Business Cycles

advertisement

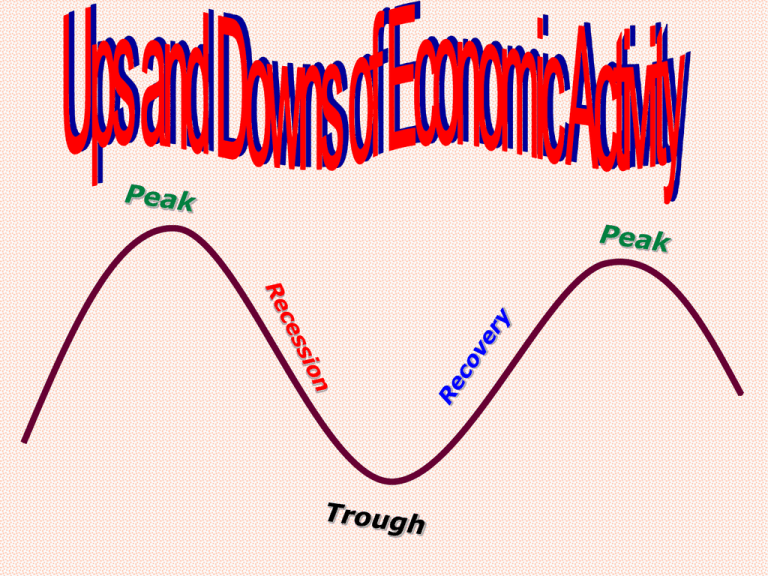

Business Cycles √ The term business cycle refers to the recurrent ups and downs in the level of economic activity, which extend over several years. √ Individual business cycles may vary greatly in duration and intensity. √ All display a set of phases. THE BUSINESS CYCLE Phases of the Business Cycle RECESSION TROUGH RECOVERY Level of business activity PEAK Time Level of business activity PEAK Time √ Peak or prosperity phase: Real output in the economy is at a high level Unemployment is low Domestic output may be at its capacity Inflation may be high. Level of business activity RECESSION Time √ Contraction or recession phase: Real output is decreasing Unemployment rate is rising. As contraction continues, inflation pressure fades. If the recession is prolonged, price may decline (deflation) The government determinant for a recession is two consecutive quarters of declining output. Level of business activity TROUGH Time √ Trough or depression phase: Lowest point of real GDP Output and unemployment “bottom out” This phase may be short-lived or prolonged There is no precise decline in output at which a serious recession becomes a depression. Level of business activity RECOVERY Time √ Expansionary or recovery: Real output in the economy is increasing Unemployment rate is declining The upswing part of the cycle. Real GDP per year Business Cycle-one cycle through 4 phases Peak Peak Trough One cycle Time Recessions since 1950 show that duration and depth are varied: Period 1953-54 1957-58 1960-61 1969-70 1973-75 1980 1981-82 1990-91 2001 Duration in months 10 8 10 11 16 6 16 8 8 Depth (decline in real GDP) — 3.0% — 3.5% — 1.0% — 1.1% — 4.3% — 3.4% — 2.6% — 2.6% app. —3.3% How Indicators Monitor the Four Phases of the Business Cycle • The Leading Indicator System … provides a basis for monitoring the tendency to move from one phase to the next. …assesses the strengths and weaknesses in the economy … gives clues to a quickening or slowing of future rates of economic growth … indicates the cyclical turning points in moving from the upward expansion to the downward recession, and from the recession to the upward recovery. Leading indicators anticipate the direction in which the economy is headed. The coincident indicators provide information about the current status of the economy 1) changing as the economy moves from one phase of the business cycle to the next 2) telling economists that an upturn or downturn in the economy has arrived. Lagging indicators change months after a downturn or upturn in the economy has begun and help economists predict the duration of economic downturns or upturns. Based on the theory that expectations of future profits are the motivating force in the economy. Companies may expand production of goods and services and investment in new structures and equipment,when business executives believe that their sales and profits will rise. When they believe profits will decline, they reduce production and investment. These actions generate the four phases of the business cycle. Causes of Fluctuations Innovation Political events Random events Wars Level of consumer spending Seasonal fluctuations Cyclical Impacts — durable and non durable An Actual Business Cycle 1981 - 1990 ($ billion, 1992 dollars) Real GDP Peak 6000 5200 Peak 4600 Trough ‘80 82 ‘85 One Cycle ‘90 The Great Depression The Great Depression [continued] Great Depression Stats Global Depression, 1929-1932 Ave. Unemployment Rate, 1925-1928 Ave. Unemployment Rate, 1929-1933 Percent Decrease in Prices, 1929-1932 Six Million “Rosie the Riveters” World War II Production of these items brought us out of the Great Depression. 300,000 warplanes 124,000 ships 289,000 combat vehicles and tanks 36 billion yards of cotton goods 41 billion rounds of ammunition 2.4 million military trucks 111,527 tank guns and howitzers •$288 billion was spent on the war, •$100 billion in the first six months. Unemployment hit an all-time low of 1.2% and personal savings were 25.5%.