A New Keynesian Perspective on the Great Recession

advertisement

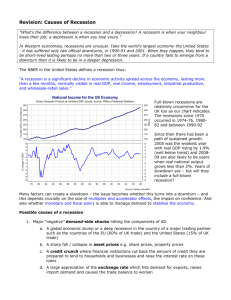

A NEW KEYNESIAN PERSPECTIVE ON THE GREAT RECESSION WRITTEN BY: PETER IRELAND IN THE JOURNAL OF MONEY, CREDIT AND BANKING,VOL. 43 Tyler Halberg, Dylan Adler, and Kevin Reitz THESIS In terms of its macroeconomics, does the Great Recession of 2007-2009 really stand apart from its two immediate predecessors: the milder recessions of 1990-1991 and 2001? BACKGROUND Recession of 2007-2009 New Keynesian Model Focus on post-1983 period Compare the Great Recession of 2007-2009 to: Milder Recessions of 1990-91 and 2001 Monetary Policy Failed 2007-09 recession had a combination of aggregate demand and supply disturbances Difference Shocks lasted longer and more severe MODEL Small-scale model that focuses on three main equations: The New Keynesian IS Curve Behavior of a representative household The New Keynesian Phillips Curve Optimizing Behavior of monopolistically competitive firms that face explicit costs of nominal price adjustment Monetary Policy Rule How the central bank adjusts the short-term nominal interest rate in response to movements in output and inflation Empirical Analysis Output Inflation Short-term nominal interest rate MODEL (REPRESENTATIVE HOUSEHOLD) Expected Utility Function 𝐸0 ∞ 𝑡 𝑡=0 𝛽 𝑎𝑡 𝑙𝑛 𝐶𝑡 − 𝛾𝐶𝑡−1 + 𝑙𝑛 𝑀𝑡 𝑃𝑡 − ℎ𝑡 Monetary policy affects: Money Supply Consumption Household’s Utility MODEL (REPRESENTATIVE GOODSPRODUCING FIRM) Maximize Profits 𝑃𝑡 1 𝑌 0 𝑡 𝑖 𝜃𝜃𝑡 −1 𝜃𝑡 Firm’s Real Profits 𝑑𝑖 𝜃𝑡 𝜃𝑡 −1 − 1 𝑃 0 𝑡 𝑖 𝑌𝑡 𝑖 𝑑𝑖 MODEL (CENTRAL BANK) Variant of the Taylor Rule Output Growth or Inflation rise or fall below average FIRST ORDER CONDITIONS FIRST ORDER CONDITIONS RESULTS All three recessions were the result of adverse preference and technology shocks Lower bound zero interest rate Government had to implement a highly restrictive monetary policy The monetary policy prolonged and intensified the recession CONCLUSION In terms of its macroeconomics, does the Great Recession of 2007-2009 really stand apart from its two immediate predecessors: the milder recessions of 1990-1991 and 2001? All three recessions were caused by a combination of aggregate demand and supply disturbances The Great Recession had adverse shocks that lased much longer and were much more severe Zero lower bound on short-term interest rate Need more complete and detailed assessment of monetary policymaking strategy THREE THINGS TO TAKE AWAY… Technology and preference shocks were the main causes of each recession The zero lower bound nominal interest rates forced the Fed to implement a strict monetary policy through the Taylor rule, which prolonged and intensified the recession of 2007-2009 Monetary policy is limited when helping the economy respond efficiently to supply-side shocks