Financial Accounting Concepts & Principles: FASB, GAAP, SEC

advertisement

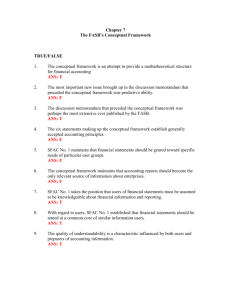

Introduction A major part of understanding financial accounting is understanding the basic concepts and principles on which financial accounting and reporting are based. Notice that we studying financial accounting and reporting. The procedures used to prepare the financial statements and financial information are only a means to an end. The goal is to produce information that can be used by decision makers (both internal and external). The first part of the course deals with financial accounting. Financial accounting is concerned with the way businesses communicate financial information to the public: the various categories of people who invest in, lend money to, or do business with an entity. Listed below are concepts, principles, definitions, and organizations that you will need to understand in order to prepare financial information: 1. Financial Accounting Standards Board (FASB) The FASB is the rule-making body that establishes financial accounting concepts and standards. The FASB has 7 voting members. These members devote their full time to their duties at the FASB and must resign from their prior organizations. Members cannot hold investments in companies in order to ensure objectivity. Members are not required to be CPAs (although many are) and have distinguished themselves as being among the most knowledgeable regarding financial accounting and reporting and business generally. The FASB is financed by fees collected from public accounting firms that audit publicly traded companies. The FASB emphasizes a due process in which those affected by the rules the FASB promulgates are allowed express their views regarding the setting of standards of financial accounting and reporting. 2. Generally Accepted Accounting Principles (GAAP) Generally accepted accounting principles are broad guidelines, conventions, rules, and procedures of financial accounting from two main sources: a. Pronouncements from designated authoritative bodies (such as FASB) that must be followed in all applicable cases. b. Accounting practices that have been developed by respected bodies and industries or that have evolved over time. 3. Independent Auditors A professional accountant in public practice who expresses a written opinion on whether an entity’s financial statements present fairly the entity’s financial position and results of operations. A professional accountant must be licensed as a certified public accountant (CPA). The independent auditor is said to attest to the financial statements, i.e., provides a reliability check to the users of financial statements. The independent auditor must be free from any obligation to or interest in the client, its management, or its owners. 4. Securities and Exchange Commission (SEC) The objective of the SEC is to ensure that investors have adequate information to make investment decisions. A company cannot issue new securities (stocks, bonds, etc.) unless the company files a prospectus with the SEC. The prospectus reports information about the company, its officers, and its financial and operating affairs. The prospectus includes audited financial statements attested to by independent CPAs. After the securities have been sold to the public, the company must file quarterly and annual reports with the SEC in order to keep investors informed as to the status of the company and the company’s securities. Congress delegated to the SEC the authority to establish and enforce accounting standards for companies over which the SEC has jurisdiction. The SEC has relied on the accounting profession to prescribe financial accounting and external reporting requirements for companies having publicly traded securities. The SEC on occasion prods the accounting profession to move forward in resolving critical problems. 5. The Public Companies Accounting Oversight Board (PCAOB) The PCAOB is a private-sector, non-profit corporation, created by the Sarbanes-Oxley Act of 2002 (SOX), to oversee the auditors of public companies in order to protect the interests of investors and further the public interest in the preparation of informative, fair, and independent audit reports. The Securities and Exchange Commission appoints the chairman and members of the Public Company Accounting Oversight Board. Section 109 of SOX provides that funds to cover the Board’s annual budget (less registration and annual fees paid by public accounting firms) are to be collected from issuers of financial statements. 6. The Conceptual Framework of Accounting The conceptual framework is a theoretical underpinning to support solutions to accounting and reporting problems. The Conceptual Framework consists of seven Statements of Financial Accounting Concepts (SFACs—sometimes referred to as “Concepts Statements”) that describe and define the conceptual framework. The conceptual framework provides consistency among accounting standards as well as a basis for resolving new and unique accounting problems. A conceptual framework in accounting is important because it can lead to consistent standards and it prescribes the nature, function, and limits of financial accounting and financial statements. The benefits its development will generate can be characterized as follows: (a) it should be easier to promulgate a coherent set of standards and rules; and (b) practical problems should be more quickly solved. The FASB recognized the need for a conceptual framework upon which a consistent set of financial accounting standards could be based. The FASB has issued six Statements of Financial Accounting Concepts (SFAC) that relate to financial reporting. They are listed and described briefly below: SFAC No. 1. "Objectives of Financial Reporting by Business Enterprises" presents the goals and purposes of accounting. SFAC No. 2. "Qualitative Characteristics