Electronic money (also known as e-currency, e-money

advertisement

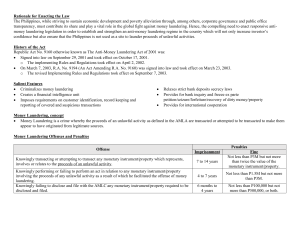

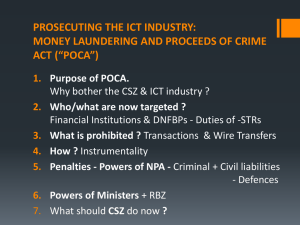

Presented by: ATTY. RICHARD DAVID C. FUNK II Under the AMLA, money laundering is “ a crime whereby the proceeds of an unlawful activity are transacted, thereby making them appear to have originated from legitimate sources.” Money Laundering as a crime is committed in three (3) different ways under the AMLA “Any person knowing that any monetary instrument or property represents, involves, or relates to, the proceeds of any unlawful activity, transacts or attempts to transact said monetary instrument or property.” Imprisonment of 7 to 14 years and a fine of not less than P 3 Million but not more than twice the value of the monetary instrument or property involved in the transaction. “Any person knowing that any monetary instrument or property involves the proceeds of an unlawful activity, performs or fails to perform any act as a result of which he facilitates the offense of money laundering referred to in paragraph (a) above.” Imprisonment of 4 to 7 years and a fine of not less than P 1 Million but not more than P 3 Million. Any person knowing that any monetary instrument or property is required under this Act to be disclosed and filed with the AntiMoney Laundering Council (AMLC), fails to do so.” Imprisonment of 6 months to 4 years or a fine of not less than P100,000 or P 500, 000 or both. “Unlawful Activity” refers to any act or omission or series or combination thereof involving or having DIRECT relation to any of the following: Kidnapping for ransom Drug related offenses, e.g., trafficking Graft and corrupt practices/acts Robbery and extortion Jueteng and Masiao Piracy on the high seas Qualified Theft Swindling Offenses punishable under the E-Commerce Act Hijacking, destructive arson, murder, even when committed against non-combatant persons Violation of the Securities Regulation Code Felonies or offenses of a similar nature under penal laws of other countries Electronic money (also known as ecurrency, e-money, electronic cash, electronic currency, digital money, digital cash or digital currency) refers to money or scrip which is only exchanged electronically. Typically, this involves the use of computer networks, the internet and digital stored value systems. Electronic Funds Transfer (EFT) and direct deposit are all examples of electronic money. Also, it is a collective term for financial cryptography and technologies enabling it Ecash- when abused/misused for criminal purposes Suspicious transactions are transactions with covered institutions, regardless of the amounts involved, where any of the following circumstances exist: 1. There is no underlying legal or trade obligation, purpose justification or economic 2. The client is not properly identified 3. The amount involved is not commensurate with the business or financial capacity of the client 4. Taking into account all known circumstances, it may be perceived that the client’s transaction is structured in order to avoid being the subject of reporting requirements 5. Any circumstance relating to the transaction which is observed to deviate from the profile of the client and/or the client’s past transactions from the covered institution 6. The transaction is in any way related to an unlawful activity or offense under this Act that is about to be, is being or has been committed 7. Any transaction that is similar or analogous to any of the foregoing AMLC RESOLUTION NO.59 s. 2005 Wire transfers between accounts, without visible economic or business purpose, especially if the wire transfers are effected through countries which are identified or connected with terrorist activities. Sources and/or beneficiaries or wire transfers are citizens of countries which are identified or connected with terrorist activities. Repetitive deposits or withdrawals that cannot be explained or do not make sense. Value of the transaction is over and above what the client is capable of earning. Client is conducting a transaction that is out of the ordinary for his known business interest. Deposits being made by individuals who have no known connection or relation with the account holder. An individual receiving remittances, but has no family members working in the country from which the remittance is made. Client was reported and/or mentioned in the news to be involved in terrorist activities. Client is under investigation by law enforcement agencies for possible involvement in terrorist activities. Transactions of individuals, companies, or non-governmental organizations (NGOs) that are affiliated or related to people suspected of being connected to a terrorist group or a group that advocates violent overthrow of a government. Transactions of individuals, companies, or NGOs that are suspected as being used to pay or receive funds from revolutionary taxes. The NGO does not appear to have expenses normally related to relief or humanitarian efforts. The absence of contributions from donors located within the country of origin of the NGO. A mismatch between the pattern and size of financial transactions on the one hand and the stated purpose and activity of the NGO on the other. Incongruities between apparent sources and amount of funds raised or moved by the NGO Any other transaction that is similar, identical or analogous to any of the foregoing. OPERATION PEP AND FAMILY BRIEF OVERVIEW INTERNATIONAL COOPERATION REPORTS BY FINANCIAL INSTITUTIONS (38STRs/169CTRs) ENFORCEMENT ACTIONPROSECUTION FOR PLUNDER FRAUD- dishonestly obtaining a benefit usually by deception/use of insidious words and machinations Phishing- type of fraud to gain personal information for the purpose of identity theft using deceptive email messages that appear to come from legitimate businesses Smishing- rather than the victim being contacted by email ( Phishing ) the victim is contacted via SMS ( text ) on a mobile phone Vishing-a new method like phishing but using the telephone to defraud the person and collect information about their identity ATM/Credit Card Skimming-illegal copying of information from the magnetic strip of an ATM/credit/debit card ????????????????? ????????????????? ??????