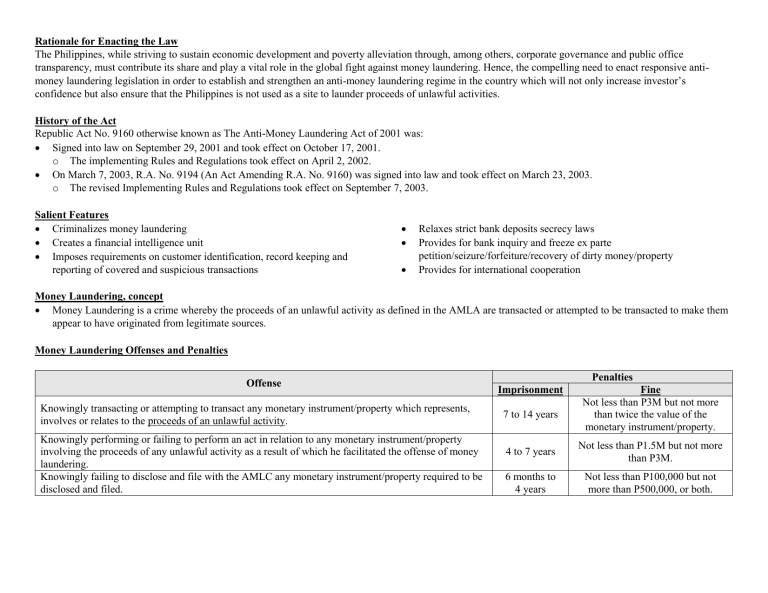

Rationale for Enacting the Law The Philippines, while striving to sustain economic development and poverty alleviation through, among others, corporate governance and public office transparency, must contribute its share and play a vital role in the global fight against money laundering. Hence, the compelling need to enact responsive antimoney laundering legislation in order to establish and strengthen an anti-money laundering regime in the country which will not only increase investor’s confidence but also ensure that the Philippines is not used as a site to launder proceeds of unlawful activities. History of the Act Republic Act No. 9160 otherwise known as The Anti-Money Laundering Act of 2001 was: Signed into law on September 29, 2001 and took effect on October 17, 2001. o The implementing Rules and Regulations took effect on April 2, 2002. On March 7, 2003, R.A. No. 9194 (An Act Amending R.A. No. 9160) was signed into law and took effect on March 23, 2003. o The revised Implementing Rules and Regulations took effect on September 7, 2003. Salient Features Criminalizes money laundering Creates a financial intelligence unit Imposes requirements on customer identification, record keeping and reporting of covered and suspicious transactions Relaxes strict bank deposits secrecy laws Provides for bank inquiry and freeze ex parte petition/seizure/forfeiture/recovery of dirty money/property Provides for international cooperation Money Laundering, concept Money Laundering is a crime whereby the proceeds of an unlawful activity as defined in the AMLA are transacted or attempted to be transacted to make them appear to have originated from legitimate sources. Money Laundering Offenses and Penalties Offense Knowingly transacting or attempting to transact any monetary instrument/property which represents, involves or relates to the proceeds of an unlawful activity. Knowingly performing or failing to perform an act in relation to any monetary instrument/property involving the proceeds of any unlawful activity as a result of which he facilitated the offense of money laundering. Knowingly failing to disclose and file with the AMLC any monetary instrument/property required to be disclosed and filed. Penalties Imprisonment 7 to 14 years Fine Not less than P3M but not more than twice the value of the monetary instrument/property. 4 to 7 years Not less than P1.5M but not more than P3M. 6 months to 4 years Not less than P100,000 but not more than P500,000, or both. Unlawful Activity is the offense which generates dirty money or property. It is commonly called the predicate crime. It refers to any act or omission or series or combination thereof involving or having direct relation to the following predicate crimes/unlawful activities: o Kidnapping for ransom o Fraudulent practices and other violations under the Securities o Drug trafficking and related offenses Regulation Code of 2000 o Graft and corrupt practices o Felonies or offenses of a similar nature that are punishable under the o Plunder penal laws of other countries. o Robbery and Extortion o Terrorism financing and organizing or directing others to commit o Jueteng and Masiao terrorism financing (R.A. 10168). o Piracy o Attempt/conspiracy to commit terrorism financing and organizing or o Qualified theft directing others to commit terrorism financing (R.A. 10168). o Swindling o Attempt/conspiracy to commit dealing with property or funds of o Smuggling designated person. o Violations under the Electronic Commerce Act of 2000 o Accomplice to terrorism financing or conspiracy to commit terrorism o Hijacking; destructive arson; and murder, including those perpetrated financing. by terrorists against non-combatant persons and similar targets o Accessory to terrorism financing. Other Offenses/Penalties Offense Failure to keep records is committed by any responsible official or employee of a covered institution who fails to maintain and safely store all records of all transactions of said institution, including closed accounts, for five (5) years from the date of the transaction/closure of the account. Malicious reporting is committed by any person who, with malice or in bad faith, reports/files