McGraw-Hill/Irwin

Copyright © 2011 by the McGraw-Hill Companies, Inc. All rights reserved.

1

Environment and Theoretical

Structure of Financial Accounting

PowerPoint Authors:

Susan Coomer Galbreath, Ph.D., CPA

Charles W. Caldwell, D.B.A., CMA

Jon A. Booker, Ph.D., CPA, CIA

Cynthia J. Rooney, Ph.D., CPA

1-2

Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.

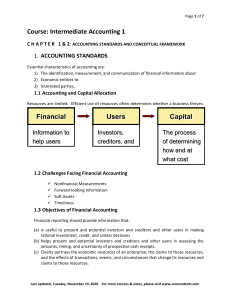

Financial Accounting Environment

Providers of

Financial

Information

Profit-oriented

companies

Not-for-profit

entities

Households

1-3

External

User Groups

Relevant

Financial

Information

Investors

Creditors

Employees

Labor unions

Customers

Suppliers

Government

agencies

Financial

intermediaries

Financial Accounting Environment

Relevant financial information is provided

primarily through financial statements and

related disclosure notes.

1-4

Balance Sheet

Income Statement

Statement of Cash Flows

Statement of Shareholders’ Equity

The Economic Environment

and Financial Reporting

A sole proprietorship

is owned by a

single individual.

A partnership is

owned by two or

more individuals.

A corporation is owned

by shareholders.

1-5

A highly-developed

system communicates

financial information

from a corporation to its

many shareholders.

Investment-Credit Decisions ─ A Cash

Flow Perspective

Shareholders

Receive

Cash

1. Dividends

2. Sale of Stock

Creditors

Receive

Cash

1. Interest

2. Loan Repayment

Accounting information should help investors

and creditors evaluate the amount, timing,

and uncertainty of the enterprise’s future

cash flows.

1-6

Cash versus Accrual Accounting

Cash Basis Accounting

Revenue is recognized when cash is received.

Expenses are recognized when cash is paid.

O

R

O

OR

R

O

R

Accrual Accounting

Revenue is recognized when earned.

Expenses are recognized when incurred.

1-7

Cash versus Accrual Accounting

Cash Basis Accounting

Carter Company has sales on account totaling

$100,000 per year for three years. Carter collected

$50,000 in the first year and $125,000 in the second

and third years. The company prepaid $60,000 for

three years’ rent in the first year. Utilities are $10,000

per year, but in the first year only $5,000 was paid.

Payments to employees are $50,000 per year.

Let’s look at the cash flows.

1-8

Cash versus Accrual Accounting

Cash Basis Accounting

Sales (on credit)

Year 1

$ 100,000

Cash receipts from

customers

$

Payment of 3

years' rent

50,000

(60,000)

Summary of Cash Flows

Year 2

Year 3

$ 100,000

$ 100,000

Total

$ 300,000

$ 125,000

$ 300,000

-

$ 125,000

-

Salaries to Cash flows in any one year may not

employees

(50,000)

(50,000)

(50,000)

be a predictor of future cash flows.

Payments for

utilities

Net cash flow

1-9

(5,000)

$ (65,000)

(15,000)

$ 60,000

(10,000)

$ 65,000

(60,000)

(150,000)

(30,000)

$ 60,000

Cash versus Accrual Accounting

Accrual Basis Accounting

Year 1

Revenue

$ 100,000

Summary of Operations

Year 2

Year 3

$ 100,000

$ 100,000

Total

$ 300,000

Rent Expense

(20,000)

(20,000)

(20,000)

(60,000)

Salaries Expense

(50,000)

(50,000)

(50,000)

(150,000)

Net Income is considered a better indicator

Utilities Expense

(10,000)

(10,000)

of future cash

flows. (10,000)

Net Income

1 - 10

$

20,000

$

20,000

$

20,000

$

(30,000)

60,000

The Development of Financial

Accounting and Reporting Standards

Concepts,

principles, and

procedures were

developed to meet the

needs of external

users (GAAP).

1 - 11

Historical Perspective and Standards

1 - 12

Current Standard Setting

Financial Accounting

Standards Board

• Supported by the Financial Accounting

Foundation

• Five full-time, independent voting members

• Answerable only to the Financial Accounting

Foundation

• Members not required to be CPAs

1 - 13

FASB Accounting Standards

Codification

The objective of the codification project was to integrate and

organize by topics all relevant accounting pronouncements

into a searchable, online database.