of Accounting Information" examines the characteristics that make accounting information useful. SFAC No. 3. "Elements of Financial Statements of Business Enterprises" defines the broad classifications of items found in financial statements. SFAC No. 4. (This Statement deals with not-for-profit entities, which are not covered in this course.) SFAC No. 5. "Recognition and Measurement in Financial Statements of Business Enterprises" gives guidance on what information should be formally incorporated into financial statements and when. SFAC No. 6. "Elements of Financial Statements" replaces SFAC No. 3 and expands its scope to include not-for-profit organizations. SFAC No. 7. "Using Cash Flow Information and Present Value in Accounting Measurements," provides a framework for using expected future cash flows and present value as a basis for measurement. SFAC No. 1 Statement of Financial Accounting Concepts No. 1 recognizes the main user groups of external financial statements as investors and creditors. Other users are employees, managers and directors of a company, customers, stock exchanges, taxing authorities, and regulatory bodies (SEC and other governmental agencies). These external users lack authority to prescribe the information they want and must rely on the information management communicates to them. The information communicated should be: a. Useful to current and potential investors and creditors (and other users) in making rational investment, credit, and other related decisions. b. Helpful to current and potential investors and creditors (and other users) in assessing the amounts, timing, and uncertainty of future cash flows such as dividend and interest payments. c. Accurate in reporting the economic resources of the business, including any claims to those resources held by other entities (outstanding liabilities), as well as the effects of any pending transactions, events, and circumstances that will affect the company’s resources and claims to those resources. Although investors and creditors are interested in cash-flow information, SFAC No. 1 asserts (based on research conducted) that financial information prepared on the accrual basis is most useful in helping investors and creditors estimate the amounts, timing, and risk of future cash flows. The accrual basis recognizes revenues when earned and expenses when incurred rather than when cash is received and paid (disbursed). SFAC No. 2 presents the qualities that make accounting information useful for decision making. Thos qualities are relevance and reliability. Primary Qualities Relevance. Accounting information is relevant if it is capable of making a difference in a decision. For information to be relevant, it should have predictive or feedback value, and it must be presented on a timely basis. Reliability. Accounting information is reliable to the extent that it is verifiable, is a faithful representation, and is reasonably free of error and bias. To be reliable, accounting information must possess three key characteristics: (a) verifiability, (b) representational faithfulness, and (c) neutrality. Secondary Qualities The secondary qualities identified are comparability and consistency. Comparability. Accounting information that has been measured and reported in a similar manner for different enterprises is considered comparable. Consistency. Accounting information is consistent when an entity applies the same accounting treatment to similar events from period to period. 7. Elements of Financial Statements Revenues Inflows of assets or settlements of liabilities (or a combination of both) during a particular accounting period; such inflows or settlements stem from the delivery or production of goods or the rendering of services. Expenses Outflows of assets or incurrences of liabilities (or both) during a particular accounting period; such outflows are necessary to the delivery or production of goods or rendering of services that constitute the entity’s ongoing major or central operations. Expenses are made to benefit the entity. Gains Increases to equity (net assets) resulting from peripheral or incidental transactions not associated with the entity’s major or central lines of business. Losses Decreases to equity (net assets) resulting from peripheral or incidental transactions not associated with the company’s major or central lines of business. They provide no benefit to the firm. Assets Probable future economic benefits obtained or controlled by a particular entity as a result of past transaction or events. Liabilities Probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events. Equity The residual interest in the assets of an entity that remains after deducting its liabilities. In a business enterprise, the equity is the ownership interest. Investments by Owners Increases in net assets of a particular enterprise resulting from transfers to it from other entities of something of value to obtain or increase ownership interests (or equity ) in it. Distributions to Owners Decreases in net assets of a particular enterprise resulting from transferring assets, rendering services, or incurring liabilities by the enterprise to owners. Distributions to owners decrease ownership interest (or equity) in an enterprise. Comprehensive Income Change in equity (net assets) of an entity during a period from transactions and other events and circumstances from nonowner sources. It includes all changes in equity during a period except those resulting from investments by owners and distributions to owners. 