a completely unwarranted or false information relative to money laundering transaction against any person. The offender is not entitled to avail the benefits of the Probation Law. Penalties Imprisonment 6 months to 1 year 6 months to 4 years Fine Not less than P100,000 but not more than P500,000, or both. Not less than P100,000 but not more than P500,000, at the discretion of the court. If the offender is a corporation, association, partnership or any juridical person, the penalty shall be imposed upon the responsible officers, as the case may be, who participated in, or allowed by their gross negligence, the commission of the crime. If the offender is a juridical person, the court may suspend or revoke its license. If the offender is an alien, he shall, in addition to the penalties prescribed, be deported without further proceedings after serving the penalties prescribed. If the offender is a public official or employee, he shall, in addition to the penalties prescribed, suffer perpetual or temporary absolute disqualification from office, as the case may be. Breach of Confidentiality When reporting covered or suspicious transactions to the AMLC, covered institutions and their officers/employees are prohibited from communicating directly or indirectly, in any manner or by any means, to any person/entity/media, the fact that such report was made, the contents thereof, or any other information in relation thereto. In case of violation thereof, the concerned official and employee of the covered institution shall be criminally liable. Neither may such reporting be published or aired in any manner or form by the mass media, electronic mail or other similar devices. In case of a breach of confidentiality published or reported by media, the responsible reporter, writer, president, publisher, manager and editor-in-chief shall also be held criminally liable. Penalty is 3 to 8 years imprisonment and a fine of not less than P500,000 but not more than P1M. Covered Institutions, concept Covered Institutions are those mandated by the AMLA to submit covered and suspicious transaction reports to the AMLC. These are: o Banks and all other entities, including their subsidiaries and affiliates, supervised and regulated by the Bangko Sentral ng Pilipinas o Insurance companies, pre-need companies and all other institutions supervised or regulated by the Insurance Commission o Securities dealers and other entities supervised or regulated by the Securities and Exchange Commission Covered & Suspicious Transaction, concept Covered transactions are single transactions in cash or other equivalent monetary instrument involving a total amount in excess of Five Hundred Thousand (P500,000) Pesos within one (1) banking day Suspicious transactions are transactions with covered institutions, regardless of the amounts involved, where any of the following circumstances exists: o there is no underlying legal/trade obligation, purpose or economic justification; the client is not properly identified; o the amount involved is not commensurate with the business or financial capacity of the client; o the transaction is structured to avoid being the subject of reporting requirements under the AMLA; o there is a deviation from the client’s profile/past transactions; o the transaction is related to an unlawful activity/offense under the AMLA; o and transactions similar or analogous to the above. Freezing of Monetary Instrument or Property The AMLC may file before Court of Appeals, before the verified application ex parte (without notice to the other party) after determination that probable cause exists that any monetary instrument or property is in any way related to an unlawful activity. The freeze order shall be effective immediately. The freeze order shall be for a period of 20 days unless extended by the court. Authority to Inquire into Bank Deposits The AMLC may inquire into or examine any particular deposit or investment with any banking institution or non-bank financial institution upon order of any competent court in cases of violation of the AMLA when it has been established that there is probable cause that the deposits or investments involved are in any way related to a money laundering offense.