Exchangeable Sukuks

advertisement

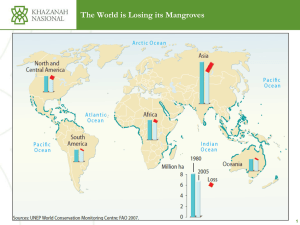

Khazanah Nasional Exchangeable Sukuks or Rafflesia Capital Exchangeable Trust Certificates (Exchangeable Sukuks) Details • In 2006, Khazanah Nasional Berhad (the Malaysian Government’s investment arm) issued the world’s first Shariah-compliant exchangeable bond • Largest exchangeable instrument issued out of Asia ex Japan in the year 2006 to date • Largest ever exchangeable bond out of Malaysia at that time • USD750 million Sukuk exchangeable into ordinary shares of RM1.00 each of Telekom Malaysia • Listed on Labuan International Financial Exhange and Hong Kong Stock Exchange • Certificates immediately traded up after pricing • One of the 3 Islamic exchangeable bonds issued by Khazanah Nasional to date (2009) • Unique & Innovative because : 1. First Sukuk structure to be backed by Sharia’h compliant financial assets (equities of Telekom Malaysia Bhd) 2. Mechanism of payment of coupons on the Sukuk : Periodic sukuk coupon payment is not guaranteed and had to be paid from the dividend income derived from the equities of Telekom Malaysia 3. Uncertainties of coupon payments are addressed by creation of sinking fund account for the benefit of the investors, wherein the dividends were accumulated to ensure availability of funds to make payment throughout the life of the transaction. Islamic structure for Khazanah’s Islamic Exchangeable Bonds Sukukholders i. ii. Rafflesia iii. Orchid iv. v. Khazanah Two special purpose companies, Rafflesia Capital Ltd. (“Rafflesia”) (the Issuer) and Orchid Capital Ltd. (“Orchid”) will be held in trust for the benefit of charities to be nominated by Khazanah. Khazanah will sell the Exchange Property, comprising the beneficial ownership of Shariah- compliant assets, i.e. shares to Orchird, which in turn sells the beneficial ownership in the shares to Rafflesia. Khazanah will retain the voting rights attached to TM shares. Rafflesia has the beneficial interest over TM shares which it holds in trust for the Sukuk holders. The Issuer then issues the Exchangeable Trust Certificates which evidence the beneficial ownership interests of Sukuk holders in the shares. Expected fixed periodic payments will be provided in cash out of the dividends paid out by the shares. Periodic Payment Exchangeable Trust Certificates - Ongoing Periodic Payment Exchangeable Trust Certificates - Maturity Please refer to the next slide for the criteria. **Conversion of TM shares The underlying financing assets (Telekom M’sia equities) were changed to the shares TM and Axiata respectively due to the restructuring done at Telekom M’sia Bhd level in year 2008. Shariah Compliance Apart from the above, there are also 2 other items that are in place : • In event of the above are breach : failed financial ratio tests OR delisted from Shariah Approved List of SC; there is a put option in place for early redemption of the sukuk • Dividends that have interest income need to be stripped off – purification of dividend Comparison between Islamic & Conventional Exchangeable Bonds Khazanah Exchangeable Sukuk #2 Khazanah Exchangeable Sukuk #1 Khazanah Exchangeable Sukuk #3 List of Awards Won