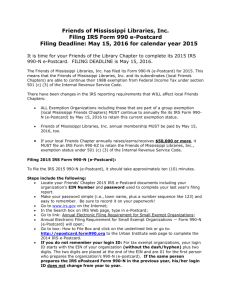

IRS 990 FORMS - Connecticut PTA

advertisement

IRS 990EZ FORMS Presented by the Connecticut Parent Teacher Student Association If your PTA grossed $50,000 or less than all you have to do is an e-postcard. Go to the following link: http://epostcard.form990.org Whenever you see the prompt for email, click it. You need a login ID and password to electronically file your organization's IRS Form 990-N (e-Postcard). Once you have completed the login ID request process, you will receive an email containing an activation link. Click on the link to activate (and use) your login ID. The e-Postcard website will not recognize your login ID until you activate it through the email link. Exempt Organizations: You will need the organization's employer identification number (EIN). The EIN is a 9-digit number with the following format ( xx-xxxxxxx ). When you enter the EIN on the next page, the system will create your login ID based on the organization's EIN. The login ID will be the EIN (without the dash) plus a two digit number (i.e. xxxxxxxxx01). Your login ID will never change. If another user requests a login ID for the same EIN, the last two digits of his or her login ID will be different (i.e. xxxxxxxxx02, xxxxxxxxx03, etc). The next page will have the state PTA name on it: PTSA CONNECTICUT INC The next page will ask for the name of your unit. There will be two questions to answer: 1. Did your business gross $50,000 or less – the answer will be yes 2. Did the business close – the answer will be no For PTAs who grossed over $50,000 You will fill out the 990EZ C – Name of organization PTSA CONNECTICUT INC/ Name of PTA Number and street School Address, Phone Number, City, State and Zip D - Employer Identification Number (EIN) This number is available from the state office F - Group Exemption Number 1319 G – Accounting Method Cash H – Check if the organization is not required to attach Schedule B Check the box J – Tax-exempt status 501(c)(3) Part I Line 1 = all income except for the $5.50 dues that you send the state Part I Line 3 = Membership dues collected above the $5.50 Part I Line 9 = 1+3 Part I Line 12 – If you are paying over $600 per year in salaries Part I Line 17 = Total expenses Part I Line 18 – Subtract line 17 from line 9 Part II Line 22 and line 27 should be the same Part III Advocacy for Children Part III Line 28 -List enrichment programs for children w/# of children Part III Line 29 – Field trips – List how many children impacted Part III Line 30 – Family activities or provided activities to enhance school literacy Part III Line 31 – What ever is left in your expenses Part IV List officers names, addresses and titles. Leave b, c & d blank Part V Lines 33 – 44e should be no, unless you have changed your bylaws, then 34 is yes Part V Line 41 – Put the word Exempt on the line Part V Line 42a – This is last year’s treasurers name and address Part V Line 42b & c – No Line 43 – Blank Line 44 & 45 - No Part VI Lines 46 - 49 – No Line 50 – N/A Line 51 – N/A Sign If Name you paid someone else to prepare the 990, then they sign it. Schedule A Name of Organization PTSA Connecticut, Inc/Name of your PTA Part I Put a Check in the box on Line 7 Part II, Section A Line 1 should equal line 9 from the 990 EZ for each year Line 4 is the total of lines 1 through 3 from EZ Part II, Section B Fill in Line 7 and Line 11 Make three copies Mail one copy to IRS Mail one copy to CT PTSA Keep one