criterion User-Specific Qualities Constraints Users of Accounting Information Predictive Value Comparability Feedback Value RELEVANCE UNDERSTANDABILITY Timeliness Verifiability Consistency Representational Faithfulness RELIABILITY Neutrality MATERIALITY (Threshold for Recognition) DECISION USEFULNESS COSTS < BENEFITS (Pervasive Constraint) DECISION MAKERS AND THEIR CHARACTERISTICS Full ILLUSTRATION file at http://testbankassistant.com 2-3 A HIERARCHY OF ACCOUNTING QUALITIES Full file at http://testbankassistant.com ILLUSTRATION 2-4 ELEMENTS OF FINANCIAL STATEMENTS Transactions and events that change resources and claims to resources over a period of time (Changes in Financial Position) Resources and claims to resources at a moment in time (Financial Position) 1. ASSETS 4. INVESTMENT BY OWNERS 2. LIABILITIES 5. DISTRIBUTION TO OWNERS 3. EQUITY 6. COMPREHENSIVE INCOME 7. REVENUES 8. EXPENSES 9. GAINS 10. LOSSES ARTICULATION 2-18