Economic Ups and Downs

advertisement

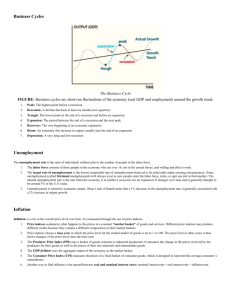

Economic Ups and Downs Chapter 6.1 1991-2001 This was the longest continuous period of economic growth the US has ever seen. During this ten year span: Those who wanted to find jobs could The unemployment rate was the lowest in history The stock market soared to an all time high Prices of good and services did not increase significantly. 1929-1939 This period became the worst economic decline in hisotry. During this time: Many americans could not find employment Many were left homeless and hungery Many factories, stores and business closed. Business Cycles A business cycle it the up and downs of the economy. There are four stages to the business cycle. They are as follows: Contraction-During this stage business activity slows down. IF this stage last to long the economy could head into a recession. Trough—this is the lowest point in the cycle, where business activity levels off. Expansion—The economy begins to recover. People spend more money. Peak-This period of prosperity marks the highest point of the cycle. At some point the peak stage a contraction occurs starting the cycle over again. Recession This is a period of significant decline in the economy. These recessions usually las from 6 month to a year. During this time the economy produces much more then consumers can use. Because of this business profits go down requiring businesses to cut manufacturing and layoff and fire workers. Consumers don’t spend money. Depression This is the downward spiral from a recession can lead to a depression. A major showdown (depression) is longer lasting and more serious then a recession. Demand decreases sharply, prices plummet, many business fail and unemployment soars. Inflation When the economy grows to rapidly—prolonged rise in the prices of goods and services. It often occurs during periods of rapid growth and expansion. Inflation affects consumers by reducing their purchasing powers. Money buys fewer things. Because inflation affects consumers who borrow, lend or invest money, they need to consider how it impacts interest rates. The fee paid to use someone else’s money over a period of time. The housing market!!!!! Factors Affecting Ups and Downs Consumer Confidence—If people feel the economy is facing an upward swing, they spend more. If they feel gloomy about the future then spending is back. Technological innovation—many business spring out of new technological innovations. These new innovations create new markets and can transform the economy, the workplace and the culture. Factors Affecting Ups and Downs Continued…. Government policies- Tax cuts, spending and the regulation of the money supply can cause the changes in the business cycle. War during times of war the demands for many goods and services associated with the war effort increases. War is associated with economic expansion. Measuring the Economy’s Health Economic indicators—Measure production, employment and inflation. Gross Domestic Product—Commonly known as the GDP, it is the total dollar value of goods and services, produced in a county during the year. Unemployment rate—this is the percentage of the civilian labor force that is without a job but, is actively seeking employment. Full employment means less than 5.5 percent. Consumer Price Index—measures the change in prices over time of a specific group of goods and services. Connection of Local, National, and Global Economics Climate changes, natural disaster, population shift, the availability of works, local government policies, and the strength of local businesses are some of the many factors that contribute to economic changes. The economies of every nation are becoming more connected. A recession in the United States can trigger economic slowdowns throughout the world.