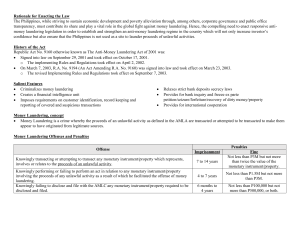

Your Logo Here ANTI-MONEY LAUNDERING 101 1 Definitions of Money Laundering processing of criminal proceeds in order to disguise their illegal origin legitimization of proceeds of specified unlawful activity crime whereby the proceeds of an unlawful activity are transacted thereby making them appear to have originated from legitimate sources (AMLA definition) 2 Elements of the Crime of Money Laundering Monetary instrument or property (MI/P) from an unlawful activity Transaction/ Attempted transaction of MI/P Knowledge that the MI/P represents, involves, or relates to the proceeds of the unlawful activity 3 Why is money laundering a problem Undermines financial institutions, social, economic and political structure of a society Stifles competition Increases the tax burden Finances terrorist activities 4 THE “ANTI-MONEY LAUNDERING ACT OF 2001” REPUBLIC ACT NO. 9160 as amended by REPUBLIC ACT NO. 9194 5 Covered Institutions 1. Banks, non-banks, quasi-banks, trust entities, other institutions and their subsidiaries and affiliates supervised or regulated by the Bangko Sentral ng Pilipinas (BSP); 6 Covered Institutions 2. Insurance companies and all other institutions supervised or regulated by the Insurance Commission (IC); and 3. All those supervised or regulated by the Securities and Exchange Commission (SEC), including securities dealers, brokers, investment houses, trading advisors, and other entities administering or otherwise dealing in currency, commodities or financial derivatives based thereon. 7 Covered Transaction ‘Covered transaction’ - a transaction in cash or other equivalent monetary instrument involving a total amount in excess of Five Hundred Thousand Pesos (Php500,000.00) within one (1) banking day. 8 Suspicious Transaction Suspicious transaction - a transaction with a covered institution, regardless of the amount involved, where any of the following circumstances exist(s): 1. No underlying legal or trade obligation, purpose or economic justification; 9 Suspicious Transaction 2. Client is not properly identified; 3. Not commensurate with the business or financial capacity of the client; 10 Suspicious Transaction 4. Deviation from the profile; 5. Similar, analogous or identical to any of the foregoing. 11 Unlawful activity (a.k.a. predicate offense) ‘Unlawful activity’ refers to any act or omission or series or combination thereof involving or having direct relation to the following: Kidnapping for ransom 2. Drug Trafficking and other violations of the Comprehensive Dangerous Drugs Act of 2002 1. 12 Unlawful activity (a.k.a. predicate offense) 3. 4. 5. 6. 7. Graft and Corruption under R.A. No. 3019, as amended Plunder (R.A. No. 7080, as amended) Robbery and extortion Jueteng and Masiao (PD 1602) Piracy (RPC & PD 532) 13 THE ANTI-MONEY LAUNDERING COUNCIL OF THE PHILIPPINES (AMLC) The Philippines’ Financial Intelligence Unit 14 Composition 1. The BSP Governor Chairman – as 2. The SEC Chairperson Member – as 3. The IC Commissioner Member – as 15 AMLC Secretariat Executive Director Technical Staff Compliance and Investigation Group Legal Evaluation Group Information Management and Analysis Group Administrative and Finance Group 16 Functions of the AMLC (1) to require submission of and receive covered or suspicious transaction reports from covered institutions (Secs 7[1] & 9[c]. 17 Functions of the AMLC (2) to issue orders addressed to the appropriate Supervising Authority or the covered institution to determine the true identity of the owner of any monetary instrument or property (Sec. 7[2] 18 Functions of the AMLC (3) (4) to institute civil forfeiture proceedings and all other remedial proceedings through the Office of the Solicitor General. to cause the filing of complaints with the Department of Justice or the Ombudsman for the prosecution of money laundering offenses. 19 What can be frozen? Monetary Instruments Coins, currency of legal tender, drafts, checks, notes, securities, negotiable instruments, bonds, commercial papers, deposit certificates, trust certificates, transaction tickets, confirmation of sale or investments, money market instruments, other similar instruments where title thereto passes to another by endorsement, assignment or delivery. 20 3 Major Requirements for Compliance by CIs 1. Customer identification and due diligence 2. Record-keeping 3. Reporting of suspicious and covered transactions 21 . Atty. Arnold T. Kabanlit Acting Council Secretary Anti-Money Laundering Council Secretariat 22