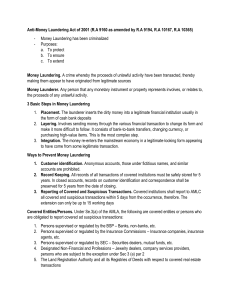

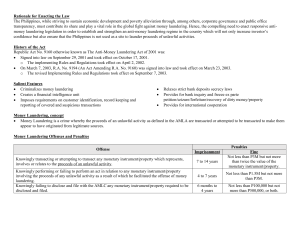

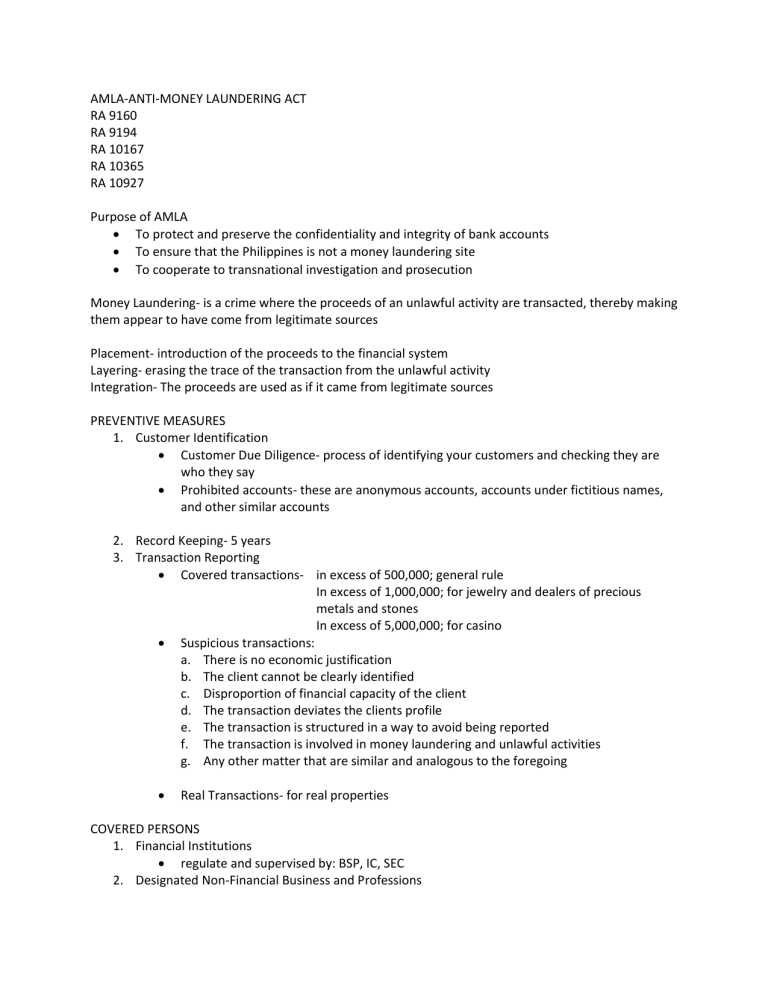

AMLA-ANTI-MONEY LAUNDERING ACT RA 9160 RA 9194 RA 10167 RA 10365 RA 10927 Purpose of AMLA To protect and preserve the confidentiality and integrity of bank accounts To ensure that the Philippines is not a money laundering site To cooperate to transnational investigation and prosecution Money Laundering- is a crime where the proceeds of an unlawful activity are transacted, thereby making them appear to have come from legitimate sources Placement- introduction of the proceeds to the financial system Layering- erasing the trace of the transaction from the unlawful activity Integration- The proceeds are used as if it came from legitimate sources PREVENTIVE MEASURES 1. Customer Identification Customer Due Diligence- process of identifying your customers and checking they are who they say Prohibited accounts- these are anonymous accounts, accounts under fictitious names, and other similar accounts 2. Record Keeping- 5 years 3. Transaction Reporting Covered transactions- in excess of 500,000; general rule In excess of 1,000,000; for jewelry and dealers of precious metals and stones In excess of 5,000,000; for casino Suspicious transactions: a. There is no economic justification b. The client cannot be clearly identified c. Disproportion of financial capacity of the client d. The transaction deviates the clients profile e. The transaction is structured in a way to avoid being reported f. The transaction is involved in money laundering and unlawful activities g. Any other matter that are similar and analogous to the foregoing Real Transactions- for real properties COVERED PERSONS 1. Financial Institutions regulate and supervised by: BSP, IC, SEC 2. Designated Non-Financial Business and Professions Jewelers Dealers of Precious metals and stones Company Service providers Other professions Casino 3. Land registration authority/Registry of deeds- for real transactions Safe Harbor Provision- A covered person who reported a transaction is protected whenever a certain client under a litigation is not guilty of any violation of this act filed a case against the covered person. CREATION OF THE ANTI-MONEY LAUNDERING COUNCIL(AMLC) Shall be composed of: 1. The governor of the BSP 2. The commissioner of the IC 3. The chairman of the SEC Shall also establish a SECRETARIAT which shall be governed by the Executive Director appointed by the three persons above. POWERS OF AMLC 1. To file criminal case Usually at department of Justice to National prosecution office and the case will be held at Regional Trial court If government officials, filing of the complaint to the Ombudsman to Office of Special Prosecutor which shall be held at Sandiganbayan 2. To initiate forfeiture cases Forfeiture- money instrument or property from the proceeds of unlawful activity shall be obtained by the government CIVIL FORFEITURE- independent with criminal case Filed to the Office of the solicitor general Title of the case Criminal case- people of the Philippines vs….. Civil case- republic of the Philippines vs….. 3. To inquire, examine, look into bank deposits or investments If there are probable cause established if involved in money laundering or unlawful activity General rule: with an order of a competent court Exceptions: Section 3(i) Serious illegal detention or kidnapping Drug related crime High jacking, destructive arson, murder Felonies or offenses similar to 1,2,12 which is punish under foreign laws Anti-terrorism Act of 2020 Terrorist Financing Prevention and Suppression Act 4. Freeze Order- stop the movement of monetary instrument or property which are in any way related to an unlawful activities If there are probable cause established if involved in unlawful activity General rule: with an order of a competent court Exceptions: Anti-terrorism Act of 2020 Terrorist Financing Prevention and Suppression Act HOW TO COMMIT MONEY LAUNDERING 1. When any person knows that a money instrument or property represents, involves, resulted from the proceeds of an unlawful activity and has done the following: a. transacts said monetary instrument or property; b. converts, transfers, disposes of, moves, acquires, possesses or uses said monetary instrument or property; c. conceals or disguises the true nature, source, location, disposition, movement or ownership of or rights with respect to said monetary instrument or property; d. attempts or conspires to commit money laundering offenses referred to in paragraphs (a), (b) or (c); e. aids, abets, assists in or counsels the commission of the money laundering offenses referred to in paragraphs (a), (b) or (c) above; and f. Performs or fails to perform any act as a result of which he facilitates the offense of money laundering referred to in paragraph (a), (b) or (c) above. 2. When a covered person knows a reportable transaction and fails to do so *if proven guilty, criminal case and forfeiture Election Period- 90 days before the election ad 30 days thereafter Cannot file money laundering case Cannot file civil forfeiture case Cannot file freezing order