1 - 14

Establishment of Accounting Standards

A Political Process

Internal Revenue

Service

www.irs.gov

Financial Executives

International

www.fei.org

American Institute

of CPAs

www.aicpa.org

GAAP

International

Accounting

Standards Board

www.iasb.org

Securities and

Exchange

Commission

www.sec.gov

1 - 15

Governmental

Accounting

Standards Board

www.gasb.org

American

Accounting

Association

www.aaa-edu.org

FASB’s Standard-Setting Process

Board receives recommendations for projects.

Board votes to add the project to its agenda .

Board deliberates the issues at a series of public

meetings.

Board issues an Exposure Draft (ED).

Board holds a public roundtable meeting on the ED.

Staff analyzes feedback and the Board re-deliberates

the proposed revisions at public meetings .

Board issues a Standards Update describing

amendments to the Codification.

1 - 16

Toward Global Accounting Standards

The main objective of the International

Accounting Standards Board (IASB) is to

develop a single set of high quality,

understandable and enforceable global

accounting standards to help participants in

the world’s capital markets and other users

make economic decisions.

1 - 17

Role of the Auditor

Auditors serve as independent

intermediaries to help insure that

management has appropriately applied

GAAP in preparing the company’s

financial statements.

1 - 18

Financial Reporting Reform

As a result of numerous financial scandals,

Congress passed the Public Company

Accounting Reform and Investor Protection

Act of 2002, (Sarbanes-Oxley Act). The goal

was to restore credibility and investor

confidence in the financial reporting process.

1 - 19

A Move Away from

Rules-Based Standards?

• Rules based accounting standards vs.

objectives-oriented approach

• Objectives oriented (principles-based)

approach stressed professional

judgment

1 - 20

Ethics in Accounting

• For financial information to be useful, it

should possess the fundamental decisionspecific qualities of relevance and faithful

representation.

• Management may be under pressure to

report desired results and ignore or bend

existing rules.

1 - 21

Analytical Model for Ethical Decisions

1 - 22

Determine the facts of the situation.

Identify the ethical issue and the stakeholders.

Identify the values related to the situation.

Specify the alternative courses of action.

Evaluate the courses of action.

Identify the consequences of each course of action.

Make your decision and take any indicated action.

The Conceptual Framework

The Conceptual Framework has been described

as a constitution, a coherent system of

interrelated objectives and fundamental that

lead to consistent accounting standards.

FASB Conceptual Framework

(Statements of Financial Accounting Concepts)

Objectives of Financial Reporting (SFAC No. 1)

Qualitative Characteristics (SFAC No. 2)

Elements of Financial Statements (SFAC No. 6)

Recognition and Measurement (SFAC No. 5 and SFAC No. 7)

1 - 23

The Conceptual Framework

FASB and IASB Joint Conceptual Framework Project

Eight Phases:

A. Objective and Qualitative Characteristics

B. Elements and Recognition

C. Measurement

D. Reporting Entity

E. Presentation and Disclosure

F. Framework for a GAAP Hierarchy

G.Applicability to the Not-For-Profit Sector

H. Remaining Issues

1 - 24

The Conceptual Framework

Objective

To provide financial information

that is useful to capital providers.

Fundamental and

Enhancing

Qualitative

Characteristics

Constraints

1 - 25

Elements

Financial

Statements

Recognition and

Measurement

Concepts

Qualitative Characteristics of

Accounting Information

Decision usefulness

Relevance

Predictive

value

Comparability

(Consistency)

1 - 26

Faithful representation

Confirmatory

value

Verifiability

Completeness Neutrality

Timeliness

Free from

material error

Understandability

Practical Boundaries (Constraints) to

Achieving Desired Qualitative Characteristics

Cost

Effectiveness

1 - 27

Materiality

Elements of Financial Statements

1 - 28

Elements of Financial Statements

1 - 29

Recognition and Measurement

Concepts

Recognition

Process of admitting

information into the basic

financial statements

1.

2.

3.

4.

Definition

Measurability

Relevance

Reliability

Measurement involves both the choice of a unit

of measure and the choice of an attribute to be

measured.

1 - 30

Underlying Assumptions and

Accounting Principles

1 - 31

Evolution of Accounting Principles

The Asset/Liability Approach

Measure assets and liabilities that

exist at a balance sheet date.

Recognize revenues, expenses,

gains, and losses needed to account

for the changes in assets and

liabilities from the previous balance

sheet date.

The focus on assets and liabilities has led to

increased interest on fair value measurement.

1 - 32

Evolution of Accounting Principles

The Move Toward Fair Value

Fair value is the price that would be received

to sell assets or paid to transfer a liability in

an orderly transaction between market

participants at the measurement date.

Market

Approaches

Income

Approaches

Cost

Approaches

1 - 33

Fair Value Hierarchy

GAAP gives companies the option to report some or all of

their financial assets and liabilities at fair value.

1 - 34

End of Chapter 1