8. Some Important Assumptions and Principles Underlying Financial Accounting Separate Entity Assumption Under the separate entity assumption, all accounting records and reports are developed from the viewpoint of a single entity, whether it is a proprietorship, a partnership, or a corporation. The assumption is that an individual’s transactions are distinguishable from those of the business he or she might own. Continuity (“Going-Concern”) Assumption The business entity in question is expected not to liquidate but to continue operations for the foreseeable future. The business is assumed to stay in existence for the period of time necessary to carry out contemplated operations, contracts, and commitments. This assumption provides the basis for the historical cost principle as well as for various classifications of accounting information (e.g., current vs. long term assets and liabilities). If a business is expected to be liquidated in the near future, assets and liabilities should be valued at net realizable amounts (liquidation values). Unit-of-Measure Assumption Money is the common denominator of economic activity and provides an appropriate basis for accounting measurement and analysis. In the United States, accountants have chosen generally to ignore inflation (changes in the purchasing power of the dollar) by assuming the unit of measure (the dollar) remains reasonably stable. This assumption results in 1970 dollars being added to 2001 dollars with no adjustment. Periodicity (Time-Period) Assumption The operating results of a business enterprise cannot be known with certainty until the company has completed its life span and ceased business operations. In the meantime, external decision makers require timely accounting information to analyze and use as a basis for their decisions. The periodicity assumption requires that changes in a business’s financial position be reported over a series of shorter time periods. The periodicity assumption necessitates the use of accrual and deferral of items in the financial statements (the accrual basis of accounting). Cost Principle The cost principle specifies that actual acquisition cost be used for initial recognition purposes. The actual acquisition cost is reliable and objective. The cash-equivalent cost of an asset is used if the asset is acquired by some means other than cash. The cost principle assumes that assets are acquired in business transactions conducted at armslength. The cost principle also is applied to liabilities. Liabilities are issued by a business in exchange for assets upon which an agreed price has been placed. This price, established by the exchange transaction, is the “cost” of the liability and provides the figure at which the liability should be recorded in the accounts and reported in the financial statements. Revenue Recognition Principle Revenue can be defined as inflows of cash or other enhancements of a business’s assets, settlements of its liabilities, or a combination of the two. Such inflows must be derived from delivering and producing goods, rendering service, or performing other activities that constitute a company’s ongoing business operations over a specific period of time. Revenue generally is recognized when (1) realized or realizable and (2) earned. Revenues are realized when products, goods, services, merchandise, or other assets are exchanged for cash or claims to cash. Revenues are realizable when assets received or held are readily convertible into cash or claims to cash. Assets are readily convertible when they are salable or interchangeable in an active market at readily determinable prices without significant additional cost. Revenues are considered earned when the entity has substantially accomplished what it must do to be entitled to the benefits represented by the revenues. Recognition at the time of sale is a common (but not the only) point of revenue recognition. Matching Principle The matching principle is based on the accrual basis of accounting and deals with the recognition of expenses. This principle requires that all expenses incurred in earning the revenue recognized for a period should be recognized during the same period. If revenue is deferred, then so should the related expenses be deferred. Some expenses are linked to revenue by a direct cause-and-effect relationship. Other expenses have no direct relationship to revenue and are recognized in the time period incurred. Full-Disclosure Principle The full-disclosure principle requires that the financial statements report all relevant information bearing on the economic affairs of a business enterprise. Under the full-disclosure principle, transactions should be reported to emphasize the economic substance of the transactions rather than the form of the transaction. The goal is to provide external users with the accounting information they need to make informed investment and credit decisions. Materiality Constraint Materiality is defined as the magnitude of an omission or misstatement of accounting that, in the light of surrounding circumstances, makes it probable that the judgment of a reasonable person relying on the information would have been changed or influenced by the omission or misstatement. The assumption is that the omission or inclusion of immaterial facts is not likely to change or influence the decision of a rational external user. The item must make a difference or it need not be disclosed. The materiality concept provides a threshold for recognition. The inclusion or exclusion of an item on the basis of materiality is situation specific. An amount may be considered immaterial in one situation but material in another. Both qualitative and quantitative factors must be considered in determining whether an item is material. Conservatism Constraint The conservatism constraint holds that when two alternative accounting methods are acceptable and both equally satisfy the conceptual and implementation principles set forth by the FASB, the alternative having the less favorable effect on net income or total assets is preferable. The reasoning is that investors prefer information that does not unnecessarily raise expectations. The conservatism constraint does not urge or require that assets or net income be understated.