The economic Cycle - Business Studies A Level for WJEC

advertisement

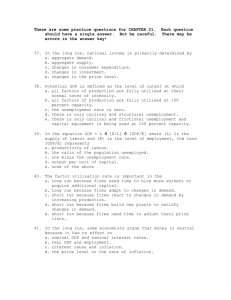

The Economic or Business Cycle Measuring Economic Activity We calculate the value of a country's output or wealth generated in a year by measuring GDP-Gross Domestic Product GDP is a measure of the value of all outputs in an economy in a single year - the £ value of all goods and services produced Current level (2012) of GDP in the UK economy is around £1400 billion. Economic or Business Cycle • Gross domestic Product does not increase at a constant rate over time – there are variations in growth rate. • There can be times of negative growth i.e. GDP decreases. • These changes in the rate of growth of GDP overtime is known as the Economic or Business Cycle Two Key Features of GDP: It grows over time the long run trend in GDP is positive, around 2.5% per year in the UK, (This is in real terms allowing for effects of inflation) It fluctuates as it grows GDP exhibits business cycle movements. In the last 15 years it has varied between plus 4% and minus 2% Below we see the variations of growth of the economy over time The yellow bars show negative growth – a recession, the economy is shrinking, The blue positive, growth – the economy is growing. The Pacific Rim Growth Growth rates vary between different countries. Developing countries often have faster growth rates than those found in Europe Growth rates in Pacific Rim countries are around 4-6%. China 8 or 9% is normal In U.K. average is around 2.5%. Parts of the Business Cycle Boom GDP Downturn (UK) Recovery/Expansion Recession time Parts of Economic Cycle - Boom Low levels of unemployment – shortages of labour occur pushing up wage rates High levels of consumer borrowing and spending Firms working at full capacity Profit levels high – high levels of consumption Inflation Increasing Interest rates increasing Boom in housing market Imports increasing High levels of Govt. Tax revenues Parts of Economic Cycle - Downturn Growth rate of GDP is starting to fall Firms decrease production and reduce stocks Unemployment starts to rise Inflation falls Investment falls Firms suffer from falling profits, falling returns from investment. Parts of Economic Cycle - recession High levels of unemployment – unemployment increased by 1 million during the recession of 2008-10 Reduced spending by consumers especially on consumer durables High levels of spare capacity for firms Low inflation Negative economic growth – the economy is shrinking High numbers of firms going bust Increased govt. Borrowing and spending Parts of Economic Cycle - recovery Consumer confidence grows – leading to increased borrowing and spending Firms increase output – build up stock levels Spare capacity used, then Investment occurs Unemployment falls – it make take more than a year of recovery for large changes in unemployment levels Government and Economic Cycle The government will attempt to control fluctuations in economic growth Aims to achieve growth at around trend level In the past has used Fiscal and Monetary policy to achieve this objective In the last 10 years the focus has been on the use of Interest Rates ( monetary policy) and Supply Side policies to achieve constant growth. Over the last 10 years the UK has been recession free, though growth has been as low as 1.5%