The Business Cycle - Oxford College of London

advertisement

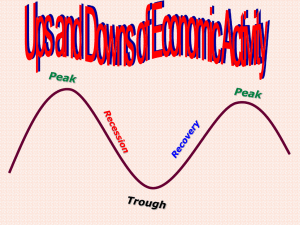

The Business Cycle Murad Rattani Oxford College of London Murad Rattani What is Business Cycle? According to Parkin and Bade’s ‘The business cycle is the periodic but irregular up and down movements in economic activity, measured by fluctuations in real GDP and other macroeconomic variables.’ Murad Rattani Phases of Business Cycle A business cycle is not a regular, predictable or repeating phenomena like the swing of the pendulum of a clock. It’s timing is random and to a large extent unpredictable. A business cycle is identified as a sequence of four phases: Contraction: A slowdown in the pace of economic activity. Trough: the lower turning point of a business cycle, where a contraction turns into an expansion. Expansion: A speed up in the pace of economic activity. Peak: the upper turning of a business cycle. Murad Rattani Phases of Business Cycle Murad Rattani Recession According to standard newspaper definition ‘recession is decline in Gross Domestic Product (GDP) for two or more consecutive quarters.’ Murad Rattani Recession (BCDC Definition) According to Business Cycle Dating Committee at the National Bureau of Economic Research (NBER) ‘A recession is the time when business activity has reached its peak and starts to fall until the time when business activity bottoms out. When the business activity starts to rise again it is called an expansionary period. By this definition, the average recession lasts about a year.’ Murad Rattani Depression Before the Great Depression of the 1930s any downturn in economic activity was referred to as a depression. The term recession was developed in this period to differentiate periods like the 1930s from smaller economic declines that occurred in 1910 and 1913. This leads to the simple definition of a depression as a recession that lasts longer and has a larger decline in business activity. Murad Rattani Depression According to the rule of thumb, A depression is any economic downturn where real GDP declines by more than 10 percent. A recession is an economic downturn that is less severe. Murad Rattani Characteristics of recession Businesses complaining of falling demand. Cuts in output. Rising unemployment. Few job opportunities. Gloomy expectations. Low levels of capacity utilisation. Falling levels of investment. Businesses making losses. Businesses closing down. Falling sales. Customers may seem price conscious. Investments in increased capacity is postponed. Murad Rattani Recovery Recovery is rather halting. Businesses are unsure that improvement in demand is sustained. Businesses are unenthusiastic about taking risk for investment. They are unwilling to take on new employees unless they are sure, so unemployment is still high. Lack of business confidence persists. Output can increase sharply as long as there is spare capacity. Businesses use their under-utilised capital equipment to increase output. When they are running at full capacity, they put expansion plans in motion, investing in new buildings, plant and machinery. Murad Rattani Characteristics of Boom Investment increases. Businesses experience shortage of skilled staff. In order to attract the skilled people, businesses bid against each other so that wages begin to rise faster than inflation. Prices are increased. High levels of demand mean that higher prices have little effect on the growth of sales. Inflation, i.e. a general rise in the level of prices, increases. Boom is also mainly characterized by supply constraints, full order book, full capacity output. Murad Rattani Characteristics of boom When recovery turns into boom, it overheats. The economy is growing too fast a rate to be sustainable in the medium term. The reason is that growth requires resources. At any given time, there could be limit of the resources available. There could be shortage of skilled staff so the companies start poaching and provide them with higher wages or train inexperienced staff. According to economists, it is called supply constraints. Businesses call it bottlenecks. Murad Rattani Characteristics of boom A full order book can occur. If capital equipment producers are working flat out, orders for labour-saving equipment will go on the order books, but will not be produced for some time. This is good for the supplier but indicates shortage of capacity. Full capacity output in the economy is the maximum production level possible when all resources are working flat out. The closer the economy gets to full capacity output, the greater the supply constraints. Therefore costs tend to rise. As cost rise, inflation accelerates. Government responds by increasing the interest rate. Murad Rattani Downturn The rising costs associated with boom discourages continuing growth. It reduces profitability and the attractiveness of further investment. Rising interest rates reduces consumers’ spending. Cost of production goes up as businesses have to pay higher interest rates. Demand for products goes down. Consumers have to pay higher mortgage rates which means lower demand for housing. Builders abandon their plans for housing construction and start laying off. People get unemployed and their purchasing power goes down. Murad Rattani Downturn Because of higher interest rates and higher cost of production, demand goes down. Not all industries are affected. The most to be affected are consumer durables. People depend upon savings and benefits. Murad Rattani Indicators of the Business Cycle As according to financial media, two consecutive quarters of negative GDP is recession, therefore GDP is a quick and simple indicator for economic contraction. The NBER (National Bureau of Economic Research) considers primarily other economic indicators as well which are 1. 2. 3. Employment Personal Income Industrial Production Murad Rattani References http://economics.about.com/cs/businesscycles/a/depressi ons_2.htm http://economics.about.com/cs/businesscycles/a/depressi ons.htm Ian Marcouse, The Business Studies Teachers’ Book (ISBN: 0340-73763-8), 1999 Murad Rattani