OLLI Course, Week 1 The Great Recession: How did it Happen?

advertisement

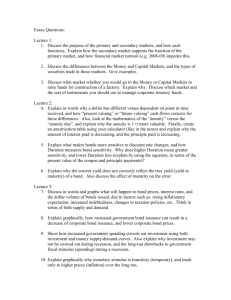

The Great Recession: How did it Happen? (OLLI Course, Week 1) Stergios Skaperdas Department of Economics University of California, Irvine October 29, 2010 Roadmap • • • • • • Basic information on the Great Recession Correlates of the crisis New finance (vs. old finance) and moral hazard The centrality of governance and property rights Persistent problems Concluding remarks Basic information about the Great Recession • • • • Official Beginning: December 2007. Official End: Mid-2009. Long-lingering effects after official end. In terms of GDP contraction and unemployment, deepest recession in post WWII period. • Unemployment rate has peaked at 10% but could get worse. • Employment barely increasing (need more than 100,000 jobs a month just to keep the employment rate the same). Graph credits: www.calculatedriskblog.com and Saint Louis Fed Gross National Product Housing Starts Capacity Utilization Employment reduction Unemployment rate by State (August 2010) Major Events • House prices peak in 2006 (without most people realizing it). • Summer of 2007: Interbank lending in trouble. • March 2008: Bear Stearns collapses, taken over by JP Morgan Chase with Government guarantees. • September 2008 (the BIG ONE): Fannie and Freddie taken over by Govt; LEHMAN collapses without Govt intervention; AIG taken over by Govt. • October 2008: TARP voted by Congress on second attempt. Correlates of the crisis • The real estate bubble. • Very low (and negative) savings rate. • Large current account deficits and global imbalances. • Change in the structure of banking and finance. • Wage income stagnation. Correlates of the crisis (cont’d) • Financialization of the economy. • Low-interest Federal Reserve policy. • “Moral Hazard” and the breakdown of the New World of Finance. • Non-enforcement of existing financial regulations and deregulation. Housing prices (Core Logic) Real House prices Savings rate Current Account Deficit “New” finance and banking • Securitization: Loans sold to globalized markets (packaged in bonds and sold to third parties like pension funds, foreign governments, other institutional investors) • Assessment of risk based on “objective” criteria (FICO scores, Rating agencies) • hedging, structured finance, derivatives (e.g., CDS “credit default swaps”; synthetic CDOs) Supposed to reduce or even eliminate risk. • Possibility of making enormous profits through “Leverage” (9 to 1, 15 to 1, 35 to 1, 45 to 1). • “Moral hazard” • Appearance (but not reality) of lower cost. Median Household Income Median Wages Financialization of the economy • Credit expansion as a way of compensating for lost income. • Mortgages, equity lines of credit, credit cards, payday loans. • Borrowing becomes a way of life; house became another breadwinner in the family. • Because of wage stagnation, expedient for politicians and the Fed to help financialization. Consumer Credit Low interest rate policy – 30-year fixed rate “Moral Hazard” and the breakdown of the New World of Finance. • Incentives for mortgage brokers and commercial banks. • Incentives for investment banks in securitization. • Rating agencies. • The Alchemy of Mathematical Finance. “Moral Hazard” and the breakdown of the New World of Finance (cntd) • Documentation and property rights. • Incentives for servicers. • Risk taking and The Too-Big-to-Fail (TBTF) Problem. Wall Street and its regulators “There are thirteen bankers in my office. They say if [the CFTC’s draft proposal for the regulation of derivatives] is published we’ll have the worst financial crisis since World War II.” From call of Larry Summers, then Deputy Treasury Secretary (in 1995), to Brooksey Born, then CFTC (“Commodity Futures Trading Commission”) Chair. The spirit of non-enforcement: OTS Chief and Bank Executives Legal and regulatory issues • Fragmentation of responsibilities (Fed, CFTC, OCC, FDIC, OTS, SEC) • Shopping for your regulator. • “Cognitive regulatory capture.” • Partnership vs corporate organization for investment banks. • TBTF problem The Relevance of Property Rights • Adam Smith on corporations • Shareholders vs managers and the SEC • Property Rights in Land (US and other rich countries vs the rest of the world.) • Property rights are necessary for a modern economy but they are also expensive. • The state as third-party enforcer. Responses to the crisis • Facilitation of Bear Stearns takeover; Fannie, Freddie, and AIG nationalizations. • Lehman allowed to go bankrupt (politically and ideologically difficult not to do so; ostensibly as a moral-hazard lesson). • TARP. Responses to the crisis (cont’d) • Fed “Quantitative easing;” and a slew of other special programs to provide emergency credit. • Fiscal Stimulus package. • Extension of unemployment benefits and other similar measures. • Dodd-Frank bill. Monetary Base M1 Money Multiplier Persistent problems • Continued high Unemployment rate and low employment levels. • Anemic growth. • Foreclosures and the crisis of property rights. • Likelihood of continued reduction in real estate prices. • Mortgage markets on life support. • TBTF problem as big as ever. Real House prices Persistent problems (cont’d) • Continued current account deficits. • Exchange rates and “beggar thy neighbor” policies. • Wages of average Americans. Concluding Remarks • Great Recession due to multiple failures in finance and its regulation. • “New” finance has been a complete failure in allocating capital. • Wall Street still dictates public policy and against basic property rights enforcement. • The Great Recession has hardly left us (and could come back with a vengeance) In two weeks: Future prospects • • • • • • Available policy choices The limits of monetary policy Helicopter drops and fiscal policy Exchange rates and trade Distributional and taxation issues Regulation and moral